Friday February 23, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. China buys up U.S. oil

(Click to enlarge)

- U.S. oil exports jumped last year, and China represented one of the largest buyers.

- The Middle East has traditionally been a big supplier of crude to China, but China is increasingly turning to North American cargoes.

- However, WTI recently jumped above the Dubai benchmark, as demand for U.S. oil pushed up WTI. That could put a cap on the volume of oil moving from the Gulf Coast to Asia.

- “At current levels, the strength in WTI relative to Dubai prices doesn’t justify arbitrage flows of U.S. crude into Asia,” Nevyn Nah, an analyst at industry consultant Energy Aspects Ltd., told Bloomberg.

2. OECD stocks close to 5-year average

(Click to enlarge)

- OECD stocks now sit just about 52 million barrels above the five-year average, down from 264 million barrels a year ago.

- Refined product stocks are likely below the five-year average, led by soaring diesel demand over the past year.

- The objective for OPEC to eliminate the inventory surplus “might be close to hand,” the IEA said last week.

- Still, OPEC signaled an intention to keep the cuts in place, erring on the…

Friday February 23, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. China buys up U.S. oil

(Click to enlarge)

- U.S. oil exports jumped last year, and China represented one of the largest buyers.

- The Middle East has traditionally been a big supplier of crude to China, but China is increasingly turning to North American cargoes.

- However, WTI recently jumped above the Dubai benchmark, as demand for U.S. oil pushed up WTI. That could put a cap on the volume of oil moving from the Gulf Coast to Asia.

- “At current levels, the strength in WTI relative to Dubai prices doesn’t justify arbitrage flows of U.S. crude into Asia,” Nevyn Nah, an analyst at industry consultant Energy Aspects Ltd., told Bloomberg.

2. OECD stocks close to 5-year average

(Click to enlarge)

- OECD stocks now sit just about 52 million barrels above the five-year average, down from 264 million barrels a year ago.

- Refined product stocks are likely below the five-year average, led by soaring diesel demand over the past year.

- The objective for OPEC to eliminate the inventory surplus “might be close to hand,” the IEA said last week.

- Still, OPEC signaled an intention to keep the cuts in place, erring on the side of overtightening the market. Saudi Arabia wants oil futures to be trading near $70 per barrel, according to Reuters, and as such, they will press to keep the cuts in place to drive up prices.

- That means that inventories should dip below the five-year average in the second half of the year.

3. BP sees peak oil demand

(Click to enlarge)

- In BP’s (NYSE: BP) annual Energy Outlook, the oil major forecasts a peak in oil demand in the mid-2030s. Still, oil demand for passenger vehicles rises and then falls, meaning it will end up being about the same in 2040 as it is today.

- Overall oil demand will be about 110 million barrels per day in 2035, or about 15 mb/d above 2015 levels.

- BP sees 180 million EVs on the roads in 2035 and over 300 million by 2040. It expects about a third of all miles driven in 2040 will come from EVs.

- The forecast is notable since such a prominent oil company sees a peak for the industry.

- But it also is not a dire one. BP’s chief economist noted that even in the most aggressive scenario, in which EVs take a 10 mb/d-bite out of oil demand, consumption still rises from current levels until the mid-2030s.

4. Ethane consumption surging

(Click to enlarge)

- The EIA predicts that ethane consumption in the petrochemical industry “will exceed increases in consumption of all other petroleum and liquid products—such as motor gasoline, distillate, and jet fuel—combined.”

- Ethane is separate out from natural gas at processing plants, along with other natural gas liquids, such as propane, butane, isobutene, and natural gasoline. Ethane is used to produce ethylene, which is a building block of plastics.

- The wave of shale gas production has sparked enormous investments in ethylene crackers. Three crackers were constructed in the U.S. in 2017, adding 210,000 bpd of capacity.

- Another six crackers could be completed by 2019, adding another 380,000 bpd.

- Exports of ethane are also expected to rise, jumping from 180,000 bpd in 2017 to 290,000 bpd in 2018 and 310,000 bpd in 2019.

5. Investors pull money from Canadian oil sector

(Click to enlarge)

- The plunge in the price of Western Canada Select – which tracks heavy oil from Canada – over the past few months has weighed on Canada’s oil industry.

- So far this year, investors have withdrawn about $56 million from the iShares S&P/TSX Capped Energy Index ETF, an ETF that tracks Canadian energy companies. At the same time, an estimated $32 million has gone into ETFs focused on U.S. stocks, according to Bloomberg.

- WCS prices continued to trade at a roughly $30-per-barrel discount to WTI, dealing a huge blow to Canadian oil producers.

- According to Scotiabank, the pronounce discount will linger until the end of 2019, when the startup of Enbridge’s (NYSE: ENB) Line 3 replacement is expected to be finished. However, the construction of TransCanada’s (NYSE: TRP) Keystone XL or Kinder Morgan’s (NYSE: KMI) Trans Mountain Expansion might be necessary to bring the WCS discount back to normal levels, Scotiabank says. But that might not be until 2020 at least.

- Scotiabank estimates that if the WCS discount lingers at current levels, it could “shave C$15.6 billion in revenue annually from the sector.”

6. Energy costs as percentage of personal expenditure keeps falling

(Click to enlarge)

- The average U.S. consumer spent less than 4 percent of total expenditures on energy, according to Bloomberg New Energy Finance, a share that is down by half since the 1980s, and down from about 7 percent from as recently as a decade ago.

- There are a variety of reasons for this. Demand is flat while everything from cars to household appliances has increasingly become more efficient.

- At the same time, surging production of natural gas and oil are lowering overall costs. The shale gas revolution has lowered electricity costs while the boom in shale oil has lowered the price of gasoline.

- Plus, the rapid increase in renewable energy is also providing options and suppressing energy prices.

- In the decade of the 2000s, primary energy consumption actually fell while GDP jumped by 18 percent.

- Americans are spending less on energy as a share of their household expenditures than ever before.

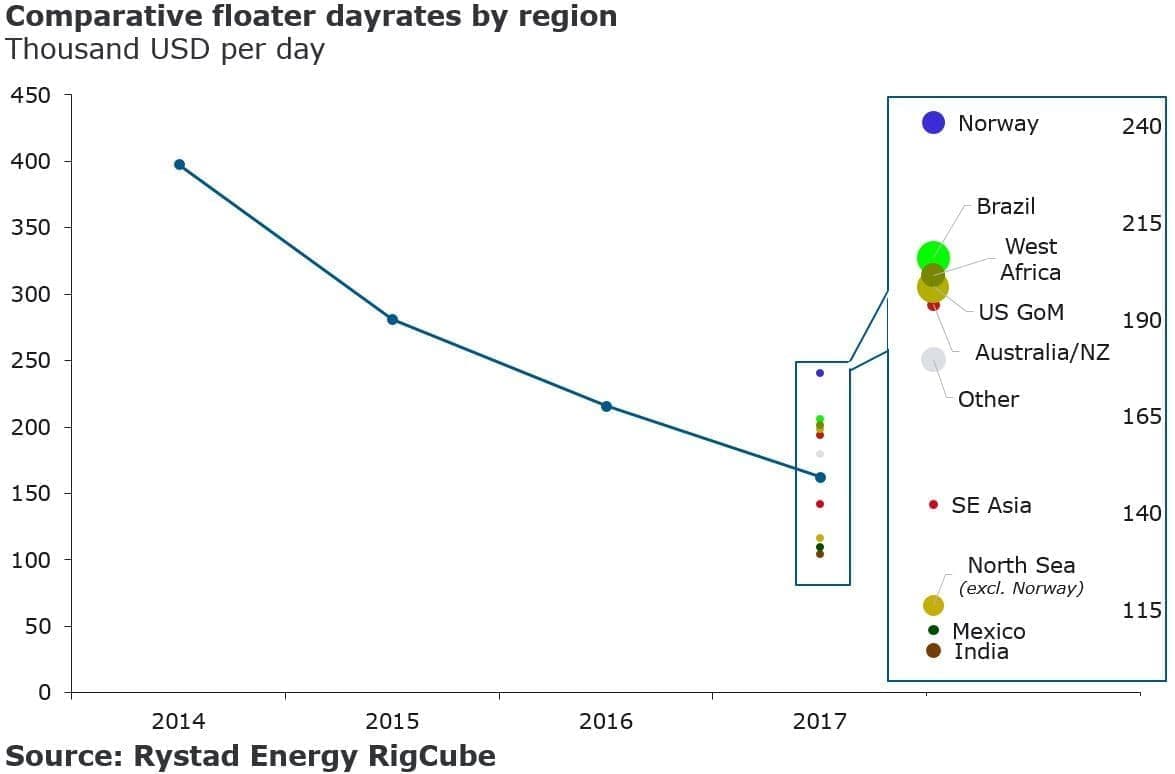

7. Norway best offshore market for rigs

(Click to enlarge)

- Offshore drilling collapsed in the 2014-2016 period, with record low levels of new offshore oil projects receiving final investment decisions. That decimated work for oilfield service companies.

- Interest in offshore oil drilling is finally picking up, due to lower breakeven prices and an uptick in oil prices.

- Norway is now offering the best rates for floating rigs in the world, due to both strong demand and comparatively high day rates, according to Rystad Energy.

- “North Atlantic Drilling Limited’s semisub West Hercules, for instance, was chartered by Statoil recently for a pair of wells in the Barents Sea at a reported rate of USD 250,000 per day,” Rystad wrote in a new report.

- The service companies that have benefited from the activity in Norway are TechnipFMC (NYSE: FTI), Transocean (NYSE: RIG) and Subsea 7 (OTC: SUBCY).

- Norway led the world in new offshore spending last year, followed by the U.S. and Mozambique.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.