The OPEC/OPEC+ agreement is now all the news in the oil sector. This substantial feat is accompanied by ample media coverage and OPEC’s attitude towards growing US crude production remained one of the main talking point throughout. One might have gotten used to the United States’ sole position as the one marking massive year-on-year output increases and stoking (somewhat unrealistic) fears that American crude will flood the global markets. In fact, it might have been the US and Canada that are disrupting the markets – just as much the technological advances of the shale gale shook energy analysts, massive tar sands production buildups could be a case study in circumspect success. To understand why this did not materialize, let’s analyze Canada’s main crude oil trends.

1. Easing of output curtailments

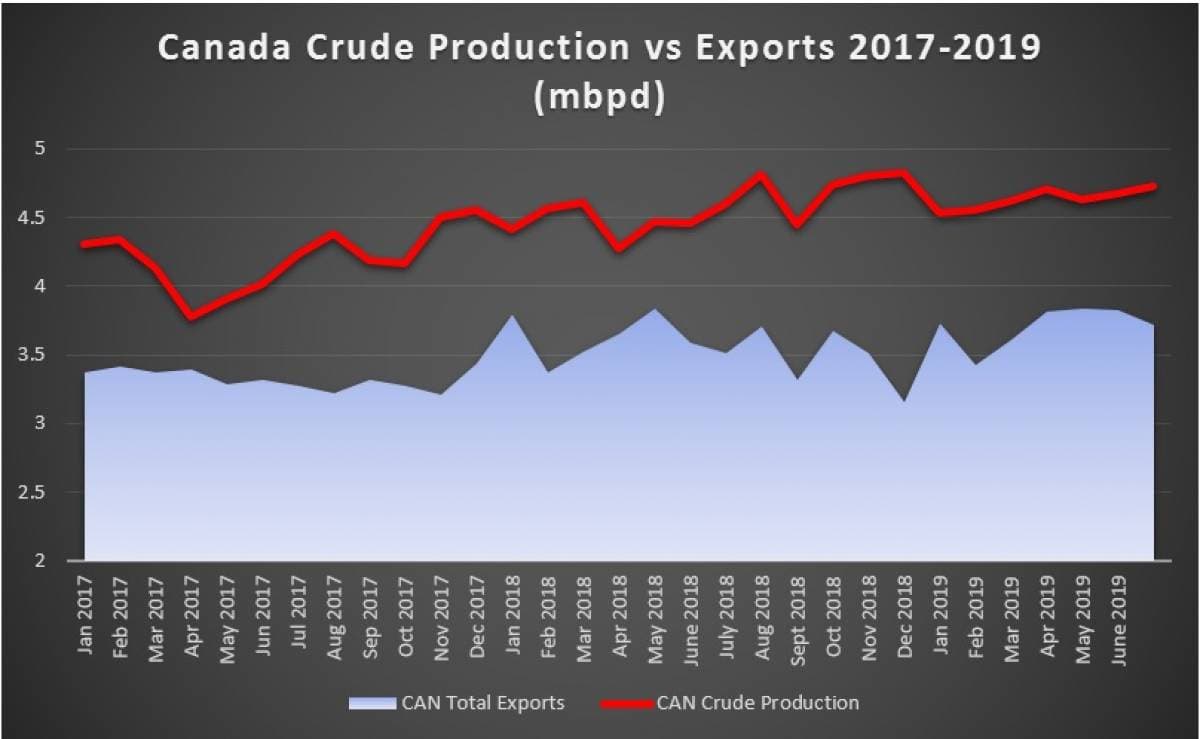

As opposed to the United States whose government fully embraced the cause of energy independence, Canadian producers are in a much less privileged position. They must contend with production curtailments mandated by the government of Alberta and pro-environment policies put forward by the Liberal government of Justin Trudeau. There has been some improvement though as the government of Alberta has gradually moved the production cap from the initial 3.56mbpd announced for January 2019 to 3.74mbpd in August 2019, marking five output cap increases along the way. The current setup is still far from ideal as still 150kbpd of crude is kept away from markets, yet still…

The OPEC/OPEC+ agreement is now all the news in the oil sector. This substantial feat is accompanied by ample media coverage and OPEC’s attitude towards growing US crude production remained one of the main talking point throughout. One might have gotten used to the United States’ sole position as the one marking massive year-on-year output increases and stoking (somewhat unrealistic) fears that American crude will flood the global markets. In fact, it might have been the US and Canada that are disrupting the markets – just as much the technological advances of the shale gale shook energy analysts, massive tar sands production buildups could be a case study in circumspect success. To understand why this did not materialize, let’s analyze Canada’s main crude oil trends.

1. Easing of output curtailments

As opposed to the United States whose government fully embraced the cause of energy independence, Canadian producers are in a much less privileged position. They must contend with production curtailments mandated by the government of Alberta and pro-environment policies put forward by the Liberal government of Justin Trudeau. There has been some improvement though as the government of Alberta has gradually moved the production cap from the initial 3.56mbpd announced for January 2019 to 3.74mbpd in August 2019, marking five output cap increases along the way. The current setup is still far from ideal as still 150kbpd of crude is kept away from markets, yet still a palpable improvement from the 325kbpd that were locked out in January.

That summer would see some relaxing was widely anticipated, former Alberta premier Rachel Notley anticipated the start of its $3.7 billion crude-by-rail capacity-building program in July 2019, adding the first 20kbpd that month, one-sixth of the total new rail capacity to be provided under the plan. The new Alberta premier Jason Kenney intends to make good on his campaign promise to divest the crude-by-rail program and have all the decision-making in terms of transportation in the hands of the oil-producing companies themselves. A mixed blessing for oil companies as it raises expenses and streamlines export procedure (i.e. no bureaucracy) at the same time, currently crude-by-rail is the only viable and available option.

2. Easing of sell-off concerns

Opting for an across-the-board output curtailment, the government of Alberta ran the risk of upsetting producers without providing any tangible relief in the form of a narrowing WTI-WCS spread. Luckily for both sides, as major and tiny Canadian producers were cutting production, the Trump Administration levied sanctions on Venezuela and set about to wind down the Iran sanctions waivers, boosting demand for the only heavy crude stream which still had potential to grow in terms of volumes, the bituminous plays of Alberta. Ever since the mandated cut began, the WCS-WTI discount did not drop below $20 per barrel, despite the occasional scare along the road.

Most notable among the disquietudes of the past six months, wildfires compelled producers to reconsider their production potential in May-June 2019. Canadian Natural Resources shut its Pelican Lake and Woodenhouse projects for 2 weeks, evacuating all personnel. Cenovus also halted production at its Marten Hills facility, the scope of which however pales in comparison to CNRL’s assets. This meant closing off some 65kbpd of production, causing Western Canadian Select prices at Hardisty, Alberta to drop to an annual low, a $16-17 per barrel discount to NYMEX WTI CMA. The WCS-WTI discount has recovered since and is now trading around the $13-dollar mark.

3. Market consolidation

Many were those who predicted back in December-January that the mandated production cuts would hit small-to-medium producers most and that leading Canadian corporations would rub through. This turned out to be true – those who already had “too much skin in the game” actually expanded their portfolio, whilst companies who could allow themselves to divest and concentrate on something else did exactly that. A fitting example is the divestment of Devon Energy’s Canadian portfolio to Canadian Natural Resources (CNR), the leading oil producer in the country, estimated at 2.8 billion. CNR’s output was boosted by some 113kbpd of heavy crude from Alberta, in addition to its own portfolio that produces 640kbpd of heavy and synthetic crude oil.

4. Unwavering dependence on the American market

It should come as no surprise that the totality of Canada’s pipeline exports is routed towards the United States. On a general basis, pipeline exports amount to 92-93 percent of aggregate Canadian crude exports. Interestingly, however, most of crude that is transported by sea also ends up in American refineries – Hibernia is a staple diet of Conoco Phillips’ Bayway Refinery in the New York area, whilst Cold Lake is sporadically bought up by Californian refiners (even though since March 2019 all Cold Lake cargoes went to China). Under current circumstances, when Venezuelan exports to the United States were barred administratively whilst Mexican USGC exports are just naturally declining, Canada’s dependence on the US might have turned out to be an incredible boon, were it not for the notorious pipeline capacity constraints.

5. Crucial Pipeline Project Given The Green Light

A result of a protracted legal battle against the federal government and a whole army of various non-governmental organizations, the 590kbpd Trans Mountain expansion projects was approved 2 weeks ago. Despite a relatively fresh ruling of the Federal Appeals Court that found the National Energy Board’s review of the pipeline project to be inadequate, the federal government has backed the project again, albeit somewhat hollowly. The federal acquiescence was met with little to none jubilation within Alberta’s political and industrial circles as Trudeau’s move still leaves a lot of leeway for environmentalist groups to nip the pipeline construction in the bud and there persists some skepticism over the amount of risk the prime minister is ready to assume in order to save Alberta’s bottlenecks.

6. Environmental opposition getting more fierce

As odd as it may sound, the main challenge for Canada’s crude industry is the rising environmentalist lobby. Not prices, not infrastructure, not even dependence on one primary market. The most immediate threat is a legislative move to block oil exports from Western Canada. The long-mooted Bill C-48 is proposing an oil tanker ban in British Columbia (prohibiting the use of vessels that can carry more than 12 500 metric tons, i.e. any proper oil tanker) which would render the Trans Mountain pipeline extension devoid of any sense, its primordial aim being to deliver Albertan crude to Asian markets. Even though the BC tanker moratorium bill was recommended not to proceed after a Transport and Communication Senate Committee review, it did so on a 6-to-6 vote.

Yet that in itself does not mean anything as the Senate still has to vote on the bill – not to be overlooked that it already passed in the House of Commons. Concurrently, Bill C-69 aims to reshape the federal assessment process for projects of national importance and scope. Although significantly watered down over the course of the three-year Senate assessment, the oil industry is still worried that it will be used as a blocking tool for new infrastructure project. Even if the Trans Mountain pipeline extension approval is here to stay, even if Bills C-48 and C-69 fail to be adopted, Canada’s crude industry is in for a heavy time. Environmental groups will inevitably take action against projects they perceive as threatening fragile marine habitats, poisoning areas that indigenous peoples hold sacred and dear.

This leaves Canada at a moral crossroads – it desperately needs new export conduits to minimize the risk of seeing crude “trapped” in Alberta. Even though the Trans Mountain pipeline extension presupposes a connection with the Puget Sound pipeline leading down to the US state of Washington, Canadian producers might also use it to diversify their exports away from American markets. Yet any pipeline connecting Alberta with the Pacific Ocean would run through a territory most hostile to fossil fuel-related developments (lest we forget that it was in Vancouver where Greenpeace was born almost 50 years ago). Canada’s efforts to syncretize environmental concerns and the need for economic growth have so far been lackluster.