Friday June 15, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

Key Takeaways

- The EIA has changed the way it displays U.S. weekly production figures, and began rounding off to the nearest 100,000 barrels per day (bpd). As such, the seemingly massive weekly increases by 100,000 bpd in each of the last two weeks should come with that caveat in mind. Still, production at about 10.9 million barrels per day (mb/d) is remarkable, given that we started the year somewhere around 10.0 mb/d.

- Exports jumped by a rather large 316,000 bpd last week, which is not surprising given the large WTI-to-Brent discount.

- Gasoline demand skyrocketed last week to an all-time high of 9.879 mb/d. Gasoline stocks (and crude oil stocks) also declined, rounding off a rather bullish weekly report.

1. OECD inventories below average

(Click to enlarge)

- As OPEC and the non-OPEC group of countries gear up for negotiations ahead of the June 22 meeting, they will be deciding on output levels against a backdrop of a much tighter oil market.

- OECD inventories have now dipped below the five-year average, both in terms of absolute inventories and in terms of days of demand cover, according to Barclays.

-…

Friday June 15, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

Key Takeaways

- The EIA has changed the way it displays U.S. weekly production figures, and began rounding off to the nearest 100,000 barrels per day (bpd). As such, the seemingly massive weekly increases by 100,000 bpd in each of the last two weeks should come with that caveat in mind. Still, production at about 10.9 million barrels per day (mb/d) is remarkable, given that we started the year somewhere around 10.0 mb/d.

- Exports jumped by a rather large 316,000 bpd last week, which is not surprising given the large WTI-to-Brent discount.

- Gasoline demand skyrocketed last week to an all-time high of 9.879 mb/d. Gasoline stocks (and crude oil stocks) also declined, rounding off a rather bullish weekly report.

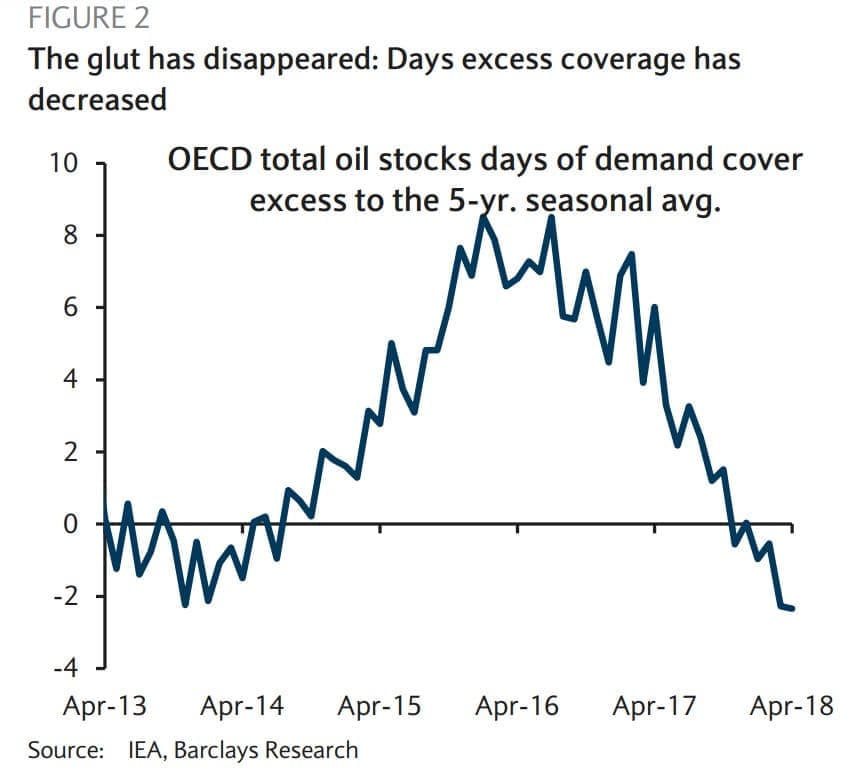

1. OECD inventories below average

(Click to enlarge)

- As OPEC and the non-OPEC group of countries gear up for negotiations ahead of the June 22 meeting, they will be deciding on output levels against a backdrop of a much tighter oil market.

- OECD inventories have now dipped below the five-year average, both in terms of absolute inventories and in terms of days of demand cover, according to Barclays.

- OECD stocks days of demand cover is now 2 days’ worth of supply below the five-year average.

- The days of demand cover “better reflects market fundamentals because it adjusts for the effect of the growth in the underlying demand,” Barclays wrote in a note. That is, the oil market is much bigger than it was years ago, so it takes more inventory to cover demand.

- Whichever metric is used, the oil market looks finely balanced, and heading in a bullish direction. Based on this data, OPEC seems to be on solid ground if it decides to pump more oil.

2. Oil price volatility jumped on news OPEC could increase output

(Click to enlarge)

- Historically, oil prices are much more volatile when OPEC declines to try to manage the market. Intervention on behalf of the cartel, whether to increase or decrease output, has consistently led to lower volatility (even if critics lament higher prices).

- The inauguration of the production cuts at the start of 2017 coincided with a sharp drop in volatility.

- Price volatility then picked up again earlier this year, ahead of the Trump administration’s decision to pull out of the Iran nuclear deal.

- Shortly after that announcement, on May 8, price volatility fell again.

- In late May, when news surfaced that OPEC and Russia were considering production increases, volatility spiked once again.

- Odds are that volatility dips after an OPEC announcement, although given the level of discord heading into the meeting, any confusion might muddle the message that the Saudis and the Russians want to send.

(Click to enlarge)

(Click to enlarge)

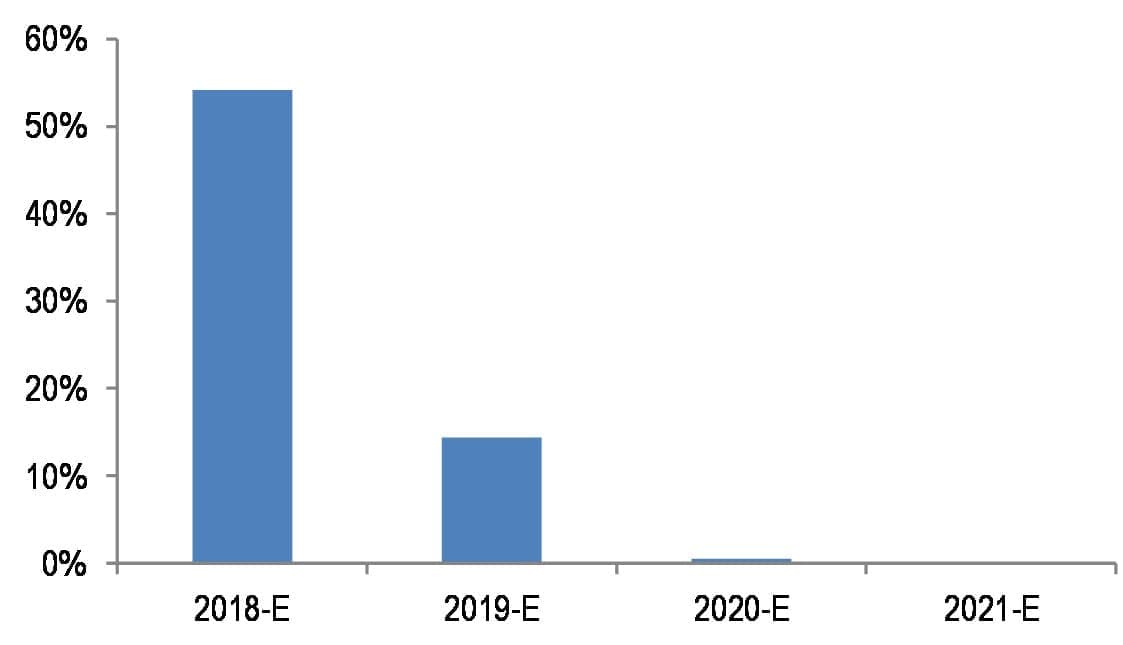

3. Shale hedges on higher prices

(Click to enlarge)

- The run up in oil prices this year compared to last have led U.S. shale drillers to secure a huge slice of their 2018 production under hedges.

- In the first quarter, shale companies put an additional 310,000 bpd of 2018 production under hedges, with WTI front month prices averaging $63 per barrel, which was up more than $7 per barrel from the fourth quarter of 2017.

- For the whole of 2018, an estimated 55 percent of production from large cap companies is hedged, while for small caps, the hedge ratio is 68.9 percent, according to JP Morgan.

- Overall, JP Morgan says, 70 percent of E&Ps have secured more than 50 percent of hedge protection for 2018. About 72 percent have begun 2019 hedges.

- The problem with this strategy, however, is that more volumes were hedged at WTI prices between $52-$55 per barrel than at $58-$62 per barrel.

- Producers are largely protected against a major downturn in prices, but they may also miss out on the upside of higher prices.

- The top 25 shale producers will lose $1.7 billion in foregone revenue because they are locked into hedges in the mid-$50s per barrel, according to Reuters, compared to if they sold oil at $70 per barrel.

4. Canadian oil-by-rail shipments spike

(Click to enlarge)

- The Permian is suffering from pipeline bottlenecks, but pipeline constraints have been a problem for a long time in Canada. The saga with the Trans Mountain Expansion is only the latest chapter in Alberta’s quest to build a major pipeline to get oil out of the province.

- The discount for Western Canada Select (WCS), which has often traded at a greater-than $20 per barrel discount to WTI, is cutting into profits for Canadian oil producers.

- Cenovus Energy (NYSE: CVE) cut production at its Christina Lake and Foster Creek projects because of reduced profits.

- In February, when the WCS discount ballooned to $30 per barrel, crude-by-rail shipments spiked.

- Rail companies are wary of building out capacity for oil producers, as they want long-term contracts that oil companies are loath to agree to.

- Still, with grain shipments set to clear off Canadian railways a bit, rail companies could begin loading more oil in the second half of 2018.

- That should help narrow the WCS-WTI discount.

Heard on the Street

Higher OPEC production isn’t a cure-all:

“However, even if the Iran/Venezuela supply gap is plugged, the market will be finely balanced next year, and vulnerable to prices rising higher in the event of further disruption. It is possible that the very small number of countries with spare capacity beyond what can be activated quickly will have to go the extra mile. ” – the International Energy Agency

Permian pipeline bottleneck creates “Haves” and “Have Nots”:

“Only up to half of…[the] production growth in the Permian is currently secured by firm transportation commitments. The rest could be exposed to significant local price differentials in 2018, pushing operators to explore alternative options of outbound crude disposition.” – Rystad Energy

The “Have Nots” will have to find alternatives:

“Most incremental production growth [in the Permian] during 2018-19 will need to be trucked or railed out of basin due to a lack of new pipelines. Producers are said to be paying $15/bbl to ship oil by truck from the Permian to the US Gulf Coast. However, this cost is not static. A shortage of truckers and trucks, coupled with accelerating 2H18 production, suggests that truck transport will get even tighter and become more expensive in the coming months, weighing on Midland pricing.” – Bank of America Merrill Lynch

(Click to enlarge)

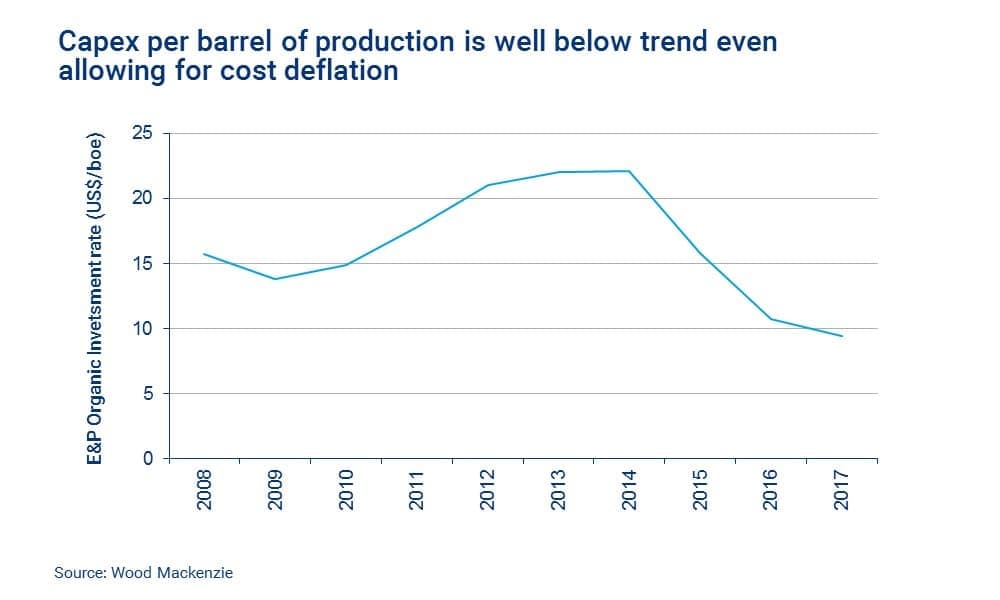

5. Shale industry keeping spending in check

(Click to enlarge)

- After dramatically cutting costs over the last few years, the oil industry is set to enjoy a windfall, particularly with prices significantly higher.

- Upstream cash margins are 65 percent higher today at $75 per barrel than they were at $112 per barrel back in 2012, according to Wood Mackenzie.

- Still, E&Ps are keeping spending low, which is what investors want. However, the industry is not investing enough to keep production sustained over the long run.

- The investment rate is just $9 per barrel of production, according to Wood Mackenzie, down from a peak of $22 per barrel in 2013.

- Of course, some of that decline is because the industry has succeeded in cutting costs, but WoodMac says only about 25 percent of the drop in investment is attributable to such improvement.

- WoodMac estimates E&Ps are spending a third less than is required to sustain production, “though there is no shame in shrinking if the alternative destroys value,” WoodMac said.

6. Permian natural gas prices sink

(Click to enlarge)

- Permian natural gas production is rising so quickly that drillers have too much of it on their hands. They are flaring some of it, but the rate of flaring is starting to approach the legal limits.

- Just as with oil, there is a dearth of gas pipeline capacity, leaving a glut of gas in West Texas.

- That has weighed on regional natural gas prices, with Waha Hub prices trading at a $1/MMBtu discount relative to Henry Hub. El Paso Permian Hub prices briefly hit $1.50/MMBtu below Henry hub.

- With Henry Hub below $3/MMBtu, Permian producers are basically trying to give away all the gas that they have. Permian gas futures for 2019 recently fell to just $1/MMBtu.

- However, because many of them are really targeting oil, and are simply producing gas as a byproduct, gas production won’t slow down unless oil output slows.

- The flip side is that if the rate of flaring starts to reach regulatory limits, producers might have to slow both oil and gas production.

(Click to enlarge)

7. Soaring Permian gas dragging down Marcellus drillers

(Click to enlarge)

- Permian natural gas production is rising quickly, keeping the country well supplied with gas.

- Gas-focused companies, such as those in the Marcellus shale, are not pleased. The WSJ notes that the average share price for the top five companies in the Permian are up more than 16 percent over the past year, while the top five producers in the Marcellus are down more than 9 percent.

- “It’s going to be tough for the Marcellus for a while,” Brian Lidsky, managing director research firm PLS Inc., told the WSJ. “There is just a tidal wave of gas coming out of the Permian.”

- Investors are asking Marcellus shale gas drillers to keep costs low and spending in check, a list that includes Cabot Oil & Gas (NYSE: COG), EQT (NYSE: EQT), Range Resources (NYSE: RRC), Antero Resources (NYSE: AR) and Southwestern Energy (NYSE: SWN).

- Only recently have Permian producers seen their share prices fall back, a situation that can be chalked up to price discounts and pipeline bottlenecks.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.