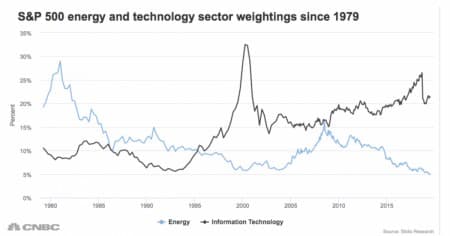

The oil and gas sector is notorious for booms and busts. The ongoing bust cycle, however, is beginning to look like the new norm with investors continuing to give the sector a wide berth. Oil and gas stocks have fallen so much that you would have to go back to 1979 to find a time when their weighting in the S&P 500 was this low - just 4 percent.

The alarm bells sounded last year after the sector’s biggest name, ExxonMobil (NYSE: XOM), dropped from the S&P 500’s Top 10 for the first time in nine decades. Energy stocks have declined another 34.6 percent so far this year and are looking to extend a decade of underperformance.

The U.S. oil and gas sector was once worth a combined $3 trillion; now there are three companies with higher valuations than the entire sector. It’s interesting to note that all three are tech giants. They also have sizable clean energy investments (not merely buying renewable-energy credits), and do not pay the massive dividends that energy companies have been doling out. Still, their shares have continued to run-up even during the Covid-19 crisis.

Source: CNBC

Source: Quartz

#1. Apple

Market Cap: $1.56T

Enterprise Value: $1.57T

Year-to-Date Returns: 22.2% At a market cap of nearly $1.6T, Apple Inc. (NASDAQ: AAPL) is the world’s second most valuable company after oil giant Saudi Aramco, which is valued at $1.76T.

Apple has long-standing commitments to clean energy. In 2018, the company announced that its global facilities including data centers, retail stores, and offices are powered with 100 percent clean energy. The company’s new headquarters in Cupertino is powered by 100 percent renewable energy, including a 17-megawatt onsite rooftop solar installation (see above).

Apple, together with its partners including utilities, has been building new renewable energy projects around the world. Apple currently has 25 operational renewable energy projects around the globe, totaling 626 megawatts of generation capacity. The smartphone manufacturer has commissioned over 485 megawatts of wind and solar projects in China where the majority of its iPhones are assembled.

Related: China Sees Tanker Traffic Soar As Oil Storage Runs Out

Further, the company is helping its hordes of suppliers to move to 100 percent renewable energy. The company, along with 10 of its Chinese suppliers, has committed $300M to build renewable energy plants over the next three years to supply 1 gigawatt of clean energy.

#2. Microsoft

Market Cap: $1.52T

Enterprise Value: $1.45T

Year-to-Date Returns: 27.2%

Microsoft is the owner of the Azure cloud, the world’s second-largest public cloud. Data centers are well-known energy hogs, consuming about 2 percent of the world’s electricity. Yet, that figure keeps rising as the internet keeps expanding at a torrid pace and hyperscale data centers pop up everywhere to power the tsunami of data.

Microsoft has been increasingly building eco-efficient infrastructure by partnering with clean energy farms. For instance, it has partnered with First Solar to use its 150-MW Sun Streams 2 solar power plant to power its new datacenters at the Mirage and Goodyear in Arizona. The software giant has revealed that renewable sources now meet half of its data center energy needs with a goal to increase that share to 70 percent by 2023.

Microsoft recently doubled its internal carbon tax and is one of 75 U.S. corporations that have been lobbying Congress to introduce a national carbon tax.

#3. Amazon

Market Cap: $1.35T

Enterprise Value: $1.33T

Year-to-Date Returns: 46.8%

Amazon Inc. (NASDAQ: AMZN) is a true internet giant, running the world’s third-largest online marketplace as well as the world’s biggest cloud operation, AWS. Amazon owns a huge transportation fleet, consisting of 30,000 Amazon-branded delivery vehicles plus another 20,000 branded trailers. With such massive operations, the company has frequently received its share of flak for its outsized role in accelerating climate change. For instance, in 2018, it’s estimated that Amazon emitted a staggering 44.4 million metric tons of CO2--greater than the carbon footprint of Switzerland.

Related: Underinvestment Could Send Oil Prices Soaring

Perhaps it is data points like these that prompted Amazon CEO Jeff Bezos to recently commit $10 billion of his personal fortune to fight climate change through the Bezos Earth Fund.

Last year, Bezos announced that his company plans to buy a whopping 100,000 electric vans from the startup it helped create, Rivian.

In March, the eCommerce company announced that it will invest in four new solar and wind projects as part of its goal to be net-zero carbon by 2040.

A few days ago, Amazon announced plans to launch a $2 billion venture capital fund that will focus on investments in technology to fight climate change and support sustainable development.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Oilfield Services May Not Recover Until 2023

- How Saudi Arabia Caused The Worst Oil Price Crash In History

- Pirates Threaten Oil Operations In Gulf Of Mexico