Bullish news on both the supply and demand side sent oil prices up again on Friday morning, with Brent falling back after flirting with $80.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

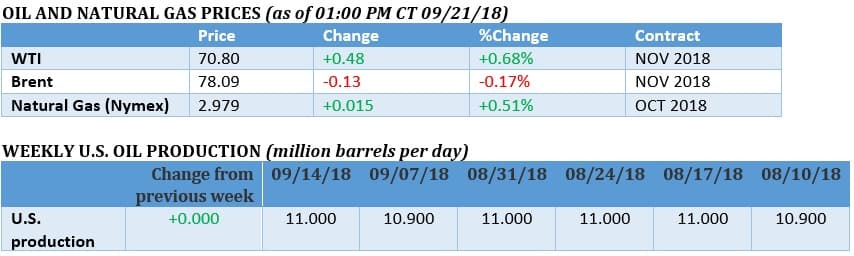

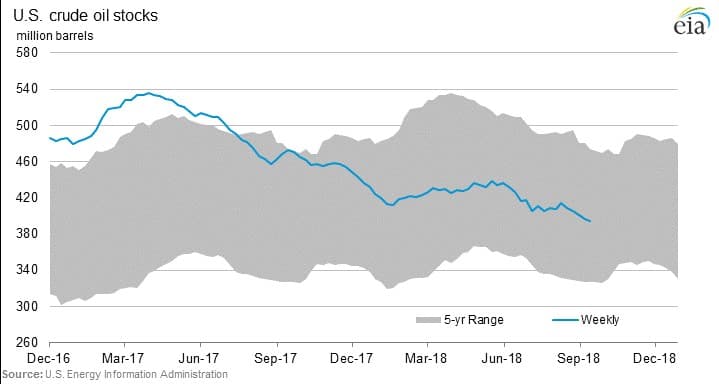

Oil prices gained this week on outages in Iran and data showing demand from the United States in August was the highest since 2007. “Exports are already down quite a bit and will probably continue to fall,” from both Iran and Venezuela, UBS Group AG analyst Giovanni Staunovo told Bloomberg. Meanwhile, strong U.S. demand is “helping the market to stay in a deficit.” In early trading on Friday, Brent was flirting with $80 per barrel.

OPEC+ meets in Algiers. OPEC+ is set to meet in Algiers this weekend to discuss some of the details stemming from the June decision to increase collective output by 1 million barrels per day. Iran’s oil minister has vowed not to attend in protest of what Iran views as a Saudi attempt to take over market share from Iran, in collusion with the United States. Ultimately, the meeting might not amount to much, and Saudi Arabia could increase production anyway, offsetting declines in Iran. “It’s likely to be a meeting high on politics and low on decisions,” said Ole Sloth Hansen, head of commodity strategy at Saxo Bank A/S, according to Bloomberg. “The producers that count are producing at will.”

India to hedge oil to avoid rupee volatility. India’s government may ask its state-owned oil companies to lock in oil at hedged prices, both to avoid the possibility of a price spike as Iran sanctions bite, but also because of the uncertain value of the rupee. India imports about 80 percent of its oil, and the sharp depreciation of the rupee this year has magnified the cost of imports. Meanwhile, India will use rupees to pay for oil from Iran beginning in November after U.S. sanctions take effect.

Russian oil producers rise to all-time high. Russia’s oil companies are enjoying a bonanza due to higher oil prices but also a weaker ruble. With costs in rubles but earnings in U.S. dollars, the cash is pouring in, pushing an index of Russian oil companies to a record high. The danger is that American sanctions related to the chemical poisoning attack in the UK or election interference in the U.S. could target Russian companies. "All investors are asking themselves -- OK, the Russian companies look attractive right now, but what about the next six months, what about the next 12 months?" Alexandre Dimitrov, head of Emerging Europe EQ Funds at Erste Sparinvest Kap Mbh, told Bloomberg.

Iraq oil exports breaking new records. Iraq’s oil exports through its southern port at the Persian Gulf could once again break a new record. Exports for the first three weeks of September average 3.6 million barrels per day, up 20,000 bpd from the 3.58 mb/d posted in August, which is the current record high. The progress comes even as protests have rocked the oil-rich but deeply unequal southern city of Basra. “There were fears that the protests would get to the terminal,” an Iraqi source told Reuters. “But so far, there is no impact.”

Related: Saudi Oil Inventories Continue To Plummet

Chevron pursues “factory model” for shale drilling. The Wall Street Journal reported on the new large-scale drilling techniques pursued by Chevron (NYSE: CVX). The “factory model” for drilling consists of “master planning an entire region of small shale wells by locking up labor, building infrastructure and securing sand and other needed materials, all at once,” the WSJ says. Economies of scale for large companies like Chevron give them an advantage over smaller drillers. “They can transfer technology and skilled people across assets and parts of their portfolio from North America to Argentina,” Andrew Slaughter, executive director of the Center for Energy Solutions at Deloitte LLP, told the WSJ. “These bigger companies have the scale to build or finance infrastructure and secure the best equipment and supplies. They have come to shale in quite a material way.”

New data on EPA biofuels waivers. In a nod to the outraged biofuels industry, the EPA published data detailing its expanded use of waivers for oil refiners, freeing them of biofuels blending requirements. Biofuels and refiners have been in a fierce war during the Trump era, as the EPA has made decisions favorable to the refining industry. The new data shows that the EPA granted 29 waivers to small refineries in 2017, up from 19 in 2016 and 7 in 2015. The waivers have been a boon to refiners but have undercut the market for biofuels and biofuel credits.

Bakken drillers move to periphery. Bakken drilling has increased significantly this year, but higher activity levels means that drillers are being forced into less desirable locations. As a result, the majority of wells in the Bakken could shift from having a peak monthly production of 1,000 bpd to a majority of wells with just 500 bpd of peak performance, according to a study from the North Dakota Pipeline Authority. In other words, drilling activity may need to double to keep output levels consistent in the years ahead.

Bullish outlook affects hedging. As the oil market outlook takes on an increasingly bullish tone, oil companies have pared back their use of hedging, hoping to gain exposure to higher prices. Meanwhile, major consumers, such as airlines, have boosted their hedging to protect themselves from the risk of higher prices. The reshuffling of the hedging mix is affecting the oil futures curve. “The major story for oil right now is not $80 a barrel, but what’s happening at the back end of the forward curve,” Thibaut Remoundos, co-founder of Commodities Trading Corporation, told the FT. “Hedging by oil producers in Brent-linked contracts is dropping off in expectation of higher prices in the future, while major consumers like airlines have been rushing to buy for the same reason. You would need to go back to 2007 to see this level of hedging from consumers.”

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Iran: We Won’t Let OPEC Boost Production

- Russia Inks Huge Deal With World’s Top LNG Importer

- Investors Back Brent To Break $80

President Trump’s efforts have failed to produce any results with oil prices exactly as his sanctions on Russia and his threats of retaliations against the German Chancellor Angela Merkel have failed to stop the construction of the Nord Stream 2 gas pipeline.

Equally his hype about the impact of his forthcoming sanctions on Iran’s oil exports will amount to nothing as his sanctions are doomed to fail and Iran will not lose a single barrel of its oil exports.

Moreover Saudi Arabia and Russia combined can’t add more than 400,000-600,000 barrels a day to the global oil market. The OPEC meeting in Algeria will not result in more oil supplies.

Against the above background, it will be very surprising if the oil price doesn’t surge beyond $80 a barrel shortly.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London