Friday June 22, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

Key Takeaways

- Because the EIA changed the way it displays U.S. weekly production figures, rounding off to the nearest 100,000 bpd, it is now difficult to decipher weekly changes. The weekly figures appear unchanged from the week before.

- Crude stocks fell sharply, a bullish result, although that was offset a bit by the increase in gasoline inventories.

- Gasoline demand appears to have plummeted but it is more likely the result of a more accurate picture of demand after an outlandishly high figure from last week.

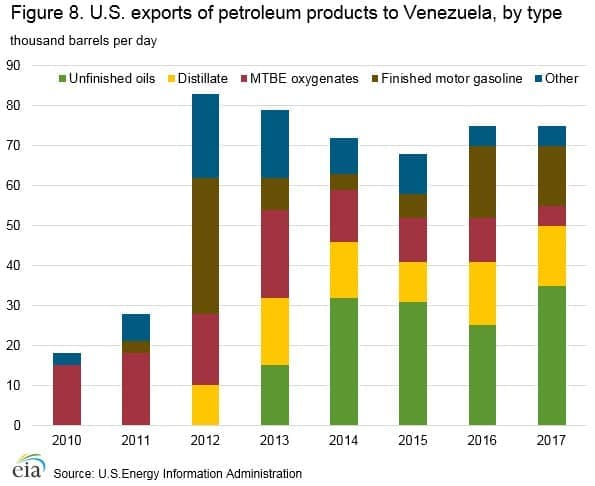

1. U.S. exports of petroleum products to Venezuela jumps

(Click to enlarge)

- The decline of Venezuela’s oil sector has led to an increasing reliance on imported petroleum products from the United States.

- Venezuela’s decrepit refineries has resulted in the declining availability of finished gasoline, distillates and other products.

- Over the last few years, Venezuela’s imports of U.S. “unfinished oils” has spiked, which is used to blend with Venezuela’s heavy oil.

- The problem for Venezuela is that more recently, it has lost control of some of its Caribbean refining and processing assets,…

Friday June 22, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

Key Takeaways

- Because the EIA changed the way it displays U.S. weekly production figures, rounding off to the nearest 100,000 bpd, it is now difficult to decipher weekly changes. The weekly figures appear unchanged from the week before.

- Crude stocks fell sharply, a bullish result, although that was offset a bit by the increase in gasoline inventories.

- Gasoline demand appears to have plummeted but it is more likely the result of a more accurate picture of demand after an outlandishly high figure from last week.

1. U.S. exports of petroleum products to Venezuela jumps

(Click to enlarge)

- The decline of Venezuela’s oil sector has led to an increasing reliance on imported petroleum products from the United States.

- Venezuela’s decrepit refineries has resulted in the declining availability of finished gasoline, distillates and other products.

- Over the last few years, Venezuela’s imports of U.S. “unfinished oils” has spiked, which is used to blend with Venezuela’s heavy oil.

- The problem for Venezuela is that more recently, it has lost control of some of its Caribbean refining and processing assets, which means it is having trouble blending its heavy oil altogether. It also is lacking cash to reliably import diluent.

- The result is oil production and exports in a freefall.

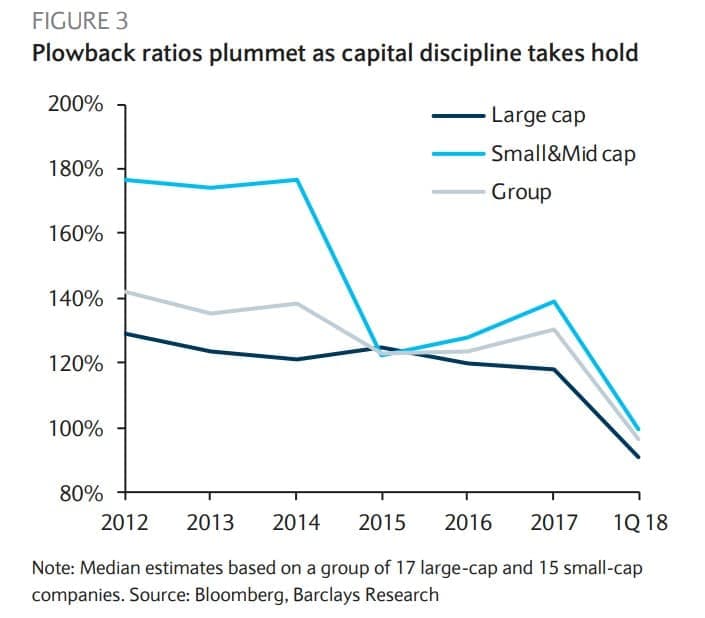

2. Capital discipline taking hold

(Click to enlarge)

- The pressure from shareholders for capital discipline for the shale industry appears to be working.

- Barclays says that the plowback ratio (capex as a percentage of cash flow from operations) for 32 large and small-cap shale companies has converged down to 100 percent, after ranging between 120 and 140 percent over the last few years.

- In fact, the first quarter of 2018 saw a sharp correction downwards, evidence that the shale industry entered 2018 with a focus on capital discipline.

- That figure did not edge up, at least in the first quarter, despite the significant increase in oil prices.

- “Even the Permian-focused operators announced just about 18% growth in their capital expenditure budgets for this year, which is rather small given significantly higher benchmark prices and a large inventory of available drilling locations,” Barclays wrote in a note.

(Click to enlarge)

(Click to enlarge)

3. Permian productivity slowing down

(Click to enlarge)

- The Permian has succeeded in bringing waves of fresh supply online over the past few years, with much of the success due to incredible productivity increases, allowing drillers to produce more from each well.

- Using more frac sand, drilling longer laterals, drilling more wells per wellpad, along with a variety of other drilling innovations, has significantly lowered breakeven costs and led to stratospheric production.

- But the productivity gains are leveling off. The drilling frenzy is forcing companies into the periphery, away from Tier 1 locations. Also, Barclays says the estimated ultimate recovery (EUR) is slowing in part because of “parent-child well interference.”

- The unexpected production problems led Barclays to lower its forecasted production growth from the Permian by 50,000 bpd this year and next.

4. Permian decline rates deepening

(Click to enlarge)

- The Permian is still expected to see strong gains in production on an absolute basis, but the existing production base is eroding at a faster and faster clip.

- The decline rate for existing output has accelerated from 4.5 percent month-on-month in 2013 to more than 6.5 percent m/m now.

- Because the Permian is producing over 3 mb/d, decline rates of that size means that the region loses 200,000 bpd every single month.

- Of course, the industry is adding more than that amount, so on net, the Permian still adds production. For instance, in July, the EIA expects the Permian to lose 215,000 bpd from legacy decline, but new drilling will add 288,000 bpd, for a net increase of 73,000 bpd.

- However, it is requiring a greater effort to continue to expand production as the legacy decline rises.

- “As total output from the region grows, a scenario might emerge where average well-productivity stops its improving trend or starts declining, which would likely require an ever-growing number of wells just to keep output stable,” Barclays wrote in its report.

5. Marcellus shale dominates U.S. natural gas

(Click to enlarge)

- U.S. natural gas production continues to break new records, and the growth is largely the result of skyrocketing production from the Appalachia region, which is mostly made up of the Marcellus shale.

- Output in Appalachia is expected to hit 28,905,951 million cubic feet per day (mcf/d) in June, a new record high. Marcellus output has grown inexorably for more than a decade. In 2007, the basin was producing less than 1,500,000 mcf/d.

- The Marcellus is expected to see record growth in 2018, largely because new pipeline projects are set to come online, unlocking new markets and adding significant new takeaway capacity.

- Pennsylvania, Ohio and West Virginia are also attracting billions in new petrochemical investments because of the natural gas abundance. Three ethylene crackers are in the works, one in each of those three states.

- Royal Dutch Shell’s (NYSE: RDS.A) Pennsylvania Chemicals cracker alone will consume 100,000 bpd of ethane when it comes online in a few years.

Heard on the Street

On the OPEC scenarios:

“If the OPEC and non-OPEC countries do agree on an increase of roughly 600,000 barrels per day, oil prices are likely to remain at around their current level. If production is raised by up to one million barrels per day, Brent is likely to fall to $70 – and an increase of more than one million barrels per day would probably drive the price below $70. If talks fail and no joint declaration is forthcoming, Saudi Arabia and Russia can be expected to step up production on their own.” – Commerzbank

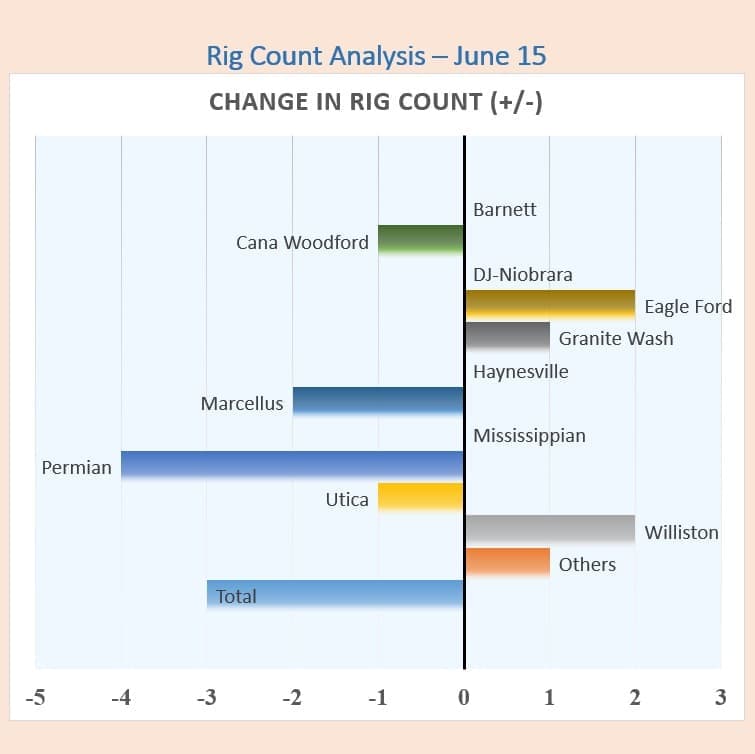

Permian pipeline bottleneck diverts attention elsewhere:

“We think producers may slow down growth in the Permian and build up drilled but uncompleted (DUC) wells and/or reallocate resources elsewhere until the constraints are worked out. We believe top beneficiaries are Eagle Ford and Bakken as the flows can bypass Cushing to access the Gulf Coast.” – Barclays

Trump to tap SPR?

“We would be surprised if there was not a further release of [from the strategic petroleum reserve] over the next three months, beyond that already agreed for budgetary purposes. Indeed, we think that the declaration of a significant release could come as early as next week, should President Trump feel that the 22 June OPEC meeting, and the oil market’s response to it, are insufficiently price-depressive.” – Standard Chartered

(Click to enlarge)

6. Offshore costs decline

(Click to enlarge)

- Offshore drilling costs have declined significantly over the past several years.

- One of the reasons for the improvements are the increasing practice of tying back several oil fields to a single platform, rather than having a drillship or platform for each field.

- That allows companies like BP (NYSE: BP) and Chevron (NYSE: CVX) to greenlight new projects at lower breakeven costs because they can use existing infrastructure to develop new reserves.

- New offshore projects recently approved have breakeven prices in the range of $35 to $40 per barrel, which is on par with some highly competitive onshore shale regions.

(Click to enlarge)

7. Venezuela’s oil activity plummets

(Click to enlarge)

- The above chart demonstrates the catastrophic decline in drilling activity one of Venezuela’s most important oil complexes, El Furrial.

- The activity index, put together by consulting firm Kayrros, uses satellite data to detect a heat signature coming from the flaring activities at El Furrial. Higher flaring is an indication of more activity.

- The activity index plummeted over the past few years. Activity spiked in the first quarter of 2018, part of the country’s attempt to revive production (or at least slow the decline), but activity plunged again in May as technical problems overwhelmed PDVSA.

- Venezuela’s production is in rapid decline, with exports falling to just 1 mb/d in May. That could drop by another several hundred thousand barrels per day in June.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.