Friday August 3, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Exxon no longer the leader of the pack

(Click to enlarge)

• ExxonMobil (NYSE: XOM) once traded at a significant premium to its peers, but it has lost much of that premium over the past year. In fact, Exxon has lagged behind the oil top oil majors since the August 2017.

• Exxon’s share price – just above $80 per share – is essentially unchanged from a year ago, despite the significant increase in oil prices. In the second quarter, Exxon’s profits rose by 18 percent year-on-year, but oil prices were up 50 percent. Exxon’s peers posted profits that were double or even triple in some cases.

• Exxon’s latest earnings report offered more reasons for worry. Overall production fell by 7 percent in the second quarter compared to a year earlier, a rather shocking figure. Management blamed maintenance, but the supermajor’s production fell to its lowest level in more than two decades.

• Unlike some of its peers, Exxon now has to significantly increase spending in order to halt sliding production, a course of action that has fallen out of favor with Wall Street.

• Exxon’s stock has been battered this year as investors have grown anxious about heavy spending…

Friday August 3, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Exxon no longer the leader of the pack

(Click to enlarge)

• ExxonMobil (NYSE: XOM) once traded at a significant premium to its peers, but it has lost much of that premium over the past year. In fact, Exxon has lagged behind the oil top oil majors since the August 2017.

• Exxon’s share price – just above $80 per share – is essentially unchanged from a year ago, despite the significant increase in oil prices. In the second quarter, Exxon’s profits rose by 18 percent year-on-year, but oil prices were up 50 percent. Exxon’s peers posted profits that were double or even triple in some cases.

• Exxon’s latest earnings report offered more reasons for worry. Overall production fell by 7 percent in the second quarter compared to a year earlier, a rather shocking figure. Management blamed maintenance, but the supermajor’s production fell to its lowest level in more than two decades.

• Unlike some of its peers, Exxon now has to significantly increase spending in order to halt sliding production, a course of action that has fallen out of favor with Wall Street.

• Exxon’s stock has been battered this year as investors have grown anxious about heavy spending plans. Exxon says it will grow production and boost profits, but that is still years away.

2. Distillate fuel inventories drop to low levels

(Click to enlarge)

• U.S. inventories of distillate fuels, which include diesel, heating oil and gasoil for maritime transit, fell to 117.7 million barrels at the end of June, below the five-year average.

• As John Kemp of Reuters argues, distillates are “the critical link between global growth and the oil market.”

• Low inventories pose a threat to global growth. If the economy continues to grow at a strong rate, distillate inventories will continue to decline, which will push up crude oil prices, ultimately dragging down the global economy.

• Or, Kemp argues, distillates could see relief if the global economy slows on its own accord.

• Adding to this problem is the pending 2020 rule from the International Maritime Organization on sulfur content in marine fuels, which will severely tighten the distillate market as heavy fuel oil is forced out of maritime shipping.

• “It seems unlikely the global economy will still be growing strongly while oil prices remain at comfortable levels for consumers at the same time as the shipping regulations go into effect at the start of 2020,” Kemp argues for Reuters. “Cyclical tightening of distillate markets plus new fuel regulations are inconsistent with moderate crude oil prices. Something will have to give.”

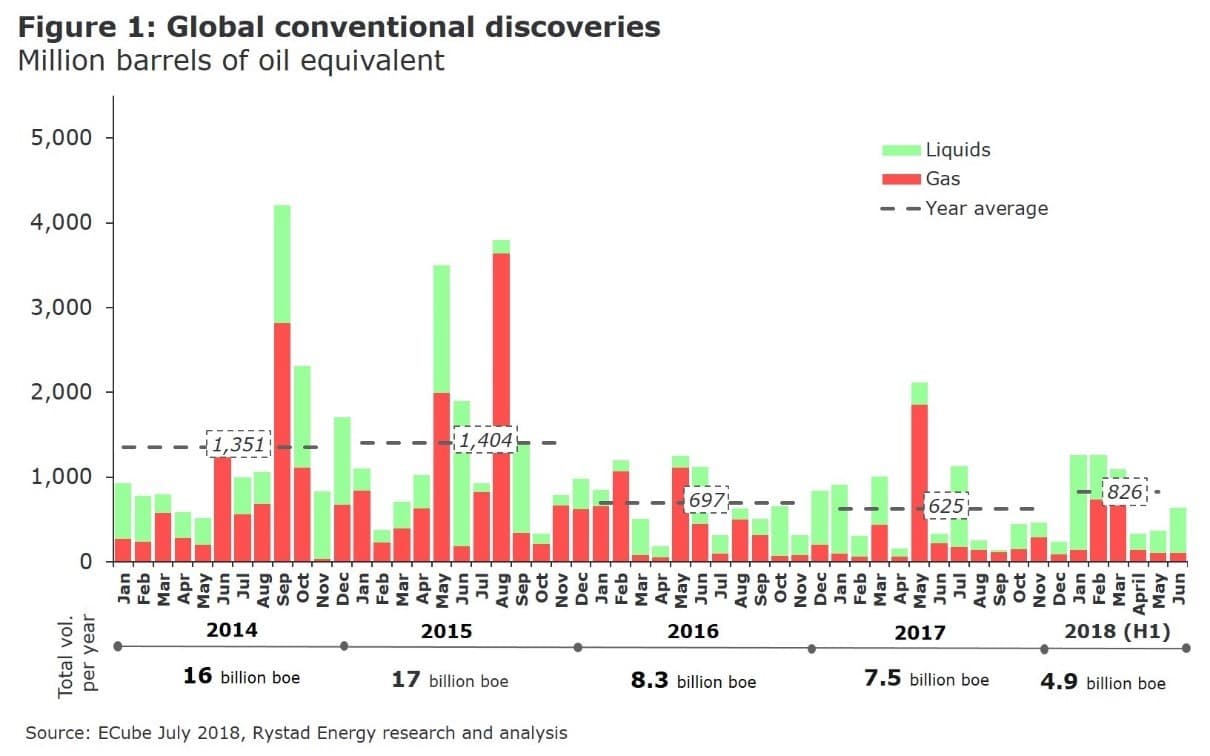

3. New oil discoveries rise by 30 percent

(Click to enlarge)

• Conventional oil discoveries jumped by 30 percent in the first half of 2018, compared to 2017 figures.

• The average monthly discovered volumes in the first six months of 2018 hit 826 million barrels of oil equivalent (mboe), compared to a monthly average of 625 mboe in 2017, according to Rystad Energy.

• The 30 percent increase in the pace of new conventional discoveries is evidence that the oil industry is on the rebound, stepping up exploration after years of cuts.

• Discoveries are still down from the 1,404 mboe monthly rate in 2015 and 1,351 mboe in 2014, but the uptick is an indication that the industry is on the mend.

• ExxonMobil’s (NYSE: XOM) multiple discoveries in Guyana led the way this year. The company made three discoveries in the Stabroek block, estimated to hold a combined 1 billion barrels of oil or more.

• A handful of discoveries in the U.S. Gulf of Mexico, Cyprus, Oman and Norway also added new reserves.

4. Offshore wind getting much cheaper

(Click to enlarge)

• Offshore wind is much more expensive than onshore wind, but it has the benefit of stronger and more consistent winds, allowing projects to generate electricity around the clock.

• Europe has been home to most of the world’s offshore wind development, but a new project in the U.S. indicates rapid change is on the way. Bloomberg reports that an 800-megawatt project off the coast of Massachusetts, to be developed by Avangrid Inc. and Copenhagen Infrastructure Partners, will sell electricity at 6.5 cents per kilowatt-hour.

• At a levelized cost, the offshore wind project would be 18 percent cheaper than any other source of electricity the region could provide. It is expected to lower energy bills by 0.1 to 1.5 percent.

• “That’s pretty shocking for us,” said Tom Harries, a wind analyst at Bloomberg NEF. “I think the wider industry expected much higher prices. The repercussions of this are it will probably awaken a lot of other coastal states to the value of offshore wind.”

5. China cuts crude imports from U.S., India increases imports

(Click to enlarge)

• China emerged as one of the top buyers of U.S. oil over the past year and a half, with imports surpassing 0.5 mb/d in the past few months.

• However, the trade war between the U.S. and China is starting to damage this relationship.

• According to ClipperData, China’s purchases of U.S. oil have fallen by roughly half in the past month.

• Meanwhile, India is stepping up imports of U.S. oil, rising from negligible levels to more than 200,000 bpd in July.

• For India, the purchases make sense. Because China is cutting back, more U.S. oil is available. Also, India needs more supplies now that U.S. sanctions are beginning to curtail Iranian oil exports. Finally, if India is to maintain some level of imports from Iran, buying up American crude could be a good strategy to convince Washington to grant India an exemption from sanctions to buy some oil from Iran.

• The shipments to India will likely rise higher if China puts import tariffs on U.S. oil, a possible scenario in the event of an escalation in the trade war.

6. Bullish and bearish forecasts

(Click to enlarge)

• Oil price forecasts from the major investment banks typically offer a variety of scenarios, but the forecasters are largely settling into two camps with two very sensible scenarios, one bullish and one bearish.

• The bullish case cites declining output in Venezuela, Libya and most significantly, in Iran. “Our bullish view is driven by the acceleration in the loss of Iranian crude oil exports from August onwards,” Harry Tchilinguirian, global head of commodities market strategy at BNP Paribas, told the Wall Street Journal. BNP Paribas sees oil averaging above $80 per barrel by the second quarter of 2019. Goldman sees Brent “retesting $80” this year. RBC and Standard Chartered also fall in the bullish camp.

• The bears argue that rising OPEC+ production, combined with surging non-OPEC output, particularly next year as more U.S. shale comes online, will keep the market well-supplied.

• Commerzbank and Citi are the most pessimistic, with forecasts for oil dropping below $60 in the second and third quarters of 2019, respectively.

7. Back end of futures curve rises on low spare capacity

(Click to enlarge)

• The front end of the futures curve has flattened as a result of rising OPEC+ supply, which has narrowed the backwardation. There is even a slight contango on the very front of the curve, suggesting concerns about the sudden rush of new supply.

• But oil traders are concerned about market tightness years from now. Bank of America Merrill Lynch put together a time series of Brent Calendar 2023 futures. Futures prices for that year have fluctuated, but spiked after the most recent OPEC+ meeting.

• The takeaway from that is that the ramp up of supply now leaves the market vulnerable in the future because of low spare capacity.

• Oil prices today are being pushed down by new barrels coming onto the market from Saudi Arabia, Russia, the UAE and Kuwait. But in several years, as the market tightens, there won’t be adequate spare capacity to call upon.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.