The last week of July started in a somewhat upbeat manner, buoyed by rumors that the US Federal Reserve might finally cut interest rates (for the first time this decade) and that US commercial crude inventories are set for a seventh consecutive drawdown. Yet do not expect sharp movements on the last day of the month as worries about global demand slowing down are still very much present on the market, resulting in July being only the second month this year that is poised for a monthly decline, albeit a palpably less painful one that the one witnessed in May. A year or two ago the ongoing Iranian vessel seizure crisis ought to have had a more discernible effect on prices yet with so many counterbalancing actors its impact remains muted, despite staying in the headlines.

As of Wednesday, the global benchmark Brent traded around $65 per barrel, whilst the WTI was $58.5-59 assessed at per barrel.

1. ADNOC Sees Murban as Regional Futures-Based Benchmark

- The Emirati national oil company ADNOC is seen to favor a move from a retroactive price-setting approach towards a forward-based one as it seeks to extract more value out of its Murban exports and fend off arbitrage competitors.

- Up to the present day all ADNOC’s official selling prices are set on a retroactive basis, i.e. the July OSPs will be known in the first days of August.

- Yet Chinese, Japanese and South Korean refiners traditionally buy crudes 2 months in advance, rendering…

The last week of July started in a somewhat upbeat manner, buoyed by rumors that the US Federal Reserve might finally cut interest rates (for the first time this decade) and that US commercial crude inventories are set for a seventh consecutive drawdown. Yet do not expect sharp movements on the last day of the month as worries about global demand slowing down are still very much present on the market, resulting in July being only the second month this year that is poised for a monthly decline, albeit a palpably less painful one that the one witnessed in May. A year or two ago the ongoing Iranian vessel seizure crisis ought to have had a more discernible effect on prices yet with so many counterbalancing actors its impact remains muted, despite staying in the headlines.

As of Wednesday, the global benchmark Brent traded around $65 per barrel, whilst the WTI was $58.5-59 assessed at per barrel.

1. ADNOC Sees Murban as Regional Futures-Based Benchmark

- The Emirati national oil company ADNOC is seen to favor a move from a retroactive price-setting approach towards a forward-based one as it seeks to extract more value out of its Murban exports and fend off arbitrage competitors.

- Up to the present day all ADNOC’s official selling prices are set on a retroactive basis, i.e. the July OSPs will be known in the first days of August.

- Yet Chinese, Japanese and South Korean refiners traditionally buy crudes 2 months in advance, rendering Murban’s (40° API, 0.8 percent Sulphur) price assessment somewhat uncompetitive to WTI or Forties.

- Moreover, ADNOC still continues to sell intra-month spot cargoes that are priced against an unknown OSP, further complicating matters for Asian buyers.

- ADNOC is looking into ways of listing Murban on the Dubai Exchange, in the footsteps of Oman which listed its Oman Blend in 2006, so that its futures prices set the OSP.

- If ADNOC goes for this, Murban will become the first Middle Eastern crude with exports streams above 1mbpd that forwent destination restricting clauses.

2. Saudi Arabia and Kuwait Discuss Neutal Zone Again

- Representatives of Kuwait and Saudi Arabia met last week to discuss the potential restart of production from the so-called Neutral Zone which could add 550kbpd of heavy crude onto the global market.

- Output from the Neutral Zone was halted in May 2015 as recriminatory claims spiraled out of control – Saudi Arabia effectively blocked a Kuwaiti refinery project in the Neutral Zone, to which Kuwait reacted by blocking Chevron, the operator of the Wafra field, from entering.

- Bringing back onstream the offshore 275kbpd Khafji crude (31-32 API, 0.7 percent Sulphur) should be relatively easy as all the equipment is still in place and intact.

- However, it would require months if not a couple of years to fully bring back the 175kbpd Wafra field (22-24 API, 1.5 percent Sulphur).

- Even though the petering out of Iranian and Venezuelan volumes from the market would suggest a suitable environment to do so, Kuwait seems to be reluctant to restart the Neutral Zone.

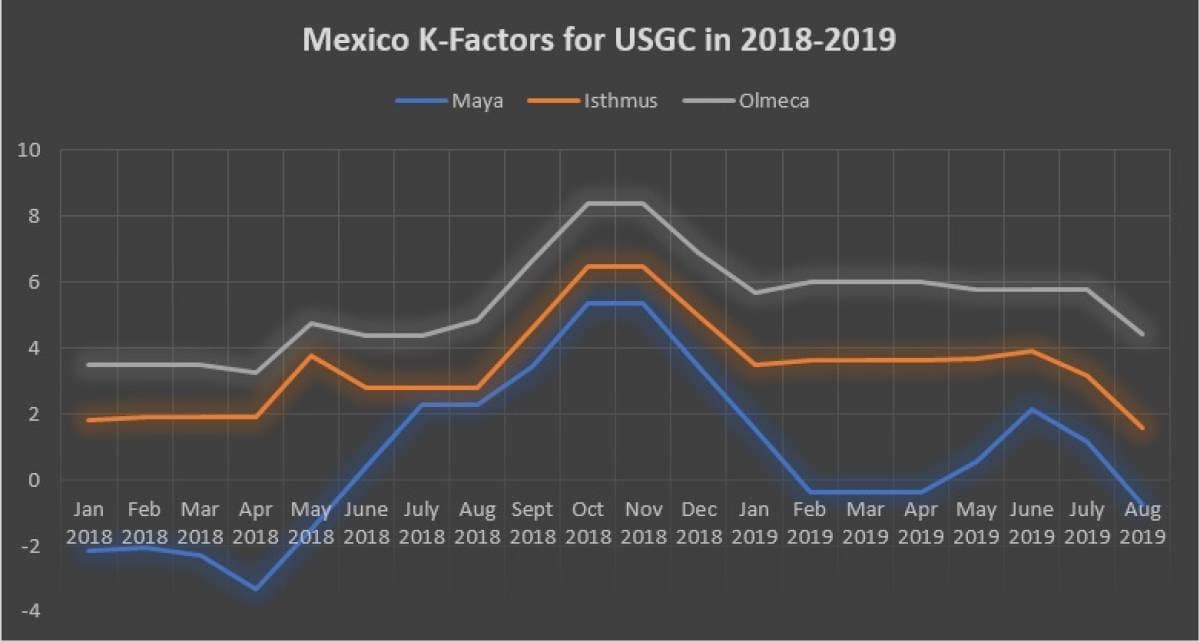

3. Mexico Drops August-loading K-Factors for USGC

- PMI Comercio International, the trading arm of Mexican national oil company PEMEX, has issued K-factors for August-loading Mexican cargoes.

- The Mexican K-factor is PEMEX’s peculiar way of adjusting export prices under conditions when its exports are routinely priced as a weighted average of the leading price indicators of the relevant region.

- K-factors for the US Gulf Coast plunged $-1.9/-1.35 per barrel with flagship grade Maya seeing the biggest month-on-month drop.

- Maya exports to the United States stood at 0.380mbpd in July, down for a second consecutive month following the 0.52mbpd attained in May 2019.

- August K-factors for Asia were largely unchained – Isthmus was simply rolled over, whilst Maya was decreased by $0.1 per barrel (to $-4.1 per barrel).

- PEMEX managed to stabilize Mexico’s oil output around 1.67mbpd, however its oil exports dropped below 1mbpd for the first time this decade (standing currently at 0.95mbpd).

4. WAF Exports to China Faltering Amid Hopes for a Robust September Rebound

- West African crude exports to Asia will witness their weakest months this year in July, averaging 2.08mbpd just a couple of months after hitting 2.72mbpd in May 2019.

- The weaker-than-usual demand comes against the backdrop of India recently reaching a 3-year high in WAF exports (0.82mbpd) as Indian refiners use Nigerian crudes to replace sanctioned Iranian volumes.

- Chinese demand for West African crudes has waned on weaker refining margins and the first round of government-granted import quotas for independent refiners nearing their end in July.

- September-loading exports to Asia, however, promise to be much more robust than July and August as two-thirds of Angolan loaders are already sold and committed.

- Angolan and Ghanaian crudes have broken all-time records last week against the backdrop of a sudden surge of interest from Chinese teapot refiners for September loaders ahead of IMO 2020.

5. South Sudan Prepares New Licensing Round

- The most oil-dependent nation in the world, South Sudan (whose GDP is 60% oil-based) is readying for a new licensing round to be held next year, with first roadtrips planned for this October.

- South Sudan is now pumping as much crude as ever since reaching independence, producing 0.18mbpd in May-July 2019, largely thanks to the South Sudan-Sudan peace deal concluded in October 2018.

- The peace accord has allowed producers active in South Sudan (CNPC, Petronas and the national NOC Nilepet) to transport their crude via Sudan to be loaded onto vessels in Port Sudan.

- South Sudan’s oil minister Awow Daniel Chuang pledged to reach pre-independence output rates (i.e. 0.35mbpd) by next year already, expediting a task that the accomplishment of which was earmarked for 2023.

- The South Sudanese authorities are seeking to engage Western majors as the country is struggling to substantially improve recovery rates.

6. Trafigura Taking Over Pakistan’s LNG Scene

- Trafigura has become the first oil and gas major ever to be granted an LNG marketing license in Pakistan, in a move that should significantly boost the Singapore-registered trader’s LNG standing.

- It seems the crucial point of Trafigura’s success with the Pakistani authorities was its commitment to develop a second LNG import terminal in Ben Qasim, owning 150 MMCf/d of its import capacity.

- Pakistan has been importing an average of 0.675 million LNG tons this year, with 65 percent of all imports sourced from Qatar, its traditional prime supplier.

- The Pakistani government expects LNG imports to triple from now to 2025 (attaining 21mtpa) as domestic production fails to keep up with the rise of consumption.

- There might be some space for other trading majors, too, as the Pakistani government has been mulling the construction of a third and fourth FSRU LNG terminal to be located in Karachi.

7. ENI Discovers Significant Gas Play in Offshore Vietnam

- ENI and its project partner Essar have announced a “significant” gas and condensate discovery in offshore Vietnam.

- The ENI-operated Ken Bau exploration well, drilled to a total depth of 3.6km, found a sandstone reservoir whose thickness exceeds 100 meters.

- Without disclosing an estimate resources in place, ENI stated that the exploration well was abandoned due to „technical issues” and that future testing might increase the resource tally.

- If preliminary assessments turn out to be workable, this might mark the end of ENI’s hitherto fruitless activity in Vietnam’s offshore following several dry exploration wells.

- Vietnam has been struggling with falling domestic output, its crude production dropped 32 percent since 2015 to 233kbpd as of year-to-date.