Attempting to trade based on pronouncements and policies coming from the Trump administration can leave many people scratching their heads. I have pointed out on multiple occasions that the frequent mixed messages and rapid flip-flopping of the White House, combined with the tendency of markets to overreact to news, makes trading in the opposite direction of a move prompted by a tweet or casual comment from POTUS a winning strategy in most cases. Sometimes though, a cigar is just a cigar, and the obvious play on a policy change is the best approach. That looks to be the case regarding the recent change in regulations on methane emissions.

Many of the policies aimed at pleasing specific industries that have come from this administration have not benefited the stocks concerned, while others have not been universally cheered by the targeted industry. The trade war was originally touted as a benefit to the U.S. steel industry, for example, but stock in U.S. Steel (X) has lost two-thirds of its value over the last year, and the big five auto markets are universally opposed to the relaxing of the so-called cafe standards for fuel economy.

Energy policy so far shows signs of both the effects of unintended consequences similar to the impact of the trade war on steel and some industry reluctance to the policy change similar to that in the car business.

Despite a very pro-fossil fuel approach from the President, energy has been, as this Reuters piece points out, not…

Attempting to trade based on pronouncements and policies coming from the Trump administration can leave many people scratching their heads. I have pointed out on multiple occasions that the frequent mixed messages and rapid flip-flopping of the White House, combined with the tendency of markets to overreact to news, makes trading in the opposite direction of a move prompted by a tweet or casual comment from POTUS a winning strategy in most cases. Sometimes though, a cigar is just a cigar, and the obvious play on a policy change is the best approach. That looks to be the case regarding the recent change in regulations on methane emissions.

Many of the policies aimed at pleasing specific industries that have come from this administration have not benefited the stocks concerned, while others have not been universally cheered by the targeted industry. The trade war was originally touted as a benefit to the U.S. steel industry, for example, but stock in U.S. Steel (X) has lost two-thirds of its value over the last year, and the big five auto markets are universally opposed to the relaxing of the so-called cafe standards for fuel economy.

Energy policy so far shows signs of both the effects of unintended consequences similar to the impact of the trade war on steel and some industry reluctance to the policy change similar to that in the car business.

Despite a very pro-fossil fuel approach from the President, energy has been, as this Reuters piece points out, not just the worst-performing sector in the S&P 500 this year, it has been the worst since Trump’s election in 2016. Of course, that is not the President’s fault, there are other more powerful influences, but it does show that even well-intentioned policies sometimes have little or no effect on stock prices.

If anything, the administration’s approach of opening up land for drilling and rubber-stamping applications for infrastructure projects has had the opposite of the desired effect. It has, along with other factors outside the government’s control, prompted massive increases in U.S. production that have kept oil prices, and therefore energy stock prices, low.

Where the disagreement amongst energy companies comes is as to whether the cost savings that will come from lighter regulation are worth the potential long-term damage that will be done to the industry as a result. While methane emissions from oil and gas fields are heavily regulated, the industry can claim to be doing something about greenhouse gas emissions, and that gives them a fighting chance against any future, greener administration or congress.

That is why the big oil companies, who think decades ahead, are opposed to this move. Smaller companies, however, who probably don’t have decades of reserves, are happy to sacrifice popularity in the future for profitability now. Most of them have supported this change, and it is there that traders and investors should be looking for opportunity.

One of the most vocal supporters of rolling back the Obama era regulations has been Harold Hamm, the CEO of Continental Resources (CLR). He is a well-known Trump supporter, but presumably his enthusiasm for this change is about more than just a partisan opposition to anything Obama did. He must think it will benefit Continental, and there is no reason to doubt him.

CLR has been hit hard even for an energy stock recently, losing nearly sixty percent of its value since the high at the end of last year. But if you look at the numbers, they have navigated this difficult market quite well. They have remained profitable and maintained a strong balance sheet, as evidenced by a current ratio of 1.03.

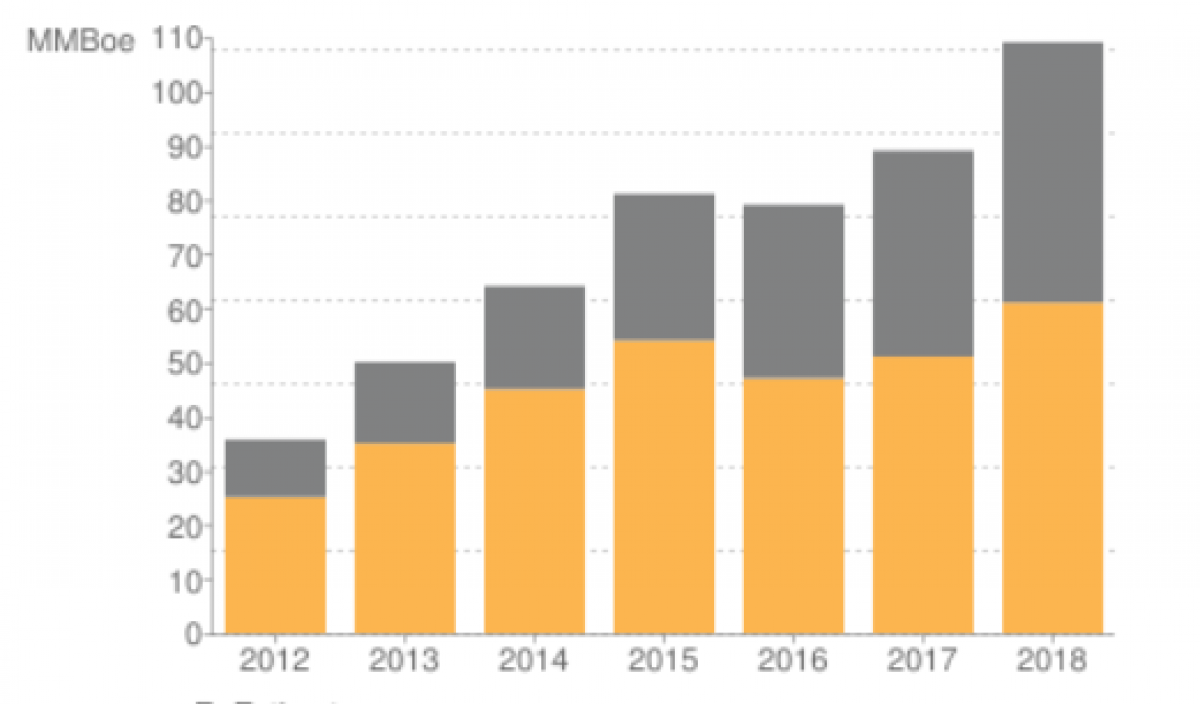

Figure 1: CLR Annual Output. Source: Contres.com

They have done that by being one of the companies leading the charge to increased U.S. output, as you can see from the chart above. Given that, any improvement in margins that results from this change will likely have an outsized positive effect on their profits, and therefore on the stock.

Buying CLR is still risky, of course given the negativity around energy stocks, but this is one case where a policy intended to benefit the industry should have the desired effect, so doing so with suitable stops looks like a decent trade.