Oil and risk markets have been enjoying a lovely bounce over the last two weeks after a December which was, let’s say, suboptimal. Brent has jumped from $50 to $59 while WTI moved from $43 to $50. Equity and bond markets have also screamed higher following a month in which S&Ps came within a whisker of ‘bear market’ territory in a 19.8% selloff.

Is the bounce in oil and other risk assets for real? Or is this merely a trap on the road to further downside pain?

In our judgment the idea that the oil market has at least found some temporary footing is very much real and we see limited downside risk in the coming weeks. There are obviously risk factors to a bullish or even neutral market outlook for oil given global economic concerns, but it feels like risks are skewed to the upside at the moment. Why? Because central bank and geopolitical risk have temporarily shifted from viciously bearish for most of the last six months to a much more sanguine near-term outlook.

On the central bank front, the U.S. Fed and PBOC have both signaled in the last two weeks that they will work to provide a soft landing for their respective economies should policymakers continue to pursue economically negative trade practices. In the U.S., Fed chief Jerome Powell’s comments that the Fed may have to reconsider shrinking its balance sheet if economic conditions tighten were an extremely potent bullish jolt for oil. This marked an incredible shift in tone from the chairman from hawkish…

Oil and risk markets have been enjoying a lovely bounce over the last two weeks after a December which was, let’s say, suboptimal. Brent has jumped from $50 to $59 while WTI moved from $43 to $50. Equity and bond markets have also screamed higher following a month in which S&Ps came within a whisker of ‘bear market’ territory in a 19.8% selloff.

Is the bounce in oil and other risk assets for real? Or is this merely a trap on the road to further downside pain?

In our judgment the idea that the oil market has at least found some temporary footing is very much real and we see limited downside risk in the coming weeks. There are obviously risk factors to a bullish or even neutral market outlook for oil given global economic concerns, but it feels like risks are skewed to the upside at the moment. Why? Because central bank and geopolitical risk have temporarily shifted from viciously bearish for most of the last six months to a much more sanguine near-term outlook.

On the central bank front, the U.S. Fed and PBOC have both signaled in the last two weeks that they will work to provide a soft landing for their respective economies should policymakers continue to pursue economically negative trade practices. In the U.S., Fed chief Jerome Powell’s comments that the Fed may have to reconsider shrinking its balance sheet if economic conditions tighten were an extremely potent bullish jolt for oil. This marked an incredible shift in tone from the chairman from hawkish to dovish especially when paired with his comments during the same outing that the bank will reconsider further rate hikes in 2019 should data worsen. In this author’s mind, the market impact of the Fed shrinking its balance sheet by more than $390b in 2018 was unquestionably the primary catalyst for stock market weakness and USD strength. A more accommodating Fed will certainly brighten the outlook across risk assets and add the bonus of a weaker U.S. Dollar. Overseas, the People’s Bank of China also gave risk markets a lift this week by cutting the reserve ratio required of Chinese banks in an important signal that the PBOC will work to soften the blow of recent trade arguments.

The second front where we think risks have shifted from negative to positive is on the geopolitical front. With respect to U.S./China relations, we believe it’s likely that President Trump pushes for a truce (which he can call a victory) in his trade war as the 2020 campaign begins. Trump will not want to campaign in a recessionary environment and will certainly realize that his trade war may have to be set on ice if he wants to have an economy worth bragging about. The even larger geopolitical risk is the increased will of Saudi Arabia to balance the oil market and return to a $60-$70 price environment. We’ve been struck by the initial round of shipment data from the Kingdom which revealed drastically lower exports (particularly to the U.S.) and believe this current round of OPEC+ cuts will certainly have teeth. Lastly on the geopolitical front is the risk of decreased supplies from Iran, Venezuela, Libya and Nigeria where exports could be jeopardized for a variety of reasons in 2019.

Are oil bulls in the clear? Are we headed back to $75 oil? Most likely not. Bearish risks remain in the market including the constant headlines on slowing global growth and a continue tsunami of oil from U.S. shale producers. Physical balances will need to change dramatically in the coming months in order to meaningful upside risk in the near term and we’ll obviously monitor that. In the near term, however, with central bankers and OPEC+ pushing crude higher while Trump and Xi increasingly need to come to some sort of truce for their own political benefit, we think it’s reasonable to expect that the bottom will not fall out of the market.

Quick Hits

- Oil prices continued to rebound steadily this week with WTI moving to $50 while Brent traded north of $59. In terms of technical analysis we’re interpreting crude oil prices as neutral. Both grades remain substantially below their 50 and 200 day moving averages and relative strength indicators on a 14-day basis suggest markets are basically fair-valued.

- By midweek crude oil had achieved its best rally in 17-months and has been the beneficiary of a major move higher across risk assets. Equities, high yield bonds and gold have all rallied substantially on hopes that the U.S. Fed has turned from disciplinary to accommodative.

- Time spreads suggest that oil fundamentals have stopped reeling but remain puffy as measured by prompt 1-month contract / 6-month contract differentials. For U.S. crude, the spread is currently trading 35 cents per month of contango suggesting that much of Texas and the midcontinent remains oversupplied. In Brent the same time spread is offering 15 cents per month of contango suggesting that European and Asian markets are more tightly supplied than the U.S. In both cases we think it’s important to note that neither spread is really rallying opposite strong moves higher in flat price, suggesting physical traders have yet to see evidence of a significant tightening for fundamentals over the last two weeks.

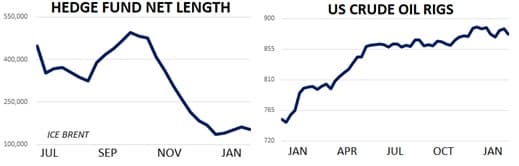

- Hedge funds have remained neutral on ICE Brent futures and options over the last four weeks holding a net long position of 152k contracts- lower by 70% since October.

- The U.S. crude oil rig count fell to 877 this week as producers have obviously began to tighten their belts opposite lower prices. Nevertheless, the rig count is higher by about 17% over the last twelve months as U.S. producers continue to pump at breakneck speed.

- Away from the oil patch markets were highlighted by massive rallies in equities this week. The S&P 500 bounced to 2,580 this week for an 11% rally off of their Christmas Eve low. The Eurostoxx 50 also rallied 4% off of its recent low mark while the Shanghai Composite has bounced 4%.

- In currency markets the U.S. Dollar has eased substantially following dovish comments made by the U.S. Fed chief last week. The US 10yr moved from 2.55% to 2.70% this week as investors sold bonds and moved into riskier equities.

DOE WRAP UP

- U.S. crude stocks were essentially flat last week ending the year near 441m bbls. Overall crude stocks are higher y/y by about 4%.

- U.S. producers continue to pump at warp speed and upped their recent record to produce 11.7m bpd last week. For context, this represents 1.05m bpd more than Saudi Arabia pumped in December.

- As for trading flows, the U.S. exported 2.2m bpd of crude last week which is slightly higher than its 6-month average of 2.1m bpd. Imports came in at 7.4m bpd which was lower than their 6-month average at 7.7m bpd.

- On the bearish side, oil continues to pile up in the Cushing, OK delivery hub. Cushing stocks added more than 600k bbls last week jumping to 41.9m bbls nearly doubling in the last four months.

- U.S. refiners showed strong demand last week processing 17.8m bpd on a w/w jump of 400k bpd. Overall refiner runs have improved by 2% y/y over the last three week period. Refiner demand increased by an average of more than 365k y/y in 2018 for an improvement of about 2%.

- U.S. gasoline stocks skyrocketed last week moving higher by nearly 7m bbls to 240m bbls. Overall gasoline stocks are higher y/y by about 3% and higher by 3% in the Mid Atlantic which includes the NY Harbor delivery hub.

- U.S. gasoline demand + exports had a tepid end to a tepid year. Overall demand averaged 10.1m bpd in 2018 for an improvement of just 0.6% v. 2017.

- U.S. distillates also jumped higher w/w by more than 8m bbls. Overall distillate fuel stocks are lower y/y by 8%.