Breaking News:

Porsche Shares Slide as Sportscar Maker Slashes Revenue Forecast

Shares of the German sportscar…

Palestinian Political Factions Agree to Reconciliation Government

Palestinian factions Hamas and Fatah…

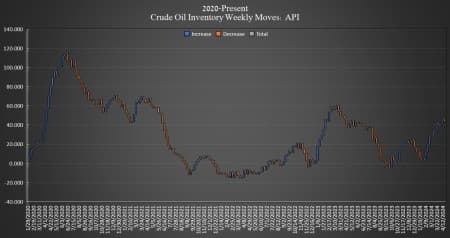

U.S. Crude Oil And Gasoline Inventories Drop Off

Crude oil inventories in the United States fell this week by 3.23 million barrels for the week ending April 19, according to The American Petroleum Institute (API). Analysts had estimated a 1.8 million barrel build for crude oil.

For the week prior, the API reported a 4.09 million barrel build in crude inventories.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 0.8 million barrels as of April 19. Inventories are now at 365.7 million barrels—the highest point since last April.

Oil prices were trading up ahead of the API data release on Tuesday, buoyed in part by the falling U.S. dollar index as business activity slumped to a multi-month low.

At 4:12 pm ET, Brent crude was trading up 1.60% on the day at $88.39, but $1.60 per barrel lower than this time last week. The U.S. benchmark WTI was also trading up on the day by 1.76% at $83.34, but down roughly $2 per barrel from this time last week.

Gasoline inventories also fell this week, by 595,000 barrels, after falling by 2.51 million barrels in the week prior. As of last week, gasoline inventories were about 4% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories rose this week by 724,000 barrels, after last week’s 427,000-barrel dropoff. Distillates were 7% below the five-year average for the week ending April 12, the latest EIA data shows.

Cushing inventories saw a draw this week, according to API data, falling by 898,000 barrels after falling by 169,000 barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Erase Gains as Iran Downplays Reports of Israeli Missile Attack

- China Scooped Up Record Volumes of Russian Oil In March

- Red Sea Could be Where Israel Strikes Next

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B