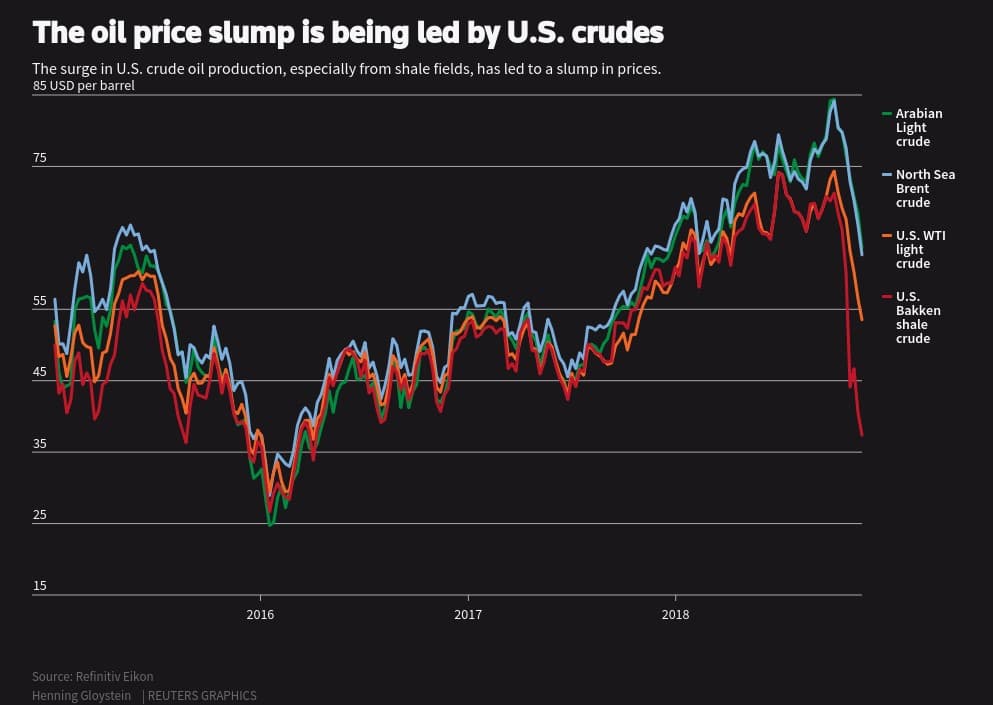

December 6 might become the next key milestone in OPEC’s drive to keep oil prices within a more or less universally acceptable range. Until then, we are going to see a lot of volatility in the oil market - as testified by last week’s oil price rollercoaster. On Monday, oil took a 6 percent plunge as fears of an impending supply glut grew. Now, just several weeks after Saudi Arabia and Russia ramped up production to compensate for the loss of Iranian volumes, it seems the two will be forced to curb their appetites.

(Click to enlarge)

The United States, however, is pumping more and more into the market, unrestricted by the OPEC+ agreement or any other commitment. Luckily for producers, oil prices rebounded on Tuesday-Wednesday thanks to the API reporting the first drawdown in US commercial crude stocks in 9 weeks (falling by 1.5 MMBbl week-on-week). As a result, Brent traded on Wednesday in the 63-64 USD per barrel range, whilst WTI oscillated in the 54-55 USD per barrel interval.

1. Libya Exports Break Five-Year Record

(Click to enlarge)

Source: OilPrice data.

- Libyan Crude exports have surpassed the 1.2 mbpd mark, for the first time since February 2013, buttressed by unusually robust sales to the Asia Pacific.

- China has become the largest buyer of Libyan crude in October, taking in 232 kbpd of it.

- Traditional European clients of Libya – Italy (230kbpd), France and Spain (205 kbpd) – remain vital market outlets…

December 6 might become the next key milestone in OPEC’s drive to keep oil prices within a more or less universally acceptable range. Until then, we are going to see a lot of volatility in the oil market - as testified by last week’s oil price rollercoaster. On Monday, oil took a 6 percent plunge as fears of an impending supply glut grew. Now, just several weeks after Saudi Arabia and Russia ramped up production to compensate for the loss of Iranian volumes, it seems the two will be forced to curb their appetites.

(Click to enlarge)

The United States, however, is pumping more and more into the market, unrestricted by the OPEC+ agreement or any other commitment. Luckily for producers, oil prices rebounded on Tuesday-Wednesday thanks to the API reporting the first drawdown in US commercial crude stocks in 9 weeks (falling by 1.5 MMBbl week-on-week). As a result, Brent traded on Wednesday in the 63-64 USD per barrel range, whilst WTI oscillated in the 54-55 USD per barrel interval.

1. Libya Exports Break Five-Year Record

(Click to enlarge)

Source: OilPrice data.

- Libyan Crude exports have surpassed the 1.2 mbpd mark, for the first time since February 2013, buttressed by unusually robust sales to the Asia Pacific.

- China has become the largest buyer of Libyan crude in October, taking in 232 kbpd of it.

- Traditional European clients of Libya – Italy (230kbpd), France and Spain (205 kbpd) – remain vital market outlets for Libya (although China’s rise was partially to Italy’s detriment).

- China is not the only Asian country to buy Libyan oil in October-November – cargoes also sailed or are sailing towards Thailand, Singapore and the United States.

- Preliminary November data indicates further growth for Libyan exports to roughly 1.26-1.28mbpd.

- This comes amid hopes of normalization, as the Tobruk and Tripoli governments agreed last week to hold elections in early 2019 under the aegis of the United Nations.

2. SOMO starts marketing first Kirkuk volumes after one-year halt

(Click to enlarge)

Source: OilPrice data.

- After more than a year-long halt, the Iraqi oil ministry and the Kurdistan Regional Government reached a deal on restarting Kirkuk exports via the Kirkuk-Ceyhan pipeline.

- The flows evidenced on Saturday-Sunday indicate a modest commencement, with 50-100 kbpd volumes flowing instead of the 300kbpd that were diverted to local refineries after the September 2017 takeover of Kirkuk, a city liberated from IS by the Peshmerga.

- Baghdad needs Erbil’s consent in this as there is only one export pipeline running to Ceyhan (the other was destroyed by IS), primarily passing through Kurdish territory.

- The current volumes are marketed by the state oil marketing company, SOMO.

- Additional rapprochement is expected as the government of Adil Abdul-Mahdi, the new Iraqi prime minister, consists of people primarily dovish on the Kurdish cause.

- The main issue will be the redistribution of oil income – even in the pre-IS years Erbil viewed Baghdad’s payment with distrust, alleging it was keeping back revenues.

- The new finance minister, Fuad Hussein, is a Kurd who has vowed to find a “balanced and transparent” solution for the KRG-Baghdad relationship.

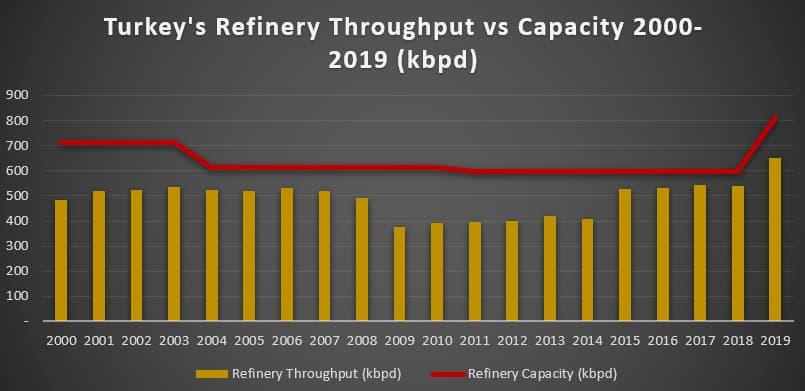

3. STAR Refinery Seems to Be In Delay

(Click to enlarge)

Source: OilPrice data.

- According to Reuters, the first greenfield refinery to come onstream in the 21st century in Europe (after the 1997 commissioning of the 227kbpd Leuna in Germany), the Turkish STAR refinery is not expected to reach full capacity until mid-2019.

- Although the Erdogan-led commissioning took place in October, commercial processing of crude is not to start before January, according to reports.

- The SOCAR-owned 214 kbpd STAR Refinery is located in Aliaga and is expected to increase Turkey’s refining capacity by a third to a total of 810 kbpd.

- With a Nelson Complexity index of 9, it is quite competitively placed on Turkey’s market.

- STAR will not have any catalytic cracking units and is not expected to produce any gasoline as there would be no space for it in Turkey’s already oversupplied gasoline market.

- The $6.3 billion STAR will be supplied by SOCAR under a 20-year supply agreement and partially by Rosneft, which will deliver 1mtpa of Urals (10 percent of total refinery capacity).

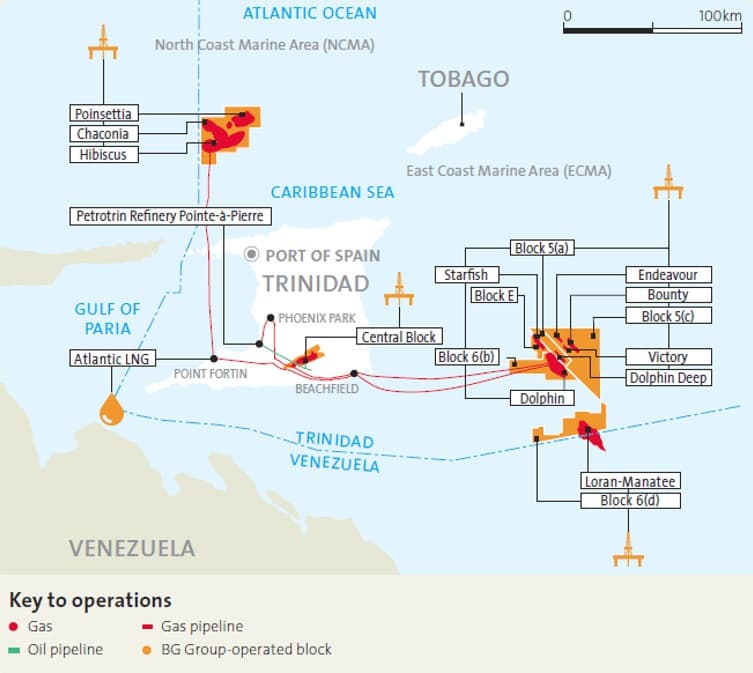

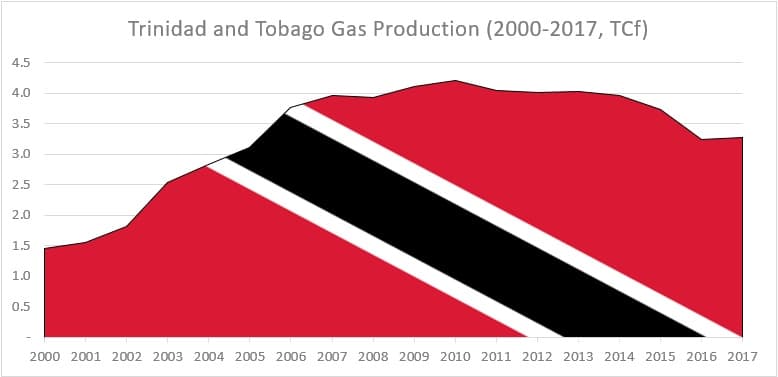

4. LNG Brings Venezuela Closer to Currency

(Click to enlarge)

Source: BG Group.

- Venezuela and Trinidad and Tobago are closing in on a deal to develop the 10 TCf Loran-Manatee gas field which sits across the maritime border of the two.

- Following a 2013 agreement between the two countries, 74 percent of the field belongs to Venezuela, whilst 26 percent is under Trinidadian control.

- Trinidad needs Venezuelan gas to replenish its export-oriented gas infrastructure, primarily the 14.8 mtpa Atlantic LNG liquefaction plant.

- Following last week’s visit of PDVSA chairman Manuel Quevedo to the Port of Spain, it seems increasingly likely that Trinidad would buy the Venezuelan share of the produced gas volumes.

- Chevron is reportedly discussing joint operatorship of the field, despite US sanctions agains the Venezuelan government and the state company PDVSA.

(Click to enlarge)

- Amid faltering Trinidadian gas output numbers, a potential success with Loran-Manatee might unblock a further 1 TCf worth of gas in the similarly cross-border Kapok-Dorado and Manakin-Coquina fields.

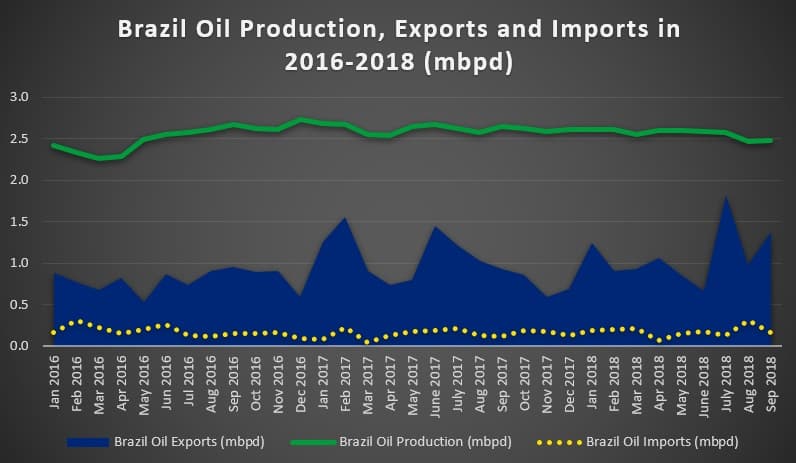

5. Brazil Sighs as New Petrobras CEO Is Named

(Click to enlarge)

Source: ANP, OilPrice data.

- Placating fears that Jair Bolsonaro’s arrival to power would jeopardize advances in Brazil’s energy markets, the president-elect picked Roberto Castello Branco as the next CEO of Petrobras.

- Many feared Bolsonaro might pick a military-backed candidate, the University of Chicago-educated Branco is an advocate of opening up Brazil’s oil and gas sector but not resorting to Petrobras’ privatization.

- Despite tough issues like continuing the diesel subsidy, selling off non-core assets and cleansing the company of its corruption-ridden image, Branco looks set to oversee Petrobras growth.

- This year’s oil production will largely remain flat year-on-year at around 2.6 mbpd, however, 2019 will witness the commissioning of 9 new FPSOs, destined to develop pre-salt offshore fields.

- As a result, Brasil’s oil output should rise next year by some 0.3mbpd, to be followed with a further 8-10 percent increase in 2020 to a total level of 3.2-3.3mbpd.

- Simultaneously, Brazil’s senate is expected to approve the ”Transfer of Rights” pre-salt auction that could see Petrobras sell up to 4 Bbbl of its Santos Basin production rights.

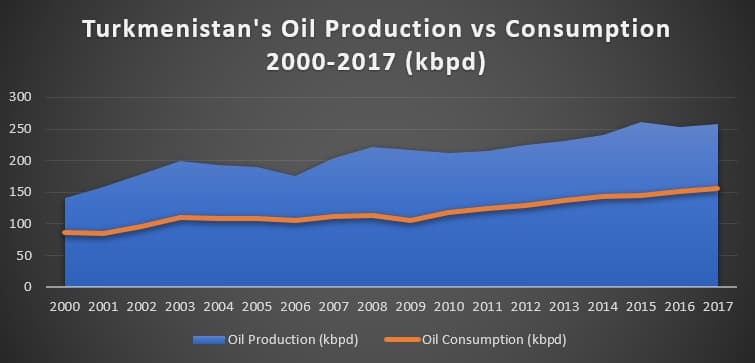

6. Turkmenistan brings centralization to a peak

(Click to enlarge)

Source: BP Statistical Survey 2018.

- Turkmenistan has created a new state oil and gas company, Napeco, to manage all crude and product exports from the country.

- Napeco will replace the similarly state-owned Turkmenneft and Turkmen Petroleum in all dealings with foreign partners, including having their crude refined at the Turkmenbashi 180 kbpd refinery.

- Thus, Napeco is poised to buy crude produced by CNPC and Petronas under PSAs in Turkmenistan, to be refined domestically or exported further on, as currently only foreign companies export crude to third parties.

- Napeco will most likely become an integrated oil and gas company, with retail and wholesale networks to be merged into it very soon.

- Previously the downstream, upstream, retail segments were all under separate state-owned companies.

7. Iran Sells More Crude to Private Companies

- As a way to mitigate the impact of US sanctions, Iran has started selling crude to private companies in Iran, predominantly private refiners.

- In its first round of sales that took place on October 28 it sold 280 Mbbls, meaning eight 35,000 barrel increments, at the equivalent of 74.85 USD per barrel.

- The second round of sales, concluded last week, yielded more interest – 700MBbls were sold to three unnamed companies for the equivalent of 64.97 USD per barrel.

- Previously, private refining companies could only buy crude oil for exports of oil products.

- At the same time, Masoud Karbasian, the former head of customs last employed for a brief stint as economy minister, has been named new head of national oil company NIOC.