Just like the rest of the oil and gas sector, the U.S. midstream oil and gas segment has been hugely disrupted by the plunge in global energy demand spawned by the coronavirus pandemic. Since the beginning of the current year, many North American midstream players have seen their market values cut roughly in half, with huge pullbacks in production as well as a ramping down of capacity by refineries, liquefaction facilities, and exporters taking a heavy toll. To make matters worse, many of these businesses have historically demonstrated weak earnings potential or carried excessive debt—or both.

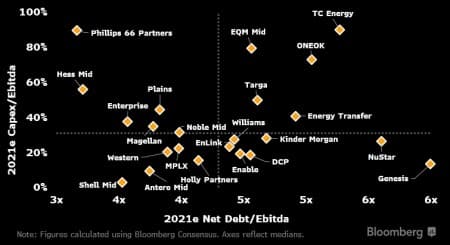

U.S. midstream oil and gas companies have not been spared thanks to oversupplied U.S. oil markets and rampant project cancellations. This is expected to drive capex and dividend cuts to well-above 50%, on average, in a bid to manage leverage, especially in the Permian Basin after heavy spending on major buildouts.

Marine terminals are expected to see a significant drop in volume, with new export projects expected to be put on hold. Gathering and processing facilities are expected to bear the brunt of the slowdown due to project cancellations and new capacity going unused.

Smaller players are expected to be hardest hit.

After all, large-cap companies tend to have healthier balance sheets than their smaller brethren, who tend to carry heavy debt burdens.

Consequently, the sector’s hefty distributions are likely to see huge cuts well into 2021 as declining Ebitda increasingly impairs leverage ratios.

That said, here are two midstream players that could actually thrive in the coming year, with both being MLPS, or Master Limited Partnerships.

MLPs are business ventures that operate as publicly traded companies, with the company that manages day-to-day operations being the general partner while the investor acts as a limited partner.

Related: Exxon’s Big Bet On Guyana’s Offshore Oil Basin Is Paying Off

An MLP is required by law to derive at least 90% of its cash flow from commodities, natural resources, or real estate. They, in turn, distribute cash to shareholders instead of paying dividends as a standard company would. MLPs combine the liquidity of publicly traded companies and the tax benefits of private partnerships because profits are taxed only when investors receive distributions.

Midstream Companies Cutting Back On Leverage and CAPEX

Source: Primary Vision

#1 Enterprise Products

Enterprise Products Partners L.P. (NYSE:EP) is the top transporter of natural gas liquids (NGLs) and also owns the most NGL fractionation capacity in the United States, as well as dock space for exports. Enterprise Products is the largest midstream MLP in the country. Enterprise has clearly read the signs of the times and has begun to work with partners to scale back its project backlog. In the past, EP was able to weather the normal industry headwinds thanks to robust cash coverage and manageable leverage. Unfortunately, Covid-19 has been anything but your average downturn, and EP has been forced to seriously cut back on Capex.

After spending $17 billion in capital projects in 2015-19, including new oil pipelines, NGL and LPG pipeline-and-export facilities, and NGL fractionation plants, the giant MLP now plans to spend just $2.5-$3 billion this year, down from a prior budget of $3.5-$4 billion as well as a combined $4 billion in 2021-22.

However, these dramatic cuts are expected to pay off big time. Related: Oil Falls After OPEC Slashes Q1 2021 Demand Forecast

Wall Street consensus has EP’s EBITDA clocking in at about $7.8 billion in 2020, down ~4%. That’s a mild fall compared to the much steeper declines at less diversified NLG peers. Indeed, EP only flattened its distribution in the first quarter (forward yield of 8.24%) as many of its peers made deep cuts to retain cash.

#2 Phillips 66 Partners

Phillips 66 Partners (NYSE:PSXP) is a midstream company founded in 2013 as a subsidiary of Phillips 66 (NYSE:PSX).

Phillips Partners owns 75% of its MLP’s limited shares, providing crucial support for revenues and financing. Indeed, PSXP has one of the strongest balance sheets of the refining-sponsored MLPs. That’s a critical consideration considering that the company currently pays a high 11.63% fwd yield, which appears well covered.

The main risk when investing in PSXP hinges on whether the Dakota Access Pipeline (DAPL) will eventually be shut following a permitting dispute. But with states and municipalities starving for tax revenues and jobs amid Covid-19, this does not look like something that’s likely to happen. A decision on an injunction will be made by early 2021, but an outage would most likely last not more than six months.

That said, both EP and PSXP remain deeply in the red.

Midstream oil and gas companies with positive returns in the current year are BlueKnight Energy Partners, LP (NASDAQ:BKEP) and Antero Midstream Corp. (NYSE:AM), with year-to-date returns of 59.3% and 10.9%, respectively.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- World Oil Demand Hits Two-Month High

- The Top U.S. Shale Gas Basin Continues To Bleed Cash

- Rig Count Sees Largest One-Week Increase Since January