The oil rally of the past two weeks continues, even though in a more tempered manner, on the back of U.S. commercial crude supplies shrinking, Russia starting to implement its OPEC/OPEC+ commitments and China promising to do whatever it takes to avert an economic slowdown.

Beijing duly demonstrated the seriousness of its intentions – following weak December trade data, the Chinese National Bank has injected a record amount of cash into the economy via reverse repo operations, further backing it up with a robust PR drive. As a consequence, the global benchmark Brent traded between 60 and 60.5 USD per barrel on Wednesday afternoon, whilst WTI hovered around 51.5-52 USD per barrel.

1. US Stocks To Stay Around 440 MMbbls

• Having fallen by a modest 1.7 MMbbl in the week to 439.7 MMbbl ending January 04, U.S. commercial crude stocks, as per last week, are expected to experience an insignificant decline or stagnation.

• In doing so, stocks have been increasing for seven consecutive weeks in Cushing, Oklahoma, whilst Gulf Coast stocks have fallen by some 5 MMbbl month-on-month.

• Gasoline stocks are expected to continue their build for the eighth consecutive week, with a further 2.5-3 MMbbl stock build expected in the week ending January 11.

• A further uptake in distillate stocks is also assumed, albeit at a much smaller pace than the 10+ MMbbl week-on-week increases in the last two weeks documented by EIA.

2. Iran…

The oil rally of the past two weeks continues, even though in a more tempered manner, on the back of U.S. commercial crude supplies shrinking, Russia starting to implement its OPEC/OPEC+ commitments and China promising to do whatever it takes to avert an economic slowdown.

Beijing duly demonstrated the seriousness of its intentions – following weak December trade data, the Chinese National Bank has injected a record amount of cash into the economy via reverse repo operations, further backing it up with a robust PR drive. As a consequence, the global benchmark Brent traded between 60 and 60.5 USD per barrel on Wednesday afternoon, whilst WTI hovered around 51.5-52 USD per barrel.

1. US Stocks To Stay Around 440 MMbbls

• Having fallen by a modest 1.7 MMbbl in the week to 439.7 MMbbl ending January 04, U.S. commercial crude stocks, as per last week, are expected to experience an insignificant decline or stagnation.

• In doing so, stocks have been increasing for seven consecutive weeks in Cushing, Oklahoma, whilst Gulf Coast stocks have fallen by some 5 MMbbl month-on-month.

• Gasoline stocks are expected to continue their build for the eighth consecutive week, with a further 2.5-3 MMbbl stock build expected in the week ending January 11.

• A further uptake in distillate stocks is also assumed, albeit at a much smaller pace than the 10+ MMbbl week-on-week increases in the last two weeks documented by EIA.

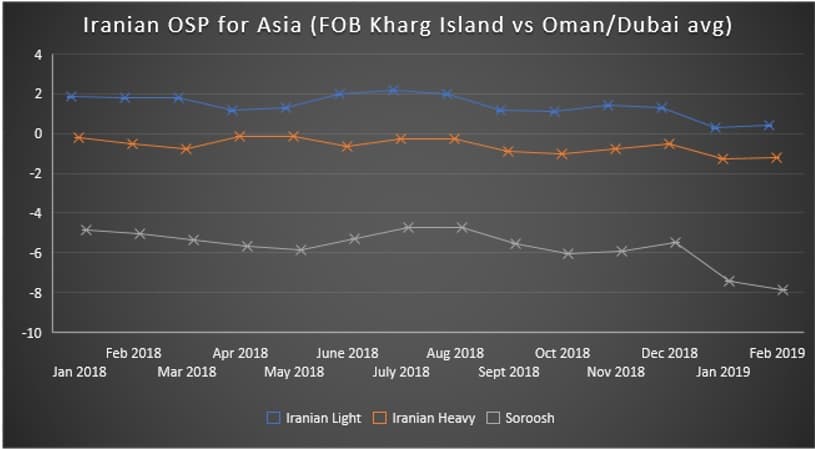

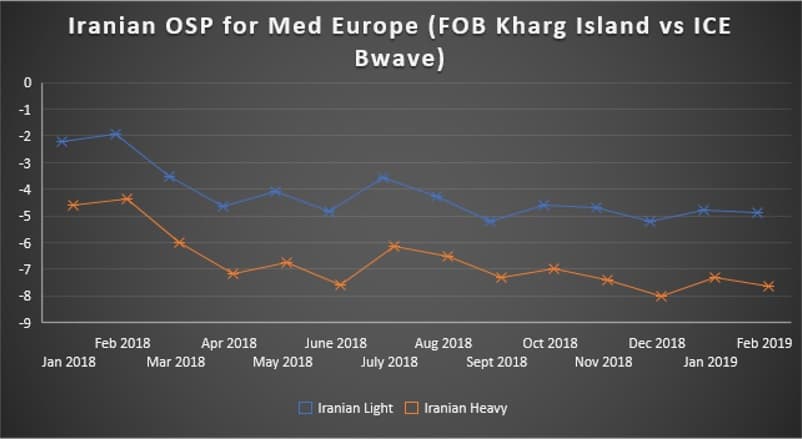

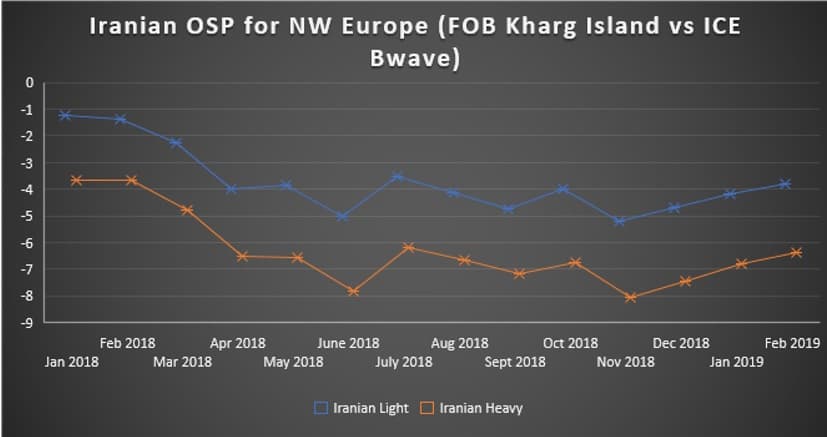

2. Iran Gives Up on Northwest Europe, Keeps Asian OSP Competitive

• The Iranian National Oil Company (NIOC) issued its official selling prices for cargoes loading in February 2019, largely reflecting the geopolitical situation as per today.

• NIOC mirrored Saudi Aramco’s 10 cent hike in February with its Asia-bound OSPs both for Iranian Heavy and Iranian Light, whilst dropping the already whopping Soroosh discount by further 45 US cents to -7.85 USD per barrel.

• NIOC also cut the official selling price for all Mediterranean-bound cargoes as some countries that were granted US waivers (Italy and Greece) are still to restart Iranian purchases.

• Iranian Heavy witnessed the steepest cut at -0.35 USD per barrel (to -7.65 USD per barrel), whilst Med-bound Iranian Light was cut by 10 cents.

• Iran has given up on Northwest Europe, which was never really a big market anyways, and after no NW European country was granted U.S. waivers turned into a tiny blip on the Iranian radar.

• NIOC has raised both Iranian Light and Iranian Heavy destined for NW Europe by 40 cents.

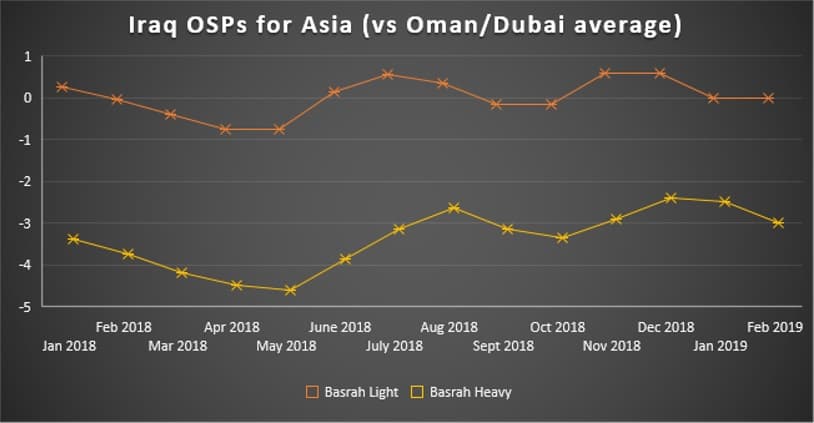

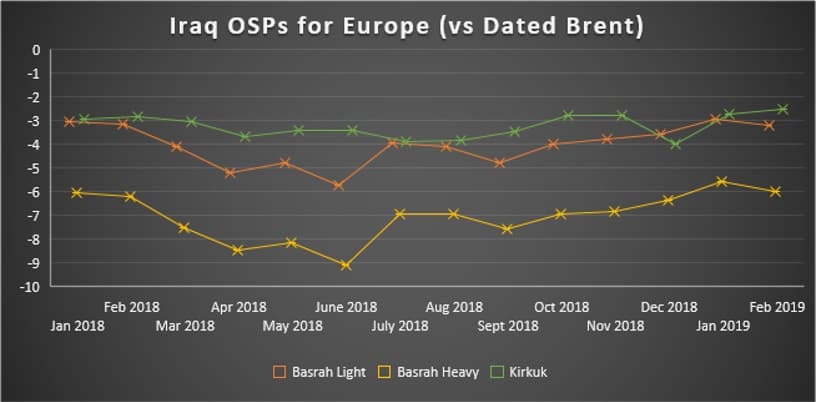

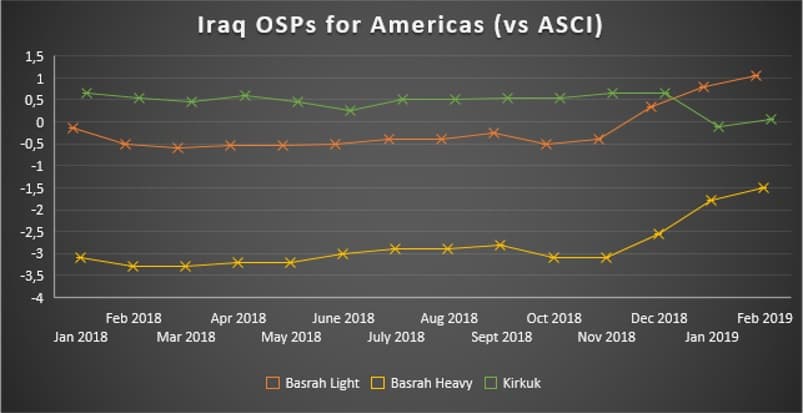

3. Iraq Lowers European OSPs For First Time Since August

• Iraq’s national oil marketer SOMO has rolled over its official selling price for Asia-bound Basrah Light cargoes in February 2019, whilst dropping Basrah Heavy prices by 50 US cents month-on-month.

• Interestingly, SOMO has cut both Basrah Light and Basrah Heavy prices destined for Europe, by 25 and 45 US cents per barrel, respectively. This marks the first time since August 2018 that SOMO lowers its European OSPs.

• The February OSP for Europe-bound Kirkuk volumes was raised by 20 cents to -2.5 USD per barrel.

• One of the possible explanations for the Basrah cuts is that SOMO wants to heat up interest towards its crudes amid a quite lukewarm reception of its tenders.

• Simultaneously, SOMO has hiked OSP differentials for all its marketed grades that are bound for the United States. Basrah Heavy witnessed the most notable increase with 30 cents up m-o-m, whilst Basrah Light and Kirkuk were hiked by 20 and 15 US cents, respectively.

• SOMO continues to tender additional volumes of crude from Basrah – it offered 2 MMbbl of Basrah Light and 1 MMbbl of Basrah Heavy in a tender closing January 16.

4. Nigerian Wit To The Rescue

• In the first days of 2019, CNOOC, the operator of the Egina field in deepwater Nigeria, has brightened up the West African crude market, by stating the field has started production.

• The second field to be commissioned on the Oil Mining Lease 130 following the Akpo field (started in 2009), Egina is expected to reach peak output of 200kbpd this year already.

Source: UPI.

• This, however, does not bode very well with Nigeria’s commitments under the OPEC/OPEC+ agreement, stipulating for a 53kbpd cut in the upcoming months (from the October 2018 output level of 1.74mbpd).

• Thus, the Nigerian oil ministry now seeks to reclassify Egina crude (with a gravity of 27° API and 0.17 sulphur content) as condensate to exempt it from the OPEC/OPEC+ cuts.

• The problem is that Egina is far from being a condensate – the generally accepted delineation between crude and condensate is around 45° API – moreover, it is not even a light grade (by industry standards it is a medium sweet grade).

• It remains to be seen how OPEC would react to it, although the feasibility of the endeavor is minuscule.

5. Kuwait Copies Saudi Aramco’s Moves

• Echoing Saudi Aramco’s decision to marginally increase its Asia-bound prices, the Kuwaiti Petroleum Company raised the Feb 2019 official selling price of its main grade, KEB, by 10 cents to a discount of 25 US cents vs the monthly Oman-Dubai average.

• This leaves the Kuwait Export Blend-Arab Medium differential unchanged month-on-month, amounting to -0.3 USD per barrel.

• The overwhelming majority of KEB is supplied to Asian countries (including the geographically African Egypt), with the largest non-Asian buyer being the United States and the Netherlands accounting for 3-3% of KPC’s export volume (some 23-24 MMbbl per year).

• The February OSP for the Kuwaiti Super Light Crude was hiked by 40 cents, mirroring Saudi Aramco’s decision to raise its Arab Extra Light premium over the monthly Oman-Dubai average from 0.75 to 1.15 USD per barrel.

• The Kuwait Super Light grade has an API gravity of 48 degrees and a sulfur content of 0.357 percent.

6. ENI Goes Hard Into UAE Upstream, Wary of Downstream

• The Italian oil major ENI was awarded three concessions in the UAE Emirate of Sharjah, spreading over 1 885 km2, acting as an operator with a 75 percent stake.

• The company was also granted 2 offshore blocks in the Abu Dhabi emirate on Saturday, under the first competitive licensing round started by ADNOC.

• The blocks will be developed along the Ghasha sour gas concession, expected to attain 1.5 BCf per day of gas, where ENI has recently bought a 25 percent stake.

(Click to enlarge)

• In a further bid to extend its Gulf presence, ENI has signed an exploration and production agreement with Oman’s Ministry of Oil and Gas on Monday.

• ENI CEO Claudio Descalzi stated the company needs to diversify away from Africa – where most of ENI’s major discoveries of late took place (Rovuma, Coral, Zohr) – and that the Gulf would amount to a third of the company’s revenue in the next 5-7 years.

• At the same time, ENI seems to shy away from investing into the Ruwais refining complex, the expansion of which is one of ADNOC’s main goals for the 2020s.

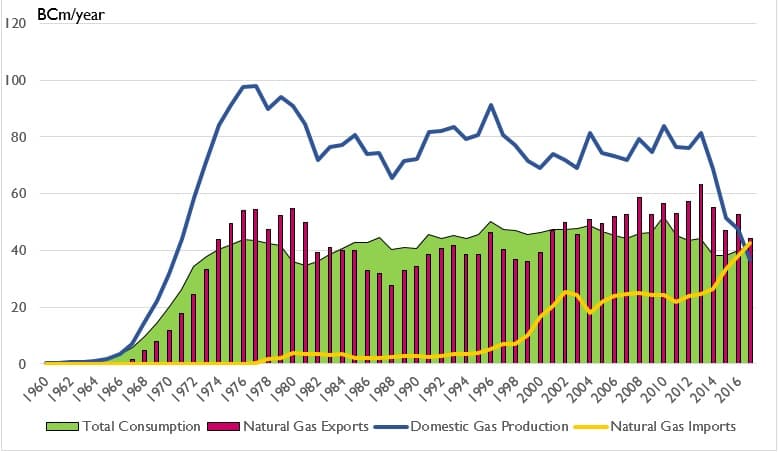

7. Dutch Court to Decide If Groningen Withdrawal Pace Is Adequate

• This week the Dutch High Court would consider demands, both private and public, to cease gas production immediately on the nation’s largest Groningen gield.

• The January 17 hearing will by no means be the last one as the 26 objections raised are expected to be heard out from January to April.

• Environmental risks dominate the Groningen debate as drilling for gas (since 1959) has contributed to a palpable increase in seismic activity, both in terms of scope and frequency.

• Having oscillated within the 60-73 BCm per year interval between 2004 and 2014, the current production is capped by the Dutch authorities at 19.4 BCm per year, to be lowered further to 12 BCm per year by 2022.

(Click to enlarge)

Source: Statistics Netherlands, OilPrice data.

• The Mark Rutte-led government has set 2030 as the year of a final field shutdown.

• Although the court hearings are unlikely to result in an immediate cessation of production, the way the Groningen debate proceeds will shape the future of „difficult” oil and gas projects in Europe and could become a precedent on how NGOs ought to act to shut down an environmentally damaging project.