Friday January 5, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Capex slightly bottoming out

(Click to enlarge)

- Upstream capital and exploration expenditures among E&Ps is nearing a rebound, but the increase from 2016 lows are a drop in the bucket compared to how far spending has fallen from 2014 levels.

- Spending hit $900 billion in 2014, but had plunged by nearly half two years later. Rystad energy predicts that spending will bottom out this year at $510 billion, essentially flat since 2016 when spending dropped to $512 billion.

- North American spending saw the sharpest decline, but also saw a rebound in 2017 by 18 percent.

- North America will also see the largest growth going forward at 8 percent CAGR through 2025.

- The steep spending declines has translated to the lowest volume of new oil discovered in seven decades. At only 7 billion barrels of oil equivalent discovered in 2017, it was the worst total since the 1940s.

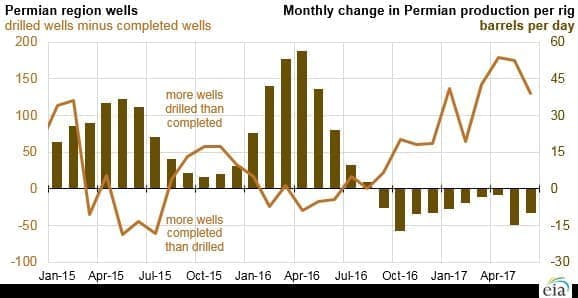

2. Permian production per-rig declining

(Click to enlarge)

- The amount of oil produced per rig in the Permian basin is declining, with 10 consecutive months in a row of falling production-per-rig. On its face, that appears to signal falling productivity.

-…

Friday January 5, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Capex slightly bottoming out

(Click to enlarge)

- Upstream capital and exploration expenditures among E&Ps is nearing a rebound, but the increase from 2016 lows are a drop in the bucket compared to how far spending has fallen from 2014 levels.

- Spending hit $900 billion in 2014, but had plunged by nearly half two years later. Rystad energy predicts that spending will bottom out this year at $510 billion, essentially flat since 2016 when spending dropped to $512 billion.

- North American spending saw the sharpest decline, but also saw a rebound in 2017 by 18 percent.

- North America will also see the largest growth going forward at 8 percent CAGR through 2025.

- The steep spending declines has translated to the lowest volume of new oil discovered in seven decades. At only 7 billion barrels of oil equivalent discovered in 2017, it was the worst total since the 1940s.

2. Permian production per-rig declining

(Click to enlarge)

- The amount of oil produced per rig in the Permian basin is declining, with 10 consecutive months in a row of falling production-per-rig. On its face, that appears to signal falling productivity.

- However, the declining output per rig is probably a result of oil companies drilling more wells than they are completing.

- That results in a rising backlog of drilled but uncompleted wells. The EIA notes that there isn’t a “clear cause” for why companies are not completing wells as fast as they are drilling them, but notes that a widening WTI-Midland discount relative to WTI-Cushing suggests there are “transportation constraints.” In other words, there isn’t enough pipeline capacity.

- Another factor to consider is a strategic decision to drill a bunch of wells from the same pad, only to deploy completion crews after all of the wells are drilled.

- The bottom line is that falling production-per-rig does not necessarily mean there are serious problems in the Permian or that absolute output is set to fall anytime soon.

3. How high can oil prices go?

(Click to enlarge)

- Oil prices jumped at the start of 2018 to fresh multi-year highs, as geopolitical tension related to Iran spooked the markets.

- And with 2018 supposed to be the year in which inventories come back to average levels, there are many reasons why there is upside potential. But how high can oil go?

- Bloomberg noted that the December 2018 $100 call is the most held Brent options contract – bets that payoff if oil gets that high.

- These are just bets though, and not forecasts of likely scenarios. But they highlight a growing belief among investors that the odds of an oil price spike are not as remote as conventional wisdom dictates.

4. Gulf debt rising

(Click to enlarge)

- Gulf Arab energy companies took on a record volume of debt this year to pay for expansions. Bloomberg notes that part of the motivation for the $28.7 billion in new debt was to take advantage of low interest rates.

- But the total was 15 percent more than the previous record set in 2015. Bloomberg finds that the companies surveyed took on $71.4 billion over the past three years, more than double the amount from the previous three-year period.

- Low oil prices, at least compared to the pre-2014 era, are sapping companies of revenues. “I think we will see more debt-raising by state energy companies in 2018,” Robin Mills, CEO of Dubai-based consultant Qamar Energy, told Bloomberg.

- Companies in Kuwait, Saudi Arabia and the UAE are expected to spend a massive $600 billion over the next five to 10 years.

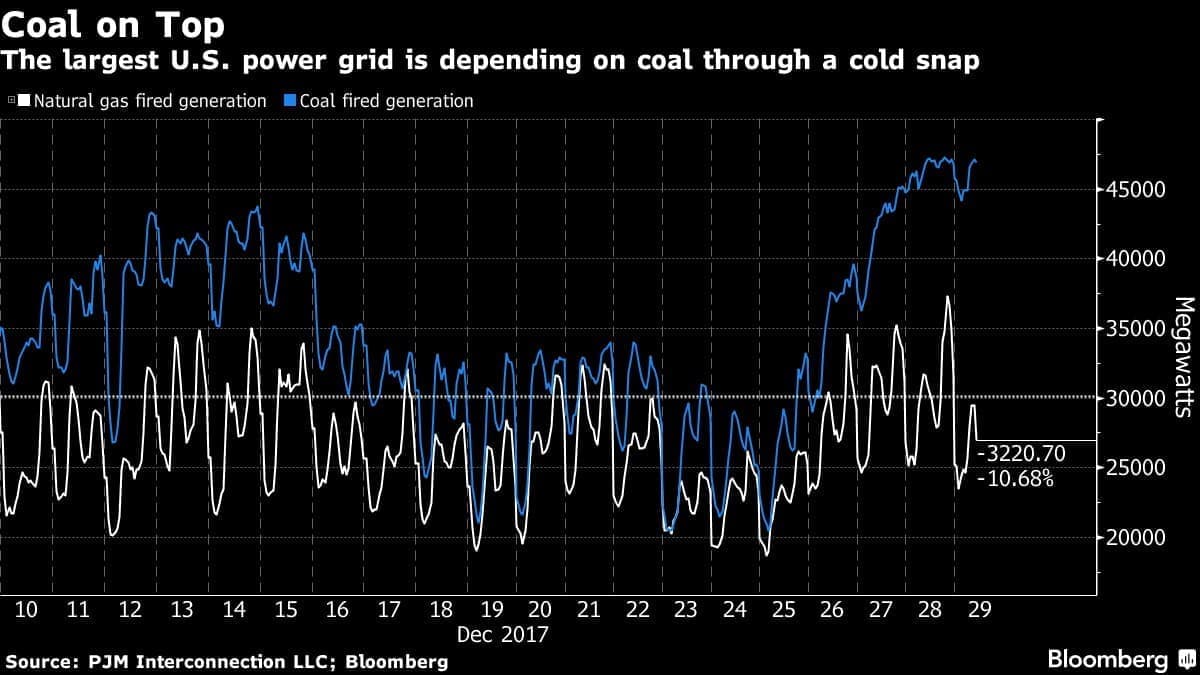

5. Coal receives boost from cold weather

(Click to enlarge)

- The “bomb cyclone” that is hitting the eastern half of the U.S. is putting a strain on natural gas and causing utilities to lean more on coal-fired power plants.

- Coal has reclaimed the top spot for electricity generation, although probably only temporarily. “Most likely gas prices are too high,” said Tai Liu, an analyst at Bloomberg New Energy Finance. At $18/MMBtu, he said, “I’d rather run my coal units if I can choose between the two.”

- Indeed, regional bottlenecks for natural gas, a perennial problem for New England, have resulted in spot natural gas prices in the northeast spiking to over $35/MMBtu.

- But weather is temporary and the structural problems for coal ensure its long-term decline.

6. Natural gas consumption hits all-time high

(Click to enlarge)

- The cold weather led to a record-breaking day for natural gas consumption. On January 1, the U.S. consumed 142 billion cubic feet of natural gas, eclipsing the previous record of 142 bcf set in 2014 during the polar vortex.

- Gas consumption is seasonal, with peaks in the winter for heating, followed by lows in spring and autumn.

- But both the peaks and valleys are getting higher – the result of a structural increase in gas demand from the ongoing coal-to-gas switch in the electricity sector.

- Nevertheless, the extreme cold across most of the eastern seaboard in the U.S. has led to a temporary spike in gas consumption.

- Nymex gas prices are slightly up, but still subdued at about $3/MMBtu. Inventories have declined below the five-year average, but with expectations of steady increases in gas production from prolific shale basins, gas traders are not losing their cool.

7. Future oil demand from petrochemicals

(Click to enlarge)

- The IEA estimates that petrochemicals will become the most important source of oil demand growth through 2040. Between 2016 and 2040, the IEA estimates oil demand in the petrochemical sector will grow by 6.2 million barrels per day (mb/d).

- That compares to road transport that only adds 3.3 mb/d (which is mostly from freight rather than passenger vehicles). Aviation and shipping is expected to add 4.7 mb/d.

- However, these numbers are not inevitable. Bloomberg notes that companies developing bioplastics developed from sugar cane, wood and corn will expand by 50 percent in the next five years.

- Bioplastics are still growing from a small base, accounting for just 1 percent of the plastics market.

- However, just as EVs make up a small share of the passenger vehicle market, and many analysts see EVs taking a large bite out of oil demand in the coming decades, the same might be true for plant-based plastics.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.