It seems this was all there could be in a groundbreaking attack on the planet’s most crucial oil infrastructure – two weeks of turmoil and crude prices start decreasing again on largely negative economic signals. Saudi Arabia managed to repair most of the damaged infrastructure in Abqaiq and Khurais remarkably swiftly, even sooner than the end-September it promised, yet the overall market sentiment shifted to a rather sour one, nevertheless. The agenda moved back to one of 2019’s overarching themes, the US-China trade war, the prospect of which now seems more worrisome as previously amidst faltering global manufacturing levels. The totality of these topics will most certainly be around for the upcoming months, despite the occasional upward movements.

(Click to enlarge)

Amidst Wednesday’s news of US commercial crude inventories decreasing, crude prices have moved upwards a bit, with global benchmark Brent moving to $59 per barrel, while US benchmark WTI traded around $53.7-54 per barrel.

1. Southeast Asian sweet crudes rise to all-time highs

• Malaysia has benefited greatly from the Saudi drone attack-induced market tremors, with most of its light sweet crude prices soaring to all-time highs in the last days of September.

• Spot market premiums for light sweet Kimanis (38.6° API, 0.06% Sulphur) have moved from the traditional $6 per barrel premium level to 7.6 per barrel this Tuesday, whilst similar quality Kikeh (37.6° API, 0.06% Sulphur)…

It seems this was all there could be in a groundbreaking attack on the planet’s most crucial oil infrastructure – two weeks of turmoil and crude prices start decreasing again on largely negative economic signals. Saudi Arabia managed to repair most of the damaged infrastructure in Abqaiq and Khurais remarkably swiftly, even sooner than the end-September it promised, yet the overall market sentiment shifted to a rather sour one, nevertheless. The agenda moved back to one of 2019’s overarching themes, the US-China trade war, the prospect of which now seems more worrisome as previously amidst faltering global manufacturing levels. The totality of these topics will most certainly be around for the upcoming months, despite the occasional upward movements.

(Click to enlarge)

Amidst Wednesday’s news of US commercial crude inventories decreasing, crude prices have moved upwards a bit, with global benchmark Brent moving to $59 per barrel, while US benchmark WTI traded around $53.7-54 per barrel.

1. Southeast Asian sweet crudes rise to all-time highs

• Malaysia has benefited greatly from the Saudi drone attack-induced market tremors, with most of its light sweet crude prices soaring to all-time highs in the last days of September.

• Spot market premiums for light sweet Kimanis (38.6° API, 0.06% Sulphur) have moved from the traditional $6 per barrel premium level to 7.6 per barrel this Tuesday, whilst similar quality Kikeh (37.6° API, 0.06% Sulphur) rose to a 7.5 per barrel premium against Brent.

(Click to enlarge)

Source: OilPrice data.

• Interestingly enough, high freights rates for intercontinental voyages have resulted in most of Malaysian crudes remaining in the region, with most of Kimanis going out to India, Australia and Singapore, its traditional outlets.

• Heavier regional grades, such as the Indonesian Duri (20.3° API, 0.2% Sulphur), have also increased in value, albeit at a smaller rate – Duri’s premium to Dated rose almost $1 per barrel month-on-month.

• The appreciation of Malaysian crudes and the refiners’ need to diversify away from them has in turn led to a price hike in Australian condensates (which up to end-Sept did not budge much), with Ichthys moving to an all-time high premium of $4 per barrel against Dated.

2. Libyan OSPs on the Rise, Internal Rupture Fears Loom Large

• The Libyan national oil company (LNOC) has increased all its October-loading official selling prices amid rising demand as European refiners seek low-sulphur crudes ahead of IMO 2020.

• Reaching a 6-year high, Libya’s main export stream (290-300kbpd) Es Sider has seen its October OSP rise 30 cents m-o-m to a $0.05 per barrel premium against Dated Brent.

• Libya’s other significant streams in Esharara, Mellitah and Sarir were also hiked 30 cents month-on-month, whilst lighter Abu Attifel saw its OSP increase by 10 cents per barrel m-o-m.

(Click to enlarge)

Source: OilPrice data.

• LNOC is struggling to overcome an internal crisis as multiple staff from its fuel distribution company broke away, accusing the company of undersupplying Eastern Libya with jet fuel and kerosene, only to establish a rival fuel distribution firm.

• There is a real risk that the newly-formed company might be transformed into a direct competitor of the national LNOC, acting as a tool in Field Marshal Haftar’s pressurizing of the Tripoli government.

(Click to enlarge)

Source: OilPrice data.

• Libyan exports have dropped 12 percent month-on-month, averaging 0.91mbpd in September 2019.

3. Algeria Pulls Off Rapid Hike on October OSPs

• Algeria’s state oil company Sonatrach has increased its October-loading Saharan Blend official selling prices by 0.85 per barrel from September, the most drastic month-on-month increase in 4 years.

• Saharan Blend’s surge comes amid a similar appreciation of Mediterranean rivals CPC and Azeri Light, whilst concurrently reflecting a more robust demand for low-sulphur crudes as IMO 2020 looms.

• Sonatrach presented last week its SH 2030 Strategy which sees solar PV panels feeding most of the company’s facilities, along with an intensified exploration drive that should lead to a production of 700 Bcf/year of shale gas by 2030.

(Click to enlarge)

Source: OilPrice data.

• Algerian crude exports have stayed at the same 0.48mbpd as in September 2019.

• Sonatrach has called upon Algerian authorities to speed up the adoption of a new hydrocarbons law, as the current setup impedes cooperation with international majors (in the past 10 years, the share of JVs in the national total decreased from 33 to 25 percent).

4. Mexico Weighs Record HSFO Prices into October K-factors

• PMI International, the trading arm of Mexico’s national oil company PEMEX, has sizably increased its formula adjustments, also known as K-factors, for October-loading cargoes.

(Click to enlarge)

Source: OilPrice data.

• PMI was confronted with a difficult choice as HSFO prices across continents bounced back from their August weakening as physical shortages and crude diversions on the back of the Saudi drone attacks pushed HSFO prices into new highs.

• HSFO, a key element in Maya assessments, surpassed WTI prompt-month WTI Houston twice in September, all the while moving to the narrowest against Dated Brent in history.

• In view of the above, PMI set the October-loading USGC-bound Maya K-factor at $0.5 per barrel, $3.25 per barrel lower than in September, whilst Isthmus was hiked by $2 per barrel.

(Click to enlarge)

Source: OilPrice data.

• Asia-bound Maya cargoes loading in October will see their K-factors drop a little to $-4.95 per barrel, whilst the K-factor for Isthmus crude was rolled over from September.

• PEMEX has revamped the top management of PMI, naming Ulises Hernandez as the new CEO, fueling market speculation that the Mexican NOC will seek to change its pricing formulas soon.

5. India Is Mulling the Sale of Top Refiner

• India’s government is considering plans to sell a controlling stake in state-owned refiner Bharat Petroleum to a private domestic firm or foreign investor, extending the potential pool in a deal which initially was meant to be a state-to-state transaction.

• Bharat Petroleum is the 2nd largest oil refiner in India, running the 310kbpd Kochi and 240kbpd Mumbai refineries, also co-owning the 156kbpd Bina and soon-to-be 180kbpd Numaligarh Refineries.

(Click to enlarge)

Source: OilPrice data.

• The initial plan was to sell 53.3 percent of Bharat to the Indian national IOC, however due to monopolization risks, massive underappreciation potential and IOC’s debt overload the government decided to seek a foreign partner.

• Saudi Aramco is already in talks to buy 20 percent of Reliance Industries’ refining and petrochem business, leaving BP, Total and Rosneft as main potential buyers.

• Bharat Petroleum was initially set up in 1928 by Shell (which so far expressed no interest in an Indian downstream expansion) and was nationalized in 1976.

• Faced with a budget gap of some 4 percent for the 2019-2020 fiscal year, the Modi government sees oil sector privatization as a suitable means to keep state coffers healthy.

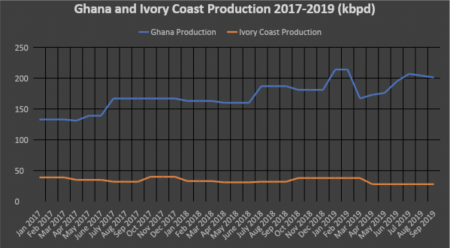

6. Ghana and Ivory Coast Agree to Act Jointly

• The governments of Ghana and Ivory Coast have agreed to a joint development of their offshore oil and gas resources that transgress into each other’s territory.

(Click to enlarge)

Source: OilPrice data.

• The framework agreement fully reflects the 2017 decision of the International Tribunal for the Law of the Sea in Hamburg which found that Ghana did not violate Ivory Coast’s rights by conducting offshore appraisal in disputed areas.

• The dispute hindered the development of Tullow’s TEN fields (Tweneboa, Enyenra and Ntomme) whose output could have risen to 80kbpd by the mid 2010s, from the current plateau of 65kbpd.

• With a mere 100 million in currently assessed oil reserves, Ivory Coast might see the development of offshore blocks CI-523, 524, 525 and 605, boosting heavily its somewhat meagre current production of 30kbpd.

7. Tanzania Tries to Revive Licensing Round

• The government of Tanzania is working to restart its stalled licensing round that has been shut for more than 4 years amid weak international demand.

• Tanzania’s 4th Licensing Round, announced first in 2013, introduced heavier taxation and more stringent regulatory norms than the country’s initial 2008 production-sharing model, resulting in lukewarm demand (4 blocks out of the offered 8 elicited no bids whatsoever).

• The deepwater licensing round comprises blocks relinquished by ExxonMobil, Statoil and BG, despite having discovered commercially viable gas deposits that increased Tanzania’s gas reserves tally to 57 TCf.

(Click to enlarge)

Source: Nogtec.

• It remains to be seen whether oil majors would be up for it, especially given that Tanzania not only did not ease its taxation regime but also introduced a new local content regulation.

• With all blocks located in water depth of 2-3 000 meters and far from producing oil infrastructure, Tanzania’s dreams of joining neighboring Kenya and Mozambique in their hydrocarbon quest seem rather unreasonable so far.

So much for the Numbers Report. We will see you next week with a new portion of fresh energy insights.