In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

Key Takeaways

- U.S. oil production hit 11.0 million barrels per day (mb/d), a new record high and a major milestone in U.S. energy history.

- Imports surged by 1.635 mb/d, helping to explain a sharp increase in crude stocks.

- The stock draw and the production increase cast a bearish pall over the report, but the market seems overly gloomy. The gasoline stock drawdown, and the sharp increase in gasoline demand should offset that perception.

1. Shale drillers more efficient

(Click to enlarge)

• U.S. shale drillers continue to improve their efficiency, and not just in the Permian basin.

• New-well production per rig is sharply up in all major shale basins compared to a year ago.

• For instance, in the Eagle Ford, the average rig is estimated to produce around 1,500 barrels per day from a new well in August, up roughly 300 barrels per day compared to the same month a year earlier.

• The average rig in the Permian will produce around 600 barrels per day in August from a new well, compared to around 500 barrels per day in August 2017.

• However, this figure will moderate the more the industry throws rigs back into service, if only because the denominator…

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

Key Takeaways

- U.S. oil production hit 11.0 million barrels per day (mb/d), a new record high and a major milestone in U.S. energy history.

- Imports surged by 1.635 mb/d, helping to explain a sharp increase in crude stocks.

- The stock draw and the production increase cast a bearish pall over the report, but the market seems overly gloomy. The gasoline stock drawdown, and the sharp increase in gasoline demand should offset that perception.

1. Shale drillers more efficient

(Click to enlarge)

• U.S. shale drillers continue to improve their efficiency, and not just in the Permian basin.

• New-well production per rig is sharply up in all major shale basins compared to a year ago.

• For instance, in the Eagle Ford, the average rig is estimated to produce around 1,500 barrels per day from a new well in August, up roughly 300 barrels per day compared to the same month a year earlier.

• The average rig in the Permian will produce around 600 barrels per day in August from a new well, compared to around 500 barrels per day in August 2017.

• However, this figure will moderate the more the industry throws rigs back into service, if only because the denominator on this equation will be larger.

2. Oil price volatility surges

(Click to enlarge)

• Oil price volatility has spiked in the last few weeks.

• Goldman Sachs argues that there is volatility in the fundamentals, but that the U.S. government is layering on extra volatility because of “political decisions.”

• “After delivering 1.3 mb/d of production growth this year, the US is about to deliver the next million barrels per day shifts in global supply by year-end through its SPR or foreign policy,” Goldman Sachs argues.

• The investment bank says that the U.S. has pushed Saudi Arabia to ramp up supply, although it isn’t clear how far Riyadh will go. Also, talk of a release from the SPR has rattled the oil market.

• Most importantly, the potential outage in Iran remains unclear. Anywhere from 0.5 to 2.5 mb/d could be disrupted, with a wide range of possible outcomes resting in the hands of the U.S. government.

• “The uncertainty on the magnitude and timing of these shifts has muddied the near-term outlook for oil fundamentals, with such supply changes large enough to potentially turn the 0.5 mb/d June de?cit into a 0.3 mb/d August surplus and back into a 0.6 mb/d November de?cit,” Goldman argued.

• The uncertainty around these numbers is driving up volatility.

3. Upstream oil and gas investment edges up

(Click to enlarge)

• Global energy investment fell by 2 percent to USD$1.8 trillion in 2017, a problem that the IEA warned about this week in a major report.

• However, upstream oil and gas rebounded a bit, rising by 4 percent in 2017. Spending will rise by another 5 percent. The IEA says that “investor confidence in the upstream oil and gas sector continues to recover in response to rising oil prices and sustained oil demand growth.”

• Still, after falling by 40 percent between 2014 and 2016, spending at $450 billion in 2017 is still down by a third from 2014 levels.

• U.S. shale is growing “briskly.” But spending on conventional oil and gas is flat, with the industry increasingly concentrating investment on brownfield development.

4. Permian gas is explosive

(Click to enlarge)

• Despite warnings about pending pipeline bottlenecks for both oil and natural gas in the Permian basin, gas output continues to grow at a rapid rate.

• The EIA estimates that gas production in the Permian will grow by another 234 million cubic feet per day in August, compared to July.

• That is putting increased pressure on natural gas prices in the Permian. The Waha Hub in western Texas has gas prices selling for nearly $1 per MMBtu below Henry Hub.

• Producers can flare the gas, but state regulations only allow that immediately after completion.

• “If natural gas production continues to grow, and natural gas prices continue to fall, some producers in the area may cease oil production to avoid producing associated natural gas,” the EIA said in a report.

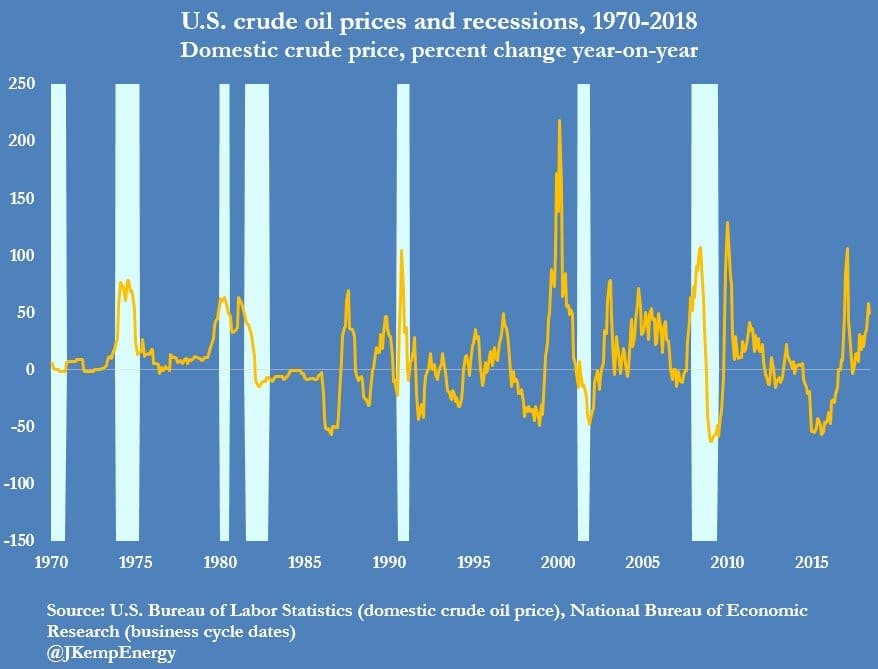

5. Oil prices could test economy

(Click to enlarge)

• Oil prices have climbed very far very fast, even though they have fallen back from the highs hit earlier this month.

• The IMF warned this week that the risks to robust global economic growth are “mounting,” citing the U.S.-China trade war as well as rising interest rates.

• But sharp increases in oil prices could also put a strain on growth. The recessions of 1973-1974, the early 1980s, the early 1990s and 2008-2009 all coincided with sudden and severe increases in oil prices.

• The increase in oil prices this year, combined with dollar strength, led to painful shocks in emerging markets, with protests in Brazil and an IMF bailout in Argentina two prominent examples of the economic fallout.

• Bloomberg points out that drivers in Republican-leaning states purchased a fifth more gas than in blue states, while having disposable income that was 16 percent lower. That helps explain the political fear from the White House, the tweets aimed at OPEC from President Trump and the open talk of an SPR release.

Heard on the Street

Oil rout overdone?:

“We think there is little reason for the market to push prices significantly lower than current levels. We do not think Libya has regained stability, as demonstrated by recent attacks on oil fields. We also do not think that there has been any significant softening in the US approach to Iran sanctions, and do not expect the rise in output from key producers to lead to a market surplus in Q3 or Q4.” – Standard Chartered

EIA data is getting crazy:

“Once again, oil prices yesterday did not react to the US inventory data as one would normally have expected. Given the unexpectedly sharp 5.8 million barrel increase in crude oil stocks last week, prices should really have fallen...A week earlier, prices had reacted to a 12.6 million barrel inventory reduction by decreasing significantly. What is the explanation for this unusual market response? It is perfectly possible that the weekly data have become less meaningful in the eyes of market participants due to the pronounced fluctuations in the past four weeks (-9.9 million, +1.2 million, -12.6 million, +5.8 million barrels)…It would therefore not be at all surprising if next week’s data went the other way again.” – Commerzbank

Are the bears coming back?:

“The sell-off was triggered by bearish demand and supply news: the escalating US-China trade war, the end of the Libya disruption and the potential for a more gradual decline in Iran exports than previously feared. Friday also came news that the US administration was actively considering an SPR release. These supply shifts, alongside the ongoing surge in Saudi production, create the risk that the oil market moves into surplus in 3Q18.” – Goldman Sachs

6. Trump considers SPR release

(Click to enlarge)

• The Trump administration is reportedly considering a release of oil from the SPR. No release is imminent and no decisions have been made, but if Saudi Arabia is unable to cover for lost barrels from Iran, it would increase the likelihood of a release.

• The SPR has enough oil to cover 102 days’ worth of U.S. oil imports.

• John Kemp of Reuters argues that a release would be counterproductive. The SPR is intended to be used to cover for short-term outages, not sustained shortfalls in supply.

• In fact, using the SPR to suppress prices would blunt the impact of the price signal needed to bring new supply online, Kemp argues. In other words, the market will adjust to a supply shortfall through higher prices, which will signal to oil producers to bring new supply online.

• An SPR release would obscure that price signal, while also depleting critical stockpiles needed for a sudden outage.

7. ExxonMObil loses its swagger

(Click to enlarge)

• Once the darling of Wall Street, ExxonMobil (NYSE: XOM) has lost a lot of its luster.

• Exxon’s stock used to trade at a premium compared to its peers, with investors “at times recognized twice the value in Exxon’s assets compared with rivals BP PLC, Total SA, Chevron Corp., and Royal Dutch Shell PLC,” the Wall Street Journal wrote.

• Exxon’s production is no larger today than it was in 1999, and has been eroding steadily over the last few years.

• More recently, CEO Darren Woods has outlined an aggressive spending campaign at a time when Wall Street is calling for capital discipline. Exxon is set to spend $28 billion in 2019, a 45 percent increase compared to 2016. Chevron (NYSE: CVX), by comparison, has spending flat this year compared to 2017, and 18 percent below 2016 levels.

• “Most investors like Exxon, but they like other companies better,” Mark Stoeckle, chief executive of Adams Funds, which owns about $100 million in Exxon shares, told the WSJ. “The market is not willing to reward Exxon for spending today in hopes that it will bring good returns tomorrow.”

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.