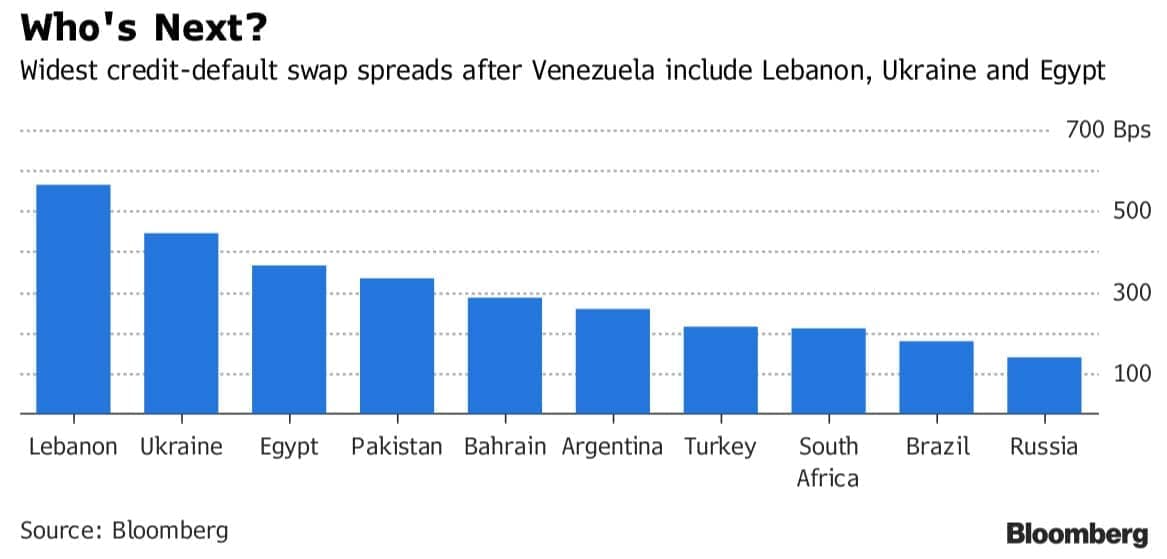

"It's a wake-up call for a lot of people who will say ‘Look, the stuff I own is actually very risky'..." warns Ray Jian, who oversees about $6 billion at Pioneer Investment Management Ltd. in London. "People have been ignoring risks in places like Lebanon for a long time," and the official default of Venezuela this week has emerging-market money managers are looking to identify countries that might run into trouble down the road.

(Click to enlarge)

While Bloomberg reports that while none are nearly as badly off as Venezuela - where a combination of low oil prices, economic mismanagement and U.S. sanctions did the country in - traders are scouting for credit risk, from Lebanon, where Prime Minister Saad Hariri’s sudden resignation has once again thrust the nation into a Saudi-Iran proxy war, to Ecuador, where recently elected President Lenin Moreno continues to expand the debt load in a country with a history as a serial defaulter.

(Click to enlarge)

1. Lebanon:

One of the world’s most indebted countries, Lebanon may hit a debt-to-gross domestic product ratio of 152 percent this year, according to International Monetary Fund forecasts. That’s coming at a time when political tension is rising. Hariri’s abrupt resignation, announced from Riyadh on Nov. 4, triggered about $800 million of withdrawals from the country as investors speculated that the nation would be in the crosshairs of a regional feud between the Saudis and Iranians. While the central bank says the worst may be over, credit-default swaps have hit a nine-year high. Related: Can Oil Majors Continue To Beat Estimates?

2. Ecuador:

After a borrowing spree, the Andean nation’s external debt obligations over the next 12 months ballooned to a nine-year high relative to the size of its GDP. Ecuador probably has the highest default risk after Venezuela, according to Robert Koenigsberger, the chief investment officer of Gramercy Funds Management. The country will be vulnerable “when the liquidity environment changes and they can no longer go to the market to get $2.5 billion to plug the hole," he said. Finance Minister Carlos de la Torre told Bloomberg in an email on Thursday that there is "no default risk" for any of Ecuador’s debt commitments and the nation’s indebtedness is nowhere near "critical" levels.

3. Ukraine:

While the Eastern European nation’s credit-default swaps have declined from their 2015 highs, persistent economic struggles are giving traders reason for caution. GDP expansion has slowed for three consecutive quarters and the World Bank warns that the economy is at risk of falling into a low-growth trap. Ukraine’s parliament approved next year’s budget on Tuesday as it eyes a $17.5 billion international bailout.

4. Egypt:

Egypt’s credit-default swaps are hovering near the highest since September. The cost for protection surged in June as regional tensions heated up amid a push by the Saudis to isolate Qatar. While Egypt has been able to boost foreign-currency reserves and is on course to repay $14 billion in principal and interest in 2018, its foreign debt has climbed to $79 billion from $55.8 billion a year earlier.

5. Pakistan:

Pakistan’s credit-default swaps surged in late October and linger near their highest level since June. South Asia’s second-largest economy faces challenges as it struggles with dwindling foreign reserves, rising debt payments and a ballooning current account deficit. Pakistan is mulling a potential $2 billion debt sale later this year. Speaking at the Bloomberg Pakistan Economic Forum last week, central bank Deputy Governor Jameel Ahmad played down concerns over the country’s widening twin deficits.

6. Bahrain:

Bahrain’s spread rose dramatically in late October to the highest since January after it was said to ask Gulf allies for aid. The nation is seeking to replenish international reserves and avert a currency devaluation as oil prices batter the six Gulf Cooperation Council oil producers. Although its neighbors are likely to help, Bahrain could still be left with the highest budget deficit in the region, according to the IMF.

7. Turkey:

Despite high yields, investors are still reluctant to buy Turkish bonds. The nation has been caught up in a blur of political crises, driving spreads on credit-default swaps to their highest level since May. Turkey was the only holdover on S&P Global Ratings’s latest “Fragile Five” list of countries most vulnerable to normalization in global monetary conditions.

By Zerohedge

More Top Reads From Oilprice.com:

- When Will Oil Demand Begin To Taper Off?

- The Hidden Cost Of Electric Cars

- Musk’s “Hardcore Smack-Down” To Gasoline Vehicles