Friday October 27, 2016

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil outages at lowest since 2012

(Click to enlarge)

- The world seems like it is beset with geopolitical instability, but tell that to the oil market. Unplanned global supply disruptions fell to only 1.6 million barrels per day (mb/d) in September, the lowest level since January 2012, according to the EIA.

- The volume of outages has shrunk by a whopping 1 mb/d in the past six months alone, the result of restored production in Libya, Nigeria and Iraq. Canada also brought some disrupted output – from the horrific wildfires last year – back online in August 2017.

- In fact, the recent peak in outages occurred in the spring of 2016, topping out at more than 3 mb/d of disrupted output in May 2016. That was due to the combination of outages in Libya, Nigeria and Canada.

- It is no wonder that the recent outage in Iraq – due to the seizure of the Kirkuk oil fields by Iraq from the Kurdish government – have barely been reflected in oil prices. Some 400,000 bpd have been taken offline, but Brent is still at about $58 per barrel.

- Moreover, with OPEC keeping barrels off of the market by about 1.2 mb/d, there is a reservoir of spare capacity that could…

Friday October 27, 2016

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil outages at lowest since 2012

(Click to enlarge)

- The world seems like it is beset with geopolitical instability, but tell that to the oil market. Unplanned global supply disruptions fell to only 1.6 million barrels per day (mb/d) in September, the lowest level since January 2012, according to the EIA.

- The volume of outages has shrunk by a whopping 1 mb/d in the past six months alone, the result of restored production in Libya, Nigeria and Iraq. Canada also brought some disrupted output – from the horrific wildfires last year – back online in August 2017.

- In fact, the recent peak in outages occurred in the spring of 2016, topping out at more than 3 mb/d of disrupted output in May 2016. That was due to the combination of outages in Libya, Nigeria and Canada.

- It is no wonder that the recent outage in Iraq – due to the seizure of the Kirkuk oil fields by Iraq from the Kurdish government – have barely been reflected in oil prices. Some 400,000 bpd have been taken offline, but Brent is still at about $58 per barrel.

- Moreover, with OPEC keeping barrels off of the market by about 1.2 mb/d, there is a reservoir of spare capacity that could plug any hole.

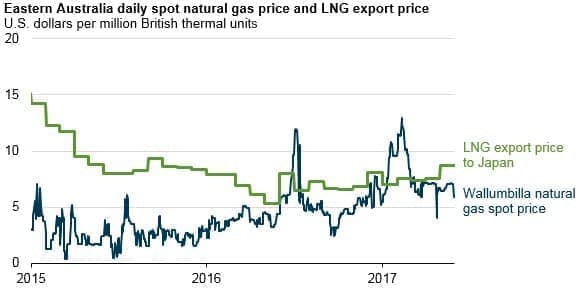

2. Australia gas prices rise because of LNG

(Click to enlarge)

- Australia has emerged as one of the largest LNG exporters in the world, but that has not come without costs.

- Domestic natural gas prices in Australia’s east and southeast have more than doubled after the startup of a handful of major LNG export projects.

- The volume of gas diverted for export in Queensland alone is twice as much as the total domestic consumption of gas in the eastern and southeastern states.

- The problem is that there are more LNG projects in the works – Australia is set to overtake Qatar as the largest LNG exporter in the world in 2019.

- That could lead to a shortage of gas, which will likely result in sharper price spikes. The Australian government is moving to limit gas exports to avoid such a scenario, a situation that represents risks to LNG exporters such as Chevron (NYSE: CVX) and Royal Dutch Shell (NYSE: RDS.A).

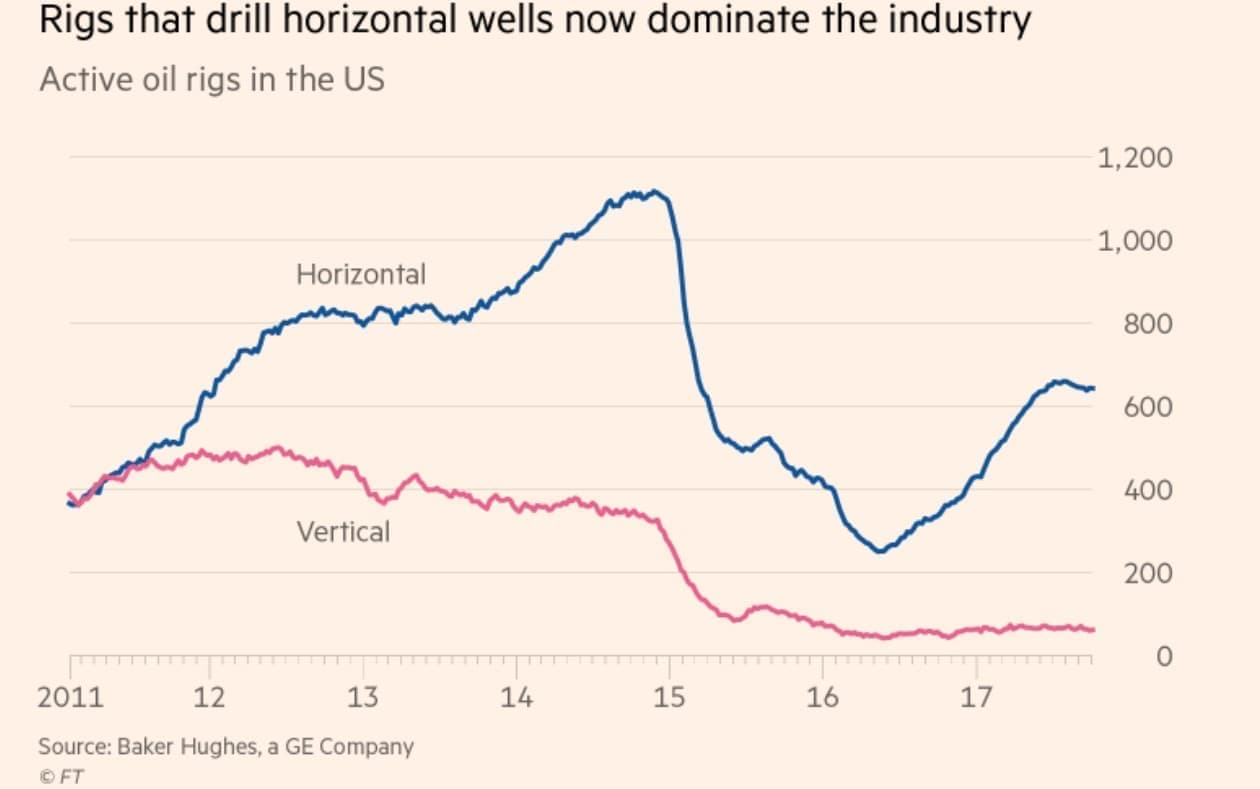

3. No more vertical drilling

(Click to enlarge)

- The U.S. shale industry has dramatically improved its efficiency, producing more oil and gas at a significantly lower cost than it used to. That has allowed it to ramp up production while lowering breakeven prices.

- But one of the reasons drillers have become more efficient is the switch to horizontal drilling, which allows companies to produce more hydrocarbons from a given well.

- The transition away from vertical drilling to horizontal drilling began years ago, but accelerated after oil prices collapsed in 2014.

- Now, vertical drilling has almost completely disappeared. This is significant because drillers have used up one of the ways to become more efficient, meaning that further gains will be much harder to come by.

- That raises questions about the growth and cost projections for the industry.

4. Shale still posting poor cash flow

(Click to enlarge)

- The U.S. shale industry seems to have lost its status as the darling of Wall Street.

- Shale companies, despite impressive growth figures and lots of oil production, are not rewarding shareholders.

- A Bloomberg sample of 48 U.S. shale companies, cited by the FT, shows that the industry has been cash flow negative for years, despite boasting about lower breakeven prices.

- The 48 companies were cash flow negative by a whopping $40 billion in 2015, a figure that was cut in half last year, but remains large.

- Goldman Sachs said in an October research note that it still expects the industry to outspend cash flow next year.

- Investors are losing interest and demanding strategic change, with a focus on profits rather than growth.

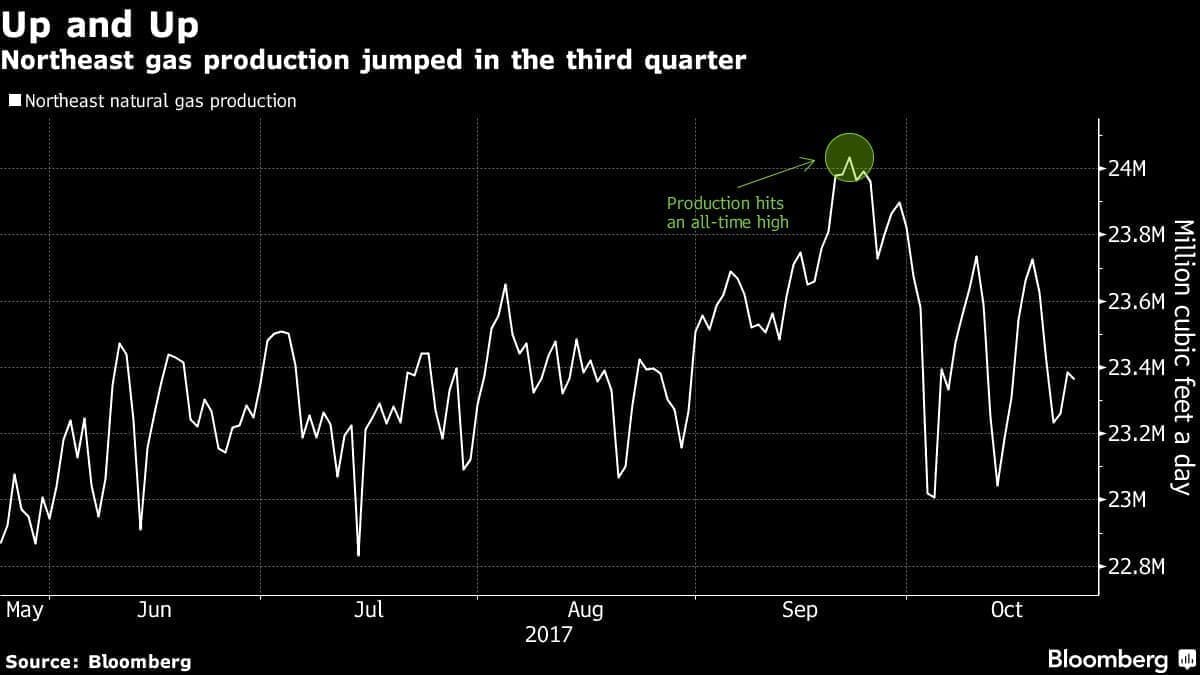

5. Gas production peaks, falls, but will rise again

(Click to enlarge)

- Natural gas production hit a wall in 2016 on low gas prices, but also low oil prices, which led to vanishing rig count. Gas output rebounded strongly this year, and hit an all-time high in the Northeast in September.

- That surge in output helped offset outages in Texas from Hurricane Harvey. But the Northeast is growing so fast that output fell in October as stiff competition for drilling services led to drilling delays, according to Bloomberg.

- But new pipelines, such as Energy Transfer Partners (NYSE: ETP) Rover pipeline, will allow production to continue to rise.

- However, like the oil sector, natural gas producers are facing pressure from investors to prioritize profit, not just production.

6. Oil majors expected to see profits rise

(Click to enlarge)

- The five largest oil companies in the world – BP (NYSE: BP), Shell (NYSE: RDS.A), Total (NYSE: TOT), ExxonMobil (NYSE: XOM) and Chevron (NYSE: CVX) – are expected to generate $34 billion of cash in the third quarter, according to estimates from Jeffries, and reported by Bloomberg.

- They are still aiming to completely cover fund dividends as well as capex from their cash flow, a situation that is still elusive for a few. “It’s not peak diet yet,” BP’s CEO Bob Dudley said. “Our industry is going through a great, massive change in the cost structure.”

- But the third quarter is expected to be much better, with 4 of the 5 expected to see quarter-on-quarter cash flow growth.

- The significant improvement this year has diminished fears that the oil majors would pare back their dividends. Improving cash flow likely means that dividends are safe for the foreseeable future.

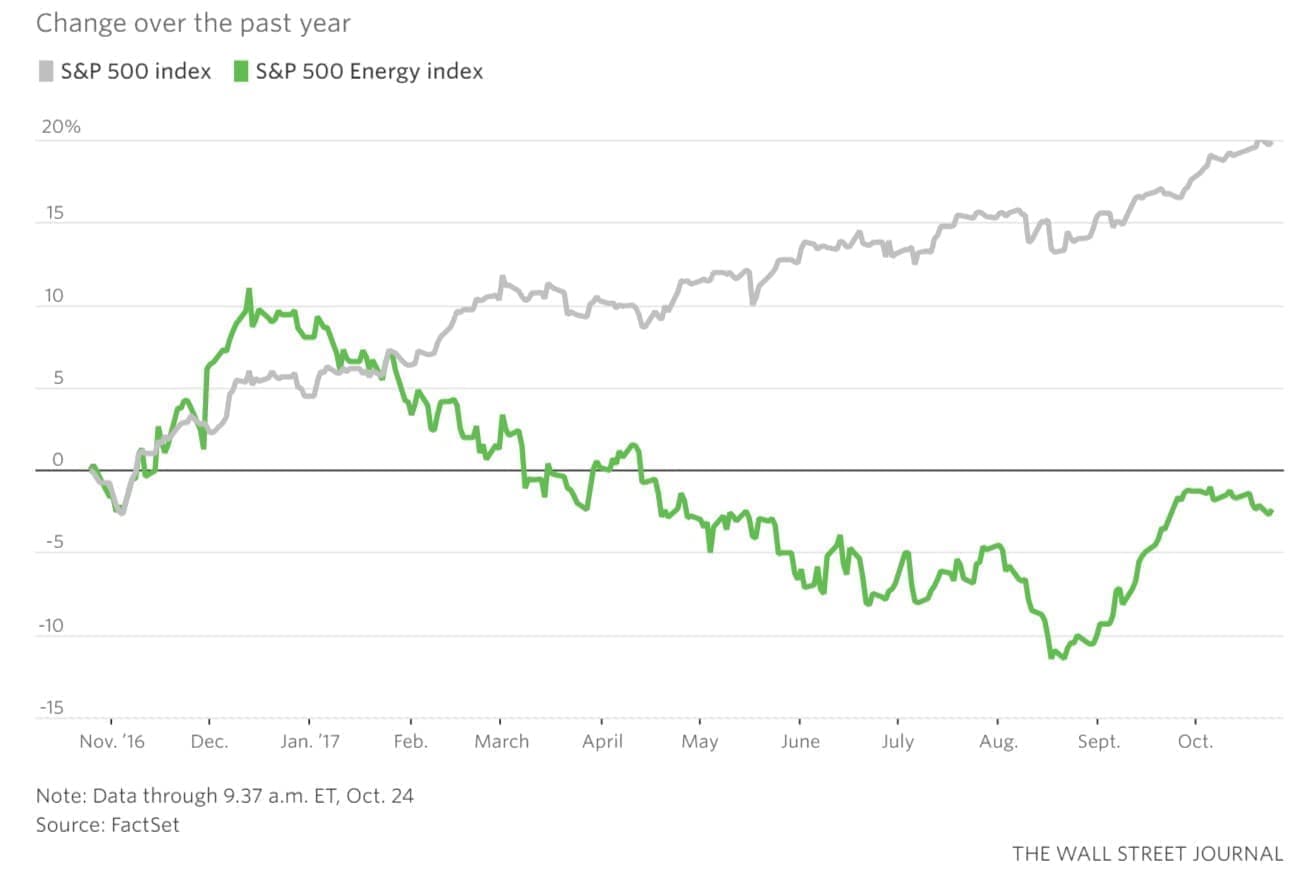

7. Energy still lags the market

(Click to enlarge)

- Energy investors have seen improved sentiment of late, but energy equities are still down in 2017, at the same time that the broader S&P 500 has had a banner year.

- The S&P 500 Energy Index is down 3 percent on the year, even as crude prices have climbed 10 percent.

- Typically, energy equities have a 75 percent correlation with oil prices, so the divergence between oil prices and the stock performances of energy companies is highly unusual, according to the Wall Street Journal.

- Investors have soured on energy, particularly U.S. shale. High debt, a lack of new investment, and above all, poor cash flow, are all contributing factors.

- Analysts believe that the energy industry will need to post several quarters of positive figures in order to woo back investors.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.