1. U.S. shale grows even with lower prices

- OPEC+’s task in Vienna was complicated by the fact that the projections for U.S. shale growth are all over the map.

- The latest projection from Rystad Energy finds that U.S. shale will grow “even in an environment with lower prices.”

- The Norwegian consultancy said that the oil market would see a substantial build in inventories in 2020 without deeper OPEC+ cuts.

- Rystad notes that despite the significant decline in the U.S. rig count, the pace of spudded wells has not fallen dramatically.

- Still, spending has fallen by 6 percent in 2019 and is expected to decline by another 11 percent in 2020.

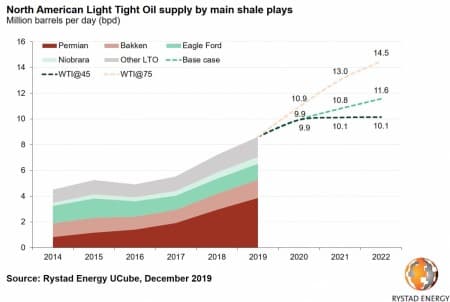

- Rystad’s base case is U.S. light tight oil production grows to 11.6 mb/d by 2022, implying a CAGR of 10 percent each year between 2019 and 2022.

- But output comes to a standstill at 10.1 mb/d over that timeframe in a $45-per-barrel scenario, a mostly flat production trajectory.

2. Simple refineries not making money as IMO deadline approaches

- The IMO rules tightening up sulfur limits in marine fuels takes effect next month. Sudden changes in prices and differentials in refined product markets suggests that the refining industry is starting to make the switchover.

- Simple refiners that have limited ability to adapt could struggle. “A combination of rising compliance rates and run cuts from simple refiners could drive higher diesel cracks over the next 2 to 3…

1. U.S. shale grows even with lower prices

- OPEC+’s task in Vienna was complicated by the fact that the projections for U.S. shale growth are all over the map.

- The latest projection from Rystad Energy finds that U.S. shale will grow “even in an environment with lower prices.”

- The Norwegian consultancy said that the oil market would see a substantial build in inventories in 2020 without deeper OPEC+ cuts.

- Rystad notes that despite the significant decline in the U.S. rig count, the pace of spudded wells has not fallen dramatically.

- Still, spending has fallen by 6 percent in 2019 and is expected to decline by another 11 percent in 2020.

- Rystad’s base case is U.S. light tight oil production grows to 11.6 mb/d by 2022, implying a CAGR of 10 percent each year between 2019 and 2022.

- But output comes to a standstill at 10.1 mb/d over that timeframe in a $45-per-barrel scenario, a mostly flat production trajectory.

2. Simple refineries not making money as IMO deadline approaches

- The IMO rules tightening up sulfur limits in marine fuels takes effect next month. Sudden changes in prices and differentials in refined product markets suggests that the refining industry is starting to make the switchover.

- Simple refiners that have limited ability to adapt could struggle. “A combination of rising compliance rates and run cuts from simple refiners could drive higher diesel cracks over the next 2 to 3 months, in our view,” Goldman Sachs said in a note.

- Refiners with high complexity will fare much better. These companies have facilities that can adapt the fuel mix to comply with the IMO rules.

- Goldman recommended Buy ratings for refiners that have “high clean product exposure,” including Marathon Petroleum (NYSE: MPC), Phillips 66 (NYSE: PSX), Valero (NYSE: VLO) and Par Pacific Holdings (NYSE: PARR).

- The bank put out Sell ratings for HollyFrontier (NYSE: HFC) and Delek US Holdings (NYSE: DK), among others.

3. Eagle Ford improves finances as growth moderates, but for how long?

- Overall output in the Eagle Ford is down 20 percent from its peak in 2015.

- Of the Eagle Ford’s more than 17,000 wells, roughly 60 percent of them are now producing less than 25 barrels per day. As a result, new drilling simply keeps production from declining.

- However, according to IHS Markit, the Eagle Ford finally became cash flow positive in 2019 as companies held back on drilling.

- This offers a lesson – moderating growth could finally make shale profitable.

- But that period of profitability could be fleeting as production declines. “Generating free cash is easy: stop spending on new wells,” Raoul LeBlanc of IHS Markit told Bloomberg. “The catch is that production will immediately move into steep decline in many cases.”

4. China’s copper demand remains strong

- China’s copper concentrate imports year-to-date stand at 17.9 million tonnes (Mt), up 8 percent year-on-year.

- “We expect demand for copper concentrate to remain robust given the increase in domestic smelting and refining activity and because of new projects coming online,” Standard Chartered wrote in a note.

- However, copper scrap imports are down 49 percent year-to-date.

- After a run up in prices earlier this year, copper has fallen back. Much hinges on the outcome of the U.S.-China trade war.

5. Non-OPEC production surging

- OPEC+ has helped erase an inventory overhang, but the challenge of balancing the market continues as non-OPEC supply is expected to continue to grow.

- In fact, non-OPEC output growth could hit a record high in 2020, adding around 2.26 mb/d, according to Rystad Energy. In the past few years, it has been U.S. shale adding huge volumes, but the U.S. will be joined by Brazil, Norway and Canada next year.

- “The record high production growth from non-OPEC tight oil and offshore puts significant pressure on OPEC’s ability to balance the oil market in 2020.”

- The U.S. could add 1.35 mb/d, while offshore projects could add 1.25 mb/d.

- Norway is expected to add 527,000 bpd, largely the result of the John Sverdrup startup. Brazil will add 459,000 bpd and Canada will add 244,000 bpd.

6. Soybean prices fall to 3-month low

- Soybean prices fell to a three-month low this week at 870 US cents per bushel.

- “This is due to growing skepticism among market participants that a provisional trade deal will be agreed anytime soon between the US and China,” Commerzbank wrote in a note.

- Market sentiment bounced up and down this week, jolted in each direction seemingly by the hour. But President Trump’s announcement of new steel tariffs on Brazil and Argentina soured the mood.

- “If Trump fears competition on the agricultural markets, especially from Brazil, he has good reason to: after all, Brazil has meanwhile superseded the US as the world’s largest soybean exporter, and to a significant extent,” Commerzbank said.

- Of course, Trump’s trade war has weakened the U.S. position vis-à-vis exporting to China.

- Meanwhile, Reuters projects that the soybean crop in Brazil could hit a record high 123 million tons, with the U.S. crop standing at 97 million tons.

7. Canadian oil shipments fell on rail strike

- A week-long rail strike by CN Rail workers in Canada disrupted exports of a range of commodities, including agricultural goods, cars, chemicals and crude oil.

- The strike ended, but could cause lingering effects for a month or so, according to Scotiabank.

- “The backlog of cargo not shipped over the past week will be difficult to clear with little in the way of spare capacity in the system, which means more inventory that producers will be challenged to sell later if ever,” Scotiabank said in a Nov. 27 note.

- CN Rail had exported 180,000 bpd of oil prior to the strike.

- “Oil-by-rail capacity won’t resume at prior levels as operations would on a temporarily-idled pipeline and producers of many commodities will be vying for space on the track to make up for time lost over the past week,” Scotiabank said.