Friday February 2, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil demand is soaring

- Oil demand is growing quickly, particularly in non-OECD countries. Over the past five years, non-OECD oil demand has grown nearly 5 times as fast as that of the OECD, according to Bloomberg Gadfly. The non-OECD added 6.4 mb/d of new demand while the OECD only added 1.3 mb/d.

- Goldman Sachs just hiked its Brent six-month forecast to $82.50, in part because demand is growing at a blistering rate.

- The bank said oil demand expanded by 1.73 mb/d in 2017. But more importantly, it predicts demand will grow by 1.86 mb/d this year. That is starkly different from the 1.3 mb/d forecast from the IEA.

- That growth is the result of a broad economic expansion that is really driven by emerging markets, the bank says.

- Moreover, Goldman Sachs says that the oil market has probably already reached the five-year average inventory level, which bolsters the case for higher oil prices ahead.

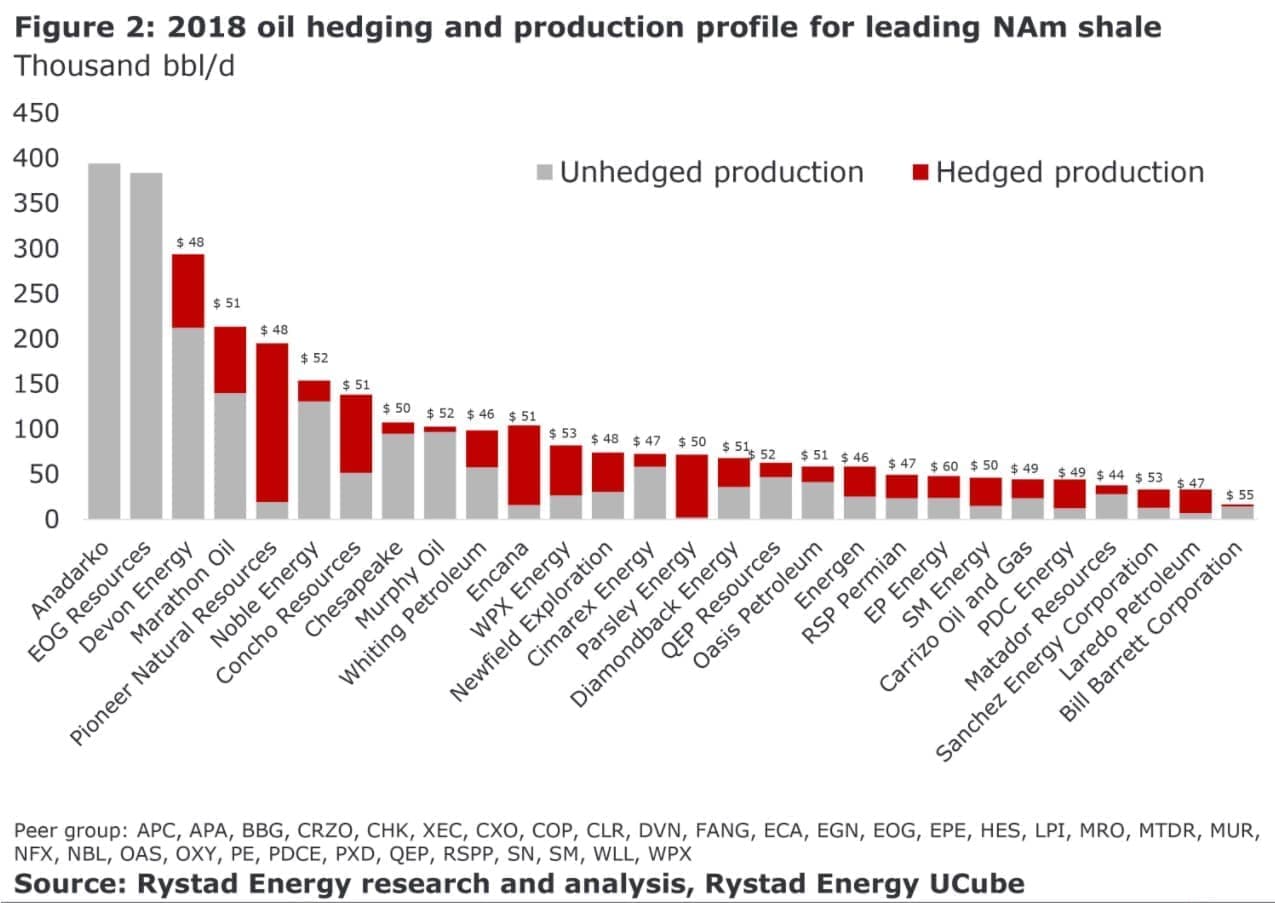

2. Some shale companies more hedged than others

(Click to enlarge)

- Rystad Energy estimates that of the amount of oil that is locked into hedges for 2018, about 42 percent of it has a ceiling price at $52 per barrel.

- That means…

Friday February 2, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil demand is soaring

- Oil demand is growing quickly, particularly in non-OECD countries. Over the past five years, non-OECD oil demand has grown nearly 5 times as fast as that of the OECD, according to Bloomberg Gadfly. The non-OECD added 6.4 mb/d of new demand while the OECD only added 1.3 mb/d.

- Goldman Sachs just hiked its Brent six-month forecast to $82.50, in part because demand is growing at a blistering rate.

- The bank said oil demand expanded by 1.73 mb/d in 2017. But more importantly, it predicts demand will grow by 1.86 mb/d this year. That is starkly different from the 1.3 mb/d forecast from the IEA.

- That growth is the result of a broad economic expansion that is really driven by emerging markets, the bank says.

- Moreover, Goldman Sachs says that the oil market has probably already reached the five-year average inventory level, which bolsters the case for higher oil prices ahead.

2. Some shale companies more hedged than others

(Click to enlarge)

- Rystad Energy estimates that of the amount of oil that is locked into hedges for 2018, about 42 percent of it has a ceiling price at $52 per barrel.

- That means that if WTI averages $60 per barrel this year, that will equate to a loss of $1.8 billion for those companies.

- The largest losses will be for Concho Resources (NYSE: CXO), Encana (NYSE: ECA), Diamondback Energy (NYSE: FANG), Devon Energy (NYSE: DVN), Pioneer Natural Resources (NYSE: PDX), QEP Resources (NYSE: QEP), and WPX Energy (NYSE: WPX).

- Anadarko Petroleum (NYSE: APC) and EOG Resources (NYSE: EOG) were not locked into hedges for 2018 as of the third quarter last year.

3. Canadian shale to attract more spending than oil sands

(Click to enlarge)

- Spending in Canada’s oil sector, like most regions, peaked in 2014. Canadian oil sands, which suffer from steep upfront costs, continues to see upstream spending decline.

- But Canadian shale is starting to attract a lot of new activity. The Montney and Duvernay shales are expected to entice nearly three times as much spending (C$31 billion) as the oil sands this year (C$12 billion).

- The long lead times and enormous costs of new oil sands projects likely means that few, if any, will be sanctioned for the next few years at least, even though they have steady and decades-long production profiles.

- Shale, on the other hand, is in vogue because of their short-cycle nature, mitigating a great deal of risk.

- Canada appears to be at the beginning stages of a shale revolution that has thus far failed to really take hold anywhere outside of the U.S.

4. Drilling costs on the rise

(Click to enlarge)

- Shale drilling costs are rebounding once again, although so far only modestly.

- Drilling costs have climbed by more than 10 percent after hitting a cyclical low in November 2016, according to Reuters. Still, they are 27 percent below the peak set in March 2014.

- The surge in the rig count over the past year – though still below 2014 levels – is putting upward pressure on the cost of rigs, equipment, services, etc.

- The rig market is much tighter than it was pre-2014 because older rigs have been entirely scrapped. Plus, newer more innovative rigs can do things that the old ones cannot, so older rigs have been shelved.

- Cost inflation will eat into the bottom lines of shale companies, edging up the breakeven prices for their operations.

5. Mexico secured nearly $100 billion in commitments for new drilling

(Click to enlarge)

- Mexico held a deepwater auction on Wednesday, another round that was met with quite a bit of success.

- 19 out of 29 contracts on offer were awarded. Royal Dutch Shell (NYSE: RDS.A) won 9 contracts – four by itself, four in partnership with Qatar Petroleum, and one with Pemex.

- In total, there are 60 companies now committed to developing oil and gas in Mexico after the energy reform laws of 2013 opened up the sector to international investment.

- Mexican officials say that the companies have committed $93 billion in new investment from Wednesday’s auction, although that is contingent upon commerciality of those blocks.

- The development of the deepwater assets will be critical to turning around what has been a long-term decline of Mexican oil output.

6. Oil majors post ongoing improvement

(Click to enlarge)

- Royal Dutch Shell (NYSE: RDS.A) earned $4.3 billion in the fourth quarter, its best performance since 2014.

- That means Shell is making about as much money with oil prices at $60 per barrel as it was when oil was $100 per barrel.

- Shell and Exxon (NYSE: XOM) are generating enough cash to cover their dividends. BP (NYSE: BP), on the other hand, is still coming up a bit short of positive free cash flow.

- But the earnings continue a trend that has been underway for near a year: balance sheets are improving, net debt and gearing are declining, and dividends are on sounder footing (and could expand).

- The oil majors could step up spending this year, but have signaled caution because of uncertainty about oil prices.

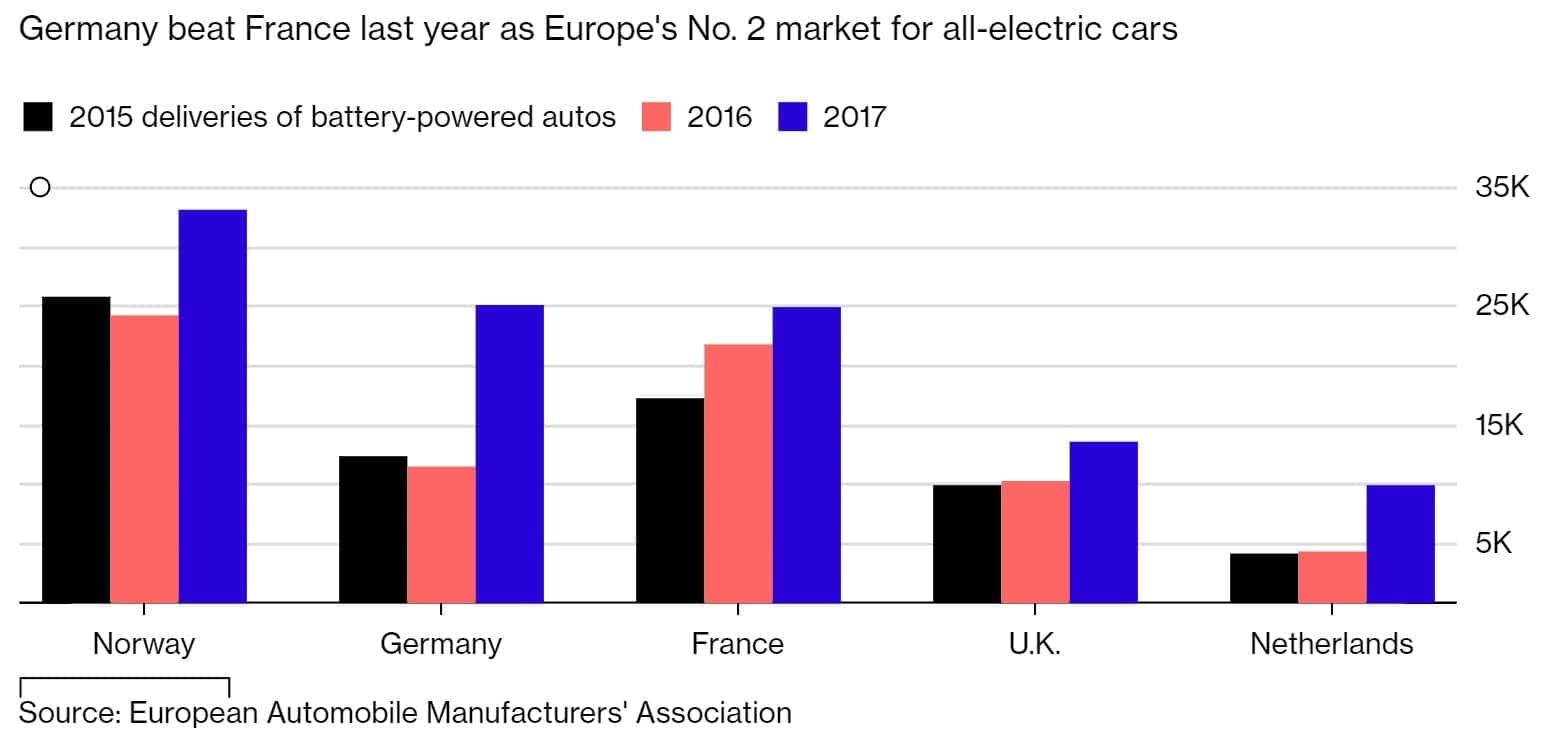

7. Hybrid and EV sales in Europe taking off

(Click to enlarge)

- Sales of vehicles powered by batteries, hybrid electric-gasoline or -diesel, fuel cells and natural gas surged by nearly 40 percent in Europe last year, according to Bloomberg.

- Hybrid sales jumped by more than 50 percent.

- That came as the entire auto market only rose by 3.3 percent in Europe.

- Still, alternative fuels vehicles only amount to 6 percent of the market.

- But the surge in sales shows rapidly growing interest in alternative fuels.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.