Friday March 1, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oilfield services struggling even as market rebounds

(Click to enlarge)

- “Oil and gas companies are back in the money,” Wood Mackenzie’s chief analyst Simon Flower said in a report. “Operationally and financially, all lights are green – production is up, costs are down and margins are up.”

- The oil majors are making more money now at $60 per barrel than they were five years ago when oil traded above $100 per barrel, Flowers said.

- However, oilfield services companies are lagging behind. Since 2014, oil producers have demanded pricing concessions from service companies.

- Service companies, desperate for work as drilling and investment dried up, had little leverage in negotiations. Surplus capacity in the service sector depressed pricing. For instance, WoodMac says that floating production system fabricators only stand at a 50 percent utilization rate.

- Meanwhile, even though the market has rebounded from the lows of 2016, producers are “sticking to capital discipline” and “shunning growth.” Global upstream spending could rise from $450 billion in 2016 to $500 billion by 2020, but that would still be sharply below the $750 billion spent at the 2014 peak.

2. Can shale reduce debt and pay shareholders?

(Click to enlarge)

- The U.S. shale industry may have just enough cash to cover debt payments and pay out dividends this year.

- An analysis of the 33 largest shale companies in the U.S. by Rystad Energy, accounting for 39 percent of production, finds that while the industry cut debt in the second half of 2018, lower oil prices may mean that they struggle this year.

- “Shale E&Ps struggle to please equity investors and reduce leverage ratios simultaneously. Despite a significant deleverage last year, estimated 2019 free cash flow barely covers operator obligations, putting E&Ps on thin ice as future dividend payments remain in question,” said Rystad Energy senior analyst Alisa Lukash. Related: U.S. Oil Rig Count Falls As Prices Slide

- Rystad says that the industry may need to trim $4 billion from its promised dividend payments over the next seven years due to inadequate cash flow.

3. Gold prices soar, investors unsure if it can continue

(Click to enlarge)

- Gold prices have eased off recent highs, dipping below $1,320 on February 28. Still, prices are up sharply since hitting a low last summer.

- Gold has been helped along by an exit of long bets on the U.S. dollar. Also, “Increasing uncertainty surrounding Brexit negotiations has led to local demand for gold limiting downside risk rather than broad safe-haven buying,” Standard Chartered wrote in a note.

- As of early February, gross long positions increased to their highest level since April 2018.

- The backtracking by the U.S. Federal Reserve has provided a jolt to a range of metals.

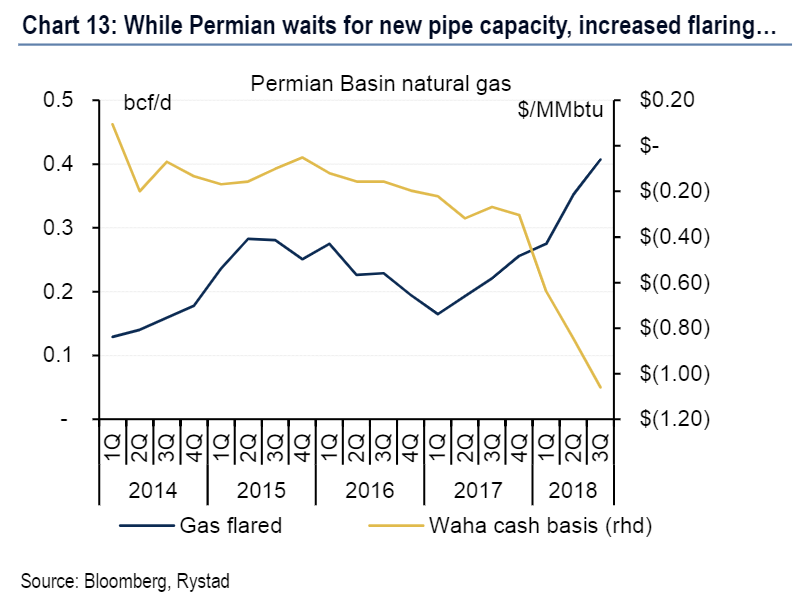

4. Lack of pipelines means Permian gas flared

(Click to enlarge)

- The lack of takeaway capacity in the Permian basin for natural gas has led to a crash in prices and a surge in flaring.

- “Cash basis in the Permian started to widen in 2017 and really disconnected with Henry Hub as gas flaring increased throughout 2018,” Bank of America Merrill Lynch wrote in a note. “Natural gas prices in the Permian could realize even weaker prices this summer as the basin waits on new natural gas pipeline capacity.”

- The Gulf Coast Express, with a capacity of 2 billion cubic feet per day (bcf/d), is the next pipeline that is expected to come online in the region, slated for the fourth quarter.

- Conversely, new midstream capacity for oil could only depress natural gas prices further since it will be an uptick in oil drilling and a subsequent increase in associated gas production.

- Meanwhile, flaring has continued to increase.

5. Steel sees slight rebound

(Click to enlarge)

- Steel production in China rose by nearly 2.5 million tons per day in February, a year-on-year increase of 10.7 percent, according to Commerzbank. Some of the increase is seasonal to allow for restocking.

- “All the same, we do not currently expect the latest inventory build to jeopardise the tentative recovery of the steel price following its marked fall in the fourth quarter,” Commerzbank wrote in a note.

- China’s “massive economic stimulus” measures should start to show up in the construction sector, the bank said, the most important sector for steel and base metals.

- The easing of the U.S.-China trade war also bodes well, taking away one of the downside risks to steel prices.

6. Investors rush into palladium futures

(Click to enlarge)

- As palladium prices break new records, investors have stampeded into bullish bets.

- Higher prices have been met with large increases in trading volumes.

- “Well over 10,000 contracts of 100 troy ounces were traded on each of the last five days of trading on the NYMEX. That is roughly twice as much as was traded on average in the preceding days since the start of the year,” Commerzbank wrote in a report on Tuesday.

Related: Where Will Putin Build His Next Gas Pipeline?

- However, the bank was skeptical. “We have long since failed to see any fundamental justification for the price increase,” Commerzbank analysts said. “In our view, any attempt to explain it by citing possible sanctions against Russian palladium producers or the end of the trade dispute are not sufficient to justify the extent of the price rise – palladium has skyrocketed by over 80% since its August low.”

- Palladium is used in vehicles to help reduce emissions. The price has skyrocketed since late last year.

7. Cobalt prices continue decline

(Click to enlarge)

- Cobalt prices fell yet again in February, continuing a long slide that has gripped the market since last summer.

- The unexpected supply increase in the Democratic Republic of Congo has helped undercut prices. The surplus could extend for another year or two.

- As of February 27, cobalt prices were just below $15 per pound, down from $17.24/pound in January.

- Glencore’s (LON: GLEN) CFO Steve Kalmin said in February that the glut would be temporary, saying that the market is suffering from “a bit of indigestion.” he added “Companies, including ourselves, need to be smart about how they manage supply.”

- Cobalt is critical for batteries and the surge in expected sales of electric vehicles over the next few years should mop up the excess cobalt supply.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.

More Top Reads from Oilprice.com:

- BP CEO Dudley: U.S. Shale Is ‘A Market Without A Brain’

- Saudi Arabia Aims To Become Large Natural Gas Exporter

- Is U.S. Oil Returning To China?

The three biggest chunks of the global economy are the global oil industry, the economies of the oil-producing countries and global investments. All of them benefit from rising oil prices.

While it is true that low oil prices could reduce the cost of manufacturing, thus helping the global economy to grow, it is a short-term benefit as this is vastly offset by a curtailment of global investment which forces companies around the world to cut spending, sell assets and make thousands, if not millions, of people redundant. Just look at the adverse impact of the 2014 oil price crash on the global economy.

Rising oil prices invigorate global investments, enhance the revenue of oil-producing nations thus enabling them to spend more on oil exploration and the expansion of their production capacity to be able to meet global demand and also enable the global oil industry to keep growing and being able to finance new projects worldwide.

My research shows that a fair price for oil ranges from $100-$130 a barrel. Such a price range is good for the global economy and its major ingredients. It also enhances the global demand for other commodities.

A continuation of low oil prices leaves no winners only losers. It also demonstrates the destructive power of low oil prices.

As for the US shale oil industry, I have always maintained that it is an industry with diminishing returns and therefore will never be profitable irrespective of oil prices. Since its actual inception in 2008, it has been in a vicious circle. It has to continue production to remain afloat and without borrowing it can’t continue to produce thus amassing huge debts estimated in hundreds of billions of dollars and being unable to pay meaningful dividends to its investors.

The Achilles heel of the US shale oil industry is the steep depletion rate ranging from 70%-90% in the first year of production necessitating the drilling of thousands of wells just to maintain production. It is estimated that US shale producers need to drill some 10,000 new wells every year at an annual cost of $50 bn just to maintain production. That adds year after year to their fast-growing debts.

Wall Street investors have been aware of this situation since the beginning of shale oil production. But major investors hoped that shale companies would scale up, achieve efficiencies and lower breakeven prices to the point that they could turn a profit.

The US shale oil industry could become a diminished presence in the global oil market if not a thing of the past within 5-10 years.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Too much oil coming online both conventional and shale. US shale using new technology and methods are breaking even in the high teens / low 20's. Now recovering 15% to 17% of recoverable oil per acre, up from 5% 5 years ago, going to over 30% in next 3 years. Hess new 2018 wells rate of return 55% at $50.00 oil. An oil tsunami will hit OPEC by 2020. The free market will "stabilize" and "balance" the oil market at $45 to $50/bbl.