The number of active oil and gas rigs in the United States took a steep dive this week, dipping 15 rigs—the third straight weekly loss.

The total oil and gas rig count in the United States now stands at 913 rigs, up 360 rigs from the year prior, with the number of oil rigs in the United States decreasing by 7 this week and the number of natural gas rigs decreasing by 8.

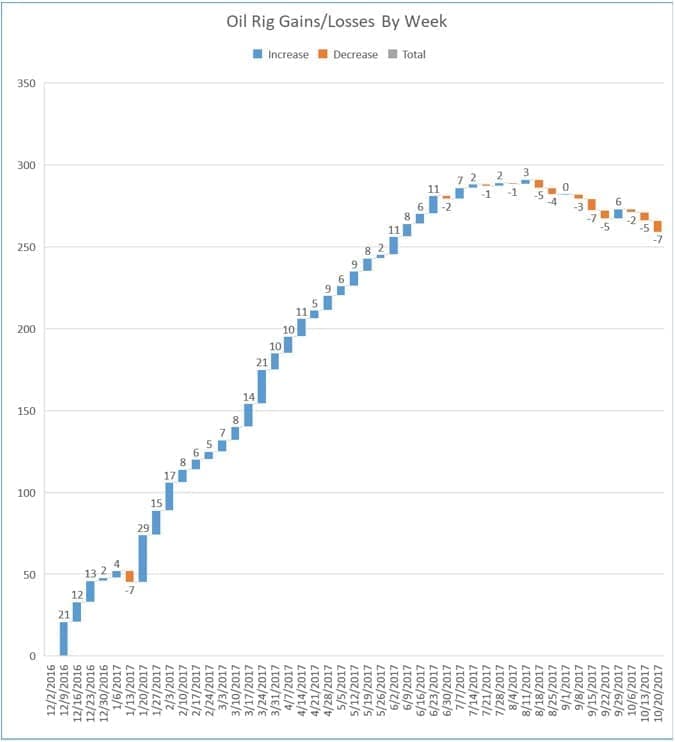

The oil rig count now stands 293 above the count one year ago, shedding a total of 32 oil rigs in the last ten weeks. Natural gas rigs have fallen four rigs in the last 10 weeks, but the trendline for both types of rigs is distinctly downward.

(Click to enlarge)

The spot price for WTI fell on Friday despite the disturbance in Iraq over the Kurdish referendum that sparked controversy over oil production and exports, and despite US and Iran tensions over sanctions that calls into question Iran’s ability to negotiate oil contracts with foreign investors. Oil prices seem stuck in a rut, stubbornly on track to end in a small loss for the week, even as EIA’s Wednesday’s report showed crude oil inventories had shed 5.7 million barrels for the week ending October 13.

At 12:43pm EST on Friday, WTI was trading down $0.18 (-0.35%) at $51.33—pennies below the WTI price of $51.35 at noon last Friday. Brent crude was trading down today by $0.19 (-0.33%) on the day at $57.04—$.08 under last week’s price. Related: Are Combustion Engines Reaching Peak Demand?

The biggest losers last week by basin were the Eagle Ford (-6) and Barnett (-4). This week, it’s the Permian (-6) and Haynesville (-3) basins that took the brunt of the cuts.

US crude oil production slipped by almost a million barrels daily for the week ending October 13, coming in at 8.406 million barrels per day—down significantly from the week’s prior 9.480 million barrels per day.

At 14 minutes after the hour, WTI had regained some ground at $51.46, with Brent crude trading at $57.28.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- A New Oil Crisis Is Developing In The Middle East

- Trump’s Iran Decision Haunts Big Oil

- Can Trump Drive A Wedge Between Saudi-Russian Alliance?