Friday April 19, 2019

1. China’s oil demand remains robust

- The bearish case for crude oil this year largely comes down to softening demand, particularly in China.

- However, China has defied expectations of an economic deceleration. China just posted strong GDP figures, as well as strong crude demand.

- In March, China’s refineries processed an average of 12.5 mb/d, which surprised on the upside. “Though this was somewhat less than the record-high levels achieved in January and February, the significantly lower crude oil imports in March had suggested a lower rate of crude oil processing,” Commerzbank wrote in a note. “The level in March was still extremely high, and was up by 3% year-on-year. Chinese refineries turned a record-high 12.6 million barrels per day into oil products in the first quarter.”

- Strong Chinese demand significantly decreases the odds that global oil demand disappoints.

2. Silver prices low

- Silver prices have fallen sharply over the past month, owing to high stocks.

- But demand could pick up if the U.S.-China trade war eases. Still, prices may not rebound significantly until later this year, according to Standard Chartered.

- “Supply declined in 2018 driven by lower output in the US, Peru and Canada while demand edged higher as jewellery demand growth offset softer industrial demand,” Standard Chartered wrote in a note. “We expect supply to recover in 2019, as well as industrial demand, but…

Friday April 19, 2019

1. China’s oil demand remains robust

- The bearish case for crude oil this year largely comes down to softening demand, particularly in China.

- However, China has defied expectations of an economic deceleration. China just posted strong GDP figures, as well as strong crude demand.

- In March, China’s refineries processed an average of 12.5 mb/d, which surprised on the upside. “Though this was somewhat less than the record-high levels achieved in January and February, the significantly lower crude oil imports in March had suggested a lower rate of crude oil processing,” Commerzbank wrote in a note. “The level in March was still extremely high, and was up by 3% year-on-year. Chinese refineries turned a record-high 12.6 million barrels per day into oil products in the first quarter.”

- Strong Chinese demand significantly decreases the odds that global oil demand disappoints.

2. Silver prices low

- Silver prices have fallen sharply over the past month, owing to high stocks.

- But demand could pick up if the U.S.-China trade war eases. Still, prices may not rebound significantly until later this year, according to Standard Chartered.

- “Supply declined in 2018 driven by lower output in the US, Peru and Canada while demand edged higher as jewellery demand growth offset softer industrial demand,” Standard Chartered wrote in a note. “We expect supply to recover in 2019, as well as industrial demand, but silver prices are unlikely to be driven higher by their supply and demand dynamics.”

- For prices to rally, investors will need to turn positive. As it stands, investors have staked out a net-short position.

3. IMO regulations could cause oil price spike

- The International Maritime Organization has rules that take effect in January, affecting global shipping. Ship-owners will have to switch from high-sulfur fuel oil to low-sulfur fuel oil, distillates or LNG to comply with the rules.

- In the short run, demand for diesel and other distillates is set to surge. Diesel demand could jump by 1.6 to 2.3 mb/d next year. About 1.1 mb/d of refining capacity is set to come online.

- “Even then, it is also important to note that middle distillate refinery utilization rates are exceptionally high and will likely remain so over the next few months,” Bank of America Merrill Lynch wrote in a note.

- “To sum up, the risk of an oil price spike is not insignificant, as options markets suggest,” Bank of America wrote. The options market implies only a 2 percent chance of Brent spiking to $100 per barrel. But Bank of America says that the odds of a price spike are not so remote.

4. Commodity prices on the upswing

- Commodity prices typically bounce around in the short-run, but taking a step back and looking at the broader cycle, it appears that prices are on the upswing.

- “Healthy global economic growth provides a solid demand backdrop for commodities through 2020, allowing fundamentals to reassert commodity-specific price paths over the coming years,” Scotiabank wrote in a report.

- The first quarter turned out to be bullish, after speculative bearish sentiment was reversed following a spate of positive economic news.

- “Oil and copper contracts are up 37% and 11%, respectively, from late-December lows while the S&P500— which also collapsed through December as sentiment toward risk assets soured— is up 22%,” Scotiabank said. If the U.S.-China trade war winds down, commodities are set for further gains.

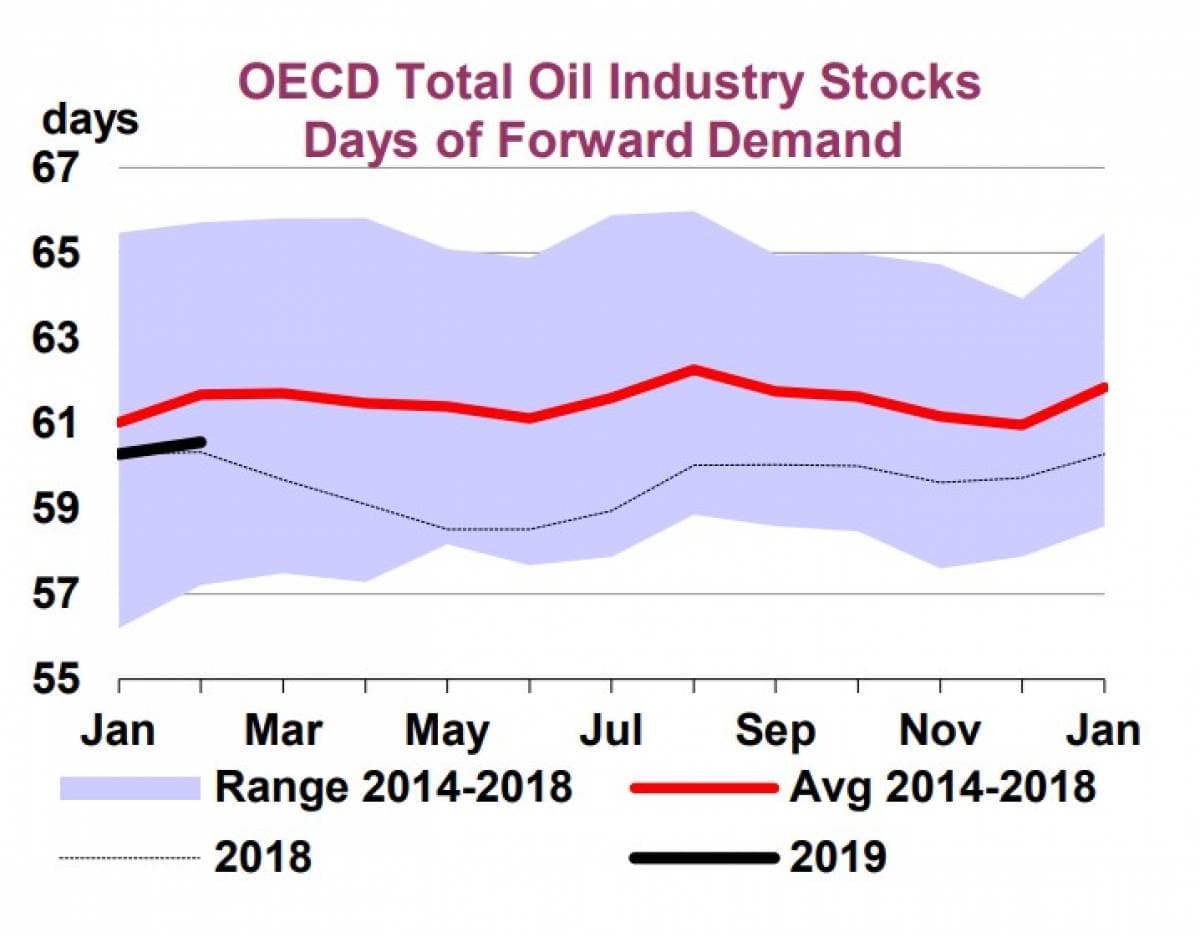

5. Oil stocks near five-year average

- The much-hyped “five-year average” for global oil inventories was the benchmark for the OPEC+ cuts in 2017-2018. After rebounding last year following the unwinding of the cuts, the new round of production curtailment is aimed at draining the surplus in stocks.

- As of February, total OECD oil stocks stood 16 million barrels above the five-year average.

- However, in terms of days of forward demand cover, “which is a more relevant assessment,” according to the IEA, stocks are below the five-year average.

- The oil market is tightening. There are two key factors that will largely determine the trajectory for the rest of the year: Iran sanctions and the decision from OPEC+ on extending the production cuts.

- The U.S. government will decide in the next two weeks on Iran sanctions, and then OPEC+ will take that into account when it meets a month after that.

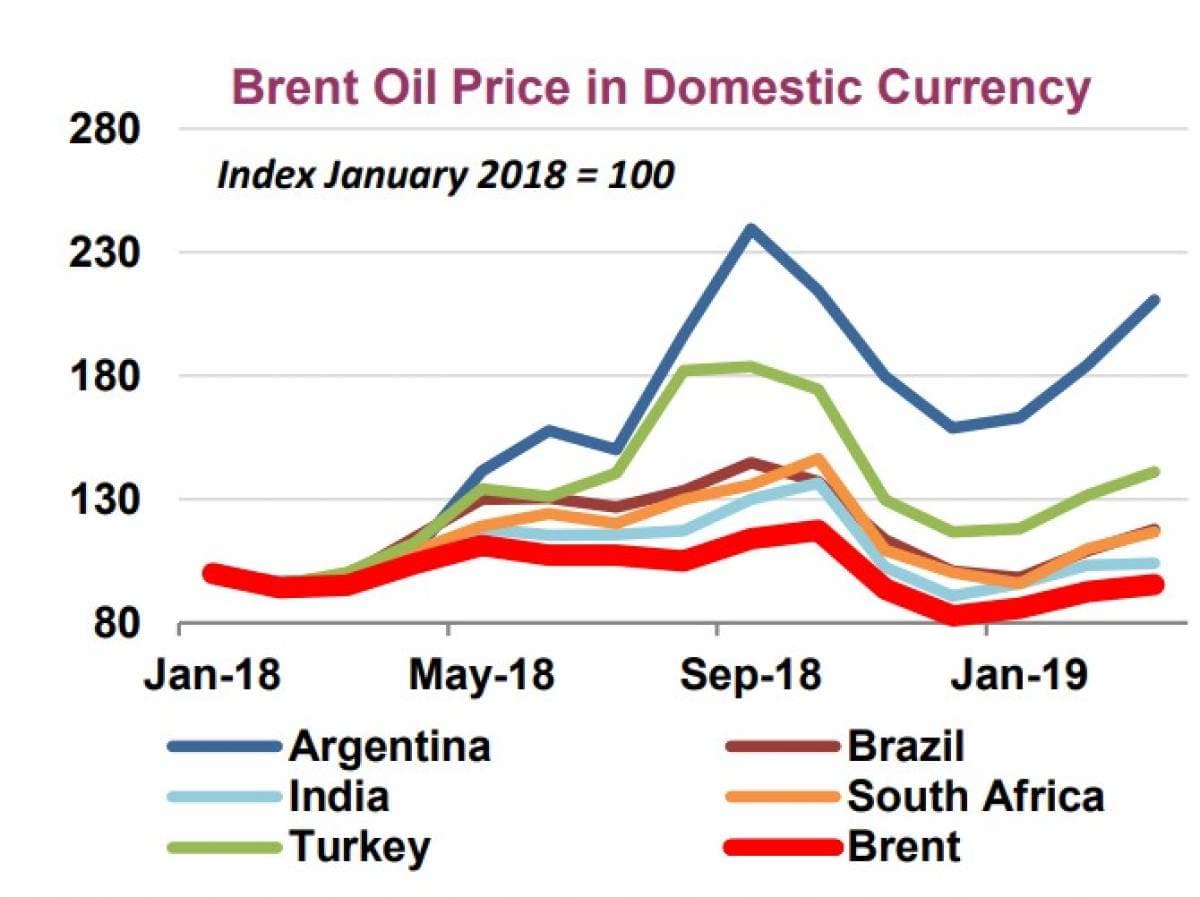

6. Emerging markets key to demand

- Oil prices are up more than 30 percent this year, and while the OPEC+ cuts and key supply outages have driven up prices, the increase is also the result of “resilient” demand, the IEA argued.

- The IEA maintained its demand forecast of 1.4 mb/d, which means it does not see a significant impact form the downside risks from a slowing economy.

- However, demand growth hinges very much on emerging markets. Oil is vastly more expensive in some countries because of currency weakness. “While financial flows to emerging markets appear to have stabilised in the past few months, Turkey and Argentina continue to experience a currency crisis,” the IEA noted. Both the Turkish lira and Argentina’s peso have fallen more than 10 percent this year, despite the more dovish stance from the U.S. Fed.

- Last year, the currency crisis in Turkey and Argentina seemed to spark a contagion to a broader basket of currencies. That has ebbed somewhat, but presents an ongoing risk to demand.

7. LNG trade growing quickly

- Bloomberg notes that Vitol Group moved its LNG trading desk to London from Geneva in order to be closer to top management, a clear sign that the company views LNG as an increasingly important part of its business.

- The volume of LNG that Vitol has traded has doubled since 2016, according to Bloomberg. Vitol’s CEO said that the market for LNG is like a “much younger crude oil market,” meaning one that will reap enormous profits in the years ahead.

- Other traders have seen similar growth in trading volumes, including Gunvor and Trafigura.

- The proliferation of LNG export terminals has helped mature the market for LNG, providing more sources of supply, a more liquid market, more transparent prices, and crucially, paving the way for sky-rocketing consumption.

- A wave of new LNG export capacity is coming online this year, keeping prices depressed. But for consumers and traders, that is an opportunity.