U.S. Refinery Fall 2018 Turnaround Season

This summer, United States refineries operated just shy of record highs, running close to 100 percent utilization rates. Refineries reached a new record-high gross input value of 18.243 million bpd for the week ending August 10. The record-high run rate pushed utilization to 98.1 percent, the highest recorded since 2005, according to the U.S. Energy Information Administration (EIA) Weekly Petroleum Status Report. These peak run rates are a function of high summer demand and low crude oil pricing as midstream capacity constraints widen regional crude oil differentials. However, these rates will not continue for much longer, as peak summer demand season comes to a close with refinery maintenance season beginning in September.

Refinery utilization rate is a function of the volume of crude input divided by the overall refinery capacity. A decrease in utilization rate signifies a refinery outage cause by an unplanned refinery upset (such as a fire) or a planned event, called a turnaround. Genscape monitors these refinery outages in real-time and collects data on planned maintenance, available through the North American Refinery Intelligence Service.

Genscape’s North American Crude Oil Runs Forecast examines the real-time outages in combination with publicly available turnaround information and forward crack spreads to forecast crude oil demand out three years.

Fall Maintenance Outlook: Gulf Coast Below Average, Mid-Con Above Average

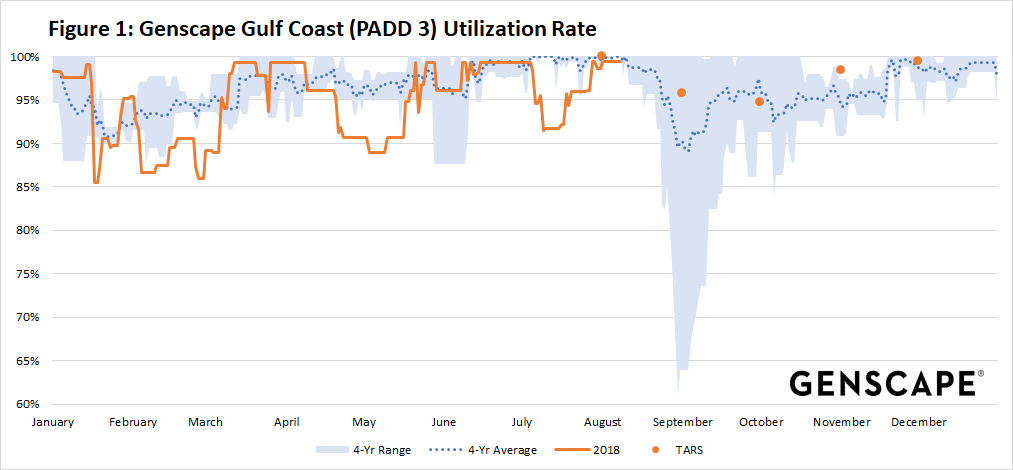

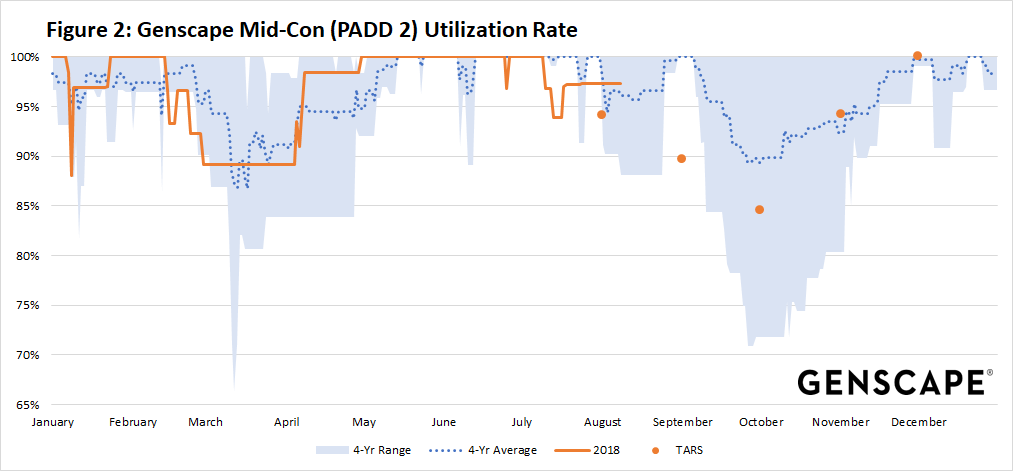

This fall, two trends are emerging for two main regions: PADD 3 and PADD 2. The U.S. Gulf Coast region (PADD 3) will have a lighter-than-usual refinery turnaround schedule, while the U.S. Mid-Continent region (PADD 2) will have a heavier-than-usual maintenance burden. As a result, the Gulf Coast will see utilization rates higher than average, while the Mid-Con will see larger crude run dips.

The Gulf Coast region is enjoying low crude feedstock cost and high refined product demand. Barring any severe weather outages, Genscape expects refineries to continue running with only a few small planned maintenance events through 2018. The lowest PADD 3 refinery runs occur in September and October with 95 percent and 94 percent utilization rates, respectively, with offline volumes in the range of 430,000 bpd to 535,000 bpd, according to Genscape’s Crude Oil Runs Forecast.

Figure 1: PADD 3 Fall 2018 Refinery maintenance expected to be much lighter than 2017. Source: Genscape North American Refinery Intelligence Service, North America Crude Oil Runs Report. Click to enlarge

Related: Mexico’s New President To Deal Blow To Oil Industry

The Mid-Continent region is also taking advantage of high refinery crack spreads and low crude input costs, leading to deferred turnarounds. Several major maintenance events, originally scheduled for this spring or early summer, pushed back to September and October. The delays will likely compound with other scheduled maintenance projects and lead to the lowest utilization rate in the area since 2015. Genscape expects PADD 2 refinery runs to be the least in September and October with 89 percent and 84 percent utilization rates, respectively, resulting in 305,000 bpd to 460,000 bpd of offline volumes.

Figure 2: PADD 2 Fall 2018 Refinery Maintenance to peak in September/October and is expected to be heavier than 2017. Source: Genscape North American Refinery Intelligence Service, North America Crude Oil Runs Report. Click to enlarge

Risk Factor: The Hurricane Season

Hurricane Harvey rattled the Gulf Coast last year after making landfall near Corpus Christi, TX, on August 25, 2017. Many units shut for an extended period following storm damage and widespread flooding. The lowest daily utilization of refinery units occurred on August 30, 2017 when CDUs, vacuum distillation units (VDUs) and fluid catalytic crackers (FCCs) were used at 61 percent, 59 percent and 52 percent, respectively, according to Genscape’s North American Refinery Intelligence Service. For week ending September 8, 2017 EIA data showed PADD 3 refinery runs fell to 5.721mn bpd, a 60.7 percent utilization rate.

For 2018, the National Oceanic and Atmospheric Administration (NOAA) predicts a quieter hurricane season, with a 60 percent chance the Atlantic hurricane season will be below normal levels. However, despite below normal predictions, storms will likely come with a near-normal prediction of 30 percent and a 10 percent chance of an above-normal season. Related: Which Refiners Win From Strict Fuel Regulations?

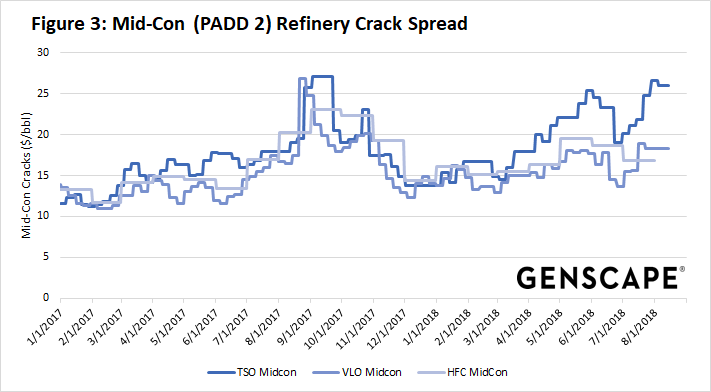

Figure 3: Mid-Continent (PADD 2) refinery crack spread 2017-2018. Crack spread primarily increased in fall 2017 due to Hurricane Harvey damaging Gulf Coast (PADD 3). Recent spread increase is due to midstream pipeline constraints. Source: Andeavor, Valero, and HollyFrontier Investor Relations. Click to enlarge

With Gulf Coast refineries damaged and shut due to Hurricane Harvey last fall, Mid-Continent refineries ran especially hard in September 2017 to take advantage of the severe deficit in capacity. The market responded to the supply decrease, sharply increasing Mid-Continent crack spreads. Recently, the Mid-Continent crack spreads are on the rise again this fall, but for a different reason. Here, midstream pipeline constraints are causing regional widening of crude price differentials, shown in Figure 3. Refineries are taking advantage of these price arbitrages, purchasing cheaper crude inputs and increasing crack spreads.

Conclusion

This summer, refineries are reaching peak run rates due to high summer demand and low crude oil pricing. Recent midstream capacity constraints widened crude oil differentials, increasing regional refinery crack spreads. Refinery operators take advantage of these price arbitrages and postponing planned maintenance. Looking forward, Genscape expects the U.S. Gulf Coast region (PADD 3) will have a lighter-than-usual refinery turnaround schedule with offline volumes in the range of 430,000 to 535,000 bpd, 95 percent and 94 percent utilization rates, in September and October. In the Mid-Continent (PADD 2), Genscape expects a heavier-than-usual maintenance burden, with 89 percent and 84 percent utilization rates, resulting in 305,000 bpd to 460,000 bpd of offline volumes in September and October, respectfully.

By Rob Bickhart via Genscape.com

More Top Reads From Oilprice.com:

- Is This North America’s Next PetChem Hub?

- Natural Gas Inventories “Dangerously Low"

- From AK To EV: The World’s Weirdest Electric Car