Turkey’s military invasion into northeastern Syria has moved crude prices higher after this week’s trading failed to move WTI below the $52 per barrel mark. With a further Middle Eastern imbroglio looming, the list of geopolitical risks continues to increase – Iran’s occasional overtures towards the United States have been falling on deaf ears, while Venezuela seems to have no chance of sanctions being removed while Maduro is in place. Following a somewhat unexpected flareup, the global heavy sour shortage might witness a further aggravation as Ecuador struggles to placate its rioting populace, triggered by President Moreno’s move to end fuel subsidies – the situation is so bad that Moreno has already moved his administration out of the capital (Quito remains overruns by riots) into Guayaquil.

Some 0.2mbpd of heavy sour will be gone from the global markets if Ecuador cannot regain control of its Petroamazonas oil subsidiary. Wednesday afternoon saw global benchmark Brent trading at $58.5-58.8 per barrel, whilst US benchmark was assessed around $53-53.2 per barrel.

1. Chinese Crude Imports Still Cannot Breach 10mbpd Threshold

- Chinese crude imports have dropped month-on-month to 9.92mbpd, down from 9.97mbpd in August 2019, on the back of an overall (much larger) Asian crude imports decrease.

- Aggregate Asian crude imports have suffered more from the Saudi production outage, reaching a 6-month low of 24.04mbpd in September, down 1.09mbpd…

Turkey’s military invasion into northeastern Syria has moved crude prices higher after this week’s trading failed to move WTI below the $52 per barrel mark. With a further Middle Eastern imbroglio looming, the list of geopolitical risks continues to increase – Iran’s occasional overtures towards the United States have been falling on deaf ears, while Venezuela seems to have no chance of sanctions being removed while Maduro is in place. Following a somewhat unexpected flareup, the global heavy sour shortage might witness a further aggravation as Ecuador struggles to placate its rioting populace, triggered by President Moreno’s move to end fuel subsidies – the situation is so bad that Moreno has already moved his administration out of the capital (Quito remains overruns by riots) into Guayaquil.

Some 0.2mbpd of heavy sour will be gone from the global markets if Ecuador cannot regain control of its Petroamazonas oil subsidiary. Wednesday afternoon saw global benchmark Brent trading at $58.5-58.8 per barrel, whilst US benchmark was assessed around $53-53.2 per barrel.

1. Chinese Crude Imports Still Cannot Breach 10mbpd Threshold

- Chinese crude imports have dropped month-on-month to 9.92mbpd, down from 9.97mbpd in August 2019, on the back of an overall (much larger) Asian crude imports decrease.

- Aggregate Asian crude imports have suffered more from the Saudi production outage, reaching a 6-month low of 24.04mbpd in September, down 1.09mbpd month-on-month.

- In comparison, China’s impact was minimal as the country’s refineries brought in 1.62mbpd, only 2 percent less than in August 2019.

- US crude arrivals to China in particular and Asia, in general, are bound to plummet in November-December as the US-imposed COSCO sanctions brought the Asian freight market to a 3-year high.

- As things stand today, the US will see the loading of 2 more China-bound VLCCs (one of them an SPR release) on October 23-24, following which the USGC-China activity seems to be going down.

- Against the background of the embittered US-China trade talks, Chinese refiners have taken in 6.7 MMbbls of Iranian crude in September, averaging 0.223mbpd for the month.

2. Saudi Aramco Hikes Asian Prices Even Higher with November OSPs

- Having swiftly recovered from the September 14 drone attacks on Khurais and Abqaiq, Saudi state oil company Saudi Aramco has set the tone for a further crude appreciation in Asia.

- The November-loading official selling prices for Asia-bound Arab Light was hiked 70 cents m-o-m to a $3 per barrel premium against Oman/Dubai Avg, the highest in more than 5 years.

- The Arab Medium November OSP for Asian cargoes went even further, up $0.7 m-o-m to $2.35 per barrel, the highest in almost 8 years.

- Following the recent drops in European Urals quotes, Saudi Aramco dropped its November OSPs for NW Europe by $1.25-1.6 per barrel and for the Mediterranean by $1-1.7 per barrel.

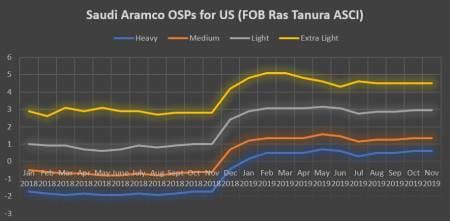

- Continuing its 2019 policy of minimum changes to US pricing, Saudi Aramco has simply rolled over all the October OSPs into November 2019.

- Thus, despite Aramco hitting a 9-year low in September average production (at 8.4mbpd), the Saudi NOCs price-setting takes advantage of the recent developments as November prices are based on widening Dubai backwardation in September.

3. ADNOC Takes September OSPs To 5-Year Highs

- Abu Dhabi state oil company ADNOC set its retroactive selling prices for September-loading cargoes, testifying to the recent price appreciation trend in Asia.

- ADNOC has hiked the September OSP for Murban, its flagship crude and potentially UAE’s soon-to-be benchmark, 89 cents m-o-m to a $4.08 per barrel premium against front-month Dubai, the highest since February 2014.

- Increasing medium sour Upper Zakum and light sour Das by 84 and 54 cents month-on-month (to $3.48 and $2.53 per barrel premium against Dubai) ADNOC has set 5-year highs, too.

- In the case of Das, September 2019 marks the highest-ever premium attained as the grade only started pricing in March 2014.

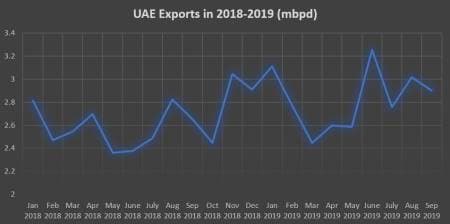

- UAE crude exports have decreased to 2.9mbpd in September 2019, down 4 percent month-on-month.

- One of the most prominent changes in September was South Korea’s robust appetite for UAE crudes, bringing in 11.7 MMbbls last month, more than double its usual 6-7 MMbbls per month.

4. WAF Crudes Suffer From Skyrocketing Freight Prices

- The US Treasury’s sanctions on Chinese shipping firm COSCO have complicated the life of West African crude producers as landed prices have soared to every continent, tangibly hindering their competitiveness.

- WAF-Eastern China VLCC freight rates have risen to $37 per metric ton, their highest in more than 11 years as tightening spot freight shipping availabilities have jeopardized November loaders.

- The Qua Iboe-Lanshan VLCC route, one of the most frequent routes from Nigeria to China, the nominal Worldscale rate of which is around $31.7 per metric ton, peaked at 110-115% WS.

- This is the first time since data-generating companies started assessing spot freight levels that WAF-China VLCC freight levels have moved above 100 percent WS.

- For WAF crudes to stay competitive, Nigerian, Congolese and Angolan premiums to Dated Brent have started to shrink throughout this week, dropping on average $0.5 per barrel w-o-w.

- Angolan Nemba, which wielded a 0.5-0.6 per barrel premium to Dated has most recently been heard trading flat, whilst Congolese Djeno has plunged into negative territory on Monday.

5. Consumption Tax Hike Leaves Japanese Refiners Perplexed

- Japan’s downstream industry is trying to assess the potential damages from the October 01 consumption tax hike (from 8 to 10 percent), a step the Abe Administration sees as part of cutting the country’s gargantuan debt load.

- Despite the government promising some $19 billion on blow-softening measures, such as rebates for non-cash payments, Japanese refiners are preparing for the worst and reassessing their M&A plans.

- In the last 9 years, Japan has already lost 1.5mbpd of refining capacity due to a stringent governmental ”rationalization policy” that puts a premium of refining depth.

- The VAT increase would most probably lead to big Japanese refiners (especially with foreign NOC backing) getting even bigger and the simultaneous dissipation of smaller ones.

- Japan’s Trade and Industry Ministry (METI) expects domestic demand to drop almost 10 percent from now by 2024, reaching a 2.6mbpd level, from the current 2.8mbpd.

- If the current estimates for the propagation of EVs are held up, Japan’s product demand would halve by 2040 to a mere 1.4mbpd.

- With product demand dropping over the longer term, some of Japan’s less sophisticated refineries will be most certainly shut down – such as JXTG’s 110kbpd Osaka Refinery (already confirmed).

6. NIOC Starts Drilling On IPC Fields

- The Iranian national oil company NIOC has started drilling on several fields that were previously included in the Iranian Petroleum Contract, signaling an official end to Teheran’s opening to Western majors.

- Most notably NIOC has encountered commercially viable reserves of hydrocarbons at the 3.3 Bbbls Mansouri field, having spudded a well in Q1 2019. október 9.

- It was expected that NIOC would tender Mansouri out to a consortium composed of Russian LUKOIL and Indonesian Pertamina, yet US sanctions have frustrated Iran’s endeavor.

- Private Iranian company PEDEC has been allocated 4 IPC fields – Sepehr, Jufair, Aban, Paydar-e Gharb – which were heretofore appraised by NIOC, indicating Teheran would be eager to outsource new fields to private capital.

- Aban and Paydar-e Gharb were supposed to be developed by the Russian state-owned Zarubezhneft, meaning even relatively well-sheltered Russian state companies are wary of following through with pre-sanctions MoUs on field development.

7. Rosneft Switches to Euros in both Crude and Products Trade

- For the first time in its history, Russian national oil company Rosneft has set the Euro as default currency on one of its crude tenders, a 100kt Urals cargo from the Baltic port of Primorsk.

- The sanctions-stricken Rosneft has been flirting with the idea for quite some time already, issuing its last 6-month Urals and CPC in the Black Sea, allowing for Euro payments, too.

- Rosneft has already moved to euro-based pricing on its August marine fuel and naphtha tenders, all the while signaling to do the same from January 2020 onwards with gasoline, LPG and coking products, too.

- The Russian major sees the euro switch as a major part of derisking its daily activities from current and potential US sanctions.

- Concurrently, the Russian Central Bank has been de-dollarizing its reserves – a year ago 40% of its currency reserves were in USD, dropping to around 20% currently (with EUR and CNY both moving 10% up).