Noble Energy, (NYSE: NBL) is a company I’ve had my eye on for a while. Recently they had been trading as high as 8X earnings and I thought that was a little overvalued. My patience has been rewarded and shares are down about 30% over the last six months, making the multiple much more palatable.

Noble is a legacy wildcatter whose roots go back almost a hundred years to the 1930s when Lloyd Noble bought his first drilling rig. Over the years it spawned several subsidiary companies that had individual remits and competencies. In 2002, there was a rebranding as Noble Energy that placed all of the E&P assets into one company. The survivor is now a good-sized independent oil company with a global footprint, exploring for and producing oil and gas all over the world.

Noble is still a wildcatter at heart-someone who looks for oil in places that it isn't currently produced and has a pretty decent track record in the exploration arena. Most notably, the massive discoveries offshore Israel that inspired this article.

The ownership thesis for Noble is keyed to this successful wildcatter spirit that takes them into rank exploration areas and delivers growth.

Recent history

With the first gas discovery at Mari B in 2004 and followed in 2009 by the Tamar discovery, Noble pioneered hydrocarbon development in Israel's coastal waters. In 2010, continued exploration delivered the "Mother" of all gas fields in this locality, Leviathan (named appropriately after…

Noble Energy, (NYSE: NBL) is a company I’ve had my eye on for a while. Recently they had been trading as high as 8X earnings and I thought that was a little overvalued. My patience has been rewarded and shares are down about 30% over the last six months, making the multiple much more palatable.

Noble is a legacy wildcatter whose roots go back almost a hundred years to the 1930s when Lloyd Noble bought his first drilling rig. Over the years it spawned several subsidiary companies that had individual remits and competencies. In 2002, there was a rebranding as Noble Energy that placed all of the E&P assets into one company. The survivor is now a good-sized independent oil company with a global footprint, exploring for and producing oil and gas all over the world.

Noble is still a wildcatter at heart-someone who looks for oil in places that it isn't currently produced and has a pretty decent track record in the exploration arena. Most notably, the massive discoveries offshore Israel that inspired this article.

The ownership thesis for Noble is keyed to this successful wildcatter spirit that takes them into rank exploration areas and delivers growth.

Recent history

With the first gas discovery at Mari B in 2004 and followed in 2009 by the Tamar discovery, Noble pioneered hydrocarbon development in Israel's coastal waters. In 2010, continued exploration delivered the "Mother" of all gas fields in this locality, Leviathan (named appropriately after an ancient sea monster) and has spent the last nine years developing it to first gas. This is on track for the end of 2019. With an estimate of 16 TCF in place, it is truly worthy of the name, Leviathan.

Noble has a stable of projects that are ready to contribute to the bottom line while requiring minimal additional investment to realize the effects. Built out infrastructure in Israel and Equatorial Guinea serves as an expansion base to bring on new fields without starting from the ground up.

Brent Smolik, NBL's President:

“Our world-class Leviathan project ended the year near 81% complete with the target start-up by the end of this year. We expect to sell an average of 800 million cubic feet a day from Leviathan in 2020. We anticipate significant regional demand growth and we're excited that the Noble EMEA gas can satisfy a portion of that growing demand.”

Drivers for growth in Noble: Leviathan, Alen, Shale

Leviathan and the adjacent fields form a core area for the company's future growth. With a 10-year deal in place to sell the gas to an Egyptian company, much of the revenue side of the equation is in place. Why does Egypt need Israeli gas?

Its own internal supplies are inadequate to deliver the growth forecast of 5.2% for the Egyptian economy over the next few years. Egypt is a developing market hub for North Africa, with a number of industries planning to manufacture locally. Additionally, as is the case in so many developing countries, the air quality is horrendous, so gas is a solution for cleaner energy production.

The same metrics apply for gas sales into Israel, where gas from Leviathan will help to assure energy security by providing a second source of gas (Tamar being the first).

Sales contracts also are in place for delivery of Leviathan gas to Jordan and to British Gas (now Shell) for supply to its ELNG plant in Idku, Egypt.

As always, demand underscores the need for continued hydrocarbon development. Israel has been dependent on some of these same sources for energy needs. Awkward to say the least and potentially perilous given the geopolitics of the area. Discoveries theorized by Israel's Ministry of Hydrocarbons and with a prospect developed by Ratio Oil and Gas and commercialized with farm-in partner, Noble Energy has changed that dynamic for the foreseeable future.

With the majority of the infrastructure capex now behind them, Noble projects free cash flow from Leviathan as combination of gas sales and lowered capex budgets for this phase of the development of about $1 bn/annually beginning in 2020.

There is a second phase planned for Leviathan that will bring another 8-10 TCF into the existing facilities and only require the drilling of new wells to the deeper interval. Not an insignificant cost but nothing like the expense of the build out.

Alen gas project

Noble is also progressing the Alen gas monetization project with a recent agreement with the government of Equatorial Guinea to process Alen gas through an LNG plant located in Punta Europa, E.G. This is a significant step toward monetization of over 3 Tcf of discovered gas in the area. This expansion will give Noble the benefit of linkage to higher priced global LNG markets while requiring only minimal new infrastructure modification.

First gas to market is forecast for the first half of 2021, and additional reservoirs have been identified for as satellite producers.

Shale

With their activity focused primarily but not limited to the Delaware, DJ, and Eagle Ford basins, Noble has been able to grow production 100% YoY while reducing capex per well.

Noble has been delivering Wolfcamp and Bone Spring completions that make 180-200 BOEPD. They have permits for another 600 wells that at current drilling rates amount to several years of uninterrupted operations. A lot of emphasis will be given capex-wise to the Permian as these wells are oil prone.

Midstream

Noble controls its destiny with regard to takeaway capacity out of the Permian and DJ basins. Publicly-traded Noble Midstream Partners (NBLX) gives Noble capacity to grow its Permian and DJ positions without worry about pipeline takeaway.

Noble President, Brent Smolik's comments with regard to a recent 8K filing regarding an asset review that might lead to monetization or spin-off of the pipeline assets.

“Our midstream assets within Noble and NBLX are very valuable. And we do not believe this is sufficiently reflected by the markets for either entity. As we evaluate potential scenarios, we will keep in mind the investor sentiment around MLP structure and IDRs.”

Portfolio High Grading

The effort to streamline operations and improve the quality of its portfolio will help asset sales to continue. Recently NBL announced its plans for 2019.

NBL kicked off the year paring down its portfolio with a sale of 13K net acres in Reeves County, Texas, for $132 mm. Further, NBL has targeted 2019 additional asset sales in the range of $500 mm to 1 bn to reduce capex spend by about 17%, while increasing U.S. onshore production by 10%.

Asset sales in Q4 totaled $226M, composed primarily of cash received for the divestment of a 7.5% working interest in its offshore Israel, Tamar area.

The divestitures have the potential to increase to financial performance by about 10% according to Morgan Stanley.

The Future

Exploring new areas where there is no production currently is a skill-set of Noble's. Recently, they bought into Shell (RDS.A, RDS.B) a new PSC license in Colombia's deepwater play.

As an example of the importance of this type of activity to an E&P company's long-term prospects, I would offer the much-lauded Leviathan field that Noble is now getting ready to be harvested. At one time, Israel's offshore environment was considered rank wildcat territory.

You don't find typically whales (big oilfields) in areas where there has been heavy fishing. You need to chart new courses for big gains, and Noble's track record here is excellent.

Financial Performance

- Noble reported total revenues of $1.052 billion in the first quarter of 2019. This represents an 18.20% decline over the $1.286 billion that the company had in Q-1 of 2018.

- The company reported an operating loss of $91 million in the most recent quarter, versus the $708 million operating profit that it reported in the year-ago quarter.

- Noble Energy had total sales volumes across its U.S. onshore portfolio of 253 mboe/day in the quarter. This reflects new record production levels from its assets in the DJ basin.

- The company reported an operating cash flow of $528 million in the current quarter. This represents a 9.43% decline over the $583 million that it had in Q-1, 2018.

- Noble Energy reported a net loss of $289 million in the first quarter of 2019, as compared with the $574 million net profit that the company posted Q-1, 2018.

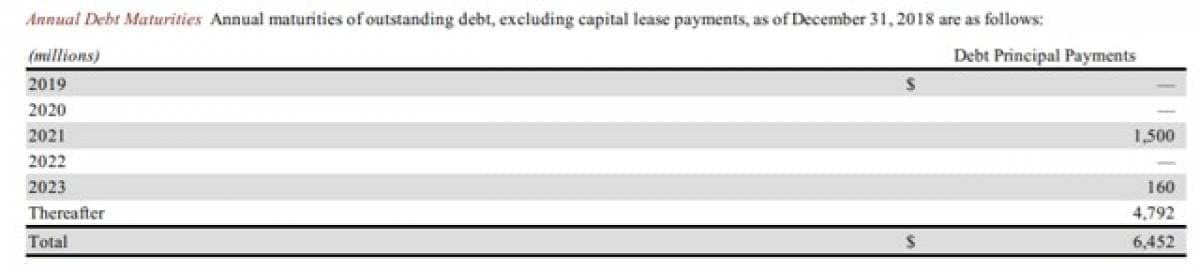

Debt maturities

Maturities are spaced out after 2021, and total indebtedness/capitalization is 0.58, giving the company a lot of breathing room before dilutive capital raising measures would be remotely necessary. Further, tight capital controls have enabled the company to reduce interest expenses by 25% over the last three years. The company expects to begin funding capex from funds from operations so the trend toward reduction in over-all indebtedness should continue. Current interest costs of $288 mm are covered by cash flow. The company currently has about $800 mm in cash on hand and an untapped $4.0 bn revolver, alleviating any liquidity concerns.

The stock is down from Q-1

As can be seen in the chart below the stock has suffered mightily since the Q-1 earnings release. Declining revenues, profits, and cash flow are seldom seen in a favorable light by the investment community. Recently opinions have shifted with 75% of the professional analysts that cover NBL, rating as a strong buy.

Risks

Probably, the single thing most worthy of a mention here is the location of one of their most significant assets - Leviathan, offshore Israel. This is a turbulent section of the world and billions of dollars of infrastructure could be taken out with a single missile. It's a risk that really can't be discounted.

Certainly, recent events in the Arabian Gulf, with Iran shooting down a U.S. drone accentuate this risk.

Your takeaway

Noble seems like a well-run company, balancing needs for growth with prudent financial management that is reflective of the uncertain environment for oil currently. They have a diverse structure that gives them secure streams of income from their shale assets while giving them exposure to international sales that might bring higher profits. Noble is currently trading around 5 x EBITDA. The stock price is not taking into account the earnings that will come with the onset of Leviathan sales, which could add as much as $2.00 EPS in 2020. When those earnings begin to hit quarterly, the stock price should rise.

Analysts, looking down the road see a lot to like about this company, as nearly two-thirds are putting a buy on the shares at current levels. Analysts generally like cash flow and reduced capex, and Noble is bringing both.

I think the stock is attractive at current levels but will watch a bit for a slightly better entry point before considering taking a position. The most I would expect, given the current market fundamentals is a decline of about 5%, which may not come any time soon. It's a risk you have to evaluate against the goals you have set for your portfolio.