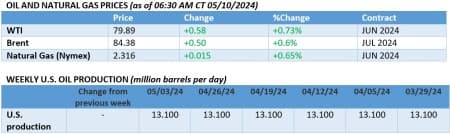

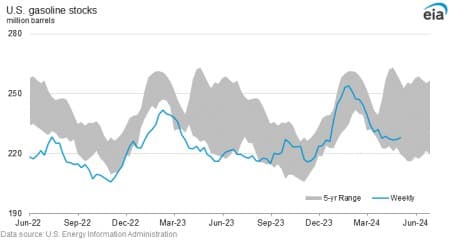

Following several weeks of declines, oil prices are now rising once again on a combination of geopolitical risk, rising demand, and supply concerns.

Friday, May 10th 2024

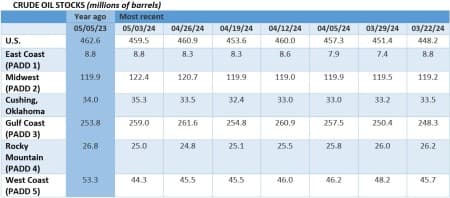

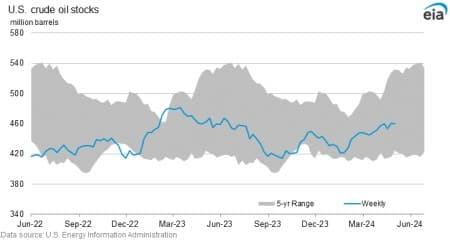

Oil prices are once again climbing after several weeks of declines. Falling US crude inventories and robust Chinese imports have sparked some bullish sentiment in oil markets. Brent futures are set to post their first weekly gain since early April, moving closer to $85 per barrel, further boosted by the easing of the US labor market (jobless claims the highest in eight months) and Israel’s Rafah operation.

Shell Sells Singapore Refinery to Glencore Consortium. UK-based energy major Shell (LON:SHEL) has confirmed the sale of its 237,000 b/d Bukom refinery in Singapore to global trading house Glencore and Indonesian chemicals firm PT Chandra Asti in a deal worth some $1 billion.

Trump Vows to Reverse Biden Oil Policy. According to media reports, Republican presidential candidate Donald Trump vowed to reverse the Biden administration’s environmental rules and halt the current freeze on new LNG export terminals, asking them to raise $1 billion for his campaign.

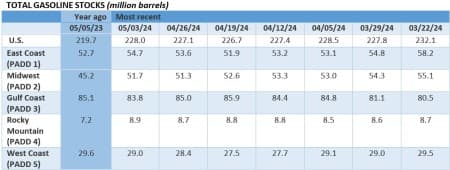

China Boosts Oil Imports. China’s oil imports have risen year-over-year to about 10.88 million b/d last month, a 5.5% increase compared to April 2023, with refinery activity boosted by high-flying activity during the Labour Day holiday and also improving manufacturing activity.

Guyana Approves Joint Consortium Bid. Guyana’s government has greenlighted a bid for the shallow water block S-4 from TotalEnergies (NYSE:TTE), Petronas, and QatarEnergy, marking the first acreage to be allotted in the country since ExxonMobil landed the Stabroek block in 1999.

Suncor Eyes Full Control of TMX Exports. Canada’s oil major Suncor Energy (TSO:SU) will be leasing Aframax tankers to deliver crude oil shipped on the Trans Mountain Expansion (TMX) pipeline, avoiding third-party commodity trading shops, as it seeks to ramp up flows to PADD 5.

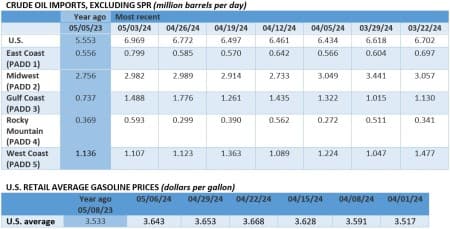

US Government Resumes SPR Purchases. The US Department of Energy issued a solicitation for a new refill of the Strategic Petroleum Reserve now that WTI prices dropped to $79 per barrel, seeking to purchase 3.3 million barrels of oil for an October delivery to the Big Hill storage facility.

Insurance Firms Dismiss Chevron’s Iram Claim. Three insurance companies have rejected the claim of US oil major Chevron (NYSE:CVX) over the seizure of its oil cargo that was seized by Iran last year, as the Chevron-chartered tanker Advantage Sweet was confiscated by the Iranian military in April 2023.

Trafigura Boosts Renewable Portfolio. Global commodity trader Trafigura has agreed to expand its ownership of UK-based biodiesel firm Greenergy after buying the company’s European business, now taking over all Canadian assets for an undisclosed sum.

US Puts Pressure on Malaysia’s Iran Ties. The US Treasury is poised to target Iran’s export capacities by targeting service providers in Singapore and Malaysia as approximately half of the Middle Eastern country’s exports carry out ship-to-ship transfers in the Malacca Strait, to be further shipped to China.

Platinum Set for Biggest Deficit In A Decade. The platinum market is set for the largest supply shortfall in 10 years as Russia produces less and industrial demand remains firm, according to catalyst maker Johnson Matthey, with the deficit widening to 598,000 ounces from last year’s 518,000oz.

Texas Power Prices Surge on High Demand. Electricity prices in Texas increased almost 100-fold this week, with ERCOT reporting spot prices at the North Hub jumping to $3,000 per MWh, as unusually warm weather boosts cooling demand amidst underperforming wind power generation.

Mexico Wants a Bigger Say in Pemex Operations. As the Mexican government continues to keep its national oil firm Pemex afloat despite some $45 billion of maturing debt over the next 3 years, the country’s Finance Ministry said it wants to have a bigger say in the investment decisions taken.

Saudi Aramco Ups Capital Expenditures. Despite Saudi Aramco’s decision to cut back its production capacity expansion, the Saudi NOC reported a 23.8% increase in capital expenditure in Q1 2024, boosted by new investments into natural gas, renewables, and lower-carbon fuels.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- BP Hints That Its Goal to Cut Oil and Gas Output Could Be Flexible

- Oil Risk Premium Wanes

- OPEC Resolves Compensation Plans for Overproducing Members

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert.