Oil has now well and truly slumped into a bear market, producing one of the most impressive decline streaks in the past few years. This Friday marks the eleventh day in a row that oil has fallen, dropping more than 20 percent from the four-year high it attained just a couple of weeks ago.

(Click to enlarge)

At the end of the trading week, WTI traded at around 59-60 USD per barrel, while Brent slipped below 70 USD per barrel to reach a six-month low. Against such a depressive trend, OPEC, which is set to meet on Sunday in Abu Dhabi, has signaled its willingness to implement production cuts, only weeks after key OPEC players started pumping more.

1. US crude stocks increase for seventh week in a row

(Click to enlarge)

- US commercial crude stocks have increased for the seventh week in a row, this time by 5.8 MMbbl to reach 431.8 MMBbl.

- The current commercial stock level is still 26 MMbbl short of last year’s 457 million barrels.

- Hikes in PADD 2 and 3 were the main build factors, with buildups of 5 and 2 million barrels, respectively.

- In contrast to crude stocks, gasoline stocks have reversed course and increased by almost 2 million barrels after three weeks of declines.

- Standing at 228 MMbbl (almost 20 MMbbl higher than last year this time), the hike in gasoline stocks took place amid falling volumes of finished gasoline production, down by 650kbpd w-o-w.

2. Saudi Arabia Goes Flexible with December…

Oil has now well and truly slumped into a bear market, producing one of the most impressive decline streaks in the past few years. This Friday marks the eleventh day in a row that oil has fallen, dropping more than 20 percent from the four-year high it attained just a couple of weeks ago.

(Click to enlarge)

At the end of the trading week, WTI traded at around 59-60 USD per barrel, while Brent slipped below 70 USD per barrel to reach a six-month low. Against such a depressive trend, OPEC, which is set to meet on Sunday in Abu Dhabi, has signaled its willingness to implement production cuts, only weeks after key OPEC players started pumping more.

1. US crude stocks increase for seventh week in a row

(Click to enlarge)

- US commercial crude stocks have increased for the seventh week in a row, this time by 5.8 MMbbl to reach 431.8 MMBbl.

- The current commercial stock level is still 26 MMbbl short of last year’s 457 million barrels.

- Hikes in PADD 2 and 3 were the main build factors, with buildups of 5 and 2 million barrels, respectively.

- In contrast to crude stocks, gasoline stocks have reversed course and increased by almost 2 million barrels after three weeks of declines.

- Standing at 228 MMbbl (almost 20 MMbbl higher than last year this time), the hike in gasoline stocks took place amid falling volumes of finished gasoline production, down by 650kbpd w-o-w.

2. Saudi Arabia Goes Flexible with December OSPs

(Click to enlarge)

- Saudi Aramco has raised its December 2018 Asia-bound prices for Arab Heavy and Medium by 20 and 40 cents, respectively, whilst cutting Light premiums by 10 cents and Extra Light by 30 cents per barrel.

-This comes amid weaker spot demand for December cargoes and lower margins for gasoline and naphtha in Asia.

- The increase in Heavy and Medium prices reflects hefty fuel oil margins in Asia and Saudi Arabia’s confidence it will take over some of Iran’s missing volumes.

- Aramco hiked all prices destined for NW Europe by some 20-80 cents per barrel, whilst cut all light and medium prices for the Mediterranean (Arab Extra Light by a whopping 1.4 USD per barrel).

- Arabian grades have come under serious pressure amid the Med Urals spread falling last week to its lowest in the past three months, -1.6 per barrel.

- Prices for US customers have also been subject to steep hikes, all grades witnessed 1.3-1.4 USD per barrel increases as the Saudis prioritize Asia, where the Saudis now exports 5mbpd.

Note: USD/barrel, set vs ASCI FOB Ras Tanura.

3. Iran targets the Mediterranean with December OSPs

(Click to enlarge)

- NIOC, the Iranian national oil company, has cut all prices for December cargoes destined for the Mediterranean on a Kharg Island basis, setting sights on waiver-receiving Italy, Greece and Turkey.

- The Mediterranean prices on a FOB Sidi Kerir basis were dropped by a smaller, albeit still palpable amount of 20-30 cents per barrel.

- The premium for heavy sour Med-bound Soroush has plummeted from -7.30 against ICE Bwave this January to the current record price of -11.05 USD per barrel.

- On the other hand, NIOC has raised all prices for Northwest Europe by 50-60 cents per barrel, whilst committing to only minor premium cuts to its main market outlet, Asia.

-The Asia-bound Iranian Light premium to the Platts Oman/Dubai average was decreased by 10 cents to +1.3 USD per barrel, with Iranian Heavy witnessing a 20 cent per barrel cut to -0.55 USD per barrel. Iranian Light (ex Kharg Island) Aug 18 Sept 18 Oct 18 Nov 18 Dec 18 Differential to

4. ADNOC cuts retroactive premiums for October

(Click to enlarge)

- ADNOC has cut October premiums for its lighter sour grades Murban and Das by 19 and 24 cents per barrel, respectively, amid weak naphtha and gasoline margins in Asia Pacific.

- The October Murban official selling price was set at 82.30 USD per barrel, at a 2.91 USD per barrel premium to the Dubai benchmark.

- The Das OSP was set at 2.31 USD per barrel premium, at 81.70 USD per barrel.

- ADNOC’s OSPs are set retroactively, as opposed to the forward-looking price-setting of Saudi Aramco or NIOC, allowing for more pricing flexibility.

Official selling prices for Abu Dhabi crudes vs Dubai and Brent Weighted Average (USD per barrel).

5. SOMO clamps down on third-party sales of Basrah

(Click to enlarge)

- The Iraqi state oil marketer SOMO has started a campaign against third-party resales of its Basrah cargoes, in what can be perceived as a tightening of sales terms and conditions.

- Spot trading for Basrah cargoes has all but disappeared in the past weeks as relevant trading companies do not want to antagonize SOMO before it allocates 2019 volumes.

- If the tightening is more than just a cautionary signal, SOMO will most likely restrict term sales to companies possessing refineries and limiting the destination clauses to specific refinery-adjacent locations.

- Strict destination clauses are a norm with Saudi Aramco and Kuwait Petroleum, SOMO has historically had more liberal stance in its allocation decisions.

- Amid missing Iranian volumes, Basrah Light became one of the most interesting substitutes for European refineries, on top of traditional market outlets.

- However, SOMO is unlikely to seek a sudden tightening as it could substantially jeopardize its plans of expanding its market presence amid growing production.

- China and India are the largest markets for Basrah Light, accounting for 25 percent and 24 percent, respectively, with the United States coming third with 14 percent.

Monthly loadings of Basrah Light and Basrah Heavy (in million barrels).

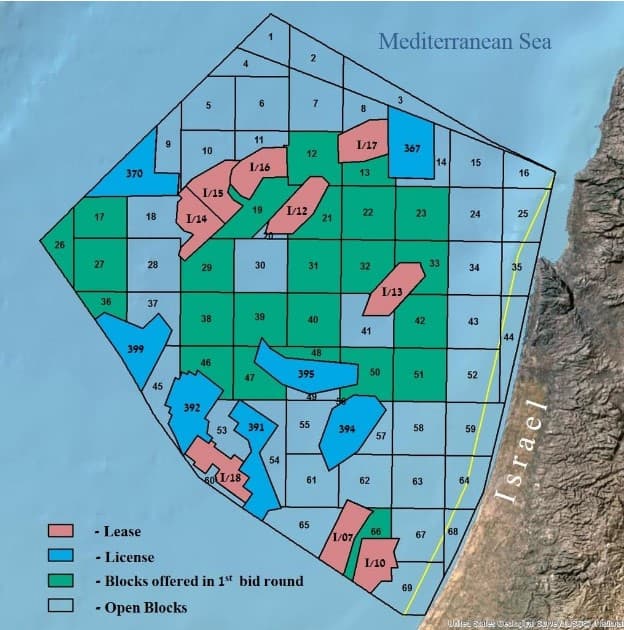

6. Israel Tries Its Offshore Luck Again

(Click to enlarge)

- Israel will offer 19 offshore blocks to energy companies in the country’s second offshore licensing round.

- Each of the blocks is roughly 400km2, all located in the southern offshore area of Israel.

- The exploration licenses will be issued for three years with a two-year prolongation option, one party may secure up to eight licenses.

- The 1st licensing round brought disappointing results as only 6 blocks were awarded out of the 24 offered (namely 12, 21, 22, 23, 31 and 32), moreover one company (Energean) took 5 out of 6 blocks.

- Israel hopes bidders will see new opportuinities in Israel after it signed supply contracts with Egypt and Jordan, but with Egypt becoming self-sufficient in gas this November-December, it might be a tough sell.

- Zone B with blocks 41, 42, 50 and 51 might be of some interest to bidders as it lies right next to Noble Energy’s 500 BCf Dalit discovery.

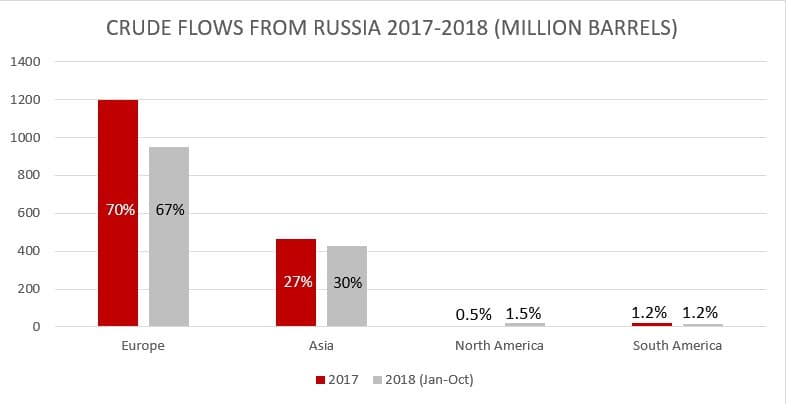

7. Russian Majors Intent on Replacing Dollars with Euro

(Click to enlarge)

- Ahead of the new 2019 supply season, Russian majors - most notably Rosneft, Gazprom Neft and Surgutneftegaz - have put forward a series of new contractual commitments from Buyers.

- These include the buyers’ responsibility to pay penalties in case additional US sanctions are levied against Russia, as well as their insistence on using euro instead of dollars for oil payments to make the transactions as sanctions-free as possible.

- Whilst the first demand is unrealistic and is very unlikely to make it into final term contracts, European tradinghouses seem to be ready to switch to euros.

Note: Includes CPC Blend volumes, the majority of which is produced in Kazakhstan.

Source: Oilprice Data.

- Europe, where a swath of refineries was built specifically to refine Russian crude, is the top destination for Russian oil, accounting for 67 percent of its total exports.