One gets very accustomed to good things and it is certainly true for daring presidential tweets, impossible to discern whether it is a genuine emotional outburst or an irregular thought-out rebuke. The latest “please relax and take it easy” tweet aimed at OPEC will certainly become a classic gem for energy bugs, yet in the meantime, it has managed to cause some trouble. Oil prices declined some 3.5 percent on Monday after the tweet went out, however on Tuesday already they bounced back partially following OPEC’s assurances that it would stick to the charted production cut commitments.

(Click to enlarge)

Despite a global glitch at CME Group on Wednesday that halted trading for three hours, WTI traded at end of business hours on Wednesday at 57 USD per barrel, whilst Brent Dated moved within the 66.5-67 USD per barrel interval.

1. Five Weeks of Consecutive Growth for US Crude Commercial Stocks

• US commercial crude stocks rose 3.7MMbbl to 454.5MMbbl during the week ended February 15, bringing them more than 25 MMbbl above the 5-year average.

• As for preliminary results on the week ended February 22, there were so far diverging indicators as API reported an upcoming stock draw of 4.2MMbbl, whilst a Platts survey anticipated a 4MMbbl buildup.

• US crude exports have jumped significantly week-on-week, by 1.2mbpd to a whopping 3.6mbpd, however, they were counteracted by an even higher increase in crude imports, standing at 1.3mbpd over week…

One gets very accustomed to good things and it is certainly true for daring presidential tweets, impossible to discern whether it is a genuine emotional outburst or an irregular thought-out rebuke. The latest “please relax and take it easy” tweet aimed at OPEC will certainly become a classic gem for energy bugs, yet in the meantime, it has managed to cause some trouble. Oil prices declined some 3.5 percent on Monday after the tweet went out, however on Tuesday already they bounced back partially following OPEC’s assurances that it would stick to the charted production cut commitments.

(Click to enlarge)

Despite a global glitch at CME Group on Wednesday that halted trading for three hours, WTI traded at end of business hours on Wednesday at 57 USD per barrel, whilst Brent Dated moved within the 66.5-67 USD per barrel interval.

1. Five Weeks of Consecutive Growth for US Crude Commercial Stocks

• US commercial crude stocks rose 3.7MMbbl to 454.5MMbbl during the week ended February 15, bringing them more than 25 MMbbl above the 5-year average.

• As for preliminary results on the week ended February 22, there were so far diverging indicators as API reported an upcoming stock draw of 4.2MMbbl, whilst a Platts survey anticipated a 4MMbbl buildup.

• US crude exports have jumped significantly week-on-week, by 1.2mbpd to a whopping 3.6mbpd, however, they were counteracted by an even higher increase in crude imports, standing at 1.3mbpd over week (to 7.5mbpd).

(Click to enlarge)

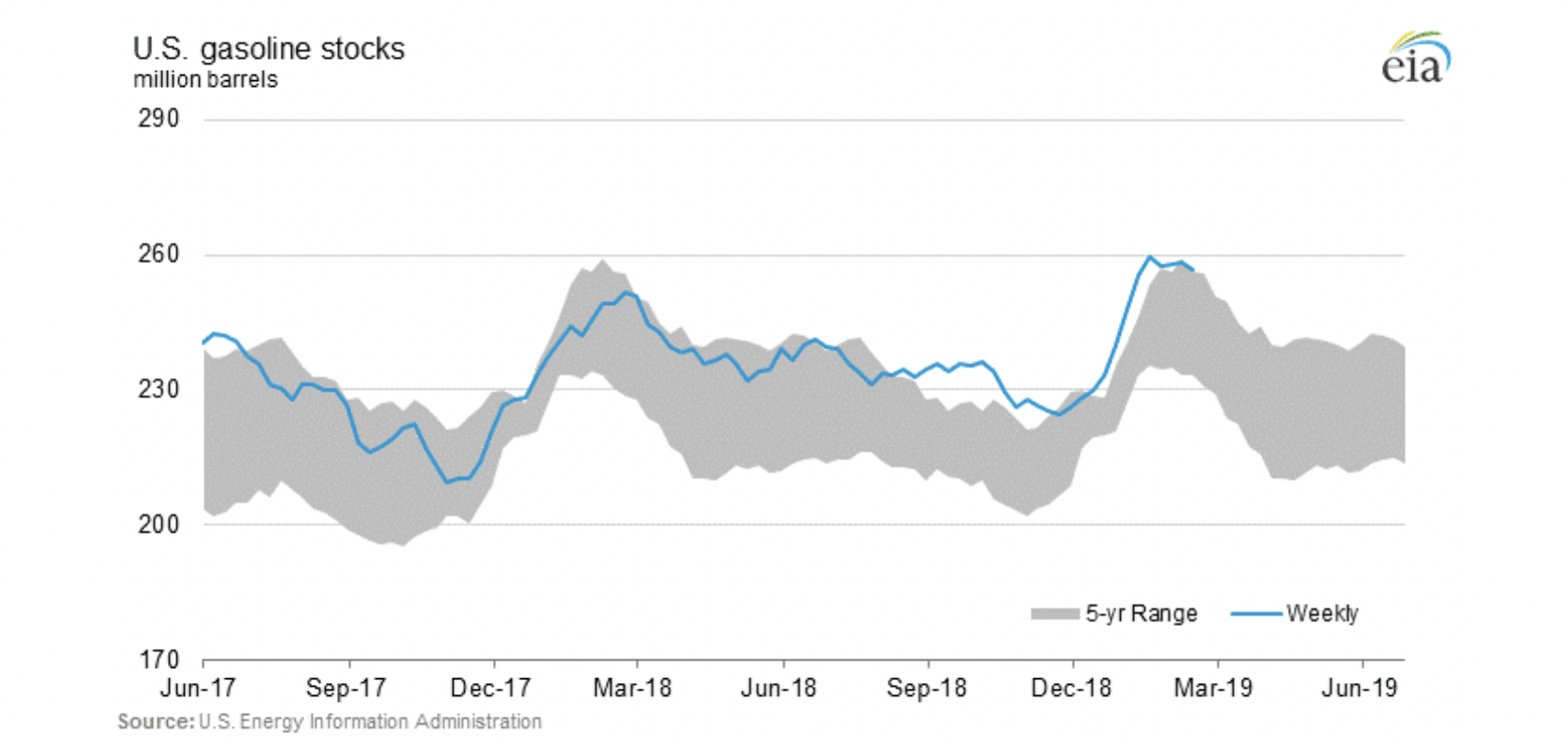

• Gasoline stocks have declined by 1.5MMbbl to 258.3MMbbl, edging it closer to the 5-year statistical range which it had surpassed in December 2018.

• Similarly to gasoline, distillate stocks dropped 1.5MMbbl to 138.7MMbbl (roughly the same level it was exactly a year ago), some 1.8MMbbl below the 5-year average.

2. Oman Feels the Urge to Merge

• Oman has announced it would merge its national oil company OOC with the state-owned refiner Orpic, streamlining the two into 2 main business lines – upstream and downstream.

• The merger has been raised in 2017 already, with the main appointments now emerging out of the haze.

• The Omani national oil firm will be headed by Musab al-Mahruqi, former head of Orpic in 2010-2016, whilst the current OOC head Isam al-Zadjali will take charge of the upstream division.

• The upcoming years will be very heavy in downstream projects being commissioned – the Sohar refinery, which saw its production capacity doubled after a recent upgrade, is supposed to include a steam cracker that would refine lighter ends to produce primarily polyethylene and polypropylene.

• Oman is also poised to build a third refinery, the 260kbpd Duqm refinery jointly with Kuwait Petroleum, which will be supplied in a 65-35 percent ratio by Kuwait and Oman, respectively.

3. Libya Hikes OSPs Despite Sharara Shutdown

• The Libyan national oil company NOC raised most of its official selling prices for March-loading cargoes.

• Es Sider, the most traded Libyan grade taking up roughly third of all exports, witnessed the steepest increase as its March OSP was hiked by 15 cents to a -0.7 discount vs Dated Brent.

• The Es Sider port, together with Ras Lanuf where from the Amna crude export stream originates, have been shut temporarily on February 25 due to bad weather.

• Esharara, traditionally Libya’s second-largest export stream, still unavailable due to a General Haftar takeover of the field (Sanalla stated it is „still not safe to operate”), saw its OSP lifted 10 cents to a -0.15 discount to Dated.

(Click to enlarge)

• One would not have guessed it from the Libyan OSPs but Libya’s exports have reached their lowest in six months to 0.766mbpd amid the Sharara ownership conundrum and regular bouts of bad weather in Libya’s ports.

4. Algeria Rolls Over March Prices

• Algeria’s Sonatrach has rolled over its Saharan Blend price for March-loading cargoes at a 30 US cent premium to Dated Brent amidst divergent market developments.

• Urals has swung back to a discount to Dated, however, remains still too high compared to the past year’s average, impacting other Mediterranean producers like Algeria.

• A robust Urals would play to Sonatrach’s cards, yet dropping CPC Blend prices and weak naphtha margins have largely offset all positive trends.

(Click to enlarge)

• After bouts of bad weather in January, Algerian crude exports have bounced back in February to around 0.623 mbpd, according to preliminary shipping data.

• In the meantime, Sonatrach is working hard to expand Algeria’s refining capacity, both by buying ExxonMobil’s Augusta refinery, by cutting oil-for-products deals with Vitol and fast-tracking the construction of two 100kbpd refineries in Hassi Messaoud and Tiaret.

5. Mexico Production Sinks to 5-Year Low

• PEMEX, the Mexican state oil company has issued its January production numbers, pointing to Mexico reaching 5-year output lows with its 1.62mbpd average, down 5 percent from December’s 1.71mbpd and more than 15 percent from 1.91mbpd January 2018.

• This bodes ill with PEMEX’s pledge to stabilize production by May 2019 at the level of 1.76mbpd, to be then followed with incremental monthly accretions until 2024.

(Click to enlarge)

• Mexican President Lopez Obrador ran much of his campaign on vows to reverse the long-standing output declines, bringing onstream almost two dozen greenfield projects.

• Crude exports went down along with the production, dropping 11 percent month-on-month to attain 1.07mbpd.

• All this takes place against the background of both Moody’s and Fitch downgrading PEMEX credit rating to just one notch above junk level and Mexican prosecution dealing with a plethora of massive-scale squandering issues.

6. Everyone Lifting Prices but Nigeria Takes It To The Maximum

• The Nigerian national oil company NNPC has raised official selling prices to its March-loading cargoes, setting new records along the way.

• The most significant month-on-month hikes to main Nigerian grades were to Brass River and Bonny Light, both up 44 cents to 1.65 and 1.63 premiums against Dated Brent.

• A largely marginal heavy grade, the 22° API Eremor witnessed the overall largest m-o-m hike, lifted by 1.23 USD per barrel to a 4.52 discount to Dated.

• Other key Nigerian grades, such as Qua Iboe, Forcados, Bonga, Pennington and EA witnessed OSP lifts in the range of 30-40 cents per barrel.

• EA’s premium to Brent, set at 3.14 USD per barrel, is the widest premium any Nigerian crude ever had against Dated.

(Click to enlarge)

• March 2019 marks the first time when NNPC has set an official selling price for Egina, the newest addition to the Nigerian export basket, at a 1.76 USD per barrel premium to Dated Brent.

7. Somalia-Kenya Offshore Blocks Row

• A diplomatic row over the territorial allegiance of four offshore blocks has flared up tensions in East Africa, pitting Kenya and Somalia against each other.

• Somalia has kicked off its licensing round this year, intending to offer 15 offshore block to potential investors, four of which are located in disputed territories (the International Court of Justice is currently considering the case).

(Click to enlarge)

• July 11 is the application deadline Somalia has set for interested companies, with the aim of finalizing all deals before the year-end, however, with Kenya sounding the tocsin on the issue, it seems unlikely that anyone would risk getting into a project which might end up in another country’s competence.

• Although still somewhat debatable, preliminary assessments show that Somalia’s offshore might contain up to 30 billion barrels of oil.

• Even if it were true, Somalia is a long way off tapping into it, as it functions under an interim constitution, with no petroleum authority or any law governing the oil and gas sector.

So much for the Numbers Report. We will see you next week with a new portion of fresh energy insights.