The drone strike on Saudi Arabia’s oil infrastructure marks one of the most serious incidents in the history of global energy. Albeit shorter than the 1979 Iranian Revolution or the Iraqi invasion of Kuwait, the attack on the Abqaiq processing plant and the Khurais oil field topped the list of biggest supply disruptions in terms of total output affected (at 5.7mbpd). Confronted with the risk of 5% of global oil supply being shut down for several weeks, oil prices jumped $8 per barrel on Monday. Saudi Arabian claims that all the damaged infrastructure would be brought back by the end of September and that no buyer would be affected by the disruption thanks to their ample crude inventories brought crude prices lower yet the conflict potential is still high in the Middle East.

With US crude inventories expected to drop for the fifth consecutive week, trading on Wednesday ended on a declining note – global benchmark Brent traded around $62.5-62.8 per barrel, whilst US benchmark WTI was assessed at $58-58.3 per barrel.

1. Sour Crudes Soar on Saudi Supply Disruption

- The crude market has reacted instantly to the drone attacks on Saudi Arabia’s Abqaiq crude processing plant and the 1.5mbpd Khurais oil field, with sour crude differentials spiking on Monday-Tuesday.

- Mars, which is of very similar quality to the Arab Light (34° API, 1.8 percent Sulphur) grade that is generally processed in Abqaiq along with Arab Extra Light, jumped almost $2…

The drone strike on Saudi Arabia’s oil infrastructure marks one of the most serious incidents in the history of global energy. Albeit shorter than the 1979 Iranian Revolution or the Iraqi invasion of Kuwait, the attack on the Abqaiq processing plant and the Khurais oil field topped the list of biggest supply disruptions in terms of total output affected (at 5.7mbpd). Confronted with the risk of 5% of global oil supply being shut down for several weeks, oil prices jumped $8 per barrel on Monday. Saudi Arabian claims that all the damaged infrastructure would be brought back by the end of September and that no buyer would be affected by the disruption thanks to their ample crude inventories brought crude prices lower yet the conflict potential is still high in the Middle East.

With US crude inventories expected to drop for the fifth consecutive week, trading on Wednesday ended on a declining note – global benchmark Brent traded around $62.5-62.8 per barrel, whilst US benchmark WTI was assessed at $58-58.3 per barrel.

1. Sour Crudes Soar on Saudi Supply Disruption

- The crude market has reacted instantly to the drone attacks on Saudi Arabia’s Abqaiq crude processing plant and the 1.5mbpd Khurais oil field, with sour crude differentials spiking on Monday-Tuesday.

- Mars, which is of very similar quality to the Arab Light (34° API, 1.8 percent Sulphur) grade that is generally processed in Abqaiq along with Arab Extra Light, jumped almost $2 per barrel intra-day on Monday to a $2.85 per barrel premium over October WTI.

- Both Mediterranean and Baltic Urals (Sulphur content at 1.8 percent is the same as Arab Light, though a bit heavier at 31° API) gained 1 per barrel, unwinding their recent declines.

- Saudi Aramco’s statement that it would bring back all damaged infrastructure by the end of September placated fears of a longer-term disruption yet Arab Light-lookalikes will still enjoy several days of unforeseen price strength.

- Availing itself of the opportunity the Russian oil company Surgutneftegaz has sold several ESPO cargoes to Asia at a $7.2 per barrel premium to Dubai quotes, beating a 6-year record high.

2. Iraq Drops European Prices for October

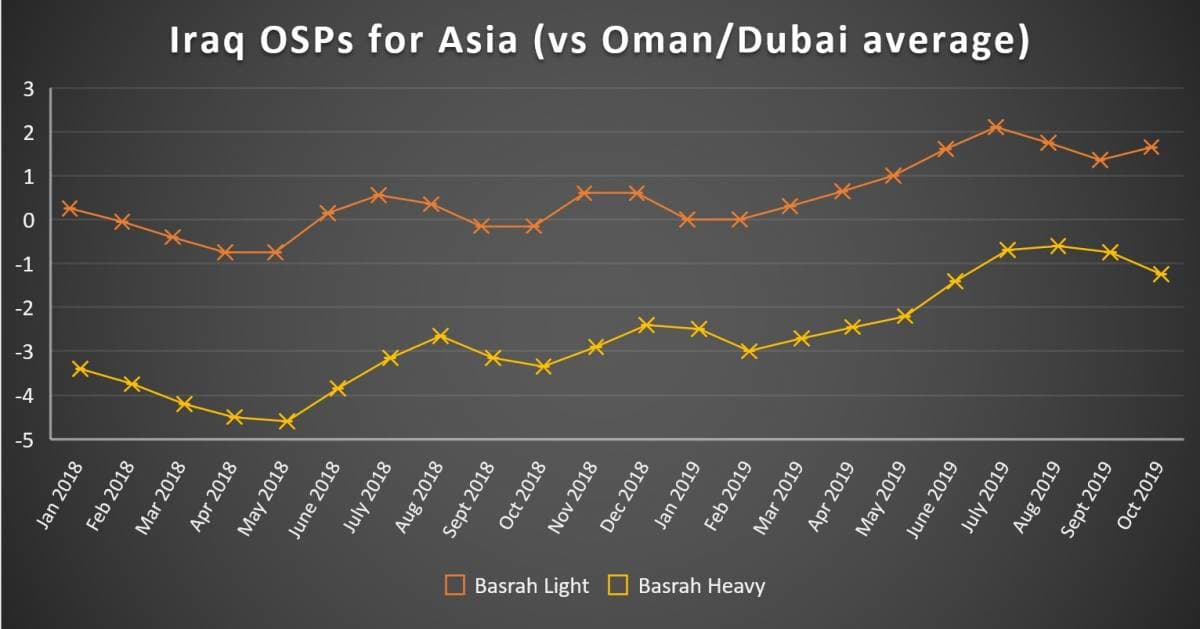

- Iraqi state oil marketer has raised the October-loading official selling price of its Basrah Light crude to Asia, whilst dropping the Basrah Heavy OSP to the same destination.

- October-loading Basrah Light destined for Asia rose 30 cents month-on-month to a $1.65 per barrel premium against the Oman/Dubai Average, Basrah Heavy is down 50 cents to a $-1.25 per barrel discount.

- SOMO has also dropped all European prices, with Basrah Heavy witnessing the largest m-o-m drop to $-7.1 discount to Dated (down $2.4 per barrel from September), whilst Kirkuk was only decreased 60 cents to a $-1.25 per barrel discount.

- Traditionally for this year, US-bound OSPs were barely changed, with Basrah Light and Basrah Heavy prices increased by 10 cents to a $1.35 premium and $-1.15 discount to ASCI, respectively, whilst Kirkuk was dropped 20 cents m-o-m to a $0.55 premium over ASCI.

- Iraqi crude exports have reached a 4-month high in August at 3.487mbpd (Kirkuk flow excluded) – the apparent non-compliance with OPEC+ quotas was somewhat mitigated by Ceyhan-loading Kirkuk flows halving to 0.181mbpd in August (down from 0.353mbpd in July 2019).

3. Kuwait Goes the Iraqi Way with October OSPs

- The Kuwaiti national oil company KPC has once again to go softer on its October-loading official selling prices, despite following the general direction set by Saudi Aramco.

- The Asia Pacific-bound cargoes of its flagship export stream KEB saw their October OSP raised 30 cents to a $1.30 premium to the Oman/Dubai average, a monthly delta that is 10 cents lower than Aramco’s Arab Medium.

- KPC’s month-on-month cuts of European OSPs are also 10 cents stronger than those of Saudi Aramco – Mediterranean KEB OSP was dropped to a $-2.65 per barrel discount to Dated, NW Europe to a $-4.65 per barrel discount to Dated.

- For the first time in the last 5 monts, Kuwait super light KSLC went flat with Arab Extra Light, set at a $2.90 per barrel premium to the Oman/Dubai average.

- Kuwait exports averaged 1.92mbpd in August 2019, down 7 percent from the July average of 2.05mbpd.

4. Iran Drops Asian Price Differentials to Record Lows

- The Iranian national oil company NIOC has taken Saudi Aramco’s cue for its October-loading OSPs, still poised to keep its market presence in Asia.

- The October price of Asia-bound Iranian Light was hike 55 cents m-o-m to a 1.8 per barrel premium to the Oman/Dubai average, whilst Iranian Heavy was increased 10 cents to a 0.05 per barrel premium.

- Apart from shrinking deliveries Iran also suffers from a shrinking of active grades - the last delivery of Soroosh anywhere took place in April 2019 (to the Maldives), while the last Foroozan cargo was taken to China in the first days of March 2019.

- In line with other Middle Eastern exporters, NIOC dropped its NW European prices by $1.3-2.2 per barrel and decreased its Mediterranean-bound OSPs by $0.6-1.8 per barrel.

- The last time an Iranian cargo reached NW Europe was in June 2018, yet NIOC managed to keep the Turkish relationship alive despite US sanctions, delivering its last cargo in early September 2019.

- The Iranian Heavy-Arab Medium and the Iranian Heavy-Basrah Heavy spreads (both at 1.60 per barrel) are the highest on record.

- Apparent Iranian crude exports have dropped to 0.29mbpd in August 2019 yet might be higher due to the intransparent nature of STS operations in and around Fujairah.

5. Johan Sverdrup Puts Urals Under Pressure

- After Urals traded at anomalous premia to Dated Brent this year, the emergence of a new European medium sour grade has pressured Urals down to more habitual territory.

- The 28° API and 0.8 percent Sulphur-containing Johan Sverdrup will start producing in October (a month earlier than previously indicated by Equinor) and will see its output grow to 0.3mbpd by end-November.

- After much of August allowed for Urals arbitrage with Urals Med staying above a 1 per barrel premium to Dated, the past two weeks have narrowed the differential and finally brought Urals Baltic prices down.

- The recent price drop was counteracted by the Saudi crude disruption, however once the supply squeeze is over, Urals should move back into negative territory for good.

- Equinor stated it expects a significant volumes of the 2.7 Bbbls Johan Sverdrup to stay in Europe – expectedly so given Sverdrup’s relatively low sulphur content which gives it a competitive edge over 1.6-percent Sulphur Urals ahead of IMO 2020.

6. Tullow Hits Second Discovery in Orinduik Block

- The UK-listed oil firm Tullow Oil announced its second discovery in Guyana’s offshore Orinduik Block, opening a new Upper Tertiary play with its Joe-1 well.

- The Joe-1 exploration well encountered 14 metres of net oil pay in sandstone reservoirs, the lowest since exploration started in Guyana’s waters (Liza hit 90 meters of net pay).

- The well was drilled to a total depth of 2 175 metres in water depth of 780 metres, i.e. is significantly shallower than the previous ones.

- Tullow CEO Paul McDade vowed to drilled 3 or more exploration wells in offshore Guyana next year to extend the company’s Guyana portfolio.

- Although derisking the Orinduik Block for further discoveries, this curbs the overall enthusiasm somewhat as the Repsol-operated Kanuku block is set to see its first exploration well drilled next week (Carapa-1).

7. Argentina Protects Vaca Muerta from Union Strikes with Military

- Oil workers in Argentina’s prime shale play Vaca Muerta have been threatening to go on strikes if the government keeps its 90-day freeze on crude and fuel prices across the country which resulted in hundreds of oilmen suspensions across the country.

- President Macri’s Administration opted for the price freeze with a view to curb the 50% inflation rate, in a rather hasty attempt to create political momentum, having lost the national primaries to Alberto Fernández.

- The decision has frozen domestic crude prices at $49.5 per barrel (initially wanting to set it as low as $45.2 per barrel), with the Saudi supply disruption only exacerbating the gap between market quotes and the former price.

- The Argentine government reacted by deploying the military police to protect Vaca Muerta producing assets, reportedly to keep the „necessary security conditions” amidst a brewing appetite for strikes.