Friday September 21, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

Key Takeaways

- Crude inventories fell again, the fifth consecutive week of declines. Stocks are now at 394.1 million barrels, the lowest level since early 2015.

- This week, gasoline inventories fell. In previous weeks, increases in gasoline stocks offset the declines in crude inventories. But the decline in gasoline stocks in the most recent report painted a decidedly bullish portrait, although it is unclear if this trend will continue.

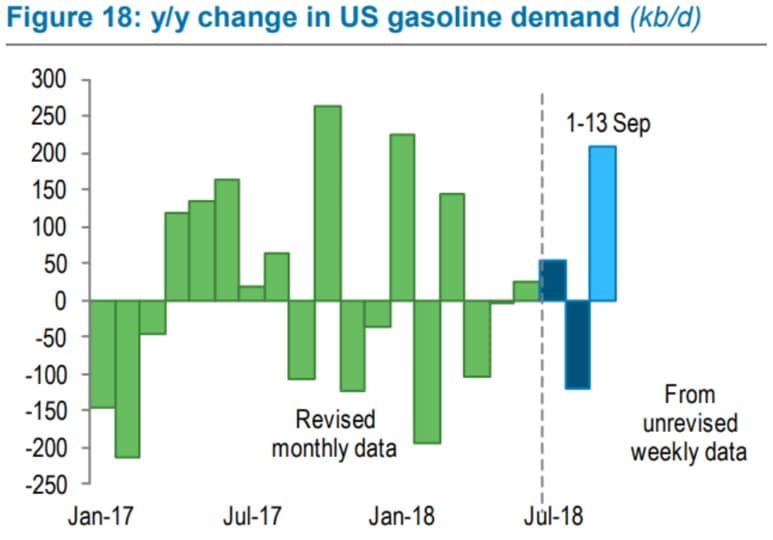

1. U.S. gasoline demand still strong

(Click to enlarge)

- U.S. gasoline demand remains robust, despite higher retail gasoline prices and hints earlier this year that pointed to a slowdown.

- In the latest EIA report, gasoline stocks fell again, despite high refining runs, a sign of healthy demand. In other words, even as refiners churned out gasoline at a high rate, the market soaked up the supply instead of diverting it into storage.

- Gasoline demand stood at 9.534 mb/d for the week ending on September 14, or about 0.372 mb/d above the five-year average and up 0.093 mb/d from a year ago, according to Standard Chartered.

- Retail gasoline prices…

Friday September 21, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

Key Takeaways

- Crude inventories fell again, the fifth consecutive week of declines. Stocks are now at 394.1 million barrels, the lowest level since early 2015.

- This week, gasoline inventories fell. In previous weeks, increases in gasoline stocks offset the declines in crude inventories. But the decline in gasoline stocks in the most recent report painted a decidedly bullish portrait, although it is unclear if this trend will continue.

1. U.S. gasoline demand still strong

(Click to enlarge)

- U.S. gasoline demand remains robust, despite higher retail gasoline prices and hints earlier this year that pointed to a slowdown.

- In the latest EIA report, gasoline stocks fell again, despite high refining runs, a sign of healthy demand. In other words, even as refiners churned out gasoline at a high rate, the market soaked up the supply instead of diverting it into storage.

- Gasoline demand stood at 9.534 mb/d for the week ending on September 14, or about 0.372 mb/d above the five-year average and up 0.093 mb/d from a year ago, according to Standard Chartered.

- Retail gasoline prices remain near multi-year highs but signs of demand erosion are still hard to find, at least in the U.S.

2. Permian bottlenecks not just about pipelines

(Click to enlarge)

- Road congestion is affecting Permian oil operations. Traffic across an 83-mile stretch of road from Odessa (where many oilfield services companies are setup) to the field in West Texas saw a 76 percent increase in traffic in 2017, according to Bloomberg.

- Royal Dutch Shell’s (NYSE: RDS.A) general manager in the Permian told Bloomberg that truck traffic might present the largest threat to Permian growth over the long-term – more so than even pipeline bottlenecks or a shortage of labor.

- “Almost everything you need at the wellhead is transported by road,” Amir Gerges of Shell told Bloomberg. “That’s the one biggest challenge, not just Shell, everyone faces.”

- There are other bottlenecks at work: labor, frac sand, completion services, and of course, pipelines.

- “There are manageable risks: skills, infrastructure, housing, health, but the piece that needs the most work is roads,” Gerges said. “One bad player can spoil it all. If there’s anything that’s going to constrain us from the projections we have for the Permian, it’s this.”

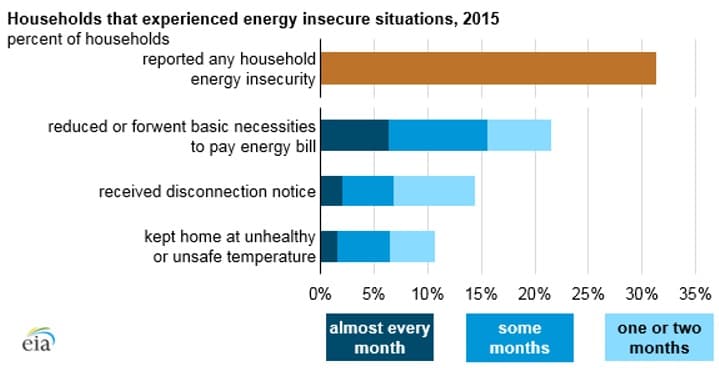

3. U.S. households struggle to pay energy bills

(Click to enlarge)

- Nearly one-third of U.S. households had trouble paying their energy bills in 2015, according to the EIA. Roughly 20 percent of households surveyed have said that they have forgone necessities such as food and medicine to pay for energy bills.

- About 11 percent of households said they keep their home at an “unhealthy or unsafe temperature,” and 14 percent of households have received notice of disconnection from their energy service because of lack of payment.

- These data points provide some clues on the demand picture. It demonstrates how households living on the margins will be forced to cutback on energy use when prices rise.

- It also demonstrates how millions of Americans are using less energy than they prefer, and less energy than they otherwise would if their incomes were a bit higher.

4. Are emerging markets oversold?

(Click to enlarge)

- Emerging market assets have taken a beating over the past few months. But the selloff, as long as it is contained, may have created a massive opportunity for risk-tolerant investors.

- Goldman Sachs said it was stepping up its purchases of Turkish and Argentinean government debt, arguing that the worst is over.

- “There’s been some dysfunctional, local political events like those in Argentina or Turkey and that’s prompting some investors who own EM risk to sell,” Philip Moffitt, Asia-Pacific head of fixed income at Goldman Sachs Asset Management, told Bloomberg. “But even places like Turkey, where the politics stink, their local financing, local sovereign balance sheets are actually strong -- they can certainly afford to fund themselves and pay their interests.”

- What does this have to do with oil? If Goldman is right and the turmoil in emerging markets is due to idiosyncratic problems, and that the downturn may have run its course, then it means that the downside risk to oil prices from an emerging market contagion may not be as serious as previously feared.

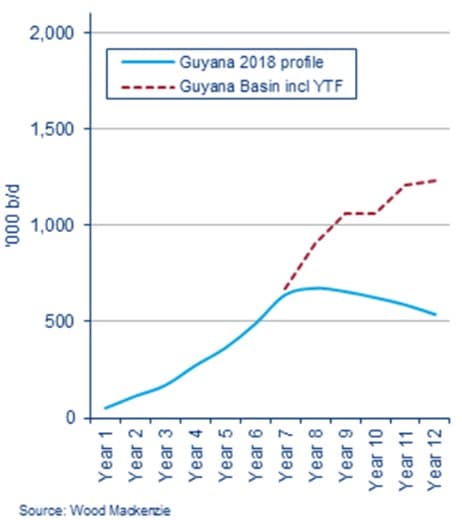

5. Guyana could become major oil producer

(Click to enlarge)

- Guyana could become the first country to enter the 1 million-barrel-per-day club in the 21st century, according to Wood Mackenzie. As WooMac pointed out, Guyana had “no upstream oil industry four years ago.”

- However, nearly a dozen oil discoveries have been logged in the past few years, led by ExxonMobil (NYSE: XOM), Hess Corp. (NYSE: HES) and Cnooc. “The exploration success rate for commercial discoveries on the block is an astronomical 82%; the global industry average is under 20%,” WoodMac said in a recent commentary.

- Total reserves in the Stabroek block could exceed 4 billion barrels of oil equivalent, most of which is oil and not natural gas.

- Forecasts put production at 750,000 bpd by 2025 with a breakeven price at $40 per barrel. But WoodMac says the yet-to-find (YTF) potential could translate into total production exceeding 1 mb/d.

Heard on the Street

Brent oil heading back to $80:

“Brent is nearing the $80 per barrel mark again. A renewed test of this threshold is only a question of time.” – Commerzbank

Oil prices become a political headache:

“We protect the countries of the Middle East, they would not be safe for very long without us, and yet they continue to push for higher and higher oil prices! We will remember. The OPEC monopoly must get prices down now!” – U.S. President Donald Trump

Offshore rebounds, shale slows:

“Shale has thus lost some momentum at a time when investors have again found an appetite for the offshore domain, stimulated by a steep reduction in offshore costs and breakeven levels, which in turn have been driven by favorable unit prices.” – Rystad Energy

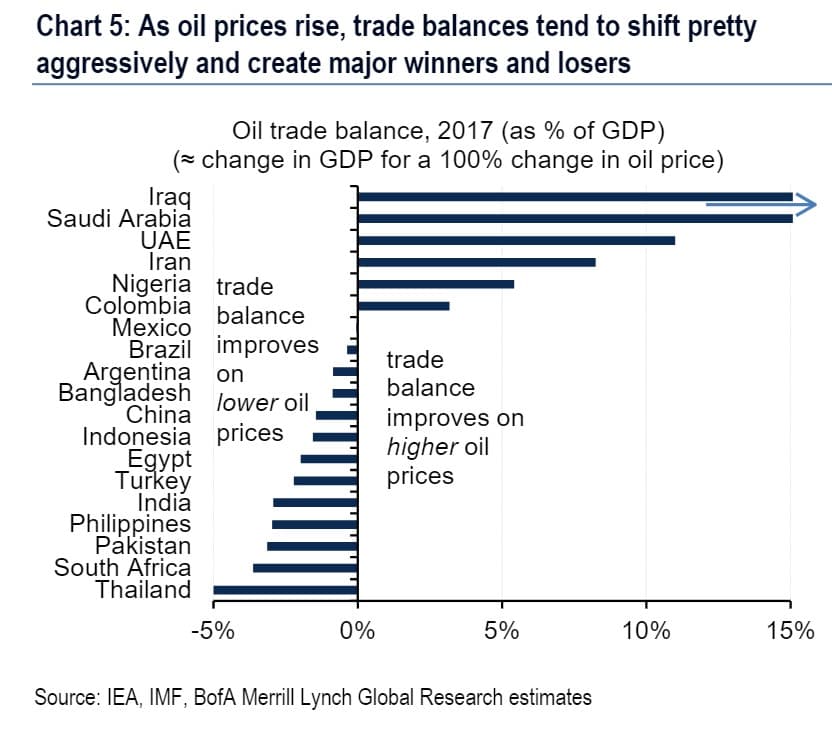

6. Winners and losers of higher oil prices

(Click to enlarge)

- Higher oil prices and have an outsized impact on trade balances.

- “Major importers like China, India, Indonesia and South Africa tend to lose big, but exporters like Iraq, Saudi Arabia and UAE tend to come out on the winning side,” Bank of America Merrill Lynch wrote in a note.

- The pain is magnified by the strength of the U.S. dollar. “Crucially, because the rally in oil has come on the back of a strong dollar backdrop, some countries like Turkey or Argentina have experienced a dramatic increase in oil prices in local FX,” BofAML wrote.

- Emerging markets are the key to demand growth, so any slip from the likes of China, India or other parts of Asia in particular, will cut into demand.

- Between 2013 and 2017, emerging markets accounted for 80 percent of demand growth.

7. Strong U.S. oil production continues

(Click to enlarge)

- U.S. oil production rose sharply in June, hitting 10.68 mb/d – a record high.

- Texas production rose by 165,000 bpd in June.

- U.S. oil production also hit 1.6 mb/d of year-on-year growth, another record high.

- “This confirms the ability of new shale industry to grow even faster than it did during the first wave of growth prior to 2015, when yearly additions peaked at 1.57 million bpd in December 2014,” Rystad Energy said in a recent report. “In a global context, such annual growth corresponds to the total oil production of some prominent oil exporters, such as Norway.”

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.