This week has witnessed a great flurry of news regarding the creation of a new Middle Eastern benchmark from the UAE flagship crude Murban. Intercontinental Exchange stated it will list Murban next year – partnered by Total, Shell, BP, Vitol and others – with the stated aim of creating a transparent, regulated and commercially usable Middle Eastern benchmark. Setting up Murban would be revolutionary, especially for ADNOC as it would provide the first light Middle Eastern benchmark. It would be terrific news for Asian refiners who, at last, would have to deal with UAE crudes, knowing the pricing environment in advance and being able to act upon it. Yet Murban has a few bugs which need to be fixed, clarifying ADNOC’s long-term commitments to the grade’s universal applicability.

There are several consequential considerations that ought to compel Middle Eastern producers to seek a new benchmark. Trade flows in the traditional domain of crudes from the United Arab Emirates or Kuwait – Asia – have been undergoing a thorough transformation. As we have established in our special report on US exports, the inflow of American barrels has pushed West African and North Sea crudes into Asia, all the while finding a special niche of its own with Asian refiners, too. Concurrently, the OPEC+ production cuts have primarily impacted the supply side of medium sour crudes, only fortifying the overall refinery slate lightening trend that has been taking place in Asia.

On the…

This week has witnessed a great flurry of news regarding the creation of a new Middle Eastern benchmark from the UAE flagship crude Murban. Intercontinental Exchange stated it will list Murban next year – partnered by Total, Shell, BP, Vitol and others – with the stated aim of creating a transparent, regulated and commercially usable Middle Eastern benchmark. Setting up Murban would be revolutionary, especially for ADNOC as it would provide the first light Middle Eastern benchmark. It would be terrific news for Asian refiners who, at last, would have to deal with UAE crudes, knowing the pricing environment in advance and being able to act upon it. Yet Murban has a few bugs which need to be fixed, clarifying ADNOC’s long-term commitments to the grade’s universal applicability.

There are several consequential considerations that ought to compel Middle Eastern producers to seek a new benchmark. Trade flows in the traditional domain of crudes from the United Arab Emirates or Kuwait – Asia – have been undergoing a thorough transformation. As we have established in our special report on US exports, the inflow of American barrels has pushed West African and North Sea crudes into Asia, all the while finding a special niche of its own with Asian refiners, too. Concurrently, the OPEC+ production cuts have primarily impacted the supply side of medium sour crudes, only fortifying the overall refinery slate lightening trend that has been taking place in Asia.

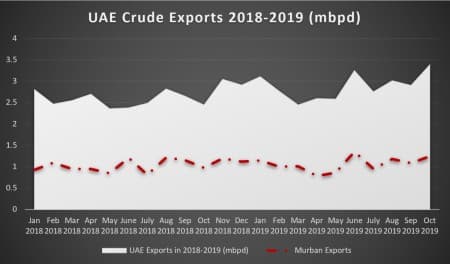

On the face of things, one can build a fairly strong case for Murban to become a new regional benchmark. It is the largest crude stream coming from the United Arab Emirates, accounting for approximately 50 percent of its production, and it is one of the largest Middle Eastern streams in general, only lagging behind heavier and sourer streams of Arab Light, Basrah Light, Arab Medium and KEB. Every single month some 35-40 cargoes of Murban sweep the international seas, totaling some 30-40 million barrels on a delivered basis. The overwhelming majority of Murban ends up with Asian refiners – this regional concentration might help ADNOC in presenting its case for an Asia-focused light benchmark.

Rivalry or revelry

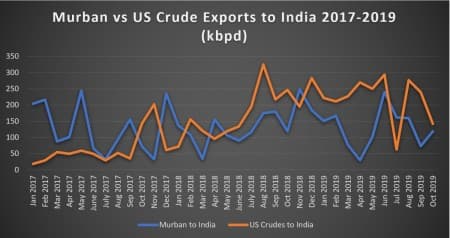

As much as Murban seems an all-round good idea that is beneficial for both producers and buyers (more than 60 refineries have had some experience with it), one needs to also think about competition, i.e. are there any other crudes which could contend with it. In terms of overall volumes, soon enough there might be larger streams which might vie for the spot of a new light benchmark in Asia. The first to come to mind is WTI – still less present in Japan or Singapore than Murban yet having the potential to move substantially higher. WTI would also have a tangible advantage over Murban in that it is already a transparent spot-traded grade, in stark contrast to the retroactively priced ADNOC crudes that still have the switch to a spot market pricing ahead of them.

As US crude exports to Asia have moved above 1mbpd starting from January 2019, one must not wait long until they take over the aggregate Murban export volumes. Tellingly, US exports to India have already overtaken Murban and might do the same for several Southeast Asian countries soon (think South Korea or Thailand). Even though WTI cannot avail itself of any Middle Eastern NOC’s political clout, its further proliferation in markets that might be considered Murban’s domain might put a question mark over the viability of a new Middle Eastern benchmark – perhaps the combination of Brent and WTI is enough to cover Asian trade? Even against the tense background of a potentially long-standing trade war between Washington and Beijing, rising WTI exports are very probable as USGC refiners seem to have reached the point of saturation in terms of light sweet refining.

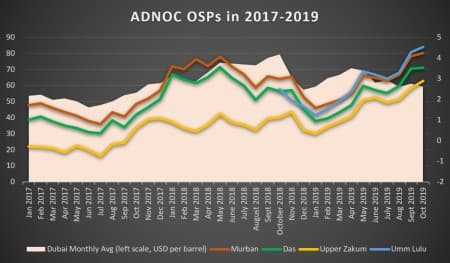

One of the most widely discussed downsides of Oman/Dubai is its susceptibility to manipulation – especially physical Oman was used by Chinese buyers (who take in roughly 85 percent of all volumes) to tinker with the crude price a bit so as to get it to more palatable levels. Could Murban be also prone to similar tweaks? The answer remains to be seen, but it seems somewhat unlikely. Murban has a diversified equity offtake split – the Abu Dhabi Co. for Onshore Petroleum Operations (ADCO) is divided between ADNOC (60 percent), European majors (Total, BP) holding 20 percent and Asian refiners holding another 20 percent – which should contribute massively to the most efficient distribution of resources across the spectrum.

If successfully carried through, Murban would become the first regional/global light benchmark that is subject to OPEC cuts. The current United Arab Emirates OPEC quota stands at 3.07mbpd and ADNOC has been at the forefront of output cut compliance, all the while sending a clear signal to the markets that it is bent on increasing its total production capacity to 4mbpd by the end of the year 2020, to be hiked to 5mbpd by 2030. There is ample reason to believe that the current setup of the OPEC/OPEC+ Vienna Alliance would extend the current output curtailment deal – the UAE’s fiscal breakeven price of $70 per barrel in 2019 (some $15 per barrel lower than that of Saudi Arabia) gives it a bit more leeway – yet it remains to be seen whether its unwavering support can last in a long-term perspective.

With a little reconsideration of its crude movements, the UAE can relatively easily buttress Murban’s market presence. ADNOC already seeks to mitigate the Murban-related impacts of any future OPEC+ output curtailment (which remains in its interest) – by late 2022, the $3.1 billion Crude Flexibility Project (CFP) launched last year so that ADNOC can tap into heavier barrels ought to be finalized, freeing up light Murban for exports and allowing for the refining of UAE-produced medium sour crudes, primarily Upper Zakum (33.9° API). Simultaneously, ADNOC wants to raise Upper Zakum output rates to 1mbpd (from the current 0.65mbpd) yet this will inevitably depend on the scope of commitments that Abu Dhabi and Dubai are ready to commit within the OPEC/OPEC+ forum.

What would happen to the Dubai/Oman benchmark itself once its biggest part, making up almost 40 percent of the aggregate production (1.2mbpd out of 3mbpd), is turned into a separate light benchmark? First and foremost, it would naturally tilt more towards the medium sour side, given its components – right now the weighted average density of Dubai (30° API/2% Sulphur), Oman (34° API/2%), Al Shaheen(28° API/2.4%) and Upper Zakum (34° API/1.8%) amounts to 34° API. Without Murban, it would hover around 31° API. Perhaps even more interestingly, the withdrawal of Murban’s 0.7 percent Sulphur content would push the average Sulphur content of the Oman/Dubai basket a whopping 0.5 percent higher, to 1.9%. That is a clear-cut double whammy for Oman/Dubai prices.