Back in February, crude tankers and product carrier company International Seaways (NYSE:INSW) predicted that tanker freight will remain healthy in the short and long term going forward, thanks to oil supply growth currently concentrated in the Atlantic Basin funneling into major oil demand centers in the East.

"We expect a great run over the next few years, as mentioned regional imbalances of oil should continue to increase the need for tankers as growth in oil production coming from the West and the oil demand from non-OECD countries in the East," CEO Lois Zabrocky said at the company’s latest earnings call.

The company expects output from countries outside of OPEC+ to climb by 1 million b/d, but sees OPEC+ supply remaining constrained due to sustained production cuts. Meanwhile, analysts at S&P Global Commodity Insights have predicted that global crude demand will increase by 1.4 mb/d in the current year.

And now another industry insider has concurred with Seaways’ bullish outlook. London-based Gibson Shipbrokers has predicted that the tanker market is likely to see increasing business coming not only from famous oil frontiers like Guyana but also from lesser-known frontiers like Namibia.

According to the shipbroker, lately, South America’s Guyana has been hogging the limelight thanks to the country’s impressive ramp up of oil production-- on track to rise to 800 kbd next year from zero in 2019. However, Gibson says new frontiers in the oil market are likely to emerge in the coming years, with Namibia a leading candidate. Related: U.S. Crude Oil Inventories Surge Fanning The Flames of Price Volatility

Sitting between oil rich Angola and oil poor South Africa, the South West African country was initially explored back in the 1970s and 1980s but was declared unviable at the time. For instance, the Kudu gas field, an offshore gas field in Namibia, was discovered 50 years ago but is likely to begin production in 2028, should FID be taken this year.

Gibson has revealed that a significant breakthrough occurred in Namibia's energy sector in early 2022 with Shell Plc. (NYSE:SHEL) and TotalEnergies (NYSE:TTE) finding oil in the Graff and Venus blocks. Venus, in particular, is a highly promising oilfield with the potential to become the largest ever discovery in Sub-Saharan Africa and one of the top 10 finds this century. The shipbroker points out TotalEnergies spent half of its exploration budget in Namibia in 2023 and plans to spend 30% of the budget in the country in 2024, signaling the importance of the new find.

So, which tanker companies are likely to benefit from the new oil and gas finds in Southern Africa?

Gibson says that whereas little is known about the specific properties or grades of the Namibian crude, the demand for such crude is likely to be primarily in the East, meaning VLCCs and Suezmaxes the most likely beneficiaries. VLCCs, or Very Large Crude Carriers, are super-massive tankers that carry 2 million barrels of oil.

“The development process is likely to be similar to Guyana, with FPSOs [Floating Production, Storage and Offloading vessels] deployed to extract the oil and transfer it onto tankers for export. Consultancy WoodMackenzie estimates that production could exceed 500kbd within a decade and continue to grow thereafter with first production likely towards the end of this decade (2028 or 2029),” Gibson told Hellenic Shipping News Worldwide.

“The government is keen to see first oil as soon as feasibly possible and is said to have sought advice from Guyana on how to structure production sharing agreements. The region has also become increasingly attractive to major oil companies, who view the country as more politically and fiscally stable compared to its neighbors to the North”, Gibson added.

Tanker Stocks Flying

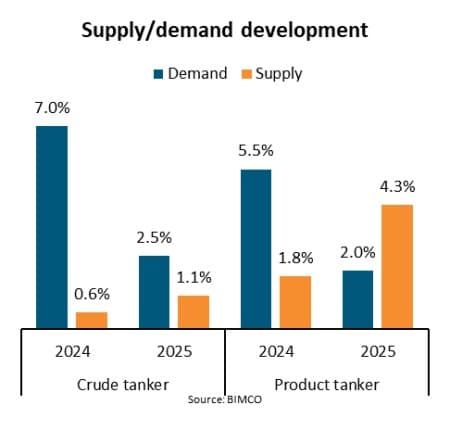

Source: BIMCO

Two months ago, shipping data provider BIMCO forecast that the supply/demand balance for crude tankers will tighten further during both 2024 and 2025, with low fleet growth, along with increasing sailing distances, creating the foundation for the improvement despite a slowdown in oil demand growth. BIMCO has predicted that crude tanker demand will grow by 6.5%-7.5% in 2024 and 2%-3% in 2025. Spot tanker freight rates reflect the bullish 2024 sentiment in the midsize tanker segment, with the Platts 70,000 mt US Gulf Coast-UK Continent freight assessment averaging $50.14/mt in January 2024, up from $43.21/mt in Q4 2023 and $28.21/mt in Q3 2023.

Not surprisingly, crude tanker stocks are flying: Tsakos Energy Navigation (NYSE: TNP) shares have returned 45.7% over the past 12 months; Teekay Tankers (NYSE: TNK) +45.5%, Frontline (NYSE: FRO) +54.3% and International Seaways (NYSE: INSW) +50.7% . Of the leading carriers, Nordic American Tankers (NYSE: NAT) and Euronav NV (NYSE: EURN) have disappointed with a +10.5% and -1.6% return, respectively.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Top Coal Province in China to Curb Output for First Time in Years

- Saudi Arabia Hikes Oil Prices in Increasingly Tight Market

- StanChart: Oil Demand Set for All-Time High in May