Leading crude producers finally decided to reassure the markets, availing themselves of the platform of the World Energy Congress in Abu Dhabi. The new Saudi Energy Minister Abdulaziz bin Salman assured everyone that OPEC+ is here to stay “for the long term”, with other participants to the deal reiterating their support for it. Concurrently, the firing of national security adviser John Bolton has revived hopes that a deal with Iran might still be possible, feeding speculation that Teheran’s renunciation of uranium enrichment might bring some „legal” Iranian volumes back to the global market.

US commercial crude stocks have been a great support for crude prices in the past month – the week ended September 06 produced another larger-than-anticipated crude drawdown. As a consequence, global crude benchmark traded around $63 per barrel on Wednesday afternoon, whilst US benchmark WTI was assessed at $57.5-57.8 per barrel.

1. Colombia Court Upholds Fracking Ban

- Colombia’s State Council upheld a temporary ban of hydraulic fracturing in the country, creating a major roadblock for state company Ecopetrol and fracking-friendly President Iván Duque.

- Colombian environmentalists have hailed the court’s decision as they perceive fracking a major threat to the Latin American country’s water supply.

- Ecopetrol CEO Felipe Bayon warned that the decision would result in Colombia being forced to import increasing volumes of crude for its own needs.

-…

Leading crude producers finally decided to reassure the markets, availing themselves of the platform of the World Energy Congress in Abu Dhabi. The new Saudi Energy Minister Abdulaziz bin Salman assured everyone that OPEC+ is here to stay “for the long term”, with other participants to the deal reiterating their support for it. Concurrently, the firing of national security adviser John Bolton has revived hopes that a deal with Iran might still be possible, feeding speculation that Teheran’s renunciation of uranium enrichment might bring some „legal” Iranian volumes back to the global market.

US commercial crude stocks have been a great support for crude prices in the past month – the week ended September 06 produced another larger-than-anticipated crude drawdown. As a consequence, global crude benchmark traded around $63 per barrel on Wednesday afternoon, whilst US benchmark WTI was assessed at $57.5-57.8 per barrel.

1. Colombia Court Upholds Fracking Ban

- Colombia’s State Council upheld a temporary ban of hydraulic fracturing in the country, creating a major roadblock for state company Ecopetrol and fracking-friendly President Iván Duque.

- Colombian environmentalists have hailed the court’s decision as they perceive fracking a major threat to the Latin American country’s water supply.

- Ecopetrol CEO Felipe Bayon warned that the decision would result in Colombia being forced to import increasing volumes of crude for its own needs.

- We assessed Colombia as one of the hottest shale plays in the world – Ecopetrol has infrastructure in place in the Middle Magdalena Basin, up to 7 billion barrels of shale oil reserves.

- Colombia has one of the lowest levels of reserves-to-production among major producers, reaching a level of 6.2 years in 2018 (total reserves estimated at 1.96 billion barrels).

2. Saudi Aramco Raises Asia Prices Even Further

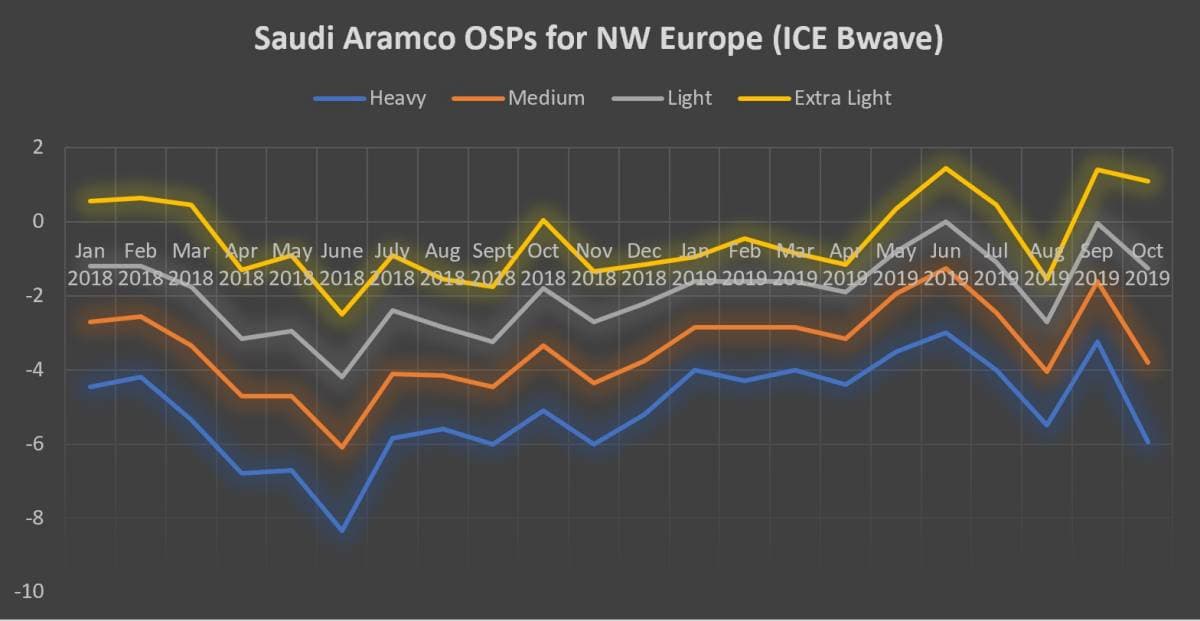

- Saudi Arabia’s national oil company Saudi Aramco hiked its Asian and American official selling prices (OSPs) for October 2019, yet cut Mediterranean and NW European prices.

- As the front-month to third-month premium on Dubai and DME Oman futures widened, Saudi Aramco increased the Asian OSPs for light crudes by $0.4-1.2 per barrel, whilst dropping Arab Heavy by 30 cents to a $0.35 per barrel premium against the Oman/Dubai average.

- The widening of the light-heavy spread is predominantly due to weak fuel oil cracks throughout August-September.

- Aramco’s NW Europe October OSPs saw a 0.3-2.7 per barrel month-on-month drops – the heavier the barrels, the bigger the price decrease with Arab Heavy falling to an 11-month low of a $5.95 per barrel discount against ICE Bwave.

- Similarly for the Mediterranean, Saudi Aramco has decreased October OSPs by $0.5-1.9 per barrel amid Russian benchmark Urals dropping back into negative territory vis-a-vis Brent Dated.

- Saudi Aramco has rolled over US-bound Extra Light prices for October, whilst increasing all the other grades sold to American customers by 10 cents per barrel.

3. ADNOC Overshoots its Retroactive August OSPs

- ADNOC, the leading national oil company of the United Arab Emirates, has issued its retroactive official selling prices for August 2019 deliveries, surprising some market-watchers as being too high given the current market conditions.

- ADNOC has increased the Murban-Dubai spread for its flagship crude to 3.195 USD per barrel, up 30 cents per barrel month-on-month – Murban is currently traded at a discount to the OSP.

- ADNOC’s latest addition Umm Lulu has grown 30 cents per barrel compared to July 2019 to 3.295 premium against Oman/Dubai, whilst medium sour Das crude has grown 35 cents per barrel to 2.65 per barrel.

- After Japanese refiners took in 54 percent of Umm Lulu exports in July 2019, August-loading cargoes (5MMbbls in total) were spread almost evenly between Singapore (38 percent), Thailand and India (31 percent each).

- Next week (September 19) will see the rare arrival of Murban into the USGC, as US major ExxonMobil is bringing a Suezmax load of the grade to South West Pass, Louisiana, the first US-bound cargo this year not to be taken to California.

- Following the last 2 years’ export peak of 3.25mbpd in June 2019, UAE crude export volumes have grown 13 percent month-on-month to 3.13mbpd.

4. Iraq Blames Overproduction Issue on Kurdistan

- Iraqi oil minister Thamir Ghadhban stated Iraq has had difficulties complying with its OPEC+ commitment of capping production at 4.51mbpd because of increased Kurdish output.

- Iraqi crude oil production stood at 4.65mpd in August 2019, up 1 percent month-on-month from July’s 4.62mpbd – and that’s the official stats of the Iraqi Oil Ministry.

- Third-party analysts have claimed that Iraq routinely undeplays its production volumes, for instance IHS Markit estimates the August crude output rate at 4.85mbpd.

- The Iraqi Oil Ministry claims that the Kurdish Regional Government (KRG) so far failed to provide the 250kbpd it ought to transfer to SOMO, the federal oil marketing company, all the while increasing output.

- Yet export volumes from Ceyhan, the only maritime port to load Kurdish crude, suggest a drop in Kurdish exports in the past months – Q3 exports so far stand at a mere 0.28mbpd.

- Concurrently to the Kurdish issue, Iraq started trucking the first barrels of a planned 10kbpd supply conduit towards Jordan, supplying Kirkuk crude to the Hashemite Kingdom’s Zarqa Refinery.

5. Alaskan North Slope Reaches Record Premiums, Sees Output Decline

- Alaska’s flagship medium sour grade Alaskan North Slope (ANS) has seen its premium against Dated Brent soar in the past several weeks to 1.95 per barrel as robust demand and narrow arbitrage possibilities for West Coast refiners push ANS upward.

- This is the first time that ANS rises so high in the past 3 years – it rose to a 2 per barrel premium against Brent exactly 6 years ago, yet that was before US exports were liberalized.

- Climate change is adversely affecting Alaskan crude production, as warmer temperatures decrease the efficiency of oil processing plants – ANS production has averaged 487kbpd 2019 YTD, down 15kbpd y-o-y.

- With 17 billion barrels of oil produced, the Alaskan North Slope is still assumed to have 28 billion barrels of recoverable crude reserves, most notably thanks to discoveries in previously overlooked formations (Nanushuk, Torok).

- ConocoPhilips’ 2016 Tinmiaq discovery wielded a 44 API density crude, boosting the chances of ANS becoming lighter over the years as new Nanushuk formation discoveries come onstream.

6. Exxon Sells Norway Assets to ENI

- As we have indicated it previous issues of the Oil Insider, ExxonMobil has been seeking an exit strategy out of its North Sea assets for quite some time.

- Reuters reports that ExxonMobil has managed to strike a deal on the sale of all its oil and gas assets in the Norwegian Sea with Vår Energi for up to 4 billion.

- Vår Energi is ENI’s Norwegian upstream branch, producing 169kbpd in 2018 – the Italian oil major owns 69.6 percent of the firm, whilst Norwegian private equity investor HitecVision has a 30.4 percent stake.

- Rystad Energy estimated that ExxonMobil’s Norwegian assets add up to 530 mboe of hydrocarbon reserves, albeit the general output rate on them is declining.

- The portfolio has more than 20 minority stakes across various projects, operated either by Equinor or by Royal Dutch Shell.

- ExxonMobil now only needs to drop off its UK North Sea assets to bring it 50-year involvement in the North Sea to a close.

7. Lebanon to Drill First-Ever Well in December

- Lebanon will see the spudding of its first-ever offshore well this December as the Middle Eastern country seeks to tap into its estimated gas reserves of 25 TCf (Beirut’s estimate).

- The consortium of ENI-Total-NOVATEK that won blocks 4 and 9 in early 2018 will use the Tungsten Explorer drillship to spud the first-ever offshore well in Block 4.

- The drillship is managed by the US firm Vantage Drilling, a counterpoint to US companies missing out on Lebanon’s offshore licensing rounds.

- The consortium will follow through with another well in Block 9, preliminarily expected in H1 2020.

- The 2nd licensing round, comprising mostly of blocks that were not taken in the first round, is still ongoing for blocks 1,2, 5, 8 and 10, with LUKOIL rumoured to be a sure candidate to enter the Lebanese offshore.