Oil markets are subject to some compelling story lines right now. Trump/Xi relations are holding risk markets hostage. The US Fed seems to be in a holding pattern on rate hikes after substantially tightening its balance sheet in 2018. OPEC+ is aggressively cutting production and Venezuela’s humanitarian and political crisis is fully boiling over.

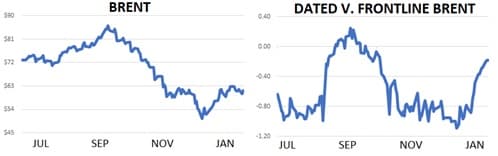

Yet, a quick glance at an oil price chart suggests that markets have ample shock absorbers on both ends of the spectrum and seem content to lazily move sideways with Brent at $60. Closing prices have enjoyed a $4 closing range since January 10th ($59-$63) and January appears to be ending with a sideways whimper after beginning with a bang. Clearly, we need the main story lines to develop further for the market to enjoy some sort of bullish or bearish momentum and break the sideways groove.

So where are we on our key risk themes as we turn to February?

With respect to global trade, US Treasury Secretary Steve Mnuchin gave a bullish jolt to stocks and commodities this week, commenting that a truce could be on the way which would remove tariffs on Chinese goods if Beijing was able to offer concessions on IP, tariffs and other issues. Equity markets are probably the best barometer now for trade deal forecasting and it’s notable that S&Ps have held on to their recent gains. Equity market pricing suggests to us that China and the US are still on course to reach some sort of truce in 2019. We also continue to believe…

Oil markets are subject to some compelling story lines right now. Trump/Xi relations are holding risk markets hostage. The US Fed seems to be in a holding pattern on rate hikes after substantially tightening its balance sheet in 2018. OPEC+ is aggressively cutting production and Venezuela’s humanitarian and political crisis is fully boiling over.

Yet, a quick glance at an oil price chart suggests that markets have ample shock absorbers on both ends of the spectrum and seem content to lazily move sideways with Brent at $60. Closing prices have enjoyed a $4 closing range since January 10th ($59-$63) and January appears to be ending with a sideways whimper after beginning with a bang. Clearly, we need the main story lines to develop further for the market to enjoy some sort of bullish or bearish momentum and break the sideways groove.

So where are we on our key risk themes as we turn to February?

With respect to global trade, US Treasury Secretary Steve Mnuchin gave a bullish jolt to stocks and commodities this week, commenting that a truce could be on the way which would remove tariffs on Chinese goods if Beijing was able to offer concessions on IP, tariffs and other issues. Equity markets are probably the best barometer now for trade deal forecasting and it’s notable that S&Ps have held on to their recent gains. Equity market pricing suggests to us that China and the US are still on course to reach some sort of truce in 2019. We also continue to believe that Trump is simply boxed in to creating some sort of deal in 2019 due to his need to boost the economy heading into election season. This is particularly true after the US government shutdown inevitably eats into 1Q GDP and employment numbers.

As for the central banks, we continue to believe that the US Fed could lend a supportive hand to risk assets in 2019 in a way that it didn’t in 2017 and 2018. This is a slow week for US Fed watching in terms of interviews and public statements but recent US housing data showed another sharp decline in y/y existing home sales for December of more than 10%- its worst mark since 2011 and tenth straight negative print. US bond yields are still substantially lower than their 2018-highs and the Fed’s balance sheet was basically unchanged at $4.05t in January after rapid asset sales in the second half of last year.

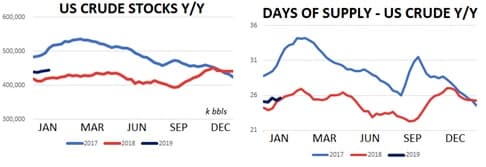

OPEC+ production cuts appear to be working and our guess is that we’ll begin to see them eat into US stockpiles on weekly DOE data beginning this spring. US supplies are currently +6% y/y and will continue to build for the next 2-3 months as refiners prepare for driving season. Our primary indication that the cartel is diligently working to cut supplies is the continued strength of Brent spreads. The prompt 6-month time spread held gains in modest contango territory this week and the differential on physical dated barrels versus the prompt futures contract has rallied massively in January. The Saudi energy minister reaffirmed the Kingdom’s commitment to supply tightening this week (also stating that they will deepen cuts in the next six months) and spread markets are clearly showing that balances should look healthier in the spring.

Venezuela’s political crisis accelerated this week after the US essentially ended business contact with the Maduro regime in an effort to install his opponent Juan Guaido as the country’s next leader. The US currently buys about 40% of Venezuelan exports (which totaled 1.2m bpd in December) and it’s likely that these shipments will find Indian and Chinese buyers in the coming months. US refiners will scramble to replace lost barrels with similarly sour barrels from Saudi Arabia and Canada but the shift in buying is not expected to have a short-term impact on prices. Analysts remain confident that Venezuela will not enjoy a production rebound anytime in the next two years due to massive underinvestment in their production efforts.

Going forward, we see Trump/Xi talks, the US Fed and OPEC+ as the most likely drivers of oil’s next move and all three have bullish and bearish potential. For now, however, oil has ample downside protection in the form of tightening daily balances and a dovish US Fed outlook while ample existing supplies of crude and gasoline should keep a lid on prices. Look for oil to continue its $60 in the near term.

(Click to enlarge)

Quick Hits

- Oil prices were essentially flat again this week with Brent trending near $61 while WTI traded $53.

- The US is intensifying its pressure on Venezuela to move away from the Maduro regime with intense economic actions. The US will essentially cease all financial contact with Venezuela until Maduro’s opponent Guaidó is recognized as the nation’s leader. PDVSA subsidiary Citgo will not be able to interact financially with the country’s sovereign wealth fund until the dispute is settled. The US was importing roughly 500k bpd of crude from Venezuela in 4Q’18. Those shipments will likely head towards China and India in the near-term future while US refiners will try to replace the lost barrels with Canadian and Saudi crude.

- Saudi Energy Minister Al-Falih reaffirmed his commitment to production cuts this week stating that the kingdom planned on delivering 102.m bpd to markets in January and 10.1m bpd in February. The Saudis pumped an average of 10.3m bpd in 2018 including an 11.0m bpd effort in November.

- Physical markers are showing a strong reaction to recent OPEC+ cuts with dated brent rallying substantially versus the prompt futures contract.

- Bloomberg reported this week that Chinese refiner Sinopec may have been caught off guard by oil’s 4Q’18 decline to the tune of about $700 million. The firm said it had wrongly hedged positions which imploded as prices sank and the unwinding of the hedge may have helped accelerate oil’s slide.

- Crude oil options continue to imply that trader’s concerns are tilted towards the downside. This week WTI 25 delta calls traded at 35% implied volatility while 25 delta put options traded at 38%.

- Hedge funds were net buyers of ICE Brent futures and options for the fifth time in the last six weeks. Net length jumped 17% w/w to 203k contracts and is and is higher by 24% since mid-December (+50k contracts.) Most of the buying has come from the unwinding of short positions as gross bearish bets have decreased by 43k contracts in the last six weeks.

- Away from oil, stock markets were hit hard early this week on Q4’18 earnings concerns and the usual dose of anxiety due to US/China trade disputes. US Treasury Secertary Mnuchin added a bullish jolt to risk assets mid-week commenting that there could be some potential for a US/China trade deal later this year.

(Click to enlarge)

DOE Wrap Up

- US crude stocks jumped about 8m bbls last week and are roughly 6% higher y/y.

- Most of the build was driven by a spike in imports opposite a sharp drop in exports. Imports jumped from 7.6m bpd to 8.2m bpd. The 1yr average for US crude imports is 7.8m bpd. Meanwhile exports fell from 3.0m bpd to 2.0m bpd (1yr average for exports is 2m bpd.)

- Domestic crude production was flat this week at a record-high pace of 11.9m bpd.

- The US currently has 25.6 days of supply on hand which is in line with its 5yr seasonal average.

- As for consumption, US refiners processed 17.05m bpd last week on a 175k bpd w/w drop. Total US demand as averaged 17.28m bdp so far in 2019 which is better y/y by 380k bpd (+2.2%.)

- Low margins are putting downward pressure on demand and will likely continue to do so in the near-term future. The WTI 321 crack yielded just $12/bbl this week for a 2yr low. Diesel fuel margins are still averaging north of $15/bbl but gasoline margins have dropped to just $5.50/bl throughout much of the US.

- Refiners overseas are doing much better with the gasoil/brent crack offering $15/bbl- about 25% above its 5yr average.

- An oversupply of gasoline persists as the culprit for low margins. US gasoline supplies jumped by about 4m bbls last week to 260m bbls and are 6% higher y/y.

- US gasoline demand + exports printed an ominously low 9.4m bpd last week for the second straight week and is lower by about 2% so far y/y.

- Distillate fuels are roughly 1% higher y/y following a 1n bbl inventory draw last week.