For the first time this year, global benchmark Brent hit a record of $72 per barrel on Wednesday, palpably reinvigorating crude market sentiment around the globe. Even though China’s Q1 economic growth of 6.4 percent and a further 3.2 percent year-on-year refinery throughput hike certainly did help crude prices – as well as an expected US commercial crude inventory drawdown – the market’s largest issue to resolve is the overall scarcity of heavy and sour crudes. If heavy supply remains at the current level in the foreseeable future, this pricing anomaly – Urals trading at $0.7-1 per barrel premiums against Dated, Basrah Light discounts narrowing to reaching all-time highs - will persist for even longer.

Thus, oil prices have risen more than 40 percent this year already, with Brent Dated sliding a bit from the $72 per barrel peak within the $71.7-71.9 per barrel interval, whilst WTI oscillated in the $64-64.3 per barrel territory.

1. White House Cracking Down on Spanish Repsol

- The Trump Administration has been scrutinizing the links between Spanish oil major Repsol and Venezuela’s state oil company PDVSA, in a bid to guarantee full compliance with US sanctions.

- US State Department special representative on Venezuela Elliott Abrams stated that bilateral discussions are ongoing between the countries on how to settle the issue.

- The end is already near it seems as Repsol has so far brought its April imports of Venezuelan crude to zero,…

For the first time this year, global benchmark Brent hit a record of $72 per barrel on Wednesday, palpably reinvigorating crude market sentiment around the globe. Even though China’s Q1 economic growth of 6.4 percent and a further 3.2 percent year-on-year refinery throughput hike certainly did help crude prices – as well as an expected US commercial crude inventory drawdown – the market’s largest issue to resolve is the overall scarcity of heavy and sour crudes. If heavy supply remains at the current level in the foreseeable future, this pricing anomaly – Urals trading at $0.7-1 per barrel premiums against Dated, Basrah Light discounts narrowing to reaching all-time highs - will persist for even longer.

Thus, oil prices have risen more than 40 percent this year already, with Brent Dated sliding a bit from the $72 per barrel peak within the $71.7-71.9 per barrel interval, whilst WTI oscillated in the $64-64.3 per barrel territory.

1. White House Cracking Down on Spanish Repsol

- The Trump Administration has been scrutinizing the links between Spanish oil major Repsol and Venezuela’s state oil company PDVSA, in a bid to guarantee full compliance with US sanctions.

- US State Department special representative on Venezuela Elliott Abrams stated that bilateral discussions are ongoing between the countries on how to settle the issue.

- The end is already near it seems as Repsol has so far brought its April imports of Venezuelan crude to zero, having reached a peak level of 82kbpd in January 2019.

- Under the Repsol-PDVSA deal structure, the former would supply roughly 20kbpd of gasoline to the Latin American country, whilst the former would provide crude at its Jose terminal.

- Repsol’s refineries in Bilbao and Cartagena are configured to process heavier crudes like Venezuela’s Merey, although it also took in Diluted Crude Oil (DCO) and Boscan.

- Repsol claims that it was receiving cargoes with Venezuelan crude as arrear settlement from PDVSA, for the roughly 60kbpd it produces in Venezuela and markets through PDVSA.

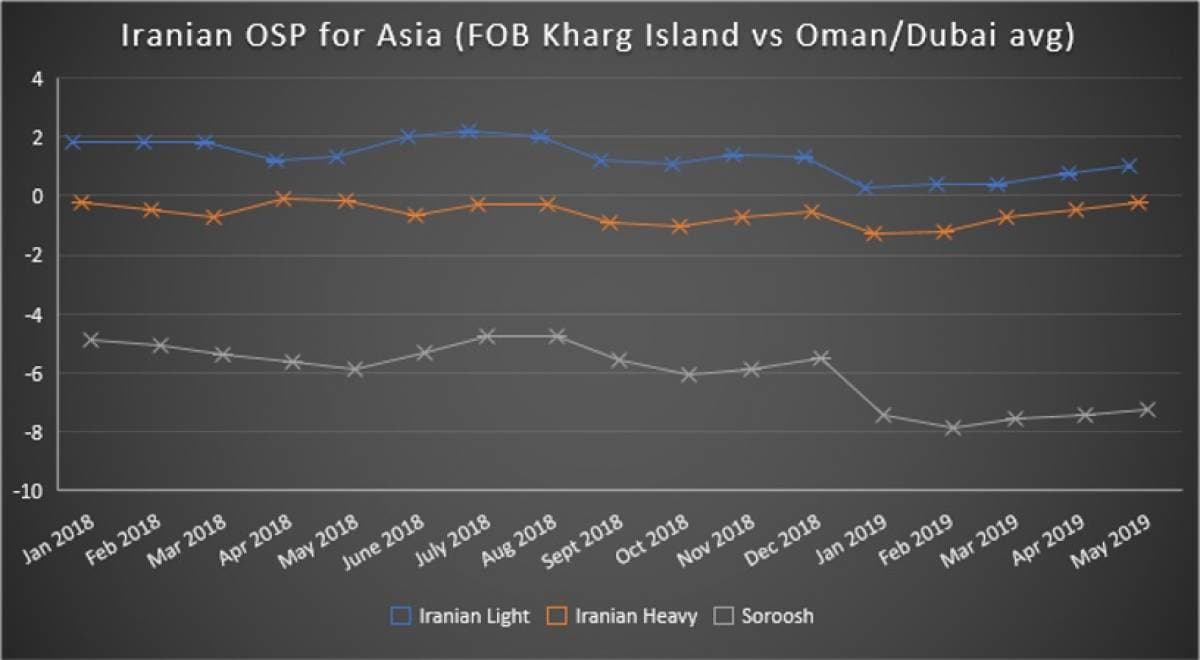

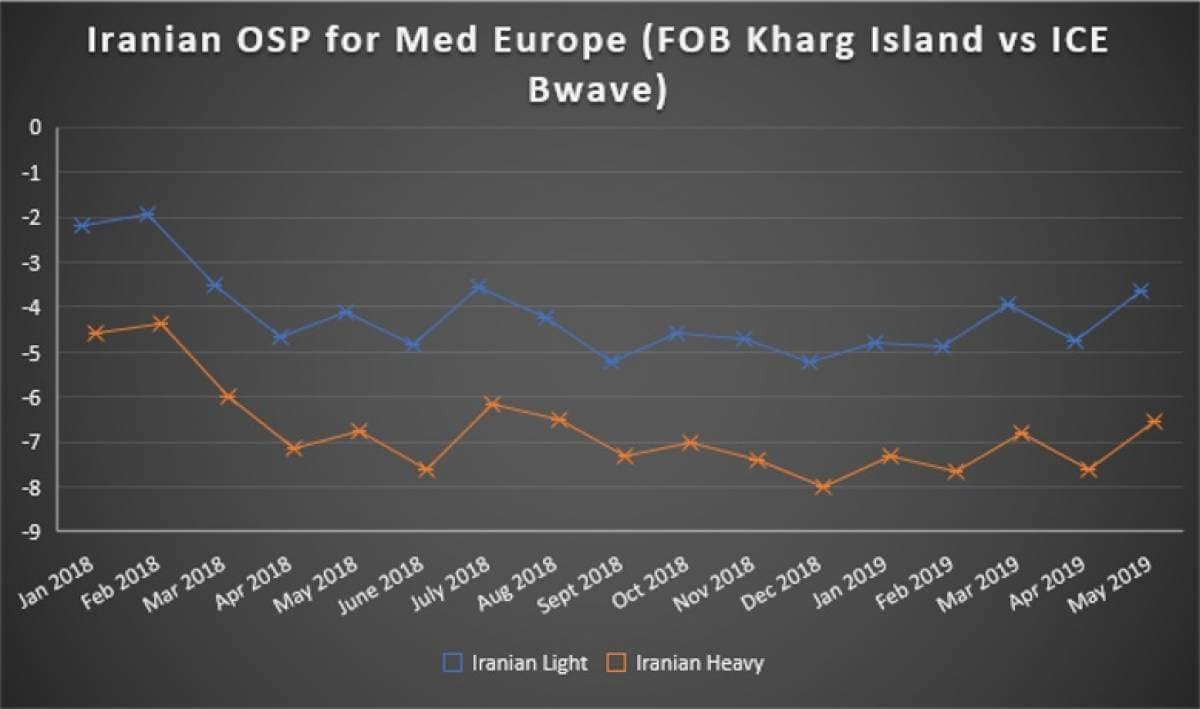

2. Despite Waiver Renewal Fears, Iran Hikes May OSPs

- Iran’s state oil company NIOC has raised May-loading official selling prices (OSP) across the whole spectrum of customers, with the virtually non-existent European buyers witnessing the steepest hike.

- As for Iran’s base market outlets in Asia, NIOC has raised its Iranian Light and Heavy prices by 25 cents per barrel, to a $1 premium and $-0.2 discount over the Oman/Dubai average, respectively.

- This is fully in line with Saudi Aramco’s 20 cent m-o-m increase on Arab Medium and Arab Light, and to a lesser extent to SOMO’s 35 cent Basrah Light hike, too.

- Counteracting the unexpectedly robust Urals in Europe, NIOC has increased the OSP of its NW Europe-bound cargoes by 1-1.1 USD per barrel, keeping the raise a little bit below those of Saudi Aramco.

- As for the Mediterranean, NIOC virtually mirrored Aramco’s moves, increasing Iranian Light and Heavy OSPs by 1.1 and 1.05 USD per barrel, respectively.

- March 2019 was Iran’s most successful month this year in terms of exports, with a 5-month high of 45.9MMbbls leaving Kharg Island, adding up to 1.48mbpd monthly average.

3. Kuwaiti May OSPs Refrain from Abrupt Moves

- Kuwait’s national oil company KPC raised official selling prices to all regions, yet shied away from cuts as drastic as Saudi Aramco’s.

- May loadings for Kuwait’s flagship Kuwait Export Blend destined for Asia were raised by 15 cents per barrel to a 0.7 USD per barrel premium against the Oman/Dubai average.

- This is less than Saudi Aramco’s and SOMO’s 20-30 cent across-the-board hikes and even less than the Iranian NIOC’s cuts above, as per above.

- KPC did increase its KEC May formula price to NW Europe by 1.10 USD per barrel and tot he Mediterranean (FOB Kuwait basis) by 0.9 USD per barrel, yet in the last 12 months only the Netherlands and France purchased Kuwaiti crude, in quantities that are dwarfed by the crude’s overall Asian demand.

- May-loading KPC cargoes that are US-bound saw their official price raised by 20 cents to a 1.15 USD per barrel premium over the ASCI index.

4. Forties’ Chinese Romance Blooms

- Up to now every single molecule of Forties crude loaded at Scotland’s Hound Point terminal set sail towards China, paving the way for a new monthly record.

- VLCCs Daishan and New Eminence loaded both 2 MMbbl in the first decade of April and are already sailing to the Chinese port of Rizhao, estimated to arrive there in late May.

- According to preliminary data, four other VLCCs are expected to load Forties this April and bring it to Chinese refiners, with the Vitol chartered Gener8 Supreme and Total-chartered Ellinis already on their way towards Hound Point.

- If the two vessels chartered by Shell for a late April loading of Forties, MT Habrut and MT New Wisdom, will take the crude to China, too, a new all-time high for Forties exports to China might be established.

- Heretofore February 2019 saw the highest Chinese share in Forties’ exports, with 91 percent of aggregate produced volumes departing for Chinese ports.

5. Libyan Exports Rise Amid Tripoli Clashes

- As we have highlighted in last week’s Executive Report, the ongoing fights for Tripoli do not present an immediate threat to Libya’s oil exports.

- In the first half of April Libyan exports jumped to 1.21mbpd, up 30 percent from the March monthly average of 0.939mbpd.

- Part of the recent upsurge in Libyan exports is due to El Sharara getting back to its nameplate production rate – three Sharara cargoes totaling 1.9 MMbbl have already left Libya this month.

- Interestingly the export increase takes place amid the Libyan NOC reducing port personnel and field staff to the lowest possible number.

- The inevitable market buzz around Libyan volumes has also pushed prices up, albeit modestly, with flagship Esharara now trading at a 0.1-0.2 USD per barrel premium over Dated, against the background of an April -0.15 USD per barrel OSP discount.

6. Largest-Ever Offshore Gas Find in Western Australia

- Australian oil and gas company Santos discovered a significant natural gas and condensate-bearing offshore field in the Carnarvon Basin offshore Western Australia.

- Drilled to a total depth of 4km, the Corvus-2 well encountered a rare 245 net hydrocarbon pay, which, according to preliminary WoodMac estimates holds at least 2.5TCf of gas and 25 MMbbls of condensate.

- Adjacent smaller fields, such as the 0.5TCf Reindeer field and the 0.6BCf Dorado field, are expected to supply the domestic gas market which seems to be fairly saturated in the mid-to-long-term.

- Taking into account the above facts, the Corvus discovery might very well serve as a starting point for a new LNG project, luckily Australian LNG is not plagued by lack of demand.

- If Santos indeed does opt for the LNG variant, it is more than likely to sell down, comfortably settling for a majority stake and operator status.

7. Kenya’s First-Ever Export Cargo Stalled Even Further

- When Tullow Oil discovered crude in Kenya’s Turkana Region back in 2012, little did it know how complicated would its marketing turn out to be.

- Tullow has been pushing for a first-ever export cargo for more than three years, however is forced to face regulatory and operative roadblocks as it has to truck the oil from the 750 MMbbl South Lokichar field next to Uganda to the eastern port of Lamu.

- The most recent blow came in March-April 2019 when residents of the Turkana County blocked Tullow’s oil-laden trucks and forced them to head back to Lokichar.

- Adding salt to Kenya’s oil injury, the reason behind the Turkana roadblocks boils down to an alleged secret granting of 15 686 acres of land to Tullow, in a move to finally start building the Lapsset pipeline.

- Until the Lapsset pipeline corridor is constructed, Tullow will have to rely on trucking as the only viable means of transportation for the 25-35 API waxy Kenyan crude.