I have established a reputation as a bit of a contrarian in certain areas of the energy market. I have been tough on pipeline companies in particular. Pipelines have attributes that simply can’t be mitigated. Among them the fact, that they must cross long distances to deliver their products, and pass native populations that are against their construction for reasons of their own. They are also hostage to the political whims of local, state, and federal leaders who typically rail against them being built. That adds up to a negative impact that has restrained shares of pipeline operators, even as the general energy market has rallied this quarter. For example, in my last OilPrice article, I called into question whether Energy Transfer, (NYSE: ET) was a colossus ready to cast off its chains and revert to its glory days? Or did it have farther to fall as a result of an adverse court decision, and more importantly to some, was its lofty ~20% distribution in jeopardy? ET is currently mired in travails over the aptly named, Dakota Access Pipeline. The market has largely discounted an adverse outcome for the company as ET’s stock remains under pressure while the continued operation of the DAPL is litigated.

So having established my creds as a pipeline doubter with broader concerns that I documented in an OilPrice article last winter about the gas market in particular, when I saw what Warren Buffett had done, my immediate reaction was...He's finally lost it!

If you haven’t been following closely, last week Warren Buffett made a move no one anticipated by forking over $10 bn for Dominion Energy’s natural gas assets. In this article we will move a little beyond the headlines and postulate what this move, by one of America’s cagiest investors might hold in store for both the pipeline and gas markets.

Warren buys Dominion's Gas assets

It was an odd timing given that on that very same day the company involved, Dominion Energy, (NYSE:D) canceled a gas pipeline with another utility player, Duke Energy, (NYSE:DUK). Perhaps they were just tired of buying their lawyers new Tesla’s, all the time. This project had been embroiled in controversy for years. And, just as it looked like they might be winning with a favorable ruling from the Supreme Court on June, 15th, they cancelled it, unemploying a raft of legal talent in the process one presumes.

Related: Is Nuclear Energy Making A Pandemic Comeback?

It turned out to be a busy day in the pipeline business as that same day, the deal with Buffett was announced. In a nearly US$10-billion deal, Dominion Energy with its sights set squarely on its goal of achieving zero-carbon electric generation by 2050, said it would be selling substantially all of its gas transmission and storage assets to an affiliate of Berkshire Hathaway.

So...what was Warren thinking?

This could be viewed as a contrarian play. The environmental lobby is pushing utilities to move away from gas, using a strategy after the success they've had pushing U.S.coal over to China, which incidentally has been building coal-fired plants, at a rapid rate. A Bloomberg article recently noted that rather than going after oil companies, the pipelines present a softer target.

“The keep-it-in-the-ground movement has increasingly turned its attention to the pipes, rather than the wells themselves, because they require various federal and state permits, which, for the most part, can be more easily litigated.”

This move makes it seem that Buffett is looking past all the noise in the market currently, and is just doing what he does better than anyone else. Buying good assets cheaply in a down cycle and waiting for the market to realize their true value. He appears unfazed by the current horrifically bad prices for gas. Does that tell us anything?

It may be a bet on the unrealized value that installed pipelines have now. It is much harder to litigate a thing once it’s built and providing services to people, an exception perhaps being the oft-litigated DAPL. A look at the financial statements for pipeline companies like ET reveal $10’s of billions of dollars of debt used to build these lines. Debt that must be repaid whether a line is put into service, or not.

If the market for gas does grow as we discuss in the next section, owning a transmission line could be a pathway to enhance profits in a few years.

Does Warren think the underlying commodity is underpriced?

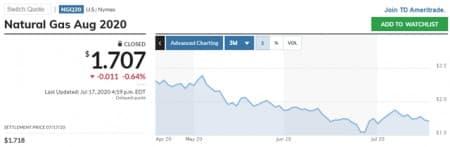

The price of natty-natural gas is just awful right now. It's supposed to be getting better, but the gas market appears not to have gotten the memo on this plan.

Warren's bet on Natty comes at near-25 year lows for this commodity with lows coming at a time when pricing should be ramping. The general idea going into spring was that the shale production that was shut-in would take a lot of associated gas off the market. It sounded good and for a time the gas driller’s stock prices ramped in anticipation, but it just hasn’t worked out so far.

Related: Is This The World’s Riskiest Oil Frontier?

Another supposition is that cheap gas will displace dirty old coal, most of which is now going to third world international markets. Last year the EIA estimated that in 2019, Natty supplied 38% of utility generating needs. Wind and Solar will take some of that market to be sure, as the Dominion move toward zero carbon in 2050 suggests, but Warren must be thinking that gas will dominate for years to come, the Greenies manipulations not-withstanding. Warren was heard to comment on this deal.

"We are very proud to be adding such a great portfolio of natural gas assets to our already strong energy business."

Your takeaway

This move by Buffett probably puts a floor on equivalent assets in companies we have discussed. This is a strong statement by one of the cagiest and most successful investors of all time.

The difficulties posed by regulatory and environmental groups in recent years to block or slow to crawl the development of key pipeline infrastructure projects, like ET's Dakota Access Pipeline, the closure of which could lead to stranded assets in the Bakken, as the chart below suggests. Or their success in delaying Keystone pipeline from Canada, which probably holds the world's record for being cancelled and then approved, and then cancelled again put a fairly fine point on existing infrastructure.

Baker Hughes, Chart by author

This infrastructure and the underlying commodity prices are undervalued by the market at present. This bet by Buffett bodes a change in the foreseeable future. This could be a catalyst for strong transmission companies like Enbridge, (NYSE:ENB), and Energy Products Partners, (NYSE:EPD) to see a move higher off multi-year lows as this reevaluation takes place.

What it says about the underlying gas market remains to be seen in my estimation and will depend on a move down in production and average storage volumes headed into the withdrawal season, still a few months in the future. The latest EIA Drilling Productivity Report suggests that production is falling off from lack of new drilling.

Current market expectations are for the weekly average to remain above the 5-year historical levels as we head into the winter withdrawal season. Having nearing topped out gas storage in recent weeks that scenario doesn't support a bull hypothesis for this commodity. We’ll see if Buffett’s optimism for Natty is justified in the coming weeks.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- Halliburton Looks Beyond Shale As Fracking Remains Unprofitable

- Oil Prices Hit Four-Month High On Vaccine Hopes

- Is The EU's Historic Green Stimulus Plan Ambitious Enough?

As you are aware planes have flown right of way for years to try and prevent leaks or catch them early. At this time, these same planes are being equipped with computerized monitors to depict where methane leaks are occurring, plus of course they are flying over all stations and plants and refineries. They will be able to share this information with the maintenance crews and within a year or two you are going to see a dramatic decline in any leaks. Kinder Morgan started this process a couple of years ago and they are now reporting that they have repaired 80-90% of their leaks. The largest NAT Gas processor in the US is currently engaging one company to fly all of their Permian Basin pipelines to resolve this issue.

What people need to better understand , is you have Trillion dollar industry that prior to this recent technology was not aware of the methane issues, but now you have the largest Industry in the world, that is gearing up to resolve this issue and retain the NG green image. Did you really think a trillion dollar industry was going to give up on their product and not fix a issue such of this. It is pretty amazing that journalist's think just because of one issue, an industry is going to tuck their tails between their legs and yell "chicken little the sky is falling". Did any of you ever remember hearing about US free enterprise system, that geared up to fight WWI and WWI , yet this industry was going to sit on its backside and not resolve the methane leaks.

I am sure you are aware if you look at both California and New York's cost of ng vs electricty, that it is currently costing both of these states twice the expense for electricity vs ng. As you continue to see the exodus of high income citizens continuing to leave NY and California and head for interior states with no income tax, the cost of energy is not something that these states will be able to withstand, especially now that natural gas is still considered green with methanes leaks being eliminated.

When you look at the fact that Dominion cancelled this pipeline project into NY, one of the reasons given, was not that they could not win the lawsuit issue, it was the fact that the alternative cost of transporting ng into New York was oddly cheaper to move on a another line and then truck the ng to the desired locations in New York. You would think that Cumo would understand that the safety issue of all these additional trucks on highways.

The fact of pipelines projects being stopped because of a radical left is not new- go back into Idaho in the mid 1995, when the Indian reservation decided not to renew a Yellowstone pipeline easement, so the companies, Exxon and Conoco at the time, built tankage at both ends of the pipeline that was not renewed, and for the last 25 years, rail cars have transported thousands of b/d , just because of one owner. They actually then reinject the crude oil at the other end back into the pipeline and I can assure you this cost was absorbed by the consumer, the Indians no longer receive any renumeration from the Pipeline companies and the environment is placed at significant more risk, plus a much higher safety risk. This is exactly what is going to happen in NY as ng will be trucked and guess who is going to bear this cost, you guessed it- the consumer. Cumo is not a very bright politician.

Just one last comment, you are portraying that pipelines will not get projects done , that is very inaccurate statement, a necessary project will get done, it just may be at double the cost, which again the consumer will bear. Sooner or later, knowledgable business men will run for office and business will be done normally, just as Trump has tried to do but unfortunately he shoots himself in the foot when he starts talking, but i did not vote for him because of his personality, i voted because he understands the business world more so than our current congress.

Warren doesn't care about the environment... he's an opportunist who understands that ignorant "greenie weenies" will be perfectly happy when windmills and solar panels are on every house because he'll be powering those houses when the weather doesn't cooperate... and he'll be making a fortune off of them.

Once the weenies realize how many condors and owls get chewed up by giant windmills they'll dump the technology, and Warren wins again. It's good to be Warren.