Friday February 9, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Big Oil’s big profits are back

(Click to enlarge)

- The oil majors posted some mixed results for the fourth quarter. ExxonMobil (NYSE: XOM) and Chevron (NYSE: CVX) badly missed expectations, reporting lower-than-expected profit as well as lower-than-expected production. That led to a selloff in their stock prices.

- Yet, the oil majors are earning nearly as much profits with Brent at $60 per barrel as they were when oil was trading at $100 per barrel.

- The savage cost cutting, layoffs, assets sales, and squeezing of oilfield service companies has helped the oil majors return to very profitable territory. They expect a continued upswing in earnings.

- Yet, analysts were disappointed this season, and investors are clamoring for more dividend hikes and share buybacks. Stock prices have taken a hit, although that has been made worse by the global financial upheaval.

2. Refining margins shrink

(Click to enlarge)

- The disappointing results from the oil majors – even as they posted large profits – came in part because of the downturn in refining margins.

- Integrated oil companies did much better than their smaller,…

Friday February 9, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Big Oil’s big profits are back

(Click to enlarge)

- The oil majors posted some mixed results for the fourth quarter. ExxonMobil (NYSE: XOM) and Chevron (NYSE: CVX) badly missed expectations, reporting lower-than-expected profit as well as lower-than-expected production. That led to a selloff in their stock prices.

- Yet, the oil majors are earning nearly as much profits with Brent at $60 per barrel as they were when oil was trading at $100 per barrel.

- The savage cost cutting, layoffs, assets sales, and squeezing of oilfield service companies has helped the oil majors return to very profitable territory. They expect a continued upswing in earnings.

- Yet, analysts were disappointed this season, and investors are clamoring for more dividend hikes and share buybacks. Stock prices have taken a hit, although that has been made worse by the global financial upheaval.

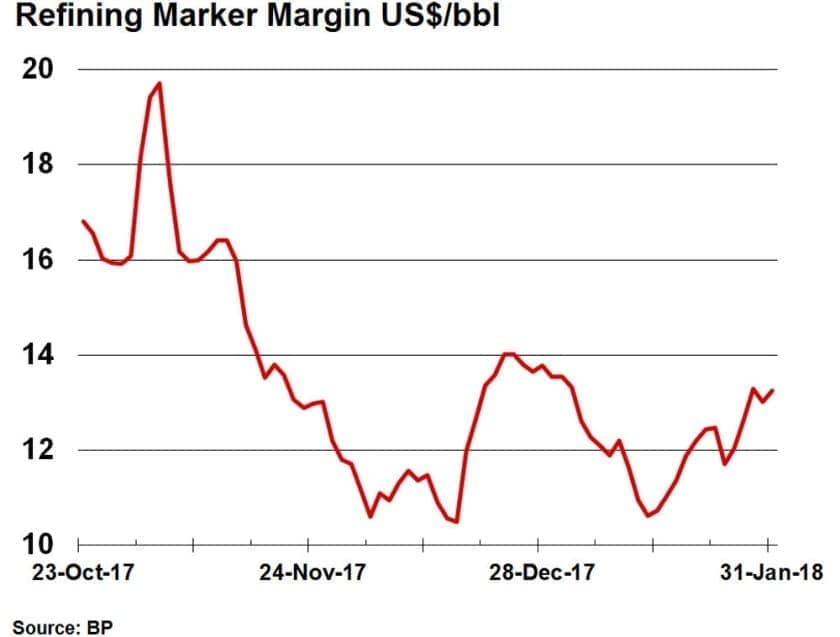

2. Refining margins shrink

(Click to enlarge)

- The disappointing results from the oil majors – even as they posted large profits – came in part because of the downturn in refining margins.

- Integrated oil companies did much better than their smaller, more upstream-focused shale brethren. When crude prices collapsed, demand rose, leading to large refining margins.

- That cushioned the blow of falling revenue from low oil prices. But with oil prices up sharply in the fourth quarter compared to the last few years, refining margins plummeted. Refiners had to buy more expensive oil, which cut into margins.

- According to BP, refining margins fell from $16.30 per barrel to $14.40 per barrel between the third and fourth quarter, falling further to just $12.10 per barrel in the first quarter of 2018.

3. Total SA hikes dividend

(Click to enlarge)

- Total SA (NYSE: TOT) reported strong results for the fourth quarter of 2017.

- The French oil company said that it would increase its dividend by 10 percent over the next three years, and it would also buyback $5 billion worth of shares.

- Total stands out among the rest of the oil majors. Some of its peers – Royal Dutch Shell (NYSE: RDS.A) and BP (NYSE: BP), for example – are doing share buybacks but not dividend hikes. Exxon (NYSE: XOM) and Chevron (NYSE: CVX) have increased their dividends but also posted disappointing earnings.

- Total is arguably performing better than the rest, and shareholders will benefit. “If the price is higher than $50, we want to be able to share part of the upside with our shareholders,” CEO Patrick Pouyanne said on a conference call on Thursday. “Given the production growth in our hands and the purchase of Maersk Oil, our cash flow per share will grow rapidly.”

4. Inventories falling back to “average”

(Click to enlarge)

- OECD oil inventories are falling pretty close the five-year average. Indeed, Goldman Sachs estimated recently that the market has probably already reached the rebalancing point.

- But the definition of the “five-year average” is a moving target. It has climbed sharply over the past two years, as the past five years is increasingly made up of a period of time in which the market was dealing with surplus. Thus, the “average” has risen.

- On the one hand, that makes the destocking process look less impressive. Stocks are still sharply higher than they were years ago. Barclays estimates that half of the reduction of the oil surplus since 2015 has been the result of the definition of the five-year average moving higher.

- The counter argument is that the oil market is much larger than it was compared to pre-2014. Demand is larger and storage capacity is larger. As a result, a higher “average” stock level is necessary.

5. Canada continues to add fresh supply

(Click to enlarge)

- The U.S. is breaking records with new shale supply, a sharp rebound after production tanked when oil prices fell.

- Output from Canadian oil sands, on the other hand, never slumped, even during the depths of the downturn. Production from oil sands is incredibly stable, even when prices crash. And because the industry continued to develop projects that were planned years ago, Canada has steadily added new supply right up to the present.

- Barclays estimates that Canada will add 200,000 bpd this year and next, one of the largest sources of non-OPEC supply growth after the U.S. and Brazil.

- The future is more uncertain. The last of the pre-2014 oil sands projects are now coming online, and there are few, if any, major oil sands projects in the pipeline. That could hinder growth.

- Yet, upgrading and retooling existing facilities could add new supply. And because production profiles are so stable, Canada could continue to see modest production increases for years to come.

6. Permian pipeline constraints

(Click to enlarge)

- Permian production is soaring and is expected to be the main contributor to U.S. supply growth this year. The EIA sees the U.S. hitting 11 mb/d by the end of 2018, a year earlier than expected.

- But the Permian could face some midstream bottlenecks, which could hurt Midland prices.

- The Midstream-Sealy pipeline, operated by Enterprise Product Partners LP (NYSE: EPD), and the Permian Express 3, developed by Energy Transfer Partners (NYSE: ETP), helped add takeaway capacity.

- However, rapidly expanding supply will mean that the region could hit another bottleneck by the end of this year.

- An estimated 3 mb/d of new pipeline capacity will come online in 2019-2021 timeframe, but until then, Midland prices could face steeper discounts relative to WTI.

7. China’s oil imports surge

(Click to enlarge)

- China added a bit of a jolt to oil demand recently, importing an average of 9.57 million barrels per day (mb/d) in January, an increase of 20 percent year-on-year and a record high.

- That is also up from just 7.94 mb/d in December.

- The Chinese government granted higher import quotas for 2018 and a Russian pipeline expansion came online, fueling much higher imports to start the year. Independent refiners are allowed to import 55 percent more oil than they were in 2017, according to Reuters.

- China’s demand is still rising (expected to increase by 400,000 bpd this year) while production is falling (expected to fall by 100,000 bpd), leading to a surge in imports.

- China surpassed the U.S. to become the largest oil importer on an annual basis in 2017, importing an average of 8.4 mb/d compared to the U.S.’ 7.9 mb/d.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.