The correlation between the OPEC/OPEC+ production cuts and rising US production has been the theme of the oil market for the past several months and most likely will be further on. This week has been no different, creating a peculiar set of counteracting trends that first push prices up, then pull them down – OPEC producing the lowest volume in 4 years was easily undone by two US oil majors, Chevron and ExxonMobil revealing their ambitious plans to ramp up Permian output even higher than it is already, with US crude stocks most likely rebounding back from last week’s decline.

Early signs (see Point 4) point to the possibility of a breakthrough in US-China trade talks, yet if the history of the last four months is anything to go by, do not bet your money on it yet. As of Wednesday end of day, Brent traded 65.7-66 USD per barrel, whilst WTI oscillated around the 56 USD per barrel mark.

1. US Crude Stocks Rise While Gasoline and Distillate Inventories Draw

- The market once again saw a stock buildup for the week ended March 01 (API reported 7.3MMBBl w-o-w – EIA 7.1 million bpd.

- US crude exports dropped to 3.4mbpd from last week’s 3.6mbpd, with imports falling along at a much steeper rate to 5.6mbpd, some 1.6mbpd down from the week ended February 15.

- After weeks of incremental decreases, the refinery utilization rate started its move upwards with a 1.2 percent hike to 87.1 percent, on the back of 179kbpd of additional crude being refined.…

The correlation between the OPEC/OPEC+ production cuts and rising US production has been the theme of the oil market for the past several months and most likely will be further on. This week has been no different, creating a peculiar set of counteracting trends that first push prices up, then pull them down – OPEC producing the lowest volume in 4 years was easily undone by two US oil majors, Chevron and ExxonMobil revealing their ambitious plans to ramp up Permian output even higher than it is already, with US crude stocks most likely rebounding back from last week’s decline.

Early signs (see Point 4) point to the possibility of a breakthrough in US-China trade talks, yet if the history of the last four months is anything to go by, do not bet your money on it yet. As of Wednesday end of day, Brent traded 65.7-66 USD per barrel, whilst WTI oscillated around the 56 USD per barrel mark.

1. US Crude Stocks Rise While Gasoline and Distillate Inventories Draw

- The market once again saw a stock buildup for the week ended March 01 (API reported 7.3MMBBl w-o-w – EIA 7.1 million bpd.

- US crude exports dropped to 3.4mbpd from last week’s 3.6mbpd, with imports falling along at a much steeper rate to 5.6mbpd, some 1.6mbpd down from the week ended February 15.

- After weeks of incremental decreases, the refinery utilization rate started its move upwards with a 1.2 percent hike to 87.1 percent, on the back of 179kbpd of additional crude being refined.

- Motor gasoline stocks have dropped for the fourth week in a row by 4.2MMbbl to 250.7MMbbl in total, which, however, is still more than 4MMbbl above the 5-year average.

- Distillate inventories have edged lower, too, albeit insignificantly by 2.4MMbbl to 136MMbbl, some 4MMbbl below the 5-year average rate.

2. Saudi Aramco Raises All Its Asia-Bound April OSPs

- The Saudi national oil company Saudi Aramco has mandated an across-the-board increase of all its April-loading grades destined for Asia Pacific.

- Arab Light and Extra Light witnessed the steepest increase, rising 50 cents month-on-month to $1.45 and $1.20 premiums over the Oman/Dubai average.

- Interestingly, Saudi Aramco cut its Mediterranean prices, with FOB Ras Tanura prices dropping a hefty $80-90 cents month-on-month, whilst FOB Sidi Kerir OSPs were down by some $60-70 cents compared to March.

- This sweeping reduction is largely Saudi Aramco’s reaction to Europe’s leading medium sour crude Urals weakening against Dated Brent, swinging back into discount territory after it traded much of January at a premium to Brent.

- Saudi Aramco April-loading OSPs for Northwest Europe were cut, too, however to a smaller extent than the Mediterranean ones, by $30-40 cents per barrel.

- Saudi Aramco rolled over its Arab Light, Medium and Heavy US-bound prices for the third consecutive month, only hiking the Arab Extra Light OSP by $30 cents to a 4.8 premium vs ASCI.

3. China Cuts VAT, Impacting Energy Profitability

- To buttress its slowing economy, Chinese authorities intend to cut value added tax (VAT) for the manufactoring sector from the current 16 percent rate to 13 percent.

- Resulting in refiners having to pay less tax on the crude they purchase, eventually bringing about savings around 1 USD per barrel on gasoline/diesel sales.

- The effect will be even more palpable with imported gasoline, diesel and fuel oil supplies, which are currently subject to a 1 percent import duty (as opposed to crude), and even more so for bitumen, lubricants and aromatics, whose import duties are even higher.

- Analysts predict the VAT cut will not produce that much of an explosion on the Chinese domestic market as the nation still experiences motor fuel oversupply, which will influence profitability more than tax rate changes.

- Pipeline gas and LNG, which are currently subject to a 10 percent VAT rate, will see it fall 1 percent.

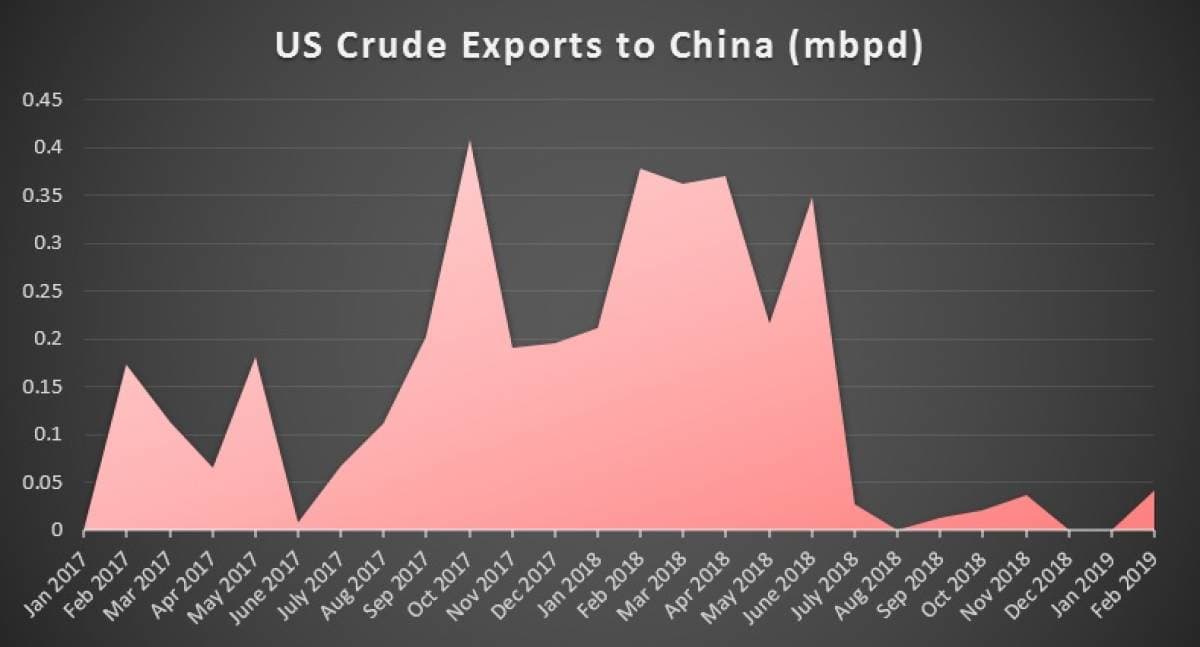

4. US Exports First Cargo of 2019 to China

- After China stopped buying American crude starting December 2019, shipping data suggest a thaw in relations might not be that far away.

- MT Maran Artemis has finished loading at the Southtex Lightering Zone on February 28 and is now on its way to Qingdao where it should arrive by mid-April.

- This marks the first occasion this year that a US crude-laden vessel is loaded and dispatched to China.

- Interestingly, the loading took place three days after US President Donald Trump’s decision to postpone the tariff hike on Chinese goods that was initially planned for March 01.

- Compared to the 53 million and 67 million barrels of US crude supplied to China in 2017 and 2018, this year’s one cargo (1.2 million barrels) indicates 2019 numbers will most probably lag significantly behind.

5. El Sharara Force Majeure Lifted

(Click to enlarge)

- The Libyan national oil company NOC lifted the 300kbpd El Sharara field’s force majeure status on Monday, stating production would start within hours and that it would be just a matter of days until the field gets back to its pre-shutdown production capacity.

- This is more than welcome news for Libya’s oil sector in general, which without El Sharara and El Feel volumes dropped to 0.89mbpd in January-February 2019 from its multi-year high of 1.16mbpd in October 2018.

- NOC estimates that shutdown and restart costs, equipment theft and missed-opportunity losses during the 3 past months amount to a hefty $1.8 billion, corroborating the necessity to create their own armed forces.

- It remains to be seen to what extent did General Haftar’s Libyan National Army retain its presence around El Sharara, however, all members of the operating company Akakus Oil received written confirmations from LNA guaranteeing the safety of operation.

6. ExxonMobil Announces Cyprus Gas Find

- ExxonMobil announced a new gas discovery in Cyprus’ offshore zone, spudding its Glaucus-I wildcat well in Block 10 to a total depth of 4200m.

- Having encountered 133 metres of an excellent gas-bearing reservoir, the Glaucus is estimated contain 5-8 TCf of gas, confirming assumptions that fields in Blocks 10 and 11 have a similar structure that Egypt’s giant field Zohr, located just a couple dozen miles from there.

- Somewhat taming the drillers’ ardour, in early February ExxonMobil and its JV partner Qatar Petroleum have spudded the Delphynus-I wildcat some 10 miles to the south of Glaucus and found no commercial volumes of natural gas.

- With Cypriot offshore drilling in full swing, Turkey has stated it would start drilling in the maritime zone northwest of Cyprus, the demarcation of which is still pending.

- Turkey’s foreign minister Mevlut Cavusoglu promised to spud the first well as soon as April, however Turkey’s national upstream company TPAO retorted it can only start operations from summer.

7. PDVSA Gas Head Jailed

- Further tightening the screws within the Venezuelan state oil company PDVSA in another tour de force of law enforcement zeal, the Venezuelan military intelligence unit Sebin detained the president of the PDVSA gas division, Rosa Mota.

- With the military searching for scapegoats to blame the current dilapidated condition on, Mota made headway with the offshore Dragon field being developed jointly by Royal Dutch Shell, PDVSA and Trinidad’s NGC.

- Interestingly, Mota was detained when PDVSA CEO Manuel Quevedo was out of the country, travelling to Riyadh in Saudi Arabia for an OPEC-IEA workshop.

- Even though 90 percent of Venezuela’s gas is associated and is mostly reinjected or flared, gas production did not witness a drop as radical as that of crude, with output standing at 3.6 BCfd as of early 2018.