Oil prices dropped on Thursday as OPEC adjusted its demand forecast, but the IEA's warning of a significant supply deficit later this year helped to bolster prices on Friday morning.

Oilprice Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com's premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per week.

Friday, March 14th, 2023

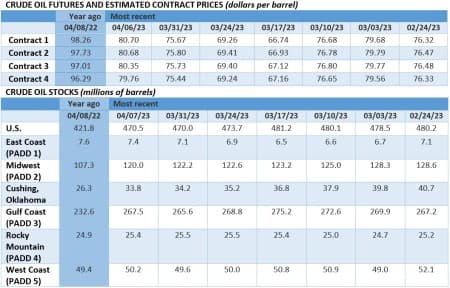

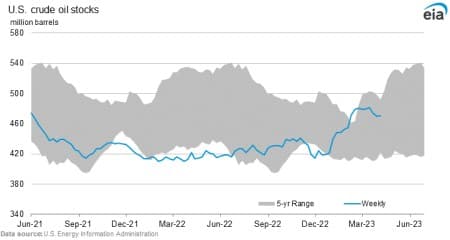

The optimism that nudged Brent above $87 per barrel, mostly stemming from US CPI figures coming in at 5.6%, looked set to wane when OPEC lowered its demand forecast for the second half of 2023. At the same time, OPEC also retrospectively increased demand in Q1, leaving it with the same annual growth as previously (2.3 million b/d). The IEA's report, however, boosted oil prices on Friday as the agency warned of the potential for a significant supply deficit later this year.

IEA Warns of Upcoming Oil Tightness. The head of the International Energy Agency Fatih Birol said that oil markets could see tightness in the second half of 2023 should voluntary production cuts of key OPEC+ producers stay in place until the end of 2023, pushing prices even higher than currently. In its Oil Market Report, the agency then warned a supply deficit caused exacerbated by OPEC+ cuts could derail global economic growth.

White House Pushes for EV Boost. The US Environmental Protection Agency proposed the heretofore most aggressive emission cuts for new vehicle sales by 2032, mandating 13% annual average pollution cuts and a 56% decrease in projected fleet emissions compared to current 2026 requirements.

Chinese Major Takes Stake in Qatari Megaproject. China’s oil major Sinopec (SHA:600028) will take a 5% stake in one of the North Field East LNG trains in Qatar, boasting an 8mtpa capacity, marking the first time that an Asian firm takes a stake in the project with Sinopec seeking to expand the cooperation.

Glencore Improves Teck Takeover Bid. Mining and trading giant Glencore (LON:GLEN) improved its $22.5 billion all-share takeover bid for Canadian miner Teck Resources, adding a further $8.2 billion in cash to sweeten the deal for shareholders, although Teck’s board dismissed it.

Ecopetrol Has a New CEO, At Last. Frustrated by repeated pipeline sabotage attacks, Colombia’s state oil company Ecopetrol (NYSE:EC) finally has a new CEO to confront its woes head-on, with Ricardo Roa, a mechanical engineer, tasked to nudge the company towards renewable energy sources.

Guyana Delays Oil Auction to July. The next big thing in South America’s upstream sector, the anticipated licensing of 14 offshore oil blocks in Guyana has been delayed to mid-July as the government allegedly needs more time to modernize its regulatory framework for a new PSA model.

Diamondback Seeking to Sell Permian Acreage. US shale producer Diamondback Energy (NYSE:FANG) is looking to sell non-core assets in the western Permian Basin, seeking to garner around $1 billion for its acreage in Pecos County, TX, as M&A activity is heating up across the country.

Speculators Get Bullish Again. Net long positions in ICE Brent jumped by more than 73,000 contracts (the equivalent of 73 million barrels) in the week to April 4, i.e. the one following the announcement of OPEC+ voluntary cuts, marking the biggest weekly gain for market bulls since late 2016.

China Remains Wary of Summer Blackouts. The Chinese government is expecting peak energy demand in the summer to exceed 1.36 TW, prompting Beijing to expedite the approval of new coal mines and fast-track the construction of already approved ones to secure higher baseload capacity.

TotalEnergies Mulls Buying Emerging Explorer. French oil major TotalEnergies (NYSE:TTE) is reportedly in early-stage talks to buy private equity-backed exploration firm Neptune Energy in a deal that could be worth more than $5 billion, stepping in before the company opts for an IPO.

Electrification Spree Worries Norway’s Public. As operator Equinor (NYSE:EQNR) and its partners seek to electrify Europe’s largest LNG plant in Hammerfest, the Snøhvit LNG terminal, the Norwegian parliament will debate proposals this week to delay or stop the plan as locals fear power shortages.

International Piracy Drops to a 30-Year Low. According to the International Maritime Bureau, the number of reported piracy and maritime armed robbery incidents in Q1 2023 was the lowest in the last 30 years, dropping to “only” 27 such incidents with only one successful hijacking. Although an oil tanker did go missing in the Gulf of Guinea after being attacked by pirates earlier this week.

Russia Threatens to End Black Sea Grain Deal. Russia has once again vowed to walk away from the UN-brokered Black Sea grain deal that is set to expire on May 18, claiming that Western powers are yet to ease restrictions on payments, insurance, and logistics for non-sanctioned goods coming out of Russia.

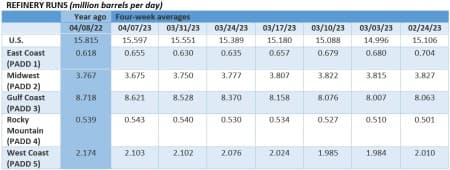

BP Launches New Platform in Gulf of Mexico. The UK-based energy major BP (NYSE:BP) announced it had started oil production at Argos, its first new platform in the US Gulf of Mexico since 2008 with a capacity of 140,000 boepd, seeking to ramp up production to 400,000 b/d by the mid-2020s.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Forgotten Equation Could Be Key In Recycling CO2

- Google Aims To Cut The Bureaucratic Red Tape In Green Power Procurement

- Europe’s Energy Troubles Continue: Hydro And Nuclear Output Declining

The IEA has a history of making wrong projections and uttering on oil. Examples abound.

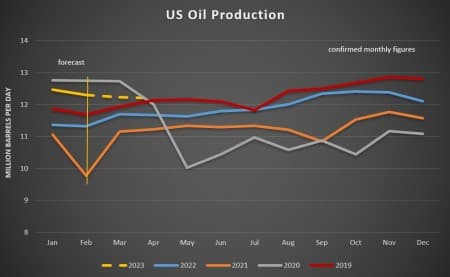

1- In 2018 it projected that by 2025 US crude oil production 46% of which come from shale oil will be bigger than the combined production of Russia and Saudi Arabia. Where is US shale now? It is a spent force incapable of rising production meaningfully.

2- In 2021 the Chief of the IEA Fatih Birol called for an immediate halt of investments in oil and gas. He was forced to retract it later in the year under pressure of rising energy prices but not before his plan for net-zero emissions by 2050 was labelled mockingly as La-La-Land by the Saudi Energy Minister Prince AbdulAziz bi Salman. The notion of net-zero emissions by 2050 or 2100 or ever is an illusion.

3- In 2022 he was still denying that the EU’s hasty policies of accelerating energy transition into renewables were behind the EU disastrous energy crisis blaming it on the Ukraine conflict when the conflict came 14 months after the crisis.

4- And now the IEA is warning of a significant supply deficit later in the year. But the global oil market has already factored in this very prospect based on robust global oil demand and underinvestment in oil and gas resulting in a shrinking global spare production capacity. Remember that it was Fatih Birol who was calling in 2021 for an immediate halt of investments in oil and gas.

Therefore, why would oil prices be bolstered by IEA’s warnings?

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert