Friday May 25, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

(Click to enlarge)

Key Takeaways

- U.S. oil production rose to another record at 10.725 million barrels per day, but the weekly increase was only a marginal 2,000 bpd. In fact, the past two weeks showed only tepid production increases, perhaps a sign that pipeline constraints in the Permian are starting to constrain output growth.

- Crude and gasoline stocks jumped by more than expected, a bearish result that pushed down prices this week.

1. OPEC considers relaxing production limits

(Click to enlarge)

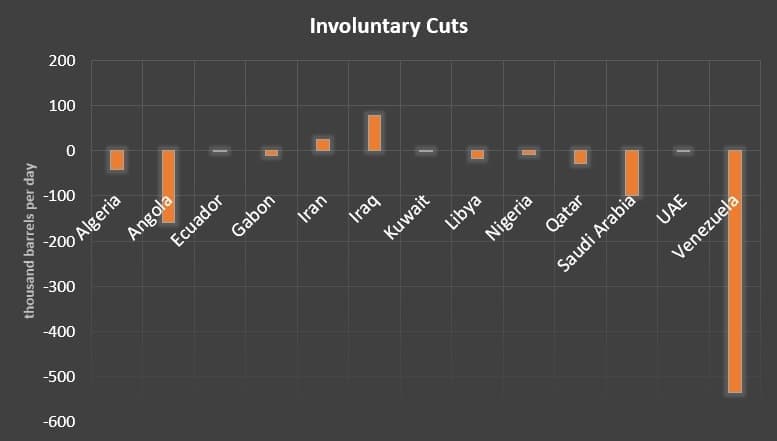

- OPEC, Russia and the other participants of the production cuts are reportedly discussing some plan to add oil back into the market, with a decision possible in Vienna in a few weeks.

- High oil prices and the catastrophic losses from Venezuela have forced OPEC’s hand.

- Details still need to be worked out but there are two options.

- Option one would be to bring output back up to the production ceiling for each individual member. Saudi Arabia would be the only country making voluntary cuts deeper than it needs to. This option would add around 100,000 bpd back to the market.

- The more aggressive…

Friday May 25, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

(Click to enlarge)

Key Takeaways

- U.S. oil production rose to another record at 10.725 million barrels per day, but the weekly increase was only a marginal 2,000 bpd. In fact, the past two weeks showed only tepid production increases, perhaps a sign that pipeline constraints in the Permian are starting to constrain output growth.

- Crude and gasoline stocks jumped by more than expected, a bearish result that pushed down prices this week.

1. OPEC considers relaxing production limits

(Click to enlarge)

- OPEC, Russia and the other participants of the production cuts are reportedly discussing some plan to add oil back into the market, with a decision possible in Vienna in a few weeks.

- High oil prices and the catastrophic losses from Venezuela have forced OPEC’s hand.

- Details still need to be worked out but there are two options.

- Option one would be to bring output back up to the production ceiling for each individual member. Saudi Arabia would be the only country making voluntary cuts deeper than it needs to. This option would add around 100,000 bpd back to the market.

- The more aggressive action would be to bring the output back to the collective output ceiling, which would mean reapportioning some production levels to all members to offset the losses from Venezuela. This option could result in additional supply of between 300,000 and 800,000 bpd.

- Oil prices fell sharply on the news on Friday.

2. European refiners already shying away from Iranian oil

(Click to enlarge)

- The European Union has vowed to keep the Iran nuclear deal in place and has promised to help European companies affected by U.S. sanctions.

- However, European refiners are already starting to wind down purchases of Iranian oil. Demand for medium-sour oil grades such as Iraq’s Basrah Light and Russia’s Urals is “picking up,” according to S&P Global Platts. The Urals discount to Brent has narrowed.

- Europe imports about a third of Iran’s 2.4 million barrels per day (mb/d) of oil exports. Oil traders told S&P Global Platts that there are already problems obtaining ship insurance and letters of credit, forcing buyers to look for alternatives.

- S&P Global Platts estimates that up to 500,000 bpd of Iranian oil could be lost in the near-term.

(Click to enlarge)

(Click to enlarge)

3. Downstream earnings gain in importance

(Click to enlarge)

- The oil majors are increasingly investing in their downstream units, even as crude oil prices rebound to new multi-year highs.

- BP’s (NYSE: BP) refining and marketing earnings have outpaced upstream profits since 2015.

- In fact, refining is a good hedge against crude prices, because downstream units can purchase cheap crude for processing. Also, demand for refined fuels tends to rise. Refining margins spiked during the oil market downturn.

- ExxonMobil (NYSE: XOM) has plans to spend $9 billion on six refineries over the next eight years. The oil major sees refining earnings growing by 20 percent through 2025.

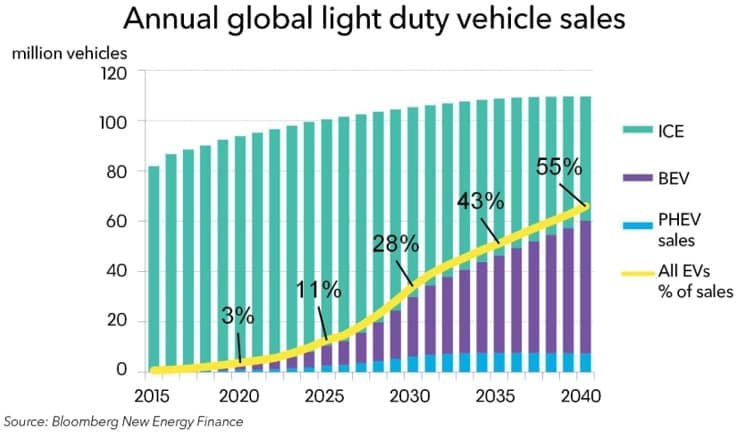

4. EVs set for rapid sales growth

(Click to enlarge)

- EV sales will surpass 1.8 million in 2018 as costs continue to decline, according to a new forecast from Bloomberg New Energy Finance. Battery costs are down 79 percent since 2010.

- By 2024, EVs will reach cost parity with the internal combustion engine on an unsubsidized basis.

- Sales will hit 11 million by 2025 and 30 million by 2030. By 2040, EVs will capture more than half of the entire global auto market.

- The growth of electric buses could be even more impressive. BNEF says e-buses will “dominate” the market, capturing 84 percent of sales by the late 2020s.

Heard on the Street

On the possibility of $100 oil:

"We should take seriously the possibility of an oil price spike ... not least because oil spikes preceded 5 of the last 6 recessions (in the US)." -- UBS

On the possibility of OPEC “relaxing” production limits:

“An increase in production would not mean any departure from the cuts agreement, as OPEC is currently producing roughly 800,000 barrels per day less than is stipulated by the agreement. Roughly three quarters of this total is due to Venezuela. There is definitely scope for raising production, in other words.” -- Commerzbank

On the amount of Iranian oil the U.S. can hope to disrupt:

“The 600,000 bpd imported by China will remain well beyond the reach of Washington. US efforts will therefore be directed primarily at the EU, India, Japan and South Korea. Combined, this leaves around 1.55 million bpd that the US can realistically target…But in practice, any removal of Iranian barrels from the international oil market will be significantly lower.” -- Verisk Maplecroft

(Click to enlarge)

5. Cobalt prices skyrocket on EV demand

(Click to enlarge)

- Cobalt, a key ingredient in lithium-ion batteries used in electric vehicles, has seen demand skyrocket, taking prices up to new heights. Cobalt prices have more than tripled in two years.

- BNEF predicts that a supply shortage could limit battery production capacity unless new cobalt mines come online. A supply crunch could emerge by the early 2020s.

- Automakers are trying to cut the use of cobalt in batteries because of soaring costs.

- Meanwhile, China is set to dominate lithium-ion battery manufacturing, holding 73 percent of the market by 2021.

6. U.S. gasoline exports go to Mexico

(Click to enlarge)

- Mexico’s decrepit refineries and falling oil production have led to an increase in dependence on the U.S.

- The U.S. exported an average of 821,000 bpd of gasoline in 2017, more than half of which went to Mexico in 2017.

- Gasoline exports continued to increase even as U.S. domestic consumption increased.

- Mexico has a presidential election on July 1, with the expected winner promising massive public investments in domestic refineries. If that occurs, it could curtail imports of gasoline from the U.S.

(Click to enlarge)

7. Natural gas inventories plunge

(Click to enlarge)

- Natural gas inventories rose to 1,629 billion cubic feet for the week ending on May 18, an increase of 91 Bcf from the week before.

- Inventories are 804 Bcf less than a year ago, and 499 Bcf below the five-year average.

- Still, natural gas Nymex prices remain below $3 per MMBtu, despite tight storage levels.

- A record volume of new gas supply is expected to come online this year.

- More importantly, pipeline capacity from the Marcellus and Utica shales is expected to jump by a third this year, from 16.7 Bcf/d to 23 Bcf/d.

- New connections to the South, Midwest, Gulf Coast and Mid-Atlantic will supercharge drilling activity.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.