Breaking News:

Geomagnetic Storms Could Devastate Washington DC's Power Supply

New research shows Washington DC…

Net-Zero Ambitions Hit Major Roadblocks in Europe, UK, and US

Net-Zero transition targets touted so…

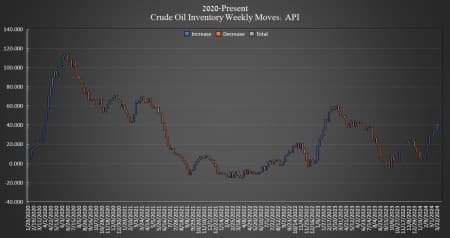

U.S. Crude Oil Inventories Surge Fanning The Flames of Price Volatility

Crude oil inventories in the United States rose this week by 3.034 million barrels for the week ending April 5, according to The American Petroleum Institute (API). Analysts had expected an inventory build of 2.415 million barrels.

This comes after the API reported a 2.286 million barrel dip in crude inventories in the week prior.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by another 0.6 million barrels as of April 5. Inventories are now at 364.2 million barrels—the highest point since last April.

Oil prices were trading down ahead of the API data release on Tuesday as ceasefire talks continue, with losses capped by the failure to make significant progress in reaching a deal that would end the conflict.

At 4:13 pm ET, Brent crude was trading down 0.96% on the day at $89.51, although still up nearly $1 per barrel from this time last week. The U.S. benchmark WTI was also trading down on the day by 1.26% at $85.34, up roughly $.30 per barrel compared to last Tuesday.

Gasoline inventories fell this week by 609,000 barrels, after falling 1.416 million barrels in the week prior. As of last week, gasoline inventories were about 3% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories rose this week by 120,000 barrels, after last week’s 2.548-million-barrel loss. Distillates were 7% below the five-year average for the week ending March 29, the latest EIA data shows.

Cushing inventories saw a build this week, rising 124,000 barrels after falling by 781,000 barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Top Coal Province in China to Curb Output for First Time in Years

- Saudi Arabia Hikes Oil Prices in Increasingly Tight Market

- StanChart: Oil Demand Set for All-Time High in May

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B