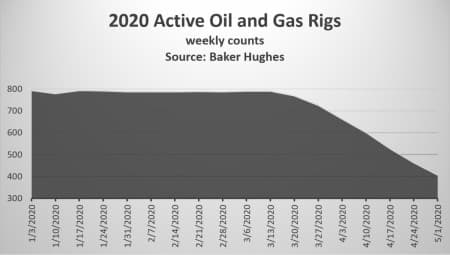

Baker Hughes reported on Friday that the number of oil and gas rigs in the US fell again this week by 57, falling to 408, with the total oil and gas rigs sitting at 582 fewer than this time last year as U.S. drillers continue to be squeezed between oversupply and under demand.

Over the last seven weeks, oil and gas rigs combined have shed a total of 384 rigs.

The number of oil rigs decreased for the week by 53 rigs, according to Baker Hughes data, bringing the total to 325—a 482-rig loss year over year. It is the fewest number of active oil rigs since June 2016.

The total number of active gas rigs in the United States fell by 4 according to the report, to 81. This compares to 183 a year ago.

The number of active rigs taken offline over the last seven weeks is a clear indication that the U.S. oil industry remains in a difficult position given the lingering lockdowns that are keeping demand for crude low.

The EIA’s estimate for the week is that oil production in the United States fell to 12.1 million barrels of oil per day on average for week ending April 24, which is 1 million bpd off the all-time high and 100,000 bpd lower than the week prior. It is the fourth straight weekly production decline.

At 11:12 am, WTI was trading up 0.96% at $19.02, while the Brent benchmark was trading down 0.60% at $26.32.

Canada’s overall rig count increased by 1 rigs this week, to 27 rigs. Oil and gas rigs in Canada are now down 34 year on year.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Could Brent Crude Oil Prices Ever Fall Into Negative Territory?

- Big Oil’s Dilemma: Cut Dividends Or Cut Operations

- Brent Oil Price Could Double By December