Friday December 8, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Wall Street wary of shale

(Click to enlarge)

- One of the major energy stories of 2017 could end up being the fact that Wall Street finally became more skeptical of the U.S. shale story.

- After years of pouring money into the sector, investors are starting to grow restless as profits remain elusive.

- There was more than $40 billion in equity issued in 2016, a near record high. But that halved to just $20 billion this year, the lowest total since the global financial crisis nearly a decade ago.

- “You’ve had a decoupling, where the companies have not followed oil prices higher, and the investor apathy has been stunning," Bobby Tudor, chairman of Tudor Pickering Holt & Co., told Bloomberg in a telephone interview.

- Wall Street and other major investors are demanding change, with an emphasis on profits instead of growth.

2. Batteries continue cost declines

(Click to enlarge)

- Lithium-ion battery prices fell 24 percent from 2016 levels, an impressive achievement after years of falling costs.

- Lithium-ion battery packs sell for an average price of $209 per kilowatt-hour, a fifth of what they cost in 2010, according…

Friday December 8, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Wall Street wary of shale

(Click to enlarge)

- One of the major energy stories of 2017 could end up being the fact that Wall Street finally became more skeptical of the U.S. shale story.

- After years of pouring money into the sector, investors are starting to grow restless as profits remain elusive.

- There was more than $40 billion in equity issued in 2016, a near record high. But that halved to just $20 billion this year, the lowest total since the global financial crisis nearly a decade ago.

- “You’ve had a decoupling, where the companies have not followed oil prices higher, and the investor apathy has been stunning," Bobby Tudor, chairman of Tudor Pickering Holt & Co., told Bloomberg in a telephone interview.

- Wall Street and other major investors are demanding change, with an emphasis on profits instead of growth.

2. Batteries continue cost declines

(Click to enlarge)

- Lithium-ion battery prices fell 24 percent from 2016 levels, an impressive achievement after years of falling costs.

- Lithium-ion battery packs sell for an average price of $209 per kilowatt-hour, a fifth of what they cost in 2010, according to Bloomberg New Energy Finance.

- BNEF predicts that the declines will continue, with prices dropping below $100/kWh by 2025.

- And the $100/kWh threshold is widely seen as the “tipping point in the adoption of [electric vehicles,” according to James Frith of BNEF.

3. Chevron cuts spending again

(Click to enlarge)

- Chevron (NYSE: CVX) announced spending cuts for 2018, a small reduction from 2017 levels, but the fifth consecutive year of declines.

- Aiding the oil major is the fact that its enormous investments in two massive LNG projects in Australia are complete, allowing for a significant reduction in spending.

- Chevron’s $19 billion spending plan for 2018 is less than half of the $41.9 billion it spent in 2013.

- But Chevron also announced a ramp up in spending on U.S. shale, a notable pivot for the oil major. The oil major will now spend about a quarter of its upstream outlays on shale, with $3.3 billion alone going to the Permian.

4. U.S. ramps up refined product exports to Mexico

(Click to enlarge)

- The U.S. has emerged as a very serious exporter of both refined products and crude oil this year, and Mexico is one of its largest buyers after the country’s historical energy reform that relaxed rules on participation from private companies.

- Bloomberg reports that ExxonMobil (NYSE: XOM) is working on plans to ship gasoline and diesel from most of its refineries on the U.S. Gulf Coast to Mexico. “Exxon Mobil is the first company to compete in the Mexican fuel market in an integrated form,” Carlos Rivas, general director of fuel for the oil major, told Bloomberg.

- The export boom is helped by the fact that Mexican oil production and refined product production has been falling.

- State-owned Pemex reported that its six refineries sold the least amount of fuel for the month of October in 27 years, because of maintenance and disruptions. Imports accounted for 74 percent of gasoline and diesel sales in Mexico in October.

- Mexico is becoming increasingly reliant on fuel from the U.S. Gulf Coast.

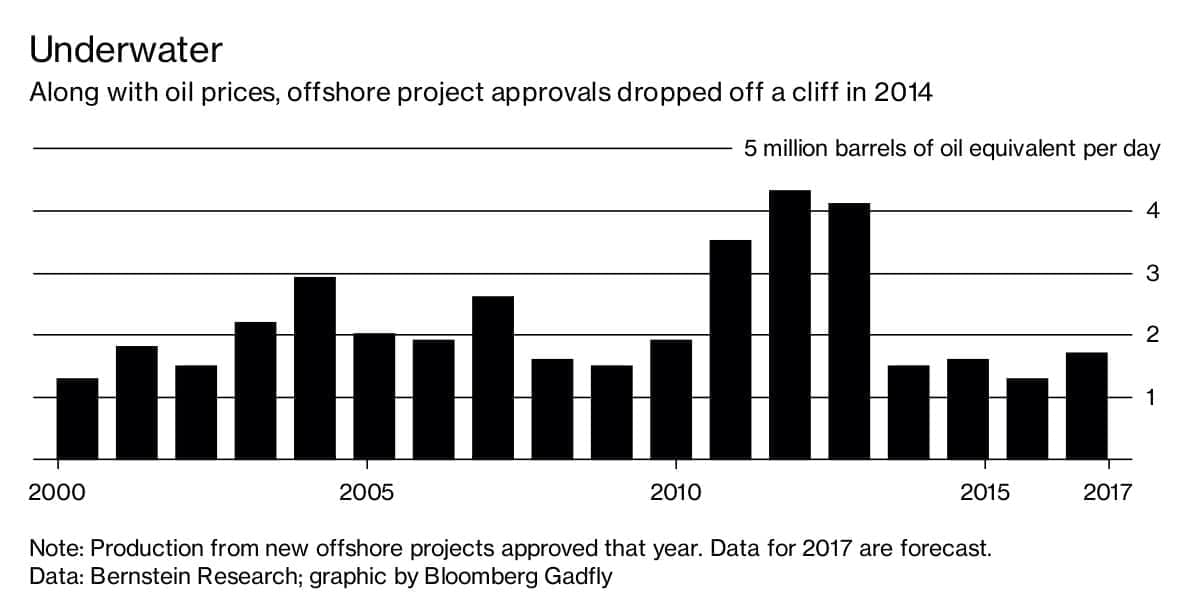

5. Offshore projects tick up in 2017

(Click to enlarge)

- The offshore sector suffered a steep downturn when oil prices collapsed in 2014. The long lead times and huge upfront costs made offshore a luxury that too many oil companies could no longer afford.

- Project approvals plunged in 2014, staying low for years even as investments and production from onshore shale surged.

- 2017 is a turnaround year, however. There have been 22 offshore projects that received a greenlight through October this year, double the 11 total projects given the go-ahead in all of 2016.

- Still, those projects only translate to less than 2 million barrels per day of production, less than half of the more than 4 mb/d of new output from offshore projects that moved forward in each of 2012 and 2013.

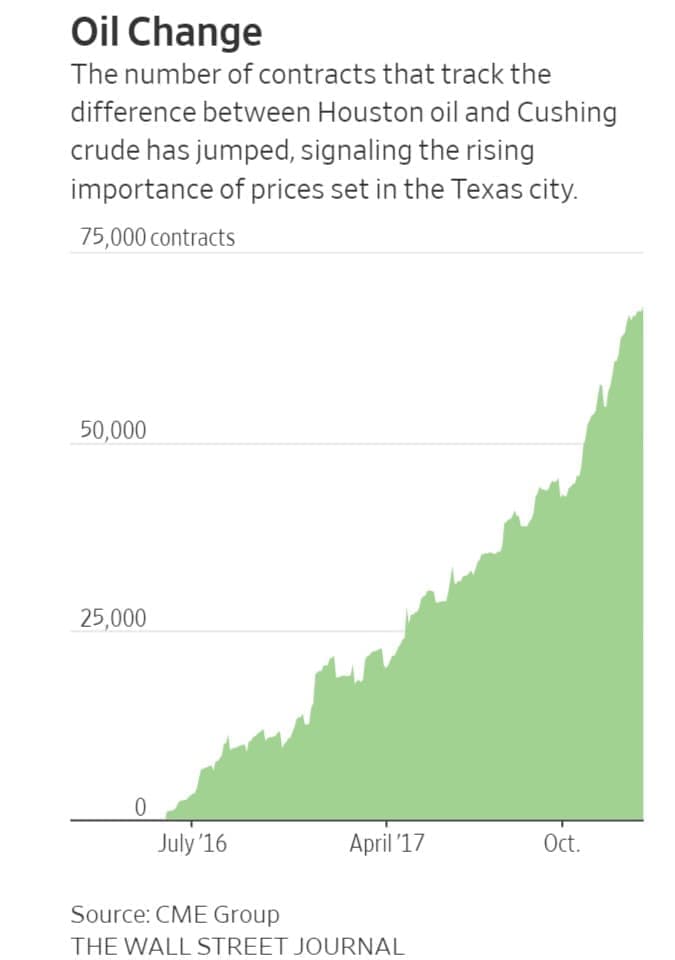

6. Houston the new trading hub

(Click to enlarge)

- The Wall Street Journal reports that Houston has emerged as a key oil trading hub this year, rivaling Cushing, Oklahoma.

- The main reason is the lifting of the crude oil export ban, which has turned the Gulf Coast into a major source of both crude and refined product exports. A lot of crude is coming from West Texas to a handful of ports on the Texas coast, bypassing the key oil hub of Cushing altogether, where the WTI benchmark is based. “Cushing is becoming irrelevant,” Philip Verleger, an energy economist who helped develop the Nymex oil futures contract in the early 1980s, told the WSJ.

- That has led to a spike in interest over WTI price based in Houston, rather than WTI in Cushing. Those two prices typically traded almost at parity, save for the $2/barrel cost of transport.

- More recently, Houston prices have traded at a $5/barrel premium over WTI at Cushing, the result of strong global demand for Texas oil.

- Last year, CME Group launched an oil futures contract that tracks the difference between the two oil prices, allowing participants to hedge their exposure to the differential.

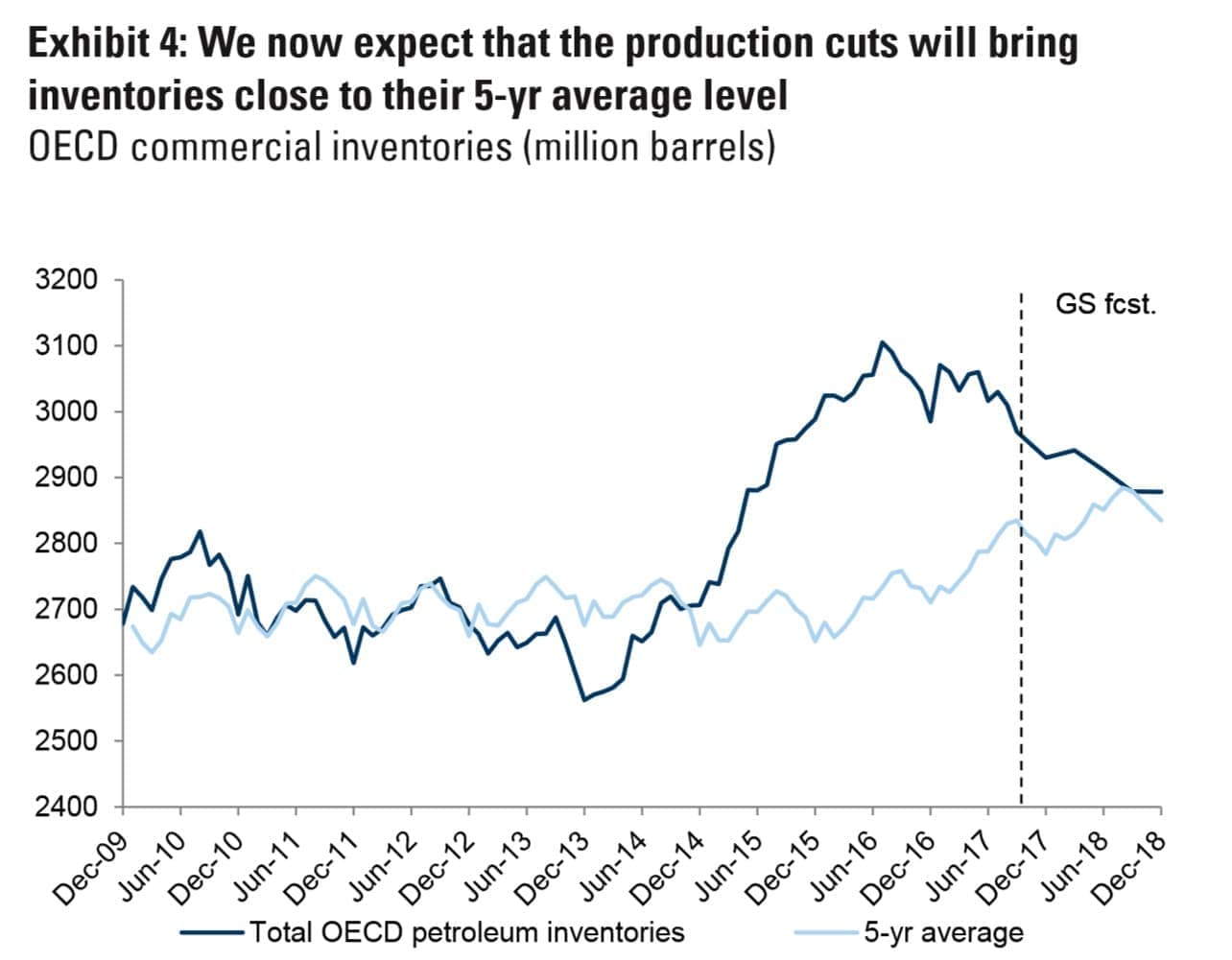

7. Inventories to hit 5-year average next year

(Click to enlarge)

- OPEC is aiming to bring global oil inventories (or OECD inventories) back down to the five-year average.

- Inventories have begun to decline sharply since the summer, and are expected to continue to decline through next year.

- Goldman Sachs predicts that inventories will hit the 5-year average by mid-2018, helped along by the steeper backwardation in the futures curve. That should help push up spot oil prices by 9 percent over the next 12 months.

- As always, there is uncertainty in that forecast, but the investment bank argues that the risk is “skewed to the upside into 2018 on the risk of an overtightening, either because of new disruptions, demand exceeding our optimistic forecast or OPEC letting the stock draw run hot.”

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.