Oil prices legged higher to begin the week after the new Saudi Energy Minister confirmed his arrival would not bring a shift in OPEC policy. To quote, Prince Abdulaziz told reporters “There is nothing radical in Saudi Arabia. We all work for the government… Fundamentally Saudi Arabia’s energy policy is resting on a few pillars. The pillars don’t change.”

The comments seemed to salve oil traders who are nervous the recent Saudi push towards an Aramco IPO could lead to a fraying of relations within OPEC and a loss in motivation for the Saudis to do the brunt of the market balancing work. (We happen to think this will only heighten Saudi resolve to keep the market tight in the coming months.) The boost in oil prices was enough to push global stocks higher as the energy sector lead gains in the S&P 500- an unusual occurrence as the sector has suffered losses of 7% since mid-July while the overall S&P has been flat.

This was an unusual start to the trading week following several months in which oil traders tended to focus on bearish news. Meanwhile, there was, in fact, some negative news for the market to digest in the form of yet another downward revision from the IEA in their global crude demand growth forecast to slightly under 1m bpd for 2019. The research organization had previously forecast 2019 demand growth of 1.4m bpd for the year back in the Fall of 2018 and 1.35m bpd until this Spring giving us all a sharp reminder of a darkening global macro picture.…

Oil prices legged higher to begin the week after the new Saudi Energy Minister confirmed his arrival would not bring a shift in OPEC policy. To quote, Prince Abdulaziz told reporters “There is nothing radical in Saudi Arabia. We all work for the government… Fundamentally Saudi Arabia’s energy policy is resting on a few pillars. The pillars don’t change.”

The comments seemed to salve oil traders who are nervous the recent Saudi push towards an Aramco IPO could lead to a fraying of relations within OPEC and a loss in motivation for the Saudis to do the brunt of the market balancing work. (We happen to think this will only heighten Saudi resolve to keep the market tight in the coming months.) The boost in oil prices was enough to push global stocks higher as the energy sector lead gains in the S&P 500- an unusual occurrence as the sector has suffered losses of 7% since mid-July while the overall S&P has been flat.

This was an unusual start to the trading week following several months in which oil traders tended to focus on bearish news. Meanwhile, there was, in fact, some negative news for the market to digest in the form of yet another downward revision from the IEA in their global crude demand growth forecast to slightly under 1m bpd for 2019. The research organization had previously forecast 2019 demand growth of 1.4m bpd for the year back in the Fall of 2018 and 1.35m bpd until this Spring giving us all a sharp reminder of a darkening global macro picture. These forecasts are also serving as bearish compliments to y/y declines in gasoline demand in the US and Europe while US refiner demand is flat y/y despite more than +2% GDP growth.

From a technician’s standpoint crude oil appears to be on steady footing after rallying from a low print of $55 on August 7th, then holding its recent low on last week’s selloff and currently trading over $62. Brent crude is currently trading above its 50-day moving average for the first time in a month suggesting the short-term momentum is with the bulls.

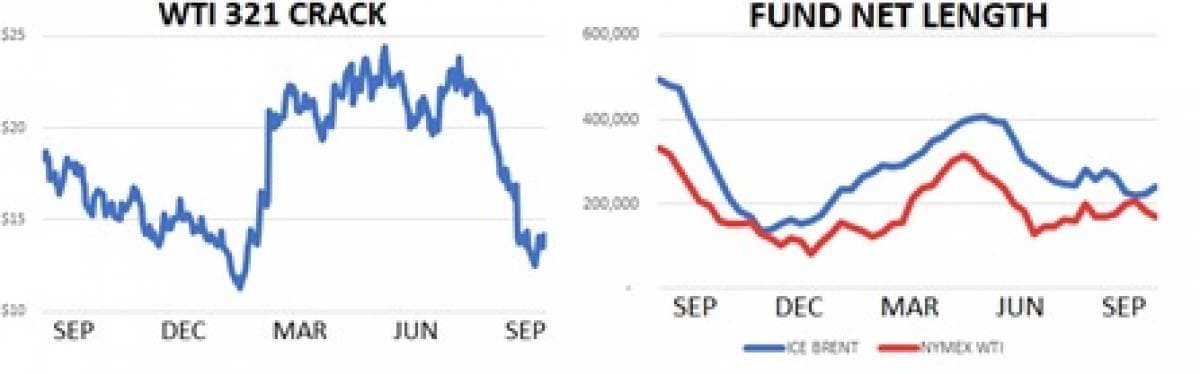

In reading signs from recent market action, however, we think most traders seem to be looking for sideways price action in the near term while worrying about downside risk on a longer time frame. In options markets, contracts dated for January of 2020 have 25 delta put options trading at a 3% premium to 25 delta call options as measured by the implied volatility that traders are paying for those options. Contracts dated for December of 2020, however, have the same put options trading at a 6% premium. Meanwhile, in spread markets the 6-month strip of Brent contracts beginning December ’19 is yielding 30-cents contango per month. Unfortunately, the same 6-month strip spread beginning in June ’20 is only yielding 15-cents of contango per month. This is consistent with the recent selling of crude oil derivatives by hedge funds who have a net-long on oil that is 44% smaller than it was back in April.

While none of these numbers ‘prove’ that oil traders are feeling negative, they do serve as powerful indicators that the refiners and merchants who need to buy oil via spreads, the producers who buy put options to hedge their output and the hedge funds who speculate on crude aren’t feeling overly positive.

Quick Hits

- Brent crude traded back above $62 this week boosted by comments from the new Saudi Energy Minister that they would continue to drive market-rebalancing efforts within OPEC. As Aramco speeds towards and IPO we might look to the Saudis to work behind the scenes to further boost prices.

- President Trump fired national security advisor John Bolton from his staff on Tuesday which- if anything- helped cool oil prices. Mr. Bolton was by far the hawkish advisor on Trump’s team and has repeatedly tried to ramp up tensions with Iran. Oil sold off about $1 when the news broke.

- Spread markets are trending bullishly and may signal that physical markets are tighter than flat price crude might suggest. This week the prompt Brent 6-month spread offered more than 30-cents of backwardation per month.

- On the election front, mortgage firm LendingTree performed an analysis and concluded that Michigan has higher odds of a recession than any other state in the US. This is notable as Michigan was a key component of Trump’s 2016 victory and suggests the Rust Belt could be underperforming the rest of the US. The US Manufacturing PMI printed 49.1 in August which was its lowest mark under the Trump administration.

- Global refining margins continued to trade at poor levels this week which does not bode well for a market in need of a demand boost. The WTI 321 crack currently pays US refiners about $13.50/bbl while on global markets the gasoil/brent crack is trading near $17.50/bbl.

- Leadership from OPEC member Equitorial Guinea said crude would have to drop into the $40-$45 / bbl range in order for the cartel to ramp up their efforts to tighten supplies.

- Bloomberg reported that Aramco heard pitches from investment banks related to their forthcoming IPO back in August. CEO Amin Nasser told reporters that banks will be chosen soon

- Hedge funds were net buyers of ICE Brent last week and net buyer of NYMEX WTI. Overall net length between the two contracts currently stands at 410k which is lower from its recent April peak by 44%.

DOE Wrap Up

- US crude stocks fell 4.8m bbls last week and are 6% higher y/y over the last two-week period.

- Crude stocks in the Cushing, OK delivery hub fell for the sixth straight week this time by about 230k bbls to 40.1m. Cushing stocks are lower by 12m bbls over the last two months as crude stocks have flowed towards the USGC for export.

- Traders shipped 6.9m bpd into the US last year from abroad and moved 3.1m bpd of US crude overseas leaving net imports of 3.8m bpd.

- US crude production fell by 100k bpd w/w to 12.4m bpd. Production has averaged about 12.1m bpd so far in 2019.

- The US currently has 24.2 days of crude oil supply on hand which is higher y/y by 7%.

- As for demand, US refiners processed 17.4m bpd last week. Demand has averaged 17.45m bpd over the last four weeks which is lower y/y by about 290k bpd.

- US gasoline stocks continued to move lower last week falling 2.4m bbls to 230m. US gasoline stocks are lower y/y by about 0.5%.

- The US currently has 23.6 days of gasoline stocks on hand which is lower y/y by 3%.

- Gasoline traded near $1.60/gl this week for a 10-cent improvement over the last week as the US market recovered from hurricane conditions which reduced demand.

- US gasoline demand + exports were estimated at 10.29k bpd last week for a 310k bpd w/w decline. Implied mogas demand averaged 10.4m bpd in August which was higher y/y by 165k bpd.

- US distillate stocks also fell sharply moving lower by 2.5m bbls to 134m. Distillate stocks have averaged 136m bbls over the last four weeks which is higher y/y by 4%.