Friday August 2, 2019

1. Shale hit, offshore growing

- Employment is shrinking in the U.S. shale sector, but growing offshore.

- “This is a clear effect of the increase in offshore sanctioning. We expect offshore commitments to nearly double from 2018 to 2020, and sustain high levels of spending over the next five years,” says Matthew Fitzsimmons, vice president on Rystad Energy’s oilfield services team.

- Demand for offshore oil services will reach $442 billion by 2025, according to Rystad Energy, up 45 percent from 2018.

- Meanwhile, onshore North America is starting to see cuts. Halliburton (NYSE: HAL) recently cut 8 percent of its workforce. Whiting Petroleum (NYSE: WLL) slashed a third of its workforce this week and saw its stock price fall more than 35 percent on Thursday – although the loss was exacerbated by the U.S. decision to hike tariffs on China.

2. Trade war hits US soybean exports

- The U.S. agricultural sector has been hit hard by the trade war, which is now set to escalate by another round on September 1.

- Soybean exports from the U.S. have plunged since the trade war began in 2018, with Brazil taking market share. According to Standard Chartered, Brazil accounted for 80 percent of China’s soybean imports over the past 12 months.

- With market access cut off, American farmers put soybeans in storage, and inventories rose to a record high of 28.6 million tons in the 2018/19 season, according…

Friday August 2, 2019

1. Shale hit, offshore growing

- Employment is shrinking in the U.S. shale sector, but growing offshore.

- “This is a clear effect of the increase in offshore sanctioning. We expect offshore commitments to nearly double from 2018 to 2020, and sustain high levels of spending over the next five years,” says Matthew Fitzsimmons, vice president on Rystad Energy’s oilfield services team.

- Demand for offshore oil services will reach $442 billion by 2025, according to Rystad Energy, up 45 percent from 2018.

- Meanwhile, onshore North America is starting to see cuts. Halliburton (NYSE: HAL) recently cut 8 percent of its workforce. Whiting Petroleum (NYSE: WLL) slashed a third of its workforce this week and saw its stock price fall more than 35 percent on Thursday – although the loss was exacerbated by the U.S. decision to hike tariffs on China.

2. Trade war hits US soybean exports

- The U.S. agricultural sector has been hit hard by the trade war, which is now set to escalate by another round on September 1.

- Soybean exports from the U.S. have plunged since the trade war began in 2018, with Brazil taking market share. According to Standard Chartered, Brazil accounted for 80 percent of China’s soybean imports over the past 12 months.

- With market access cut off, American farmers put soybeans in storage, and inventories rose to a record high of 28.6 million tons in the 2018/19 season, according to Standard Chartered.

- To make matters worse, China has suffered through an outbreak of African swine flu, leading to “widespread culling of hog herds,” which led to a significant decline in soybean imports used for feed.

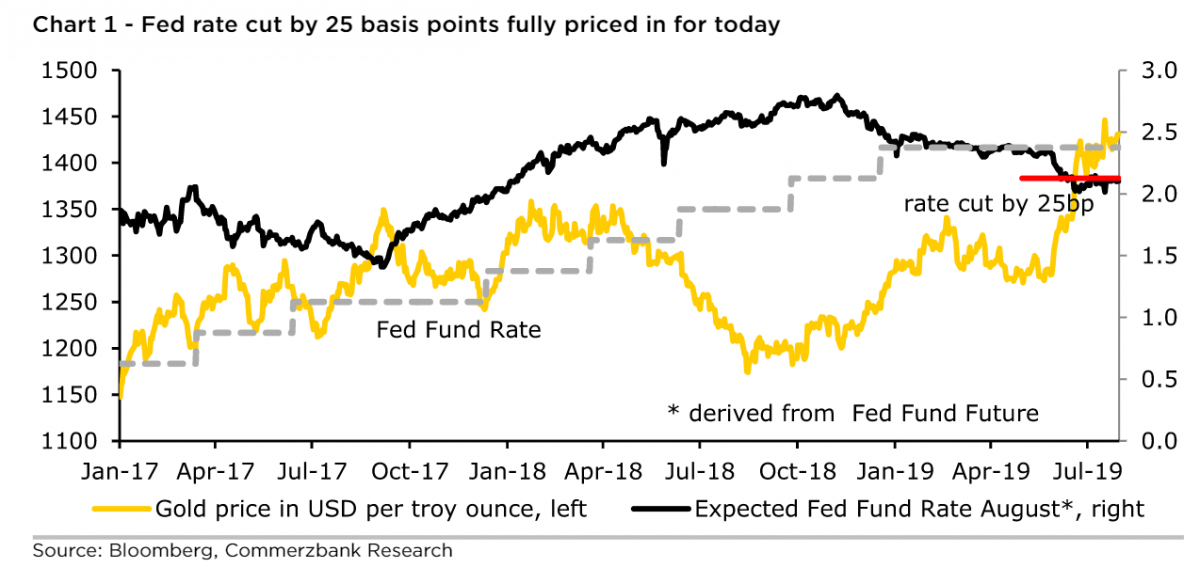

3. Fed cuts rates, disappoints gold. But trade war provides boost

- The Federal Reserve cut interest rates on Wednesday by 25 basis points, which was about what was expected. However, Fed Chairman Jerome Powell cautioned that it was not the beginning of a new dovish period for interest rates.

- The dollar rose, while equities and commodities declined. “Some rate cut expectations were also priced out and gold fell accordingly,” Commerzbank said in a note.

- However, on Thursday, gold jumped after President Trump announced new tariffs on China.

- Investors clearly flocked to gold as a safe haven asset, as concerns about the health of the global economy resurfaced.

4. Natural gas liquids market falls sharply

- Natural gas liquids (NGLs) have been a sweetener for oil producers over the past few years, adding a lucrative product to their streams. But more recently, NGL prices have crashed.

- “NGLs entered the year at seasonal highs versus WTI but have since disconnected and are pricing near record low levels due to domestic NGL demand and export growth failing to keep pace with NGL supply growth,” Bank of America Merrill Lynch said in a note.

- Lower NGL prices are exacerbating the poor returns on falling low natural gas price and relatively low crude prices.

- “To the extent possible, producers could shift plans to adjust for the NGL and natural gas price weakness going forward by reallocating capital to higher return basins with less exposure to NGLs and natural gas,” Bank of America suggested.

- The investment bank noted that basins with high NGLs (Niobrara, Utica, Oklahoma) have worse returns than those that have a bit more crude oil (Bakken and Delaware).

5. Falling lithium prices

- Lithium demand is slowing in China, while supply is on the rise, sending prices tumbling.

- Lithium prices tripled between 2015 and 2018, raising concerns about adequate supply because the EV revolution is still in its infancy.

- But the solution to high prices is high prices. A wave of new supply has come online. Six lithium mines have opened in Australia since 2017, according to Bloomberg.

- At the same time, vehicle sales have cooled in China. Lithium prices are down by 30 percent since last year.

- “The latest EV data did reveal slowing growth, inferring that on top of excess supply, demand is now a problem,” Macquarie Capital Ltd. wrote in a report this month. “The key interest for investors should be who is likely to survive.”

6. The $40 billion market for drones

- Drones can help slash costs across a variety of industries, with the potential of cost-savings on the order of $100 billion by 2024, according to a new report from Barclays.

- Drones offer an array of other advantages, from safety improvements to enhanced monitoring. For instance, oil companies can remotely inspect pipelines from far away using drones, rather than people. Telecom companies can inspect equipment in remote mountains with drones.

- The market for drones in these commercial applications could reach $40 billion by 2024, up from $2.2 billion in 2018. That’s 38% CAGR.

- Chinese tech company DJI is the frontrunner as a drone manufacturer, capturing 74 percent of the market.

7. Suez Canal grows in importance as transit point

- Oil and gas flows through the Suez Canal – and the SUMED pipeline that bypasses the canal – are up sharply over the past few years.

- Flows through both the canal and the SUMED pipeline constitute 9 percent of total seaborne traded oil and refined products in 2017, along with 8 percent of global LNG trade.

- Northbound flows, however, have slowed since 2016 as U.S. oil exports have displaced Middle East oil into Europe. OPEC producers have shifted their focus to Asia.

- Southbound flows have climbed significantly. “In particular, the Suez Canal is gaining importance as a southbound route for U.S. and Russian crude oil and petroleum products to destinations in Asia and the Middle East,” the EIA said in a report.