Futures markets are suggesting the currently benign level of natural gas price volatility may not remain through the winter months.

According to the Financial Times, market volatility this year has been the lowest on record despite inventory levels falling 19.5 percent below average and by the time winter starts are set to be at their lowest in more than a decade.

(Click to enlarge)

Source: Bloomberg (via Financial Times)

The Financial Times puts this down to investors being lulled into complacency by a seemingly unstoppable wave of new supply from the shale market rising inexorably to meet rising demand. The government last week forecast 81.1 billion cubic feet per day in dry gas production for 2018 — a record high — and up by 7.5 billion cu ft/d from 2017, the Financial Times reports.

But is the market safe to assume shale gas will supply regardless of demand?

Natural gas producers are systematically hedging their sales throughout next year, often a sign they plan to continue an aggressive policy of drilling and expansion. That activity has contributed to a dipping of forward prices, as there are more sellers in the futures market than buyers.

But inventory levels are low — some would suggest dangerously low — after a high summer demand due to hot weather increasing demand for air conditioning. Natural gas “power burn” surged to a record 37.7 billion cubic feet per day during July, the Financial Times reports.

Related: A Saudi-Iran Oil War Could Break Up OPEC

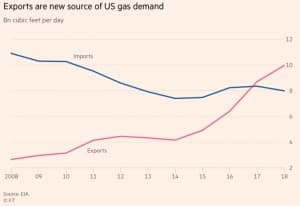

Such strong demand comes after a cold winter depleting stocks to unusually low levels. Inventory levels were low at the end of the summer and have not managed to be replaced during the normally slacker summer months. High demand is not helped by exports of natural gas and distillates running at record levels, aided by strong international demand and low U.S. domestic prices relative to global markets.

(Click to enlarge)

Forward market spreads suggest there is already competition between companies buying gas for anticipated stronger winter-month demand are meeting power companies also trying to hedge their requirements.

Volatility is traditionally lower in the slacker summer months and rises as demand ramps up in the winter. If inventory levels are high, investors are less prone to panic, rightly seeing ample supply.

But when inventory levels are low, volatility is placing complete faith in the shale producers to meet rising demand — a faith that may yet prove misplaced.

By AG Metal Miner

More Top Reads From Oilprice.com:

- Saudi Oil Minister: Aramco IPO Not Canceled

- Oil Markets Are In For A Bumpy Ride

- New Gulf Of Mexico Leases Raise Concerns