Friday June 29, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

Key Takeaways

- The massive decline in crude stocks added momentum to the price rally this week. The drawdown helped fuel speculation of a supply shortage.

- The surge in refinery runs helps explain some of the crude draw. But the modest uptick in gasoline inventories was a bullish sign, as it failed to offset the decline in crude stocks.

- The spike in crude exports also explains the crude stock draw. The WTI-Brent discount, which had widened to double-digits in recent weeks, meant that U.S. exports would likely rise. That has now finally showed up in the data. However, exports at such levels could be brief since the WTI discount shrank significantly over the past week.

1. Futures curve is the key

(Click to enlarge)

- The shape of the futures curve has historically provided some clues into where oil prices are heading.

- WTI in a state of backwardation tends to precede oil price rallies. Backwardation, in which front-month oil contracts trade at a premium to longer-dated futures, is a sign of tightness in the market. One way of interpreting those differentials is that the market is concerned about near-term supply.

- Contango, on the other…

Friday June 29, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

Key Takeaways

- The massive decline in crude stocks added momentum to the price rally this week. The drawdown helped fuel speculation of a supply shortage.

- The surge in refinery runs helps explain some of the crude draw. But the modest uptick in gasoline inventories was a bullish sign, as it failed to offset the decline in crude stocks.

- The spike in crude exports also explains the crude stock draw. The WTI-Brent discount, which had widened to double-digits in recent weeks, meant that U.S. exports would likely rise. That has now finally showed up in the data. However, exports at such levels could be brief since the WTI discount shrank significantly over the past week.

1. Futures curve is the key

(Click to enlarge)

- The shape of the futures curve has historically provided some clues into where oil prices are heading.

- WTI in a state of backwardation tends to precede oil price rallies. Backwardation, in which front-month oil contracts trade at a premium to longer-dated futures, is a sign of tightness in the market. One way of interpreting those differentials is that the market is concerned about near-term supply.

- Contango, on the other hand, in which short-term oil trades at a discount to longer-dated futures, tends to precede and occur alongside a decline in oil prices. Contango accompanies well-supplied markets, and the near-term discount occurs because there is so much oil on hand that much of it has to be diverted into storage.

- WTI backwardation has steepened recently, which is no surprise because the 360,000-bpd outage in Canada, while temporary, has tightened near-term supply.

- The futures curve is currently showing evidence that prices will continue to rise.

2. Mexico election puts crude production into focus

(Click to enlarge)

- The Mexican presidential election takes place on Sunday, July 1, and by all accounts, the winner is set to be Andres Manuel Lopez Obrador, who is varyingly described as a far left radical populist or a pragmatic center-left politician, depending on who you ask.

- Mexico’s historic energy reform hangs in the balance. AMLO, as he is known, has at times voiced vociferous opposition to auctioning off Mexico’s oil and gas reserves to private companies. He has said he would end those auctions if elected.

- He will have a tough time reversing the already-awarded contracts, or rolling back privatization, since it will require a constitutional change.

- The most likely outcome will be a slow-walking of the permitting for drilling that is already underway.

- Pemex’s oil production has eroded significantly over the past decade, falling from 3.4 million barrels per day (mb/d) in 2004 to just 1.9 mb/d in 2017. Output will continue to decline unless international companies can reverse the country’s fortunes.

3. New FIDs are gaining momentum

(Click to enlarge)

- The oil and gas industry has been extremely cautious over the past few years, keeping spending at low levels and greenlighting very few new oil projects.

- However, the pace of new FIDs is finally increasing. New projects representing $110 billion have been approved since the start of 2017, compared to only $50 billion in 2016, according to Rystad Energy.

- 17 major deepwater projects have been approved since the start of 2017, which is notable because 16 of them were previously sitting in the queue but on hold because of low oil prices. Rystad says these projects have seen a dramatic cut in costs, making most of them profitable above $30 per barrel.

- In May alone, the industry gave the go-ahead to three major projects: Total’s (NYSE: TOT) Zinia deepwater development off Angola, Cheniere’s (NYSE: LNG) LNG liquefaction Train 3 project at Corpus Christi, Texas, and Santos’ (ASX: STO) Arcadia coalbed methane project in Queensland, Australia.

- “Deepwater projects on either side of the Atlantic Ocean – from Norway to the US and from Angola to Brazil – are leading the charge towards new approvals. Higher oil prices, an improved outlook for gas demand and lower offshore development costs are driving this rebound in the industry,” Rystad Energy senior research analyst Readul Islam said in a statement.

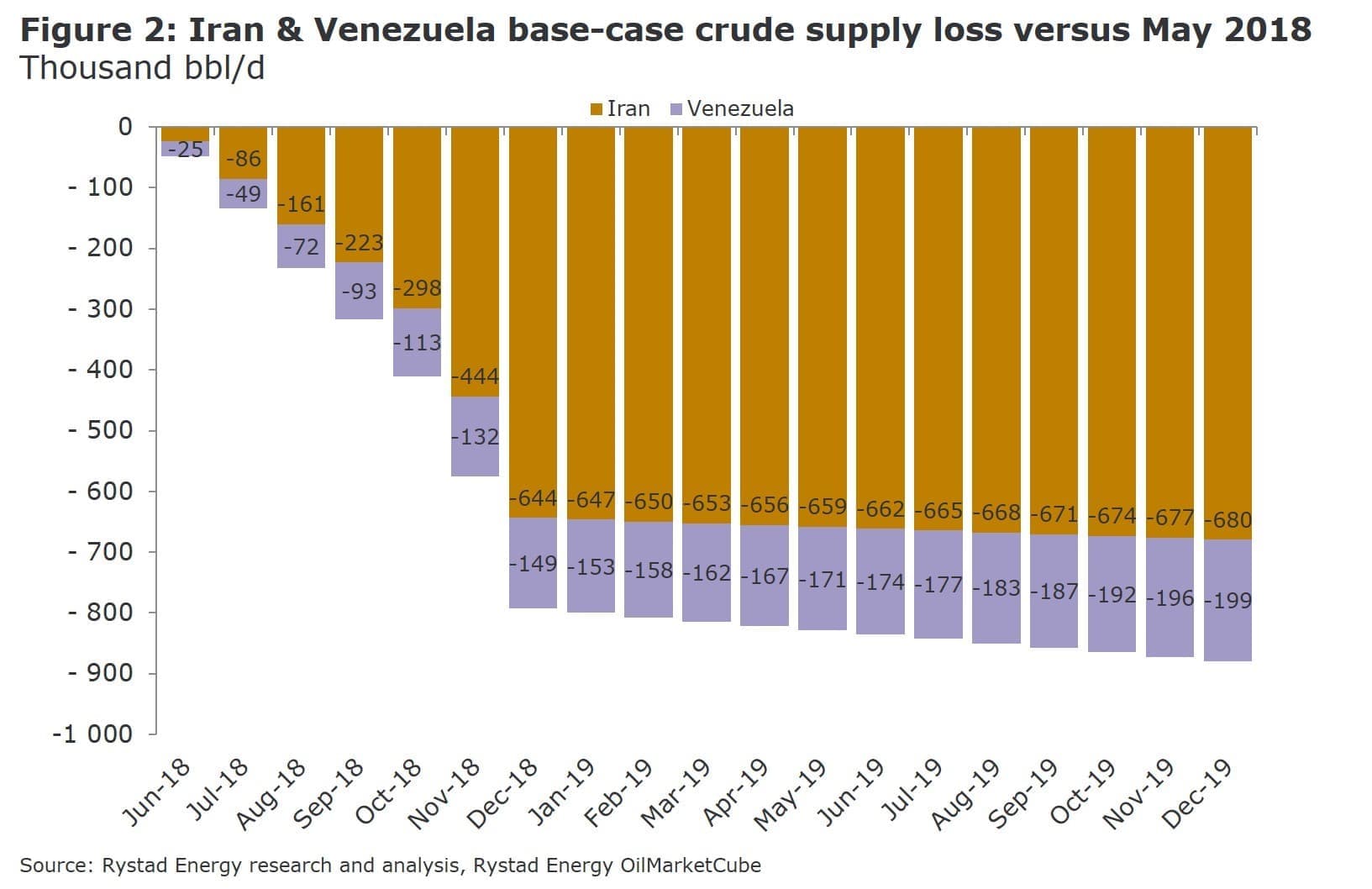

4. Venezuela and Iran outages lead to major supply losses

(Click to enlarge)

- Oil prices spiked this week after news broke that the U.S. could take a hard line towards countries buying Iranian oil. The State Department demanded countries take oil imports from Iran down to zero.

- Expectations of losses from Iran have jumped from roughly 400,000 bpd around the time Trump pulled out of the Iran nuclear deal, to something more like 1 million barrels per day following the statement from the State Department.

- Rystad Energy sees Iran losing roughly 700,000 bpd by December 2018 compared to May levels, with Venezuela losing around 200,000 bpd.

- It must be said, however, that both of those estimates look optimistic, particularly if the U.S. manages to convince countries to zero out their purchases of Iranian oil.

5. China’s gas exports to skyrocket

(Click to enlarge)

- China’s natural gas demand is skyrocketing as it tries to shut down coal plants to address its air quality issues.

- While global gas demand will rise by 1.6 percent annually over the next five years, China will account for 37 percent of the total global increase.

- China’s LNG imports are up 55 percent in the first six months of 2018 compared to a year earlier.

- In large part because of China’s voracious gas demand, the IEA says there could be a supply shortfall as soon as 2023. Up until recently, everyone thought LNG markets would be over-supplied until the late 2020s.

- The market tightness is breathing new life into LNG export terminals that had been left on the drawing board.

Heard on the Street

Long live the Permian:

“By 2024, Permian volumes will exceed the rest of tight oil combined, and though the rate of growth slows, never looks back.” – Wood Mackenzie

$90 oil by 2Q 2019:

“We are in a very attractive oil price environment and our house view is that oil will hit $90 by the end of the second quarter of next year,” - Hootan Yazhari, head of frontier markets equity research at Bank of America Merrill Lynch.

Zero tolerance?

“Our focus is to work with those countries importing Iranian crude oil to get as many of them as possible down to zero by Nov. 4…We are prepared to work with countries that are reducing their imports on a case-by-case basis. We are serious about our efforts to pressure Iran to change its threatening behavior.” – U.S. State Department official, walking back earlier comments suggesting no countries would receive waivers, and all of them would have to zero out imports

6. Libya outages linger

(Click to enlarge)

- The loss of 450,000 bpd from Libya came out of nowhere a few weeks ago, adding another headache to an oil market that is starting to see more and more outages.

- Libya suffered the destruction of several storage tanks and the temporary shuttering of its largest oil export terminals.

- The disruptions were thought to be temporary and the National Oil Corp. said that the terminals would be back online within days.

- However, General Khalifa Haftar said that the terminals would be handed over to the NOC in Benghazi, not to the internationally-recognised NOC in Tripoli.

- The uncertainty could leave unsold barrels from Libya and threaten to keep oil offline for longer.

- “The Benghazi NOC is not internationally recognised, and it seems unlikely that anything other than rogue tankers can be loaded until a legal basis backed by the UN is restored,” Standard Chartered said in a note. “Until that issue is resolved, we would expect to see a further decline in Libya’s output.”

7. Iran in a vice

(Click to enlarge)

- The U.S. State Department deserves credit (or blame) for driving up oil prices this week, after suggesting that the U.S. government would demand major importers of Iranian oil to “zero” out their purchases.

- That raised the odds of outages of 1 mb/d or higher.

- Signs of trouble are already starting to become visible.

- “Both in April and May Iranian exports averaged 2.4mn b/d as the National Oil Company squeezed barrels out of the country, presumably concerned about the turn in US politics. But there is a number of floating vessels off the Iran Persian gulf that are starting to show up, as insurance and freight challenges are already starting to disrupt flows ahead of the November deadline,” Bank of America Merrill Lynch said in a note.

- India’s oil ministry asked refiners to prepare for a “drastic reduction or zero” imports of Iranian oil beginning in November.

- “We can buy Basra Heavy, Saudi or Kuwait oil to replace Iran. Finding replacement barrels is not a problem, but it has to give the best economic value,” a source in New Delhi told Reuters.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.