Oil markets are enjoying a modestly bullish March on the back of coordinated OPEC+ production cuts and unplanned production outages in Venezuela. Peripheral bullish narratives have included dovish central bank action and progress towards a US/China trade deal which could be signed as early as April. On the other hand, global economic health fears, a persistently strong USD and elevated US production have held rallies in check.

Last week’s key headline that the US Fed plans to delay further rate hikes touched on two of these themes. Central bankers are broadly boosting risk asset levels by holding rates low. Unfortunately, traders also have to grapple with the idea that the Fed’s assessment of the US economy is dimming. The judgment of traders has been to push small gains in March with Brent moving from $66 to $68 while S&P 500 heads for a 20-point gain to 2,820.

This price action has been consistent with a year-long trend for oil. Markets are digesting large quantities of fundamental and macro news and either moving sideways or slightly higher. How are we supposed to interpret this? Are traders sanguine about risks seeing only modestly bullish opportunities ahead?

This inclination of sleepy prices opposite key headlines highlights the need to search beyond simple flat price charts for bearish and bullish risks. Two of our favorite trader sentiment gauges- options skews and time spreads- currently reveal a dodgier market than we see in the flat price charts.

In…

Oil markets are enjoying a modestly bullish March on the back of coordinated OPEC+ production cuts and unplanned production outages in Venezuela. Peripheral bullish narratives have included dovish central bank action and progress towards a US/China trade deal which could be signed as early as April. On the other hand, global economic health fears, a persistently strong USD and elevated US production have held rallies in check.

Last week’s key headline that the US Fed plans to delay further rate hikes touched on two of these themes. Central bankers are broadly boosting risk asset levels by holding rates low. Unfortunately, traders also have to grapple with the idea that the Fed’s assessment of the US economy is dimming. The judgment of traders has been to push small gains in March with Brent moving from $66 to $68 while S&P 500 heads for a 20-point gain to 2,820.

This price action has been consistent with a year-long trend for oil. Markets are digesting large quantities of fundamental and macro news and either moving sideways or slightly higher. How are we supposed to interpret this? Are traders sanguine about risks seeing only modestly bullish opportunities ahead?

This inclination of sleepy prices opposite key headlines highlights the need to search beyond simple flat price charts for bearish and bullish risks. Two of our favorite trader sentiment gauges- options skews and time spreads- currently reveal a dodgier market than we see in the flat price charts.

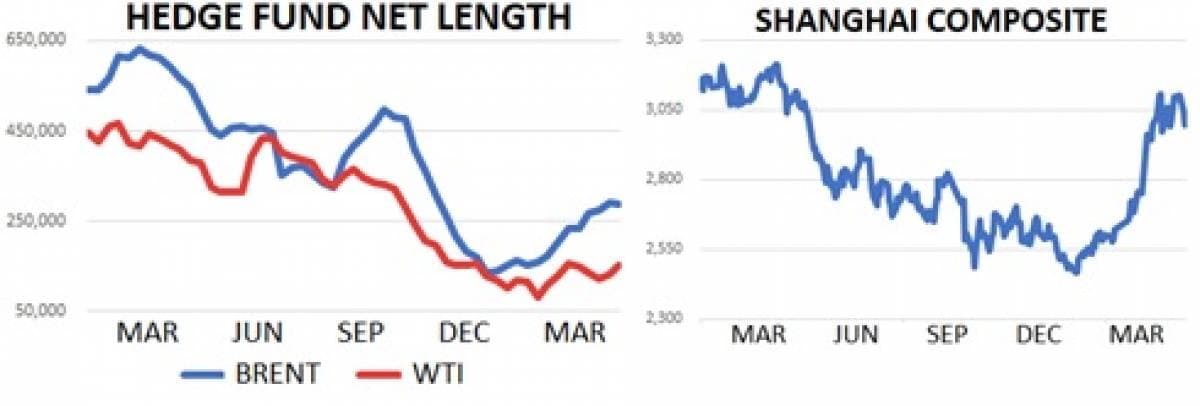

In the ‘oil insurance market,’ option skews continue to suggest that bearish risks outweigh bullish ones. This week option traders priced 25-delta call options expiring in six weeks at 25% implied volatility while similar put options priced at 30%. This 5-delta premium for bearish strikes is consistent with how options markets have measured risk so far in 2019 and suggests traders are more eager to buy downside insurance that upside insurance. This trend is especially noteworthy as a modest amount of hedge fund buying has come into the market. Funds have more than doubled their net length in NYMEX WTI derivatives over the last three months, but there doesn’t appear to be substantial demand for speculative call-buying. The bearish options skew also reveals a degree of eagerness to hedge price levels from producers who want to lock-in recent price gains rather than hope for better levels.

Time spreads, meanwhile, are showing the complete opposite risk after rising rapidly in the last three weeks. The prompt 6-month Brent spread trader over +1.00 this week for a $1.50 rally so far in 2019 and continues to forecast strong inventory draws in the second half of the year. The backwardated structure- where prompt prices trade at a premium to later dated barrels- will heavily incentivize traders to sell barrels to refiners for immediate consumption rather than wait and hold them in storage. The same structure is nearly true for WTI as well which is rapidly moving towards a ‘flat’ curve after beginning the month in a steep contango. For both US markets and abroad, spread traders are clearly signaling bullish risks on the horizon.

Looking ahead, we’re guessing a sideways price range is the most likely path for crude oil prices as risks balance out in the high $60s. While it’s certainly true that fundamentals are improving, we think that US Dollar strength and weak demand growth should limit the potential of the existing price rally. We’ll keep a close eye on spread and options traders, however, as both foresee risks on the horizon.

Quick Hits

- Brent climbed towards $68 this week while WTI increased to $59. WTI is higher by nearly 33% YTD while Brent is up by about 28%. Both contracts continue to trade in technically bullish patterns and have avoided corrections by slowly gaining upward momentum. Prices are headed towards their best Q1 since 2002.

- The Trump administration appears to be split over Iranian crude waivers heading into their expiration in May. Bloomberg reported this week that John Bolton’s National Security Council is pushing for a termination of waivers while the State Department believes they should be extended. Terminating waivers for Iranian crude buyers could halt more than 1m bpd of exports, the bulk of which appear to be heading to China for now.

- OPEC+ is expected to meet on May 19th in Saudi Arabia to discuss the progress of their current supply cut efforts. OPEC’s next scheduled meeting begins on June 25th. Recent strength in Brent spreads suggests traders think the group will continue to pull barrels from the market in the second half of the year.

- Hedge funds were net sellers of ICE Brent futures and options last week for the first time in 2019. Net length for Brent is +93% YTD. Net length in NYMEX WTI is up by about 33% this year.

- US Treasuries have posted a massive move higher following last week’s Fed comments. The US 10yr yield dropped to 2.40% for its lowest print in about 14-months. Parts of the yield curve have flipped inverted in the last week with short maturities offering lower yields than longer dated maturities. The implication is that traders believe the Fed will have to lower rates in years ahead due to poor economic performance.

- Theresa May’s Brexit proposal gained traction in Parliament this week but her hold on her title of Prime Minister did not. Several members of her party- most notably Boris Johnson- commented they could support her deal if it was accompanied by a change in leadership.

- US and Chinese trade officials are set to meet late this week and continue to appear to be on a path towards a deal. We still think that the upcoming 2020 elections will force Trump to make a deal with China at some point in 2019.

- The Shanghai Composite remains the world’s best performing stock market so far this year despite a recent modest correction and is currently about +24% YTD.

DOE Wrap Up

- Last week’s DOE report was bullish overall with strong inventory draws in crude oil, gasoline and distillates.

- US crude oil inventories fell by 9.6m bbls w/w to 439m and are higher y/y by 4.7% over the last four months

- Most of the draw in crude stocks is being driven by climbing exports while crude imports are shrinking. US traders exported 3.4m bpd of crude oil last week and have averaged 2.7m bpd so far in 2019 versus 1.96m bpd in 2018.

- As for imports, the US market took in 6.9m bpd last week and is averaging 7.1m bpd in 2019 after averaging 7.8m bpd in 2018

- US producers pumped 12.1m bpd last week tying their record-high effort

- Crude oil inventories in the Cushing, OK delivery hub fell by about 470k bbls w/w to 46.4m bbls and have largely been flat since mid-February

- The US currently has 27.4 days of crude oil supply on hand which is up y/y by about 4%.

- US refiners processed 16.2m bpd last week for a 200k bpd w/w improvement. Refine demand is lower by 250k bpd y/y over the last four weeks in a troubling sign for bulls.

- The WTI 321 crack was steady this week near $21/bbl/ gasoil brent. In overseas markets the gasoil/brent crack traded just below $15/bbl.

- US gasoline inventories fell sharply w/w to 242m bbls. Overall stocks are flat y/y.

- Gasoline demand + exports was flat w/w at 10.07 m bpd and is lower by 20k bpd YTD.

- Distillate inventories fell by 4.1m bbls w/w to 132m and are also flat y/y